Discover the top A-Book proprietary trading firms that provide real capital funding, transparent execution, and fast payouts. We’ve reviewed the best firms based on funding programs, profit shares, and trading conditions to help you find the right fit.

What Are A-Book Prop Firms?

A-Book proprietary trading firms are companies that route client trades directly to the market instead of acting as the counterparty. This means they don’t profit from traders’ losses, eliminating conflicts of interest and ensuring fair execution.

Unlike B-Book prop firms, which take the opposite side of trades (potentially leading to conflicts where they benefit when traders lose), A-Book firms align their success with yours. They earn through spreads and commissions, making them ideal for traders seeking transparency and real capital access.

Why Trade with an A-Book Prop Firm?

If you want to scale your trading career with real market exposure and instant payouts, an A-Book firm is the best choice. Here’s why:

✔ No Conflict of Interest – The firm profits from your success, not your losses

✔ Direct Market Access (DMA) – Trades are sent to liquidity providers for real execution

✔ Better Trading Conditions – Lower spreads, higher leverage, and fewer restrictions

✔ Faster Payouts – Many A-Book firms offer daily or weekly profit withdrawals

A-Book vs B-Book Prop Firms: What’s the Difference?

Many traders confuse A-Book and B-Book models, leading to misunderstandings about risk, order execution, and how these firms operate. Below is a clear comparison:

| Feature | A-Book Prop Firms | B-Book Prop Firms |

|---|---|---|

| Order Execution | Trades are routed directly to liquidity providers (banks, hedge funds, or ECNs) | Trades stay within the firm (market maker model) |

| Conflict of Interest | No, firm profits from spreads, commissions, or trader success | Yes, firm profits when traders lose money |

| Trading Conditions | Raw spreads, real market depth, no price manipulation | Higher spreads, slippage, stop hunting possible |

| Ideal For | Professional traders, institutional strategies, and scalpers | Retail traders, beginners, high-frequency traders |

| Leverage & Risk | Lower leverage, strict risk management, real market exposure | Higher leverage, flexible rules, internal risk management |

| Profit Model | Firm profits from commissions & profit splits | Firm profits from trader losses |

| Trade Transparency | Full market execution, trader-friendly | Potential for price manipulation, firm-friendly |

✅ Key Takeaway:

A-Book prop firms do not manipulate trades or trade against their traders. Instead, they pass orders to external liquidity providers, ensuring a more transparent and fair trading environment. B-Book firms, on the other hand, can act as a market maker where they hold the risk, often profiting from trader losses.

Best A-Book Prop Firms – Where Real Capital Meets Real Opportunity

Choosing the right A-Book proprietary trading firm is crucial for traders looking for real market execution, transparency, and institutional-level trading conditions. Below, we rank and review the top A-Book prop firms based on funding programs, trading conditions, profit splits, and platform offerings.

Ranking Criteria: What Makes a Great A-Book Prop Firm?

Before we jump into the rankings, here’s what we considered when selecting the best A-Book prop firms:

✅ Real Market Execution – Orders are routed through ECNs, liquidity providers, or stock exchanges, ensuring no dealer intervention.

✅ Fair Trading Conditions – Raw spreads, low commissions, and no artificial markups or slippage.

✅ Scalability – The ability to scale capital from $100K to $5M+ with a transparent growth plan.

✅ Instant or Fast Funding – Some firms offer no-evaluation instant funding, while others have a quick challenge process.

✅ Reliable Profit Split & Payouts – Fast, transparent withdrawals with high profit retention (80%-100%).

✅ Trading Flexibility – No restrictions on news trading, weekend holding, scalping, or algo trading.

- The5ers – Best for Diverse Funding Programs

- Monevis – Best for Flexible Time Limits and Fast Payouts

- Traddoo – Best for Advanced Trading Platforms & Strategic Partnerships

- FunderPro – Best for Real Capital Funding and Daily Payouts

- Lux Trading – Best for Large Capital Scaling and Career Growth

- Funded Lions – Best for Instant Funding and No Restrictions

- OriginFx – Best for Customizable Challenges and Strategic Partnerships

- Ascetic Capital – Best for Real Capital and Daily Payouts

1. The5ers – Best for Diverse Funding Programs

Overview:

The5ers is a pioneer in A-Book prop trading, offering real capital funding and multiple challenge programs for traders of all experience levels. With a Hyper Growth Plan, traders can scale accounts up to $4M while benefiting from tight spreads and real-time market execution.

Location:

Israel

What You Can Trade:

- Forex

- Metals

- Indices

- Commodities

- Stocks

- Cryptocurrencies

Profit Share:

Up to 100%

Why The5ers Stands Out:

✅ Multiple funding paths (1-step, 2-step, and bootcamp challenges).

✅ Hyper Growth Scaling – Double your account size at each milestone.

✅ Spreads from 0.0 pips – Institutional-grade conditions.

✅ Free coaching & market analytics to support traders.

✅ Frequent payouts – Withdraw while scaling your account.

Best For: Traders looking for fast capital growth and real market execution.

Summary:

The5ers offers a unique approach to prop trading with programs tailored to traders of all experience levels. Whether you’re looking for a high-risk, high-reward path or prefer to start with a low-cost evaluation, The5ers provides a range of options to help you grow your capital. With a strong focus on education, a supportive trading community, and flexible growth opportunities, it’s a top choice for traders looking to succeed with an A-Book prop firm.

Pros:

- Flexible funding programs for all trading levels.

- Spreads starting at 0.0 pips for cost-efficient trading.

- Access to coaching, webinars, and extensive trading resources.

- Real-time notifications and market insights.

- Reliable payout policy with frequent payments.

Cons:

- Initial fees required for some programs.

- High-risk programs may not suit all traders.

2. Monevis – Best for Flexible Time Limits & Fast Payouts

Overview:

Monevis is an A-Book firm offering traders up to $200,000 in funding with a simple, no-time-limit evaluation process. With an 85% profit split and reliable 7-day payouts, Monevis is perfect for traders who want a stress-free challenge.

Location:

Global

What You Can Trade:

- Forex

- Metals

- Indices

- Commodities

- Stocks

- Cryptocurrencies

Profit Share:

Up to 85%

Why Monevis Stands Out:

✅ No time limit on evaluations – Take as long as you need.

✅ 7-day payout cycle – Get paid weekly.

✅ MT5 trading platform with ultra-low spreads.

✅ Static drawdown (10%) ensures manageable risk exposure.

Best For: Traders who value time flexibility and want frequent, fast payouts.

Summary:

Monevis is an excellent choice for traders who prefer flexible evaluation processes without time limits. With access to up to $200,000 in capital and a solid profit split of up to 85%, it’s an ideal platform for traders looking for a supportive and streamlined trading environment. Monevis’ fast payouts, user-friendly MT5 platform, and transparent policies make it a top contender in the A-Book prop trading space.

Pros:

- Unlimited time to pass the evaluation.

- Fast and reliable payouts within 7 days.

- Access to an MT5 platform with low spreads.

- High profit split of up to 85%.

- Flexible funding options and scalable accounts.

Cons:

- Initial fees apply for evaluations.

- Static drawdown rules may be restrictive for some traders.

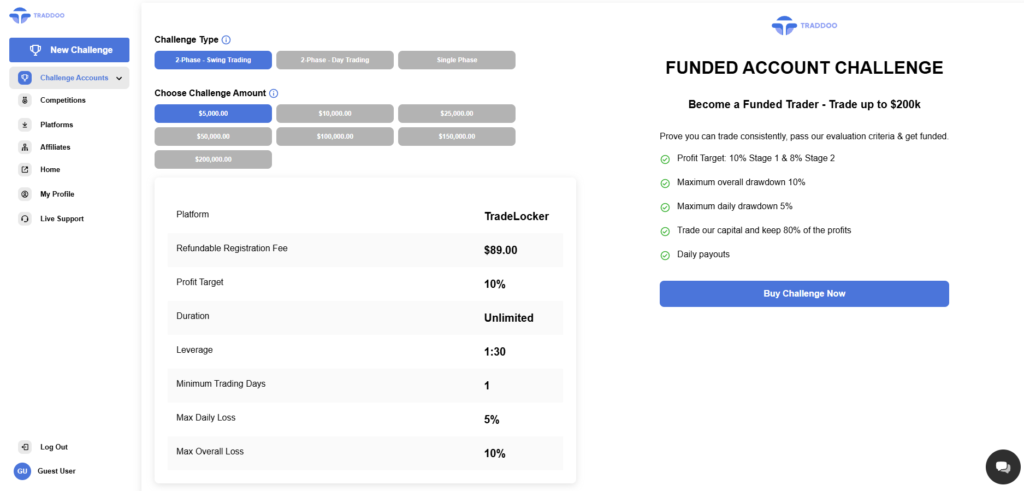

3. Traddoo – Best for Advanced Trading Platforms & Strategic Partnerships

Overview:

Tradoo, led by CEO Dylan Worrall, focuses on institutional-level trading conditions, offering real market execution via MT4, MT5, and TradeLocker. With access to a wide range of assets, traders can benefit from strategic broker partnerships for the best execution quality.

Location:

British Virgin Islands

What You Can Trade:

- Forex (Majors, Crosses, Exotics)

- EU Shares

- Global Stocks

- Cryptocurrencies

- Energies

- Metals

- Indices

Profit Share:

Up to 80%

Why Traddoo Stands Out:

✅ Multiple platforms (MT4, MT5, TradeLocker) for all trading styles.

✅ Real capital funding with liquidity provider access.

✅ No dealing desk intervention – True ECN execution.

✅ 10% max total drawdown for enhanced risk management.

Best For: Algo traders, stock traders, and futures traders looking for deep liquidity.

Summary:

Tradoo offers a robust risk management structure, providing traders with access to a broad range of assets and multiple trading platforms like TradeLocker. With standardized leverage and a transparent evaluation process, the firm presents an appealing option for traders looking to diversify their portfolio within clearly defined risk limits.

Pros:

- Multiple trading platforms, including TradeLocker.

- Real trading capital.

- Daily payouts.

Cons:

- Consistency rule during evaluation.

- New firm with limited track record.

4. FunderPro – Best for Real Capital Funding & Daily Payouts

Overview:

FunderPro funds traders with real capital from day one, ensuring daily payouts with zero artificial spreads or price manipulation. Traders can scale accounts up to $5M with transparent funding models.

Location:

Global

What You Can Trade:

- Forex

- Metals

- Oil

- Indices

- Cryptocurrencies

Profit Share:

80%

Why FunderPro Stands Out:

✅ Daily payouts – Withdraw profits any time.

✅ No trailing drawdown – Greater flexibility in trade management.

✅ Choose between Fast Track, Regular, and Swing challenges.

✅ Scale your account to $5M+ through consistent performance.

Best For: Traders who want instant access to real capital and fast profit withdrawals.

Summary:

FunderPro is redefining prop trading by offering real capital and fast payouts, with no hidden rules or restrictions. The combination of flexible challenges, a high-profit split, and the security of real money funding makes it an excellent choice for traders looking for a supportive and transparent trading environment. With its focus on empowering traders, FunderPro is a leader in the A-Book prop firm space.

Pros:

- Daily payouts from the first trade.

- Real capital, no virtual funded accounts.

- No trailing drawdowns.

- Flexible challenge options to suit different trading styles.

- 24/7 support with an active community.

Cons:

- Evaluation fees are non-refundable.

- High leverage options may not suit all traders.

5. Lux Trading – Best for Large Capital Scaling & Career Growth

Overview:

Lux Trading provides real liquidity and institutional-grade capital scaling. With real stock exchange access and a $10M scaling plan, Lux Trading is perfect for serious, career-driven traders.

Location:

Global

What You Can Trade:

- Forex (Majors, Minors, Exotics)

- Indices (SP500, NASDAQ)

- Commodities (Metals, Oil, Gas)

- Futures

- Stocks (Over 2,000 global stocks)

Profit Share:

Up to 75%

Why Lux Trading Stands Out:

✅ Trade real capital (not demo accounts).

✅ Elite Trader Program – Mentorship, salary, and risk desk access.

✅ No time limit on challenges – Trade at your own pace.

✅ Access to stock exchanges & global liquidity providers.

Best For: Traders looking for long-term career development & institutional capital.

Summary:

Lux Trading is designed for serious traders looking to manage significant capital while receiving full support, including mentorship, education, and daily market analysis. The firm’s transparent trading environment, real liquidity, and the opportunity for stable income make it an ideal choice for traders aiming to build a sustainable career.

Pros:

- Real capital and liquidity from a top-tier provider.

- No time limits on evaluations.

- Professional mentorship and support from experienced traders.

- Audited track record accepted by financial institutions.

- Access to a $10,000,000 account in just three stages.

Cons:

- High initial evaluation fees.

- Requires commitment to pass through multiple growth stages.

6. Funded Lions – Best for Instant Funding & No Restrictions

Overview:

Funded Lions offers instant funding with zero trading restrictions, making it the most flexible A-Book prop firm for traders who want to start trading real capital immediately.

Location:

Global

What You Can Trade:

- Forex

- Indices

- Stocks

- Commodities

- Cryptos

Profit Share:

Up to 50%, scaling up to 30% on some programs

Why Funded Lions Stands Out:

✅ No evaluation required – Instant funding available.

✅ Withdraw profits immediately after hitting targets.

✅ Trade forex, stocks, crypto, and commodities.

✅ No restrictions on news trading, weekend holding, or scalping.

Best For: Traders who want fast access to capital with no evaluation.

Summary:

Funded Lions is perfect for traders who want the freedom to trade with real capital without restrictions or delays. With instant payouts, no time limits, and programs designed for different trading styles, it’s an excellent option for traders seeking flexibility and fast access to profits.

Pros:

- Instant funding and payouts.

- No trading restrictions, including news trading and weekend holding.

- Flexible account sizes and programs tailored to all trading styles.

- 24/7 customer support via live chat and Discord.

Cons:

- The profit split is lower initially but can scale up with regular payouts.

- Some programs have a lower maximum drawdown, requiring careful risk management.

7. OriginFx – Best for Customizable Challenges & Strategic Partnerships

Overview:

OriginFx allows traders to customize their own funding challenges, offering real trading capital and access to hedge fund partnerships.

Location:

Global

What You Can Trade:

- Forex

- Indices

- Commodities

- Stocks

- Cryptos

Profit Share:

80%

Why OriginFx Stands Out:

✅ Customizable evaluation challenges – Set your own drawdowns & profit targets.

✅ Regulatory-backed trading environment – Secure & transparent.

✅ Partnerships with hedge funds for additional funding opportunities.

✅ Advanced analytics & AI-powered trading dashboard.

Best For: Traders who want a fully personalized prop trading experience.

Summary:

OriginFx is designed for traders seeking a fully customizable trading experience with access to professional-grade tools and strategic funding opportunities. With regulatory compliance, advanced analytics, and an 80% profit split, it’s a prime choice for traders looking to scale their trading career with confidence.

Pros:

- Fully customizable trading challenges.

- Unlimited trading days and no pressure to meet short deadlines.

- Real-time analytics and advanced trading tools.

- Partnerships with hedge funds for additional funding opportunities.

- Secure, regulated trading environment.

Cons:

- High-impact news trading is not allowed on some accounts.

- Higher starting fees for larger account sizes.

8. Ascetic Capital – Best for Real Capital & Daily Payouts

Overview:

Ascetic Capital offers real brokerage accounts, daily profit withdrawals, and zero hidden rules, making it ideal for self-disciplined traders.

Location:

Global

What You Can Trade:

- Forex

- Futures (coming soon)

- Commodities

- Cryptos

Profit Share:

80/20

Why Ascetic Capital Stands Out:

✅ Real A-Book execution – No synthetic trades.

✅ Daily withdrawals – Immediate access to profits.

✅ No restrictions on trading styles (scalping, hedging, news trading allowed).

✅ Personalized coaching & 1-on-1 mentorship.

Best For: Traders who value transparency, real capital, and fast payouts.

Summary:

Ascetic Capital is perfect for traders who seek daily payouts, real capital, and no hidden restrictions. With affordable evaluation programs and a commitment to empowering disciplined traders, it offers the ideal environment for growing your trading career.

Pros:

- Real capital and A-Book trading.

- Daily payouts with no waiting period.

- Affordable evaluation programs.

- 1-on-1 coaching and support for traders.

Cons:

- Limited asset range for now (futures and MT5 coming soon).

- Max drawdown of 8%, which may feel restrictive to some traders.

Who Should Choose an A-Book Prop Firm?

A-Book prop firms are ideal for traders who value transparency, real market conditions, and institutional-level execution. Here are the types of traders who benefit the most:

✅ 1. Professional & Institutional Traders

- A-Book firms provide direct market access (DMA) with real liquidity, making them ideal for professional traders using scalping, high-frequency, and institutional strategies.

- Lower spreads and no dealing desk intervention mean faster execution speeds with minimal slippage.

✅ 2. Swing Traders & Position Traders

- If you hold trades for several days or weeks, A-Book firms allow overnight and weekend holding, unlike many B-Book firms that have restrictions.

- Lower swap fees & real market spreads make them cost-effective for longer-term trading.

✅ 3. Traders Who Want Fair Trading Conditions

- Traders who have experienced spread manipulation, slippage, or stop-hunting from B-Book firms will find A-Book firms more transparent.

- Since orders are executed in the real market, there is no conflict of interest.

✅ 4. Traders Who Use Scalping or News Trading

- Low-latency execution and raw spreads make A-Book firms ideal for scalpers and high-frequency traders (HFTs).

- No trading restrictions during high-impact news events.

✅ 5. Traders Seeking Long-Term Career Growth

- Many A-Book firms offer career progression, allowing traders to scale up to $5M+ in funding.

- Some firms provide professional mentorship and institutional trading resources.

✅ Key Takeaway:

If you prioritize execution speed, transparency, and direct market access, A-Book prop firms are the better choice.

Are A-Book Prop Firms Better for Forex, Stocks, or Futures?

A-Book prop firms support multiple asset classes, but each market has unique advantages and considerations. Here’s how they compare:

| Market | A-Book Prop Firm Advantages | Considerations |

|---|---|---|

| Forex | – Tight raw spreads (0.0 pips) with real ECN execution – Deep liquidity & real-time price quotes – Ideal for scalping, swing trading, and algorithmic strategies | – Lower leverage than B-Book firms (often capped at 1:30 – 1:100) |

| Stocks | – Direct access to global exchanges (NYSE, NASDAQ, LSE, etc.) – Better execution with Level 2 order book visibility – No artificial spreads or markups | – Higher margin requirements (due to market volatility) |

| Futures | – Lower commissions & institutional-grade order execution – No conflict of interest between trader and firm | – Requires a higher initial capital commitment |

| Cryptocurrency | – Direct market trading with major exchanges (Binance, Coinbase Pro, etc.) – No synthetic CFDs—real crypto asset exposure | – Limited crypto pairs compared to some B-Book firms |

✅ Key Takeaway:

- Forex Traders: A-Book firms provide better spreads, deeper liquidity, and real ECN execution.

- Stock Traders: A-Book firms give direct access to stock exchanges, reducing trading costs.

- Futures Traders: Institutional execution and access to regulated markets.

- Crypto Traders: A-Book firms offer real market exposure, not just CFD-based trading.

Comparison Table: A-Book Prop Firm Features at a Glance

| Prop Firm | Profit Split | Payouts | Evaluation Type | Max Capital | Trading Flexibility |

|---|---|---|---|---|---|

| The5ers | Up to 100% | Bi-Weekly | 1-Step, 2-Step | $4M | ✅ No restrictions |

| Monevis | 85% | Weekly | 2-Step | $200K | ✅ News trading, scalping |

| FunderPro | 80% | Daily | 1-Step, Instant | $5M | ✅ Instant funding available |

| Lux Trading | 75% | Monthly | Institutional | $10M | ✅ Stock exchange access |

| Funded Lions | 50% | Instant | No evaluation | $200K | ✅ No restrictions |

| OriginFx | 80% | Custom | Customizable | $1M | ✅ Fully personalized |

| Ascetic Capital | 80% | Daily | 1-Step | $500K | ✅ No trading restrictions |

Conclusion: Choosing the Best A-Book Prop Firm for Your Trading Goals

A-Book prop firms offer traders a transparent, conflict-free trading environment with real market execution and fair profit-sharing models. Whether you’re looking for instant funding, a challenge, or long-term capital scaling, there’s an A-Book prop firm that fits your trading style and financial goals.

Final Takeaways: What to Look for in an A-Book Prop Firm

✅ Real Market Execution – Avoid dealing desk manipulation and trade directly with liquidity providers.

✅ Fair Profit Splits – Look for firms offering 80% or higher profit shares with frequent payouts.

✅ Low or No Trading Restrictions – Choose firms that allow scalping, news trading, and weekend holding.

✅ Scalability – If you want to trade big capital, pick firms with multi-million-dollar scaling plans.

✅ Flexible Evaluations – If you want no time limits or custom challenges, check the firm’s funding rules.

Which A-Book Prop Firm Should You Choose?

Want the highest capital scaling? → Lux Trading ($10M+), The5ers ($4M+ Growth Program)

Need fast payouts? → FunderPro (Daily Payouts), Ascetic Capital (Daily Withdrawals)

Prefer an evaluation with no time limits? → Monevis (Unlimited Challenge Duration)

Looking for instant funding with no rules? → Funded Lions (Trade Immediately, No Restrictions)

Want a fully customizable challenge? → OriginFx (Build Your Own Challenge, Flexible Rules)

Take Action & Get Funded Today

The best A-Book prop firms provide real capital, fair trading conditions, and unlimited growth potential. Now it’s up to you to choose the firm that aligns with your strategy and trading goals.