FXIFY is an innovative prop trading firm that offers customizable funding programs, flexible trading rules, and a wide range of tradable assets for ambitious traders.

FXIFY Review

Are you an ambitious trader looking for a prop trading firm to take your career to the next level? With so many options available, it’s essential to carefully consider your choices before deciding. In this review, we’ll be taking a closer look at FXIFY, a prop firm that provides funding programs for traders in the forex, crypto, equities, and commodities markets. We’ll delve into the company’s funding program options, fees, tradable assets, and restrictions, so you can determine whether FXIFY is the ideal prop firm to help you achieve your trading goals.

About FXIFY

FXIFY is an innovative prop trading firm that allows traders to access up to $4,000,000 in trading capital. The platform aims to provide traders with the best possible trading experience, presenting real-time analytics and metrics to help them enhance their trading skills. What sets FXIFY apart from other firms is its ability to customize trading accounts to align with each trader’s individual strategies, whether they prefer an aggressive trading approach or a more flexible timeline to achieve their objectives.

This group of experienced traders, with a mix of retail and institutional broker backgrounds, has launched their platform with a bang. Boasting over 30 years of collective trading and brokerage experience, the founding team of David Bhidey, Peter Brown, and Robert Winters have traded with many famous prop firms. Now, they’re bringing their expertise and passion for trading to the world with FXIFY.

FXIFY understands the challenges of trading and recognizes the importance of a supportive and transparent environment for success. They offer two evaluation programs, the 1-phase and 2-phase evaluations, tailored to accommodate traders with varying skill levels and risk tolerance. Moreover, FXIFY provides a friendly community that assists traders in navigating the complexities of the financial markets and achieving their goals.

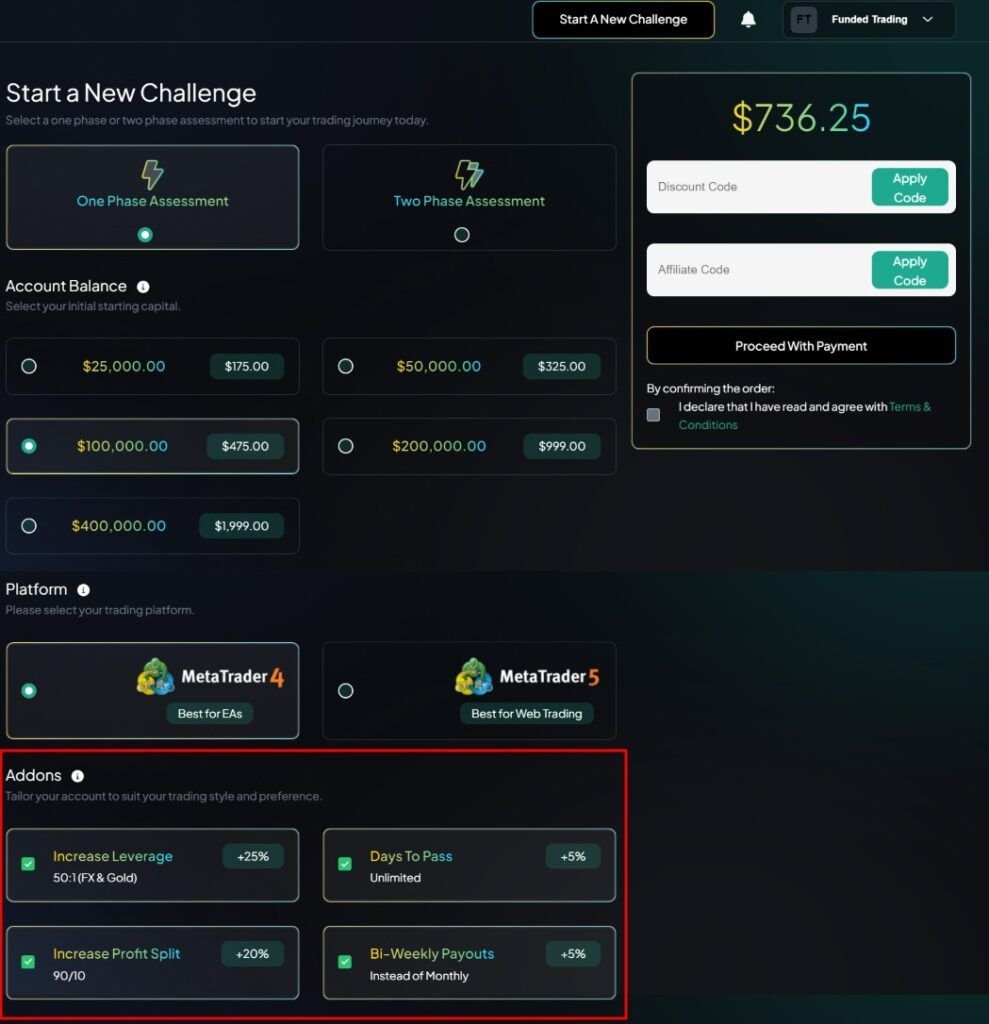

Traders can customize their accounts with FXIFY to match their individual trading styles and preferences. This includes selecting their initial starting capital and trading platform. Moreover, FXIFY provides flexible options, such as increasing leverage, extending the evaluation period, and receiving bi-weekly payouts. These can help traders optimize their accounts and reach their full earning potential.

Funding Program Options

FXIFY now offers three distinct funding evaluations to suit various trading styles and experience levels: the 1-phase evaluation, 2-phase evaluation, and 3-phase evaluation. Each evaluation is designed to assess traders’ skills and provide access to the firm’s capital.

1-phase Evaluation

This is the fastest way to get funded. Traders only need to pass one assessment, making it ideal for those seeking rapid capital growth. Account sizes range from $10,000 to $400,000 with up to 90% performance split. The trailing drawdown limit is set at 6%, and traders can trade without any time constraints, allowing full flexibility. This option encourages traders to compound their account balance to a higher level using FXIFY’s scaling plan, which can go up to $4,000,000.

2-phase Evaluation

The 2-phase evaluation remains a balanced option for traders who want to demonstrate both consistency and skill over a longer period. Traders can secure funding from $10,000 to $400,000 after passing two stages of evaluation. The first phase requires a 10% profit target, while the second phase requires 5%. With unlimited days to complete the assessment, traders can move at their own pace. The evaluation is designed for those looking to showcase strong risk management and disciplined trading over time.

3-phase Evaluation

FXIFY’s newest addition, the 3-phase evaluation, introduces a longer assessment period for those wanting to prove consistency across multiple phases. Traders progress through three stages, each with a 5% profit target. This model supports traders seeking gradual and steady growth, with account sizes ranging from $10,000 to $400,000. As with the other models, traders can enjoy a 90% performance split, no consistency rules, and the ability to hold trades over the weekend.

Fees

FXIFY provides transparent and flexible pricing options that cater to a wide range of traders. The fees now range from $59 to $1,999, depending on the initial starting capital and the evaluation type. Traders can select account sizes from $10,000 to $400,000, making it accessible for both beginners and experienced traders.

- The 1-phase evaluation fees start at $85 for a $10,000 account and go up to $1,999 for a $400,000 account.

- The 2-phase evaluation fees range from $85 to $1,999, with similar account size options.

- The 3-phase evaluation fees start at $59 and go up to $1,599, offering a more budget-friendly option for traders seeking a longer evaluation period.

FXIFY remains upfront about its pricing with no hidden costs or unexpected fees. The assessment fee covers the entire evaluation process, including setting up and maintaining the account. If traders are profitable but don’t meet their target, they can continue without a reset fee. In case of failure, they can retake the evaluation with a 10% discount.

Traders benefit from a profit split that starts at 75% and can increase to 90%. By purchasing an add-on at checkout, traders can opt for a higher profit split for an additional 20% of the regular fee.

Moreover, traders have the option to select bi-weekly payouts by paying an extra 5% fee, offering more frequent withdrawal options alongside the standard monthly payout.

FXIFY also provides several customizable add-ons to help traders optimize their accounts:

- Increased leverage of up to 50:1 for forex and gold trading, available for an additional 25% fee.

- Unlimited evaluation days can be purchased for an extra 5% fee, allowing traders to complete their assessments at their own pace.

These flexible add-ons allow traders to customize their experience, making FXIFY a versatile option for a broad range of trading strategies and preferences.

Tradable Assets

FXIFY, in collaboration with FXPIG, a reputable broker since 2010, offers a distinctive prop firm experience by providing all the essential tools you would typically expect from a regular broker. You can trade using the widely recognized MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms, supported by a top-tier multi-asset Tier 1 true STP broker, ensuring an optimal trading environment.

With FXIFY, you can access a wide range of over 300 trading instruments. This diverse selection includes various markets such as stocks, cryptocurrencies, indices, and forex, catering to traders of all kinds. Whatever your preferred trading choice may be, FXIFY has you covered.

One remarkable aspect of FXIFY is its commission-free trading for forex, gold/metals, and indices. This exclusive feature allows you to optimize your trading performance by eliminating additional costs typically associated with these assets. Moreover, you can also trade stocks and cryptocurrencies, expanding your investment opportunities all in one convenient place.

Restrictions

FXIFY stands out from other prop firms by offering very relaxed trading rules, making it even more appealing to a wide range of traders. Here’s what you can do with FXIFY:

- EAs allowed: FXIFY supports using Expert Advisors (EAs), which can help automate your trading strategies. This means you can use technology to improve your trading experience and outcomes.

- Hold over the weekend: Unlike some prop firms, FXIFY allows you to keep your trades open over the weekend. This flexibility allows you to manage your positions according to your own trading style and preferences.

- No consistency rules: FXIFY imposes no consistency rules on your trading. This means you can trade at your own pace and follow your own strategies without being restricted by specific requirements.

- No stop loss required: At FXIFY, you’re not required to set a stop loss for your trades. This gives you more control over your risk management and allows you to make decisions based on your own judgment and analysis.

These relaxed trading rules make FXIFY an attractive option for traders who prefer a more flexible trading environment, giving you the freedom to trade your way.

Challenge

FXIFY now offers three evaluation options: 1-phase, 2-phase, and the newly introduced 3-phase, giving traders even more flexibility to choose the assessment that suits their trading style.

1-phase Evaluation

In the 1-phase evaluation, the profit target is set at 10%, and there’s no time limit, allowing traders to reach their target at their own pace. A daily loss limit of 5% is in place, which is calculated based on the previous day’s end-of-day balance (5 PM EST). This evaluation is ideal for those who want a straightforward and fast path to funding with fewer steps.

The 1-phase evaluation employs a 6% trailing drawdown, which means your account cannot drop more than 6% from its highest point after achieving a new balance high. This system protects your capital while still offering flexibility for growth. Traders can start with leverage of 30:1 by default, with the option to increase it to 50:1 for forex and gold trades at checkout.

2-phase Evaluation

The 2-phase evaluation consists of two stages. The first stage has a 10% profit target, and the second stage requires a 5% profit target. Similar to the 1-phase, traders must maintain a daily loss limit of 5%. This evaluation is more structured and involves proving consistency over two stages.

The drawdown is set to a static 10%, meaning your account balance cannot decrease by more than 10% from its highest point. The second phase also offers a maximum time frame of 60 days to meet the profit target, with the option to move at a more deliberate pace if needed.

3-phase Evaluation

The 3-phase evaluation is the latest addition, ideal for traders who want to demonstrate consistency over an extended period. The profit targets for each phase are as follows:

- Phase 1: 5% profit target

- Phase 2: 5% profit target

- Phase 3: 5% profit target

This evaluation gives traders more opportunities to refine their trading over multiple phases. The drawdown limit remains static at 5% throughout all phases, allowing for tighter risk management. Traders are required to meet the daily loss limit of 5% while completing the minimum of 5 trading days for each phase. The maximum trading days are unlimited, giving traders as much time as needed to pass the evaluation.

Once you successfully complete any of the evaluation phases, FXIFY will verify your identity through Sumsub’s KYC process. Upon verification, you will sign a Trader Agreement as an independent contractor. Your funded account details will then be issued within 24-48 business hours.

FXIFY has partnered with Deel to manage trader agreements and profit withdrawals. Once the agreement and KYC process are completed, your funded account will be activated. You are also eligible for a refund of the purchase fee, plus a 25% bonus (a total of 125% of the initial fee), which is paid out with your first profit withdrawal.

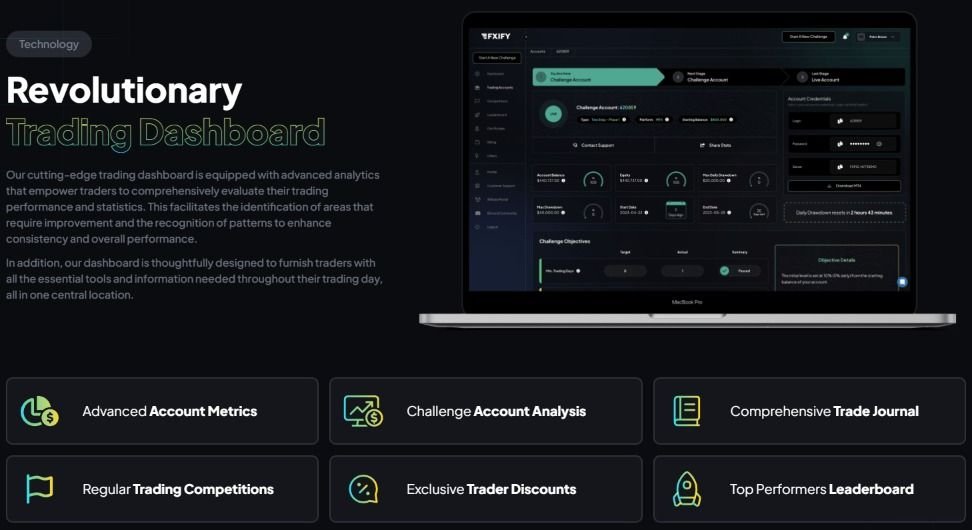

Trading Dashboard

FXIFY’s trading dashboard is widely regarded as one of the best in the market, offering a comprehensive set of features and a user-friendly interface. What sets FXIFY apart from other prop firms is that they are not another white-label prop firm. Instead, they provide a fully customized trading experience. They have carefully designed their dashboard to meet the unique needs of their traders, ensuring a seamless and efficient trading process.

One key aspect distinguishing FXIFY is its collaboration with FXPIG, a reputable broker since 2010. FXPIG brings its expertise as a Tier 1 true STP broker to the prop firm, offering a range of essential tools and services you would typically expect from a regular broker. This collaboration allows traders on the FXIFY platform to access a top-tier trading environment while benefiting from the advantages of being part of a prop firm.

FXIFY offers two popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well-known in the industry for their advanced tools and features. MT4 is a longstanding choice for forex and CFD traders, providing various technical indicators, charting tools, and automated trading options through Expert Advisors (EAs). MT5, on the other hand, offers even more advanced features and is favored by traders who require access to a broader range of asset classes. Both platforms are available to all FXIFY traders, allowing you to choose the platform that suits your needs and explore new options.

In addition to its robust features and collaboration with FXPIG, traders on the platform can participate in free monthly trading competitions. These competitions offer a chance to showcase trading skills, compete against fellow traders, and potentially win prizes. Engaging in these competitions not only adds excitement but also allows traders to test their strategies in a competitive environment, further honing their skills.

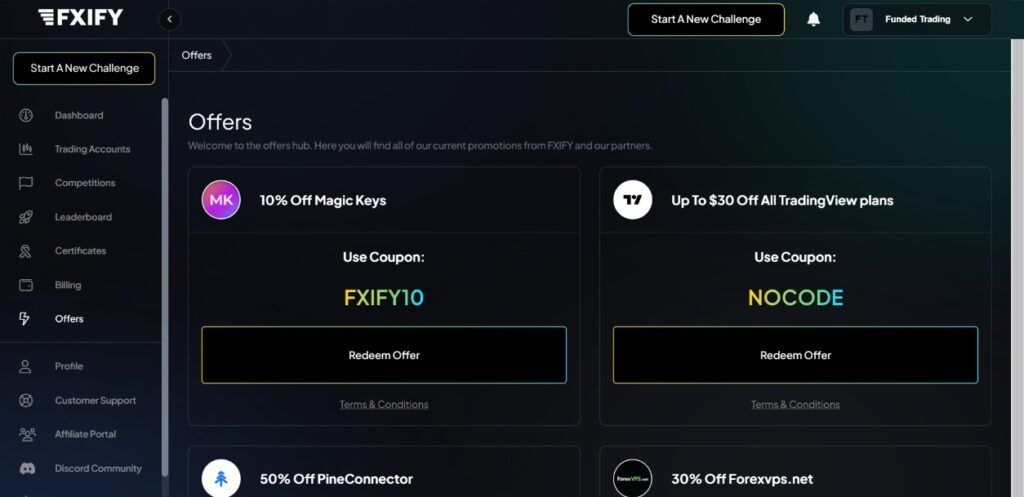

Furthermore, the FXIFY trading dashboard includes an Offers section granting exclusive discounts to the FXIFY community. These discounts are explicitly chosen for traders, providing special deals on trading-related products and services. With these discounts, traders can save costs while accessing valuable resources that enhance their trading activities. The presence of free trading competitions and exclusive closed discounts showcases FXIFY’s dedication to building a flourishing community and delivering extra benefits to its traders.

FXIFY also offers a convenient withdrawal process that caters to traders’ needs. With the Withdrawal On Demand feature, traders have the flexibility to access their profits efficiently. Unlike many other prop firms, FXIFY allows traders to request a withdrawal of profits as early as 24 hours after placing their first trade on the live account. Traders can choose the frequency of their withdrawals, with the option to make them as frequently as every two weeks. This enables traders to manage their funds according to their preferences, whether they prefer immediate withdrawals or letting their profits compound for further account growth.

Upcoming Features

FXIFY remains committed to continuous innovation and improvement in its offerings to enhance the overall trading experience for its users. They are currently working on two exciting new features that will bring added benefits to traders.

FXIFY Social Copy Trading

FXIFY is developing a Social Copy Trading feature that allows you to seamlessly replicate the trades of top-performing FXIFY funded traders within your own account. This instant reflection of their trades in your account simplifies the process and enables you to leverage their expertise. Suppose you have a live account with FXIFY and generate consistent profits. In that case, you can serve as a strategy provider, increasing your earnings by helping other traders who copy your strategy. You’ll also receive an attractive 20% commission on your trades.

FXIFY Pre-Paid Cards

Aiming to revolutionize withdrawal options and processes for funded traders in the prop trading industry, FXIFY is working on introducing its exclusive pre-paid cards. These cards will be available only to FXIFY funded traders, offering a quick and convenient way to access their earnings. Traders can experience the simplicity of withdrawing their profits directly to their FXIFY pre-paid card. By transferring profits to the pre-paid card, traders can enjoy the flexibility of using their earnings for online and in-store purchases and cash withdrawals, as per their needs. FXIFY is finalizing agreements with Mastercard and anticipates launching this feature between Q2 and Q3.

Conclusion

FXIFY stands out as an innovative and flexible prop trading firm that caters to the diverse needs of traders across various markets. With its customizable funding programs, relaxed trading rules, and extensive tradable assets, the platform provides an exceptional environment for novice and experienced traders to excel. The founding team’s vast experience and dedication to continuous improvement ensure that FXIFY remains at the forefront of the industry, offering cutting-edge features such as Social Copy Trading and the upcoming FXIFY Pre-Paid Cards. FXIFY has the potential to become one of the best new prop firms in the market, making it a prime choice for ambitious traders. If you seek a supportive and transparent prop firm to achieve your trading goals, FXIFY is undoubtedly worth considering.

FXIFY Discount Code 20%

If you want to join FXIFY, use our exclusive code for a 20% discount FT20.