This comparison is based on publicly available information as of [November 2025]. Prices and rules may change, so always check each firm’s website before joining.

Looking for the cheapest prop firms in 2025? We compared the top 10 firms with fees as low as $15, refundable challenges, and fast payouts. This guide shows which prop firm gives you the best value without wasting money.

Which Prop Firm Has the Cheapest Challenge in 2025?

Maven Trading is the cheapest prop firm in 2025. A $2,000 account starts at $15 (1-step) and a $5,000 account is $22 (2-step) with a refundable fee.

Maven combines static drawdown rules, no time limits, and quick customer support, making it the top choice for beginners who want to get funded at the lowest cost.

Comparison Table: Top 10 Low-Cost Prop Firms

The table below compares fees, account sizes, challenge steps, and coupon codes for the 10 cheapest prop firms in 2025. All firms listed refund your fee if you pass, but payout speed, platforms, and profit splits vary.

| Prop Firm | Fee | Size | Coupon Code | Review |

|---|---|---|---|---|

| Maven Trading | $22 | $5K |

MVN8

|

Read Review |

| Goat Funded Trader | $23–$33 | $5K | Automatically Applied | Read Review |

| FundedNext | $32 | $5K |

FT5

|

Read Review |

| Blueberry Funded | $35 | $5K |

FT20

|

Read Review |

| FXIFY | $39 | $5K |

FT20

|

Read Review |

| Alpha Capital | $40 | $5K |

FUNDEDTRADING15

|

Read Review |

| Pipfarm | $40 | $5K |

FTXPIPFARM

|

Read Review |

| E8 Markets | $40 | $5K |

FTR5

|

Read Review |

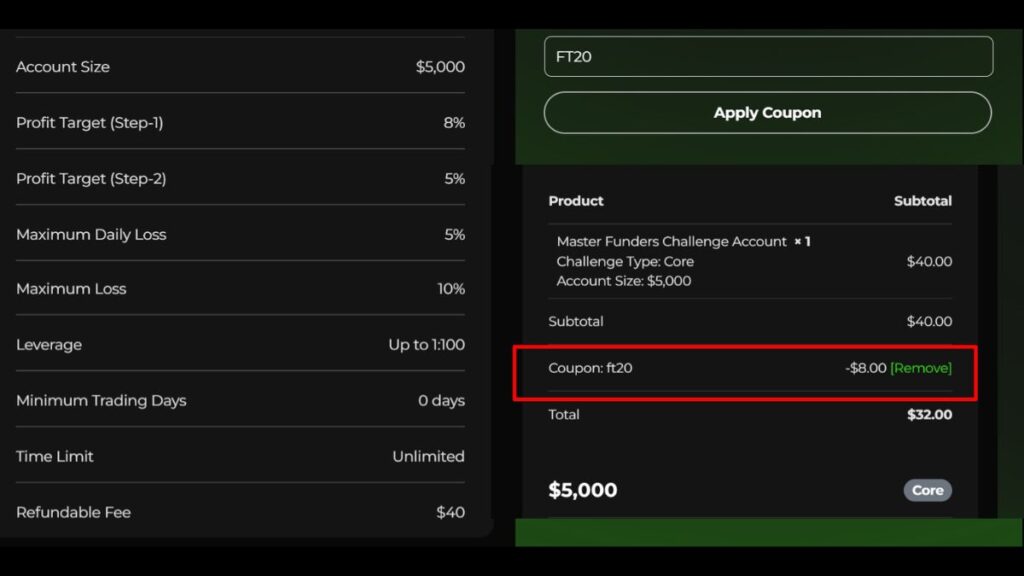

| MasterFunders | $40 | $5K |

FT20

|

Read Review |

| FundYourFX | $56 | $5K |

FUNDEDTRADING10

|

Read Review |

Challenge type:

- 1-step = Pass just one phase (often tougher rules, but faster funding).

- 2-step = Standard prop firm challenge; pass two phases for funded status.

- 3-step = Extra step, usually for lowest fees, good for learning discipline.

Firm-by-Firm Breakdown: Best For, Pros, Cons, and Unique Features

Not all cheap prop firms are created equal. While some focus on lowest entry fees, others stand out with faster payouts, higher profit splits, or easier rules.

Below, we review each of the 10 cheapest prop firms in 2025. For every firm, you’ll see:

-

Best for: Which type of trader it suits

-

Fee: Cheapest $5K capital account

-

Challenge: Type of evaluation (1-step, 2-step, or 3-step)

-

Rules: Profit targets, drawdown, and restrictions

-

Refund: If and when your fee is returned

-

Payouts: Speed and frequency of withdrawals

-

Pros & Cons: What makes them strong (or risky)

-

Special context: Tips for new traders choosing between firms

This way, you can compare beyond just price and pick the right firm for your trading style.

1. Maven Trading

Best for: Absolute beginners looking for the lowest-cost 2-step challenge.

Fee: $22 for a $5K 2-step account (MetaTrader 5 or Match-Trader). Use code MVN8 for an extra 8% discount, dropping the fee to $20.24 — the cheapest legit $5K account in 2025.

Note: cTrader version costs $44.

Challenge Type: 2-step evaluation

-

Phase 1 Target: 8% ($400)

-

Phase 2 Target: 5% ($250)

-

Drawdown: 8% static overall ($400), 4% daily ($200)

-

Refund: 100% fee refunded after passing

-

Minimum Trading Days: None

-

Profit Split: 80%+

-

Payouts: Every 10 business days

Platforms: MetaTrader 5, Match-Trader, cTrader

Special Features:

-

Weekend holding allowed

-

Swap-free accounts available

-

Buyback feature (get a second chance if you fail)

✅ Pros

-

Cheapest legit 2-step challenge

-

Static drawdown with no time limit (great for beginners)

-

24/7 live chat support

❌ Cons

-

cTrader fee is double ($44)

-

Scaling program is smaller than big-name firms

📌 Takeaway for Traders:

If you want the absolute lowest cost funded challenge, Maven is unbeatable. It’s ideal for beginners who need time flexibility and fair rules without pressure.

2. FundYourFX

Best for: Traders who want instant funding and no daily drawdown rules.

Fee: $56 for a $5K 2-step account.

Challenge Type:

-

2-step challenge (with no daily drawdown rules)

-

Or instant funding (higher cost, skip the evaluation)

Drawdown Rules:

-

4% static max drawdown

-

No daily drawdown requirement

Refund: 100% fee refunded after passing

Profit Split: Up to 90%

Platforms: Match-Trader only

✅ Pros

-

Instant funding available (skip the challenge)

-

Simple rules — no daily drawdown stress

-

High profit split (up to 90%)

❌ Cons

-

Only available on Match-Trader

-

More expensive than Maven or FundedNext

📌 Takeaway for Traders:

FundYourFX is great if you value simplicity and instant access to a funded account. The lack of daily drawdown makes it less stressful.

3. FXIFY

Best for: Traders who want a customizable 3-step challenge and don’t mind taking their time.

Fee: $39 for a $5K 3-step account.

Challenge Type:

-

3-step challenge (more phases but lower entry cost)

Drawdown Rules:

-

4% static max drawdown

Add-ons:

-

Pay extra for upgrades like 90% profit split, higher leverage, or faster payouts

Refund: 100% fee refunded after passing

Profit Split: Up to 90% (with add-ons)

Platforms: Standard (MT5, cTrader, etc., depending on plan)

✅ Pros

-

One of the cheapest options with discounts

-

Fully customizable — choose leverage, profit split, payout frequency

-

Unlimited trading days (no time pressure)

-

Refundable evaluation fees

❌ Cons

-

Must trade a minimum of 5 days per phase (can slow down fast traders)

-

Best features (like higher profit splits) require paid add-ons

📌 Takeaway for Traders:

FXIFY is perfect if you want flexibility and are willing to grind through a 3-step challenge. It’s one of the cheapest ways to get funded, but it takes patience — and add-ons can raise the cost if you want premium features.

4. Alpha Capital

Best for: Traders who want multi-platform access, high leverage, and clear rules.

Fee: $40 for a $5K Alpha Pro 6% challenge.

Challenge Type:

-

Flexible: choose 1-step or 2-step challenge

Profit Target:

-

6% ($300 on a $5K account)

Drawdown Rules:

-

6% max overall

-

3% daily

Leverage:

-

Up to 1:100 (FX)

Refund: Yes, after passing

Platforms: MT5, cTrader, DXTrade, TradeLocker

Payouts:

-

Biweekly, or 2% on-demand (min. $100 profit)

✅ Pros

-

Trade on four platforms (MT5, cTrader, DXTrade, TradeLocker)

-

High leverage (1:100 on Forex)

-

Unlimited days to complete evaluation

-

Clear and consistent payout options

❌ Cons

-

Some accounts have a performance fee (80%) for Qualified Analyst plans

-

Strict inactivity rules (account closed after 30 days idle or over-risk)

📌 Takeaway for Traders:

Alpha Capital is a solid choice if you want multiple platform options and higher leverage. The pricing is fair, but make sure you’re comfortable with their strict risk and inactivity rules.

5. PipFarm

Best for: Traders who want the highest profit share (up to 99%) and are disciplined enough to handle strict consistency rules.

Fee: $40 for a 2-step Consistency account ($5K, cTrader only)

Challenge Type:

-

2-step:

-

Phase 1 target: 9% ($450 on $5K)

-

Phase 2 target: 6% ($300 on $5K)

-

Drawdown Rules:

-

9% static overall ($450)

-

3% daily loss limit

Leverage:

-

Up to 1:30 (increases with rank/experience)

Profit Split:

-

Up to 99% (scales with experience and loyalty program)

Refund: Yes, after passing

Consistency Score:

-

50% required for both phases and for each payout

Minimum Trading Days:

-

3 profitable days per stage and between payouts

Payouts:

-

Flexible—multiple methods available

-

Payout protection: even if you breach, you still get paid if eligible

Platform:

-

cTrader only (main reason for slightly higher fee)

Scaling:

-

Up to $1.5M for top-performing traders

Special Features:

-

Payout protection (get paid even after breach if conditions met)

-

Loyalty & experience rewards (higher splits, perks, scaling boosts)

-

One of the fastest scaling programs available

✅ Pros

-

Highest profit share in the industry (up to 99%)

-

Transparent rules, no hidden restrictions

-

Flexible payouts + protection if breached

-

Unique rewards & loyalty system to support long-term traders

❌ Cons

-

Strict consistency rules and daily loss limits

-

1:30 leverage starting cap (increases later)

-

Only available on cTrader, less familiar for MT4/MT5 users

💡 Pro Tip:

If you’re ambitious and want to push for maximum payouts, PipFarm is designed for serious traders who can stay disciplined. It’s tougher than other firms, but the upside (99% profit split + $1.5M scaling) makes it worth it.

6. FundedNext

Best for: Traders who want the cheapest entry fee with high profit splits (up to 95%) and fast payouts.

Fee: $32 for a $5K Stellar Lite 2-step challenge

-

One of the lowest entry costs among legit prop firms.

Challenge Type:

-

2-step (Stellar Lite model)

-

Phase 1: 8% target ($400 on $5K)

-

Phase 2: 4% target ($200 on $5K)

-

Drawdown Rules:

-

8% static overall

-

4% daily loss limit

Refund: Yes, after passing

Profit Split:

-

Up to 95% once funded

-

Bonus: 15% profit share sometimes available during the challenge (on Stellar standard models, not Lite)

Payouts:

-

Within 24 hours (fastest in the industry)

Minimum Trading Days:

-

5 per phase (slightly restrictive vs. no-minimum firms)

Add-Ons Available:

-

No minimum trading days

-

Higher loss limits

-

Lifetime 95% payout from day one

-

Extra cost, but increases flexibility

Platforms Supported:

-

MT4, MT5, cTrader, Match-Trader

Scaling:

-

Up to $4M with consistent performance

✅ Pros

-

One of the cheapest challenges at just $32

-

High profit split (95%) once funded

-

Lightning-fast payouts (average <24 hours)

-

Multiple platforms to choose from (MT4, MT5, cTrader, Match-Trader)

-

Scaling plan up to $4M

❌ Cons

-

Minimum 5 trading days per phase

-

Add-ons cost extra (can raise the total fee)

-

cTrader & Match-Trader come with additional platform fees

💡 Pro Tip:

If you want to get started with a low-risk, low-cost challenge, FundedNext is one of the best choices. It’s especially strong if you care about fast payouts and high profit splits. Just keep in mind the minimum trading day rule and potential add-on costs.

7. E8 Markets

Best for: Traders who want maximum flexibility with a customizable challenge and multiple account options.

Fee:

-

$40 standard

Challenge Type:

-

1-step challenge (customizable setup)

Profit Target & Rules:

-

Profit target depends on configuration

-

Drawdown: 4% trailing (harder than static drawdown)

Refund: Yes, after passing

Profit Split:

-

80% base split

-

Can be increased with paid add-ons

Platforms:

-

MT4, MT5, and more depending on account setup

Scaling:

-

Flexible scaling opportunities (varies by plan)

✅ Pros

-

Customizable challenges — adjust to your trading style

-

Solid 80% base profit split

-

Unlimited trading days

❌ Cons

-

Add-ons quickly raise overall costs

-

Trailing drawdown less forgiving than static

💡 Pro Tip:

E8 is ideal if you want flexibility and customization instead of fixed rules. But if you’re new to prop trading, keep in mind the trailing drawdown can be tough compared to static rules at other firms.

8. Blueberry Funded

Best for: Traders who want a broker-backed prop firm with strong trust and transparent conditions.

Fee:

-

$35 for $5K (2-step challenge)

Challenge Type:

-

2-step evaluation

Drawdown:

-

5% static

Scaling:

-

Can scale accounts up to $2M for consistent traders

Refund: Yes, after passing

Profit Split:

-

Competitive (varies by account size, up to industry standard levels)

Platforms:

-

MT4 & MT5 with real broker infrastructure

✅ Pros

-

Backed by a fully regulated broker → extra trust & transparency

-

Unlimited time to pass the evaluation

-

Real market execution with tight spreads

-

Solid scaling potential (up to $2M)

❌ Cons

-

Leverage capped (1:50 FX, 1:10 indices/commodities) — lower than some competitors

💡 Pro Tip:

If trust and real execution are your top priorities, Blueberry Funded is one of the safest options. The lower leverage might feel restrictive, but the broker-regulated backing makes it stand out from many low-cost prop firms.

9. Goat Funded Trader

Best for: Traders who want the fastest payouts and a cheap 2-step challenge.

Fee:

-

$25 (MT5)

-

$25 (Match-Trader)

-

$37 (TradeLocker)

Challenge Type:

-

2-step GOAT challenge

Drawdown:

-

4% static

Refund: Yes, after passing

Payouts:

-

Withdraw as early as 3 days with 3% profit

Profit Split:

-

80% → up to 100% for top performers

Platforms:

-

MT5

-

Match-Trader

-

TradeLocker

✅ Pros

-

Fastest withdrawals in the industry (just 3 days)

-

No time limits → pass at your own pace

-

Multiple platform choices (MT5, Match-Trader, TradeLocker)

-

Profit split can reach 100%

❌ Cons

-

TradeLocker costs more ($37 vs $25)

-

Scaling opportunities are limited compared to larger firms

💡 Pro Tip:

If your priority is speed of payouts, Goat Funded Trader is unmatched. It’s perfect for traders who want quick withdrawals and flexible evaluation timing.

10. MasterFunders

How Do Cheap Prop Firms Work? (Key Rules, Refunds, Risks)

Cheap prop firms let you trade with company capital by paying a small, refundable challenge fee (often $15–$50 for a $2K–$5K account). If you pass their rules, you’ll receive a funded account and keep a share of the profits.

Here’s the typical process:

-

Pay the challenge fee

Example: $22 for Maven Trading’s $5K account. -

Pass the challenge

-

Hit profit targets (usually 4–10%)

-

Stay within daily and overall drawdown limits

-

-

Get funded

Once you pass, you trade the firm’s money instead of your own. -

Receive a refund

Most firms refund your evaluation fee once you’ve passed and hit your first withdrawal. -

Earn payouts

Profit splits range from 80% to 95%, paid out weekly, biweekly, or monthly depending on the firm.

Example Walkthrough:

👉 You pay $22 at Maven Trading for a $5K account.

👉 If you hit the profit target without breaking drawdown rules, you pass.

👉 You then trade live capital, keep 80–90% of profits, and get your $22 refunded.

Risks You Should Know:

-

Stricter rules: Cheap firms often have tight drawdowns (4–8%) and daily loss limits (3–5%).

-

Lower leverage: Many cap leverage at 1:30 or 1:50, compared to premium firms offering 1:100+.

-

Scaling limits: Cheap accounts often max out at $50K–$100K, though firms like Blueberry Funded allow scaling to $1M+.

Key Takeaway: Cheap prop firms are the fastest and lowest-cost entry into funded trading. They’re perfect for building a track record, but you need to manage risks carefully since the rules are stricter than higher-priced programs.

What Features Matter Most for Low-Cost Funded Accounts?

Don’t just chase the cheapest fee — a $15 challenge is useless if the rules are impossible or payouts are slow.

When comparing cheap prop firms, focus on these 5 key features:

1. Drawdown Rules

-

Static drawdown is friendlier for beginners (your max loss limit doesn’t trail your balance).

-

Trailing drawdown is stricter since it moves with your balance.

👉 Example: Maven Trading uses 8% overall / 4% daily static drawdown, while E8 Markets has a 4% trailing drawdown.

2. Profit Split

-

Top firms pay between 80% and 95% of profits.

-

Higher splits = more money in your pocket.

👉 Example: FundedNext and Goat Funded Trader pay up to 95%. PipFarm goes even further, scaling up to 99%.

3. Payout Speed

-

Fast payouts are critical.

-

Some firms process withdrawals in 24–72 hours (FundedNext, Goat Funded Trader).

-

Others stick to biweekly or monthly payouts.

4. Refund Policy

-

Most legit firms refund your fee after you pass the challenge and complete your first payout.

-

Always read the fine print:

👉 Example: Blueberry Funded only refund after your first withdrawal, not immediately after passing.

5. Account Scaling

-

Cheap accounts usually cap at $50K–$100K.

-

Some firms allow growth to $1M+ with consistent performance.

👉 Example:FundedNext can scale up to $4M, while Blueberry Funded offers up to $2M.

6. Platforms & Trading Rules

-

Make sure your preferred platform (MT4, MT5, cTrader, Match-Trader) is supported.

-

Also check for banned strategies (news trading, EAs, arbitrage).

How We Chose the Cheapest Prop Firms in 2025

To rank the cheapest prop firms, we focused on the $5,000 account size, since this is the most common starting point for traders who want to test a firm without risking much. Almost every prop firm offers a $5K option, so it gives us a fair way to compare prices across the board.

Our research included more than 20 prop firms, but we only selected the 10 most affordable firms that still meet quality standards. A cheap entry fee means nothing if the rules are impossible or payouts are delayed, so we used these benchmarks to build our list:

-

Transparent rules

-

Fast, proven payouts

-

Refundable fees

-

Reasonable platform options

-

Positive trader feedback

This way, our rankings reflect both affordability and reliability — ensuring traders don’t waste money on firms with hidden rules or payout issues.

Final Summary

Don’t just chase the lowest price. Pick a prop firm that refunds your fee, pays fast, and matches your trading style. Start small, build your track record, and scale up only after your first payout. Ready to get funded? Compare all the options above and choose the firm that actually fits your goals.

FAQs: Cheapest Prop Firm Questions Answered

Here are the answers to the real questions traders ask about low-cost prop firms in 2025.

Which prop firm is the cheapest in 2025?

Maven Trading is the cheapest, with $15 for a $2K challenge and $22 for a $5K 2-step (both refundable). Use coupon code MVN8 to drop the $5K price to $20.24.

How fast do cheap prop firms pay out?

Most firms pay within 1–7 days of your first profit. Goat Funded Trader, E8 Markets, and FundedNext are known for payouts in as little as 24–72 hours.

Is the challenge fee always refunded if I pass?

If you pass and complete the first withdrawal, top firms like Maven, FundedNext, Blueberry Funded, and PipFarm refund your evaluation fee—check each firm’s refund terms before joining.

Are cheap prop firms safe or just a scam?

Legit cheap firms exist, but scams pop up every year. Stick to firms with verified Trustpilot reviews and proof of payouts. Avoid companies with payment delays, unclear rules, or no user reviews.

Can I scale my funded account to $100K or more?

Many $5K–$10K cheap accounts cap at $50K–$100K, but FundedNext, E8, and PipFarm offer scaling to $1M+ for consistent traders.

What platform do these prop firms use?

Popular options include MT4, MT5, cTrader, Match-Trader, and DXTrade. Always confirm platform availability before paying.