Tiger Funded stands out with 95% profit rewards, a 12% drawdown limit, and a unique 200% refund on evaluation fees. Traders also earn 20% from the challenge phase and can scale accounts up to $4M. Awarded Best Challenge Prop Firm 2025 for top trading conditions.

Tiger Funded offers simulated trading challenges with 95% performance rewards, a 12% drawdown limit, 20% rewards from the challenge phase, and a rare 200% fee refund, making it stand out among prop-style programs. In 2025, it won FundedTrading Awards Best Challenge Prop Firm, highlighting its strong trading conditions and evaluation paths.

What is Tiger Funded?

Tiger Funded is a Dubai-based company providing demo trading challenges with simulated rewards, designed to test traders’ skills in a risk-free environment.

Founded at Dubai Digital Park in the UAE, Tiger Funded was created by traders with diverse backgrounds in market analysis, strategy, and risk evaluation. Their goal is to push individuals to improve performance, maintain discipline, and develop consistency while trading in a structured setting.

In recognition of this approach, Tiger Funded was named Best Challenge Prop Firm 2025, praised for combining multiple evaluation formats with trader-friendly conditions such as fast processing times, generous rewards, and scaling potential up to $4M.

The mission of Tiger Funded is to help ambitious traders sharpen their skills and achieve measurable growth. By offering tools, defined rules, and a supportive community, the platform fosters learning and disciplined decision-making, essential traits for achieving long-term success in trading.

It is important to note that Tiger Funded operates exclusively in a simulated environment. All accounts provided are demo accounts, and no real financial transactions take place. The company is not a financial institution, does not provide investment advice, and does not accept deposits. Its services are intended only for practice and educational purposes.

How do Tiger Funded challenges work?

Tiger Funded offers 1-step, 2-step, 3-step, and instant funding programs with profit targets, drawdown limits, and unlimited time.

1-Step Challenge Rules

The 1-Step Challenge is designed for traders who want a fast route to a funded account.

- Profit target: 10 percent

- Maximum drawdown: 6 percent

- Daily drawdown: 3 percent

- Unlimited trading days allowed

- Rewards: up to 95% with a 200% refund on fees after the first payout

This format appeals to traders who value simplicity, since one evaluation phase is enough to qualify.

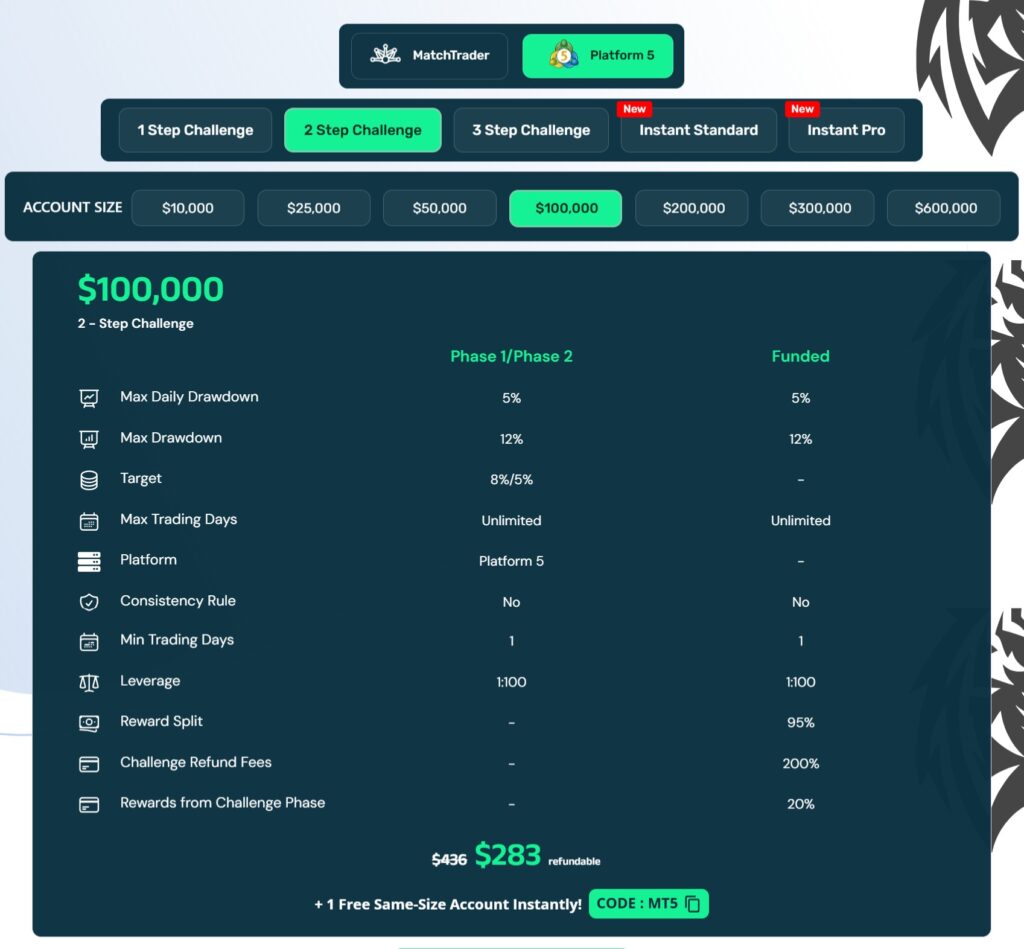

2-Step Challenge Rules

The 2-Step Challenge is for those who prefer a more thorough evaluation of consistency.

- Step 1 profit target: 8%

- Step 2 profit target: 5%

- Maximum drawdown: 12%

- Daily drawdown: 5%

- Unlimited trading days allowed

- Payouts processed in as little as 7 days

The 2-Step gives more breathing room with a larger drawdown allowance while still rewarding disciplined trading.

3-Step and Instant Funding

Tiger Funded also provides additional paths for different trader preferences.

- 3-Step challenges test traders across three stages before funding

- Instant Standard and Instant Pro accounts skip the evaluation entirely

- Account sizes range from $5,000 to $200,000, depending on the option chosen

Instant Pro enables traders to start trading without a challenge phase, making it attractive for those who want immediate access to simulated rewards.

What are Tiger Funded’s fees and account sizes?

Fees start as low as 47 dollars, scaling up with account size, with all challenges eligible for a 200% refund after the first reward.

Account sizes range from $5,000 to $200,000 in the evaluation programs. With scaling, traders can grow their accounts up to $4 million.

Tiger Funded is positioned as one of the most affordable options in the industry. A $100,000 account costs $283 compared to $549 at FundedNext.

Tiger Funded vs Competitors Pricing (100K account)

| Prop Firm | Price | Max Scaling | Refund Policy | Reward Split |

| Tiger Funded | $283 | Up to $4M | 200% refund | 95% |

| FundedNext | $549 | Up to $2M | 100% refund | 80% |

| Funding Pips | $529 | Up to $2M | 100% refund | 80% |

The refund system is one of Tiger Funded’s most attractive features. After the first payout, traders receive double their challenge fee back, which means the evaluation phase can end up being profitable on its own.

How does Tiger Funded compare to other prop firms?

Tiger Funded beats rivals on pricing, refund policy, and reward split while offering broader scaling options.

Tiger Funded vs E8 Markets vs FundedNext vs Funding Pips

| Feature | Tiger Funded | E8 Markets | FundedNext | Funding Pips |

| Cheapest account fee | $47 | $54 | $32 | $25K min size, pricing varies |

| $100K account fee | $306 | $549 (1-Step) | $399 (Stellar Lite) | $499 (avg, 2-Step) |

| Max scaling | Up to $4M | Up to $400K | Up to $300K | Up to $300K |

| Profit split | 95% | Up to 100% | Up to 95% | Up to 100% |

| Refund policy | 200% refund | 100% refund | 100% refund | No refunds |

| Time limits | None | None | Min 2–5 days | Min 3–7 days |

| Payout speed | 7 days, avg 16 hrs | Anytime after 8 days | 5–21 days | Weekly or on-demand |

Key Takeaways

- Tiger Funded has the most generous refund policy, offering 200 percent of the fee back after the first payout.

- E8 Markets is attractive for traders who want scaling up to $400K and profit splits as high as 100 percent.

- FundedNext offers affordable entry at just $32 for a 5K account, with flexible plan add-ons.

- Funding Pips stands out with multiple payout cycles, including on-demand payouts at up to 100 percent.

What can you trade with Tiger Funded?

Traders can use forex, indices, commodities, and crypto pairs with full freedom on strategies.

Tiger Funded provides access to a wide range of markets, giving traders the flexibility to diversify and test different styles.

- Forex: Major and minor currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, with leverage up to 1:100.

- Indices: Popular global benchmarks including US30, NAS100, and DAX40, allowing traders to capture market-wide moves.

- Commodities: Gold, oil, and silver are available for those seeking exposure to tangible assets.

- Cryptocurrencies: Bitcoin, Ethereum, and other leading coins can be traded with high liquidity and volatility.

In terms of strategy, Tiger Funded permits full flexibility. Traders can use Expert Advisors, trade news events, hold positions overnight or through weekends, and employ hedging methods. There are no restrictions on lot sizes, which means participants can build their positions as they see fit.

Is Tiger Funded legit and worth it?

Tiger Funded is a demo-based prop-style platform with attractive benefits, but traders must remember that all trading is simulated and carries risk.

Pros

- Low pricing starting at $47 for smaller accounts

- Performance rewards up to 95%

- 200% refund of challenge fees after the first payout

- 20% reward earned directly from the challenge phase

- No time limits on completing challenges

- Fast processing with average reward approvals in 16 hours

Cons

- All accounts are demo accounts, not live funding

- No regulated financial services, as Tiger Funded is not a broker or financial institution

Who it’s for

Tiger Funded is best for traders who want to practice discipline, refine strategies, and experience structured trading conditions without risking personal capital. It is not intended for those seeking direct access to real trading funds.

Conclusion

TigerFunded has positioned itself as one of the most affordable and flexible prop-style programs available. Between the 95% performance rewards, 200% refund on evaluation fees, and account scaling up to $4M, it creates strong incentives for skilled traders.

Winning the Best Challenge Prop Firm 2025 award underscores its reputation as a leader in structured evaluations and trader-friendly rules. For anyone seeking to sharpen their trading skills in a simulated environment, TigerFunded is a standout choice.

FAQs about Tiger Funded

What is the maximum drawdown at Tiger Funded?

The maximum drawdown is 12%, one of the most generous limits among prop-style programs.

Does Tiger Funded refund challenge fees?

Yes. After your first payout, Tiger Funded refunds 200% of the evaluation fee, effectively turning the challenge cost into a profit.

Do traders earn rewards during the challenge phase?

Yes. Tiger Funded pays 20% of profits from the challenge phase once you pass and become funded.

How much profit can traders keep at Tiger Funded?

Funded traders keep up to 95% of performance rewards, giving them one of the highest payout ratios in the industry.

How quickly are payouts processed?

The average processing time is 16 hours, with payouts available just 7 days after the first reward.

Can accounts be scaled at Tiger Funded?

Yes. Accounts can start from $5K and scale up to $4M, offering significant growth potential.