This FunderPro review looks at whether FunderPro really delivers on its promises of fast payouts, daily rewards, and high profit splits, and explains what real traders need to know before joining.

What is FunderPro?

FunderPro is a prop firm that gives traders a way to earn money by passing a trading challenge. If you succeed, you can manage a funded account and keep most of the profit. The company claims to be faster with payments and lets you get paid more often than other prop firms.

How Does FunderPro Funding Actually Work?

To get funded by FunderPro, you must pass a trading challenge. You start with a demo account. If you follow the rules and reach the profit target, you get a funded account with real money. After that, you can request a payout any time you earn at least 1% profit. You don’t have to wait for the end of the month—you can even get paid multiple times in one day. FunderPro says the average payout time is 8 hours.

FunderPro Challenge Types and Rules: One Phase, Regular, or Swing?

FunderPro offers three challenge types: One Phase, Regular, and Swing.

- One Phase: One step. This is for experienced traders who want to get funded faster.

- Regular: Two steps. You get higher leverage, which suits short-term trading.

- Swing: Two steps. You can hold trades over weekends and news events.

Each type has its own leverage, drawdown limits, and rules. The minimum account size is $5,000, and the maximum is $200,000. All challenges have unlimited time to complete, but you must follow their risk rules to pass.

Fees and Account Sizes: What Will You Really Pay?

You pay a fee to join a FunderPro challenge, and it depends on the account size you pick. Fees start at $79 for a 1-step or 2-step $5,000 account or $89 for a 2-step $5,000 swing account. If you pass and get funded, FunderPro refunds your fee. Account sizes range from $5,000 up to $200,000. You can choose the size you want based on your budget and goals. The fee is only paid once for each attempt, but if you fail, you’ll need to pay again to retry.

What Makes FunderPro Different (Or Not)?

FunderPro says its biggest difference is daily payouts. You don’t have to wait weeks or months to get your money if you’re in profit. There’s also no trailing drawdown, which some traders prefer. But most of the features—like profit split, challenge types, and support—are similar to what other top prop firms offer. The rules are standard for the industry, so don’t expect anything too unusual besides fast payments.

Profit Split, Daily Rewards & Payouts: How Fast Do You Get Paid?

FunderPro pays you 80% of your profits if you pass the challenge. If you buy the add-on, you can keep 90%. You can request a payout every time you’re up at least 1% on your original account balance. There’s no set payout schedule, and you can even get paid more than once a day. FunderPro says payouts take about 8 hours on average.

Trading Conditions: Platforms, Bots, Restrictions

You can trade with FunderPro using TradeLocker or cTrader platforms. Bots and automated trading are allowed if you use their API or cTrader tools. There are rules for news and weekend trading: only Swing accounts can hold trades over weekends or through major news events. You also can’t join from certain countries, like Russia or North Korea. Most other trading rules match what’s normal at other prop firms.

What Are the Drawdown Rules? (Daily & Overall)

FunderPro has two main drawdown limits. Daily drawdown is 5% for Regular and Swing accounts, and 4% for One Phase accounts. That means you can’t lose more than that in one day. Overall drawdown is 10% for Regular and Swing, and 7% for One Phase. If you break these rules, you fail the challenge or lose your funded account.

User Experience: Dashboard, Support, Tools

The FunderPro dashboard is simple and gives you all your account info in one place. You get 24/7 customer support through live chat, email, or Discord, and the team speaks multiple languages. FunderPro also has tools like an economic calendar, asset overview, and trade validator. These tools help you keep track of markets and check your trades before you make them.

Can You Really Get Paid?

FunderPro says you can request payouts any time your account is up at least 1%. There’s no waiting period, and they promise the average payout takes 8 hours. They also let you take out profits more than once per day. Based only on their own info, there are no payout delays or excuses listed, but you have to follow the drawdown and trading rules to stay eligible.

Reset & Retry: What Happens if You Fail the Challenge?

If you fail a FunderPro challenge, you can reset or retry for a discount. You can reset an ongoing challenge or retry a lost one within 24 hours. There’s no limit to how many times you can try again, but you pay a reduced fee each time. This applies to any challenge type or account size.

FunderPro Affiliate Program: Worth Your Time?

FunderPro lets anyone sign up as an affiliate. You get a custom link and can earn weekly commissions if your referrals make sales. Payouts start at $200, and the program includes a dashboard and affiliate manager. In 2024, they say over $1.25 million was paid out to affiliates. Like most affiliate programs, earnings depend on your own effort.

Pros & Cons

| Pros | Cons |

| Fast daily payouts—no waiting for end of month | Consistency rule limits big single-day wins |

| Up to 90% profit split possible | No weekend holding except on Swing accounts |

| No trailing drawdown (fixed max loss, not trailing) | |

| Tools for traders: economic calendar, asset analysis, trade validator, and partner indicators | |

| Automated trading and bots allowed (API, cTrader) | |

| 24/7 live chat, email, and Discord support |

FunderPro vs FXIFY: Direct Comparison for Traders

| Feature | FunderPro | FXIFY |

| Max Account Size | $200,000 | $400,000 |

| Profit Split | 80% standard, up to 90% with add-on | Up to 90% with add-on |

| Drawdown Type | Fixed (no trailing) | Trailing for most accounts, static on 3-phase |

| Minimum Payout Time | Any time >1% profit, unlimited daily payouts (avg 8h) | First payout on demand (instant), then bi-weekly |

| Challenge Fee Example | $79 for $5k, $549 for $10k; refunded if funded | $39 for $5k, $149 for $25k (2-phase); refunded if funded |

| Platforms | TradeLocker, cTrader | MT4, MT5, DXtrade, TradingView |

| Bots/EAs | Allowed on all platforms | Allowed on all platforms |

| Weekend/News Holding | Only with Swing account | Allowed on all accounts |

| Consistency Rule | Yes: single day can’t be 60%+ of challenge profit | No for most, but 30% for Lightning/Instant Funding |

| Customizable Add-ons | Fewer (profit split, tools) | More (leverage, payout, drawdown, split, performance protect) |

Want to learn more about FXIFY’s rules, payout speed, and real trader experience?

Read the full FXIFY review on FundedTrading.com.

Payout Speed and Process

- FunderPro: Request a payout any time you’re at least 1% in profit. There’s no limit on payout frequency—you can request multiple payouts per day. Payouts usually take 8 hours.

- FXIFY: First payout is instant after your first live trade. After that, payouts are available every two weeks, unless you pay for bi-weekly or other payout add-ons.

Rules and Flexibility

- FunderPro: Consistency rule limits large single-day profits (max 60% in one day). Only Swing accounts can hold trades over weekends and news. Fixed drawdown—no trailing.

- FXIFY: Most programs have no consistency rule (except Lightning/Instant Funding, which is stricter at 30%). Weekend/news holding allowed on all account types. Trailing drawdown is the default and needs careful risk management.

Platforms, Tools, and Extras

- FunderPro: Offers TradeLocker and cTrader only. Bots, automated trading, and API integration allowed. Tools include an economic calendar, asset overview, and trade validator. Support is 24/7 by chat, email, or Discord.

- FXIFY: Lets you use MT4, MT5, DXtrade, or TradingView. Bots and EAs are supported. Add-ons let you change leverage, payout speed, split, and even get “performance protection” to save profits if you breach drawdown.

Who Might Prefer Each?

- Choose FunderPro if you want fast, flexible, unlimited payouts, simple fixed drawdown rules, and don’t mind the consistency rule or platform limits.

- Choose FXIFY if you want the widest platform choice, no consistency rule (except certain plans), full weekend/news trading, and want to customize your account risk and payout options.

FunderPro Trustpilot Reviews

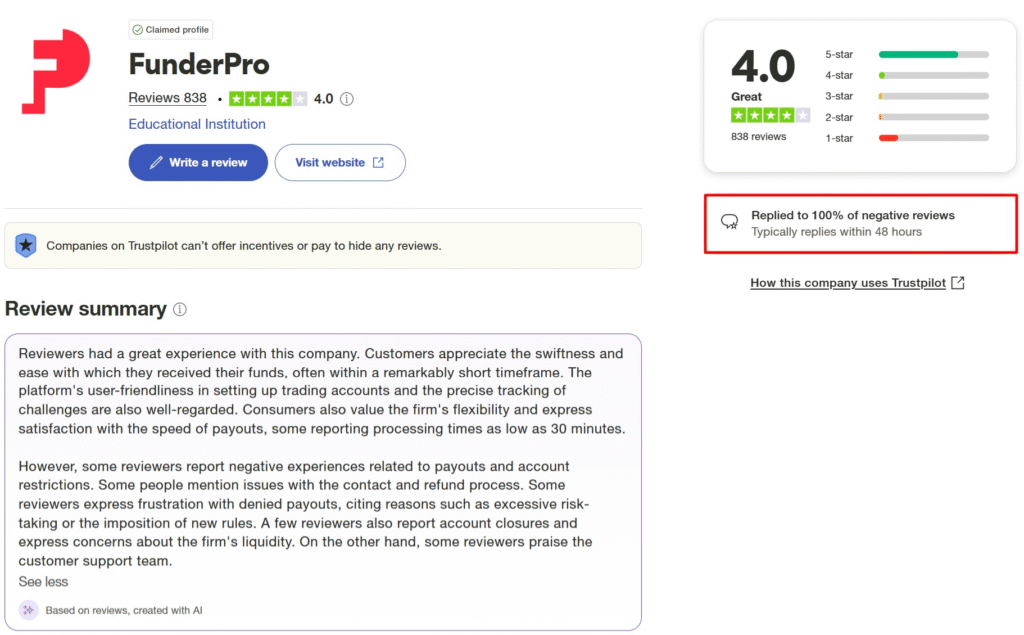

FunderPro is rated 4.0 out of 5 on Trustpilot, with over 800 reviews as of July 2025. Many traders highlight fast payouts—sometimes in less than 30 minutes—and say the dashboard and support are easy to use. Negative reviews usually come from traders whose accounts were closed for breaking risk rules or failing the consistency rule.

One thing that stands out is FunderPro’s customer service: they reply to 100% of negative reviews, usually within 48 hours. This shows they are active and responsive, even when there are complaints.

If you want to see all reviews and responses for yourself, check the official page:

Read FunderPro reviews on Trustpilot

Should You Trust FunderPro in 2025?

FunderPro offers fast payouts, flexible profit splits, and standard trading rules for prop firms. The main thing that stands out is the ability to get paid daily. Most other features match what you’ll find elsewhere. If you care most about quick rewards, FunderPro is worth a look. If you want something truly different, keep comparing.

FunderPro Discount Code 20%

If you want to join FunderPro, use our exclusive code for a 20% discount FUNDEDT

FAQs About FunderPro

How do you reset or retry a FunderPro challenge if you fail?

If you fail your challenge, you can pay a smaller fee to try again. You can reset while your challenge is still active, or retry after failing if you do it within 24 hours. There’s no limit to how many times you can reset or retry, but each time costs money. This gives you another chance without paying the full fee again.

What kind of trading tools does FunderPro give you?

FunderPro gives all traders access to helpful tools. You get an economic calendar to check news events, asset overviews to study each market, and a trade validator to check your ideas before you risk your money. These tools help you plan your trades and avoid big surprises. Some tools are free for everyone; others come with your challenge.

Can you use bots or automated trading systems with FunderPro?

Yes, FunderPro allows bots and automated trading. If you know how to code, you can use their API or cTrader bots. If you don’t, they offer an AI tool to help you build a bot without coding. Just make sure your bot follows FunderPro’s trading rules.

How does the affiliate program pay, and who can join?

Anyone can join the affiliate program, even if you aren’t a trader. You get your own link to share. If someone buys a challenge through your link, you earn a reward. Commissions are paid every week as long as you’ve earned $200 or more. You can track your earnings in a dashboard and ask the affiliate manager for help.

What happens if I break a rule on my funded account?

If you break a main rule (like going over the drawdown or hitting the consistency limit), your account is closed right away. You lose access to the funded account and must start a new challenge if you want to try again. FunderPro is strict with the rules, so always double-check before placing trades.

What are the most common reasons traders fail the challenge?

Most traders fail because they break the daily or overall drawdown rules, or they don’t follow the consistency rule. Others might make risky trades that cause a big loss. Taking time to learn the rules and using good risk management helps your chances of passing.

Are there any monthly fees or hidden costs?

No, there are no monthly fees. You only pay the challenge fee when you start or retry. After you get funded, there aren’t extra costs to keep your account open. The only extra charges are if you want to reset or retry a challenge after failing.

Can I hold trades overnight or on weekends?

You can only hold trades overnight and over weekends if you use a Swing account. Regular and One Phase accounts do not allow this, and breaking this rule can lead to your account being closed. Always check the rules for your chosen challenge before trading around the weekend.

What kind of support does FunderPro offer?

You can contact FunderPro support any time, day or night, using live chat, email, or Discord. The support team can answer questions in different languages. There’s no phone support, but the team is quick to reply and can help with trading, accounts, or payouts.

How are profits paid out—crypto, bank, or something else?

FunderPro pays profits by several methods, including crypto and possibly bank transfers. The exact options may change, so you should ask support which methods are available for your country when you get funded. They aim to process payouts in about 8 hours.

Can anyone join FunderPro from anywhere in the world?

No, not everyone can join. There’s a list of banned countries due to legal reasons. If you’re from one of these countries (like Russia, North Korea, Iran, and a few others), you can’t open an account or get funded. It’s important to check the current list before you try to sign up.

Hi Can i use my own EA

Yes, they do allow EA on their platform.