Introduction

Selecting the right trading platform is essential for any trader, whether you are just starting or have years of experience. While MetaTrader is a popular choice due to its wide range of features and broad broker support, many traders are looking for alternatives that offer different functionalities, enhanced user interfaces, or advanced trading tools. In this blog post, we explore some of the best MetaTrader alternatives, focusing on platforms that provide solid trading environments, advanced features, and user-friendly experiences.

We will look into the unique offerings of cTrader, TradeLocker, Match Trader, and DXtrade. Each platform will be evaluated based on its features, pros, and cons to help you decide which might suit your trading needs. Whether you’re interested in advanced charting tools, social trading capabilities, or seamless integration with other services, these best MetaTrader alternatives have something valuable to offer. Read on to find out which platform could become your next trading hub.

4 Best MetaTrader Alternative

1. cTrader

About

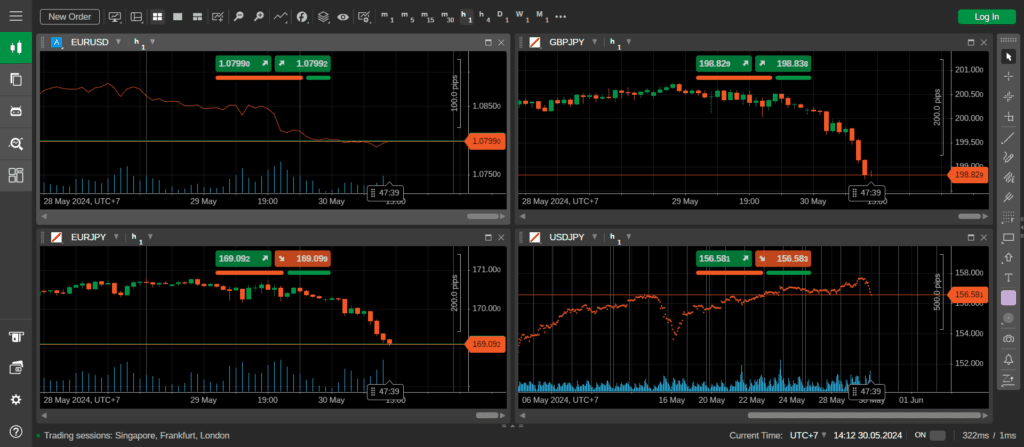

cTrader is a trading platform developed by Spotware Systems, launched in 2010. It is crafted to provide a straightforward yet powerful trading experience for forex and CFD traders. The platform’s design aims to combine ease of use with advanced features, making it suitable for a variety of trading styles and expertise levels. A key feature of cTrader is its transparent trading environment, offering Level II pricing and market depth information, which allows traders to see the full range of executable prices directly from liquidity providers.

One notable aspect of cTrader is its emphasis on speed and efficiency. The platform is recognized for its fast execution speeds, which help minimize slippage and ensure precise trade placement. This is particularly beneficial for high-frequency traders and those who require accurate trade execution. Additionally, cTrader offers extensive charting capabilities with a variety of chart types, time frames, and technical indicators, making it a strong tool for technical analysis.

cTrader also includes automated trading through cTrader Automate (formerly cAlgo). This feature allows traders to develop, backtest, and deploy algorithmic trading strategies using the C# programming language. The integration with cTrader’s ecosystem ensures the smooth execution of automated strategies. Furthermore, cTrader provides a customizable interface, enabling traders to create a workspace that fits their specific needs. The platform is accessible via desktop, web, and mobile devices, offering traders the flexibility to manage their accounts and trades from anywhere.

If you love using cTrader and want to elevate your experience by trading with bigger capital, check out the list of the best cTrader prop firms.

Features

- Advanced Charting: cTrader offers a wide range of chart types, indicators, and drawing tools, allowing traders to perform detailed technical analysis.

- Automated Trading: cTrader Automate (formerly cAlgo) enables traders to create and run algorithmic trading strategies using the C# programming language.

- Level II Pricing: Provides access to detailed market depth information, enhancing transparency and enabling better decision-making.

- Fast Execution: cTrader is known for its lightning-fast execution speeds, reducing slippage and ensuring accurate trade placement.

- Customizable Interface: The platform allows users to customize the layout and appearance to suit their trading style.

- Mobile and Web Platforms: cTrader is available on desktop, web, and mobile devices, ensuring seamless access to trading accounts from anywhere.

Pros

- User-Friendly Interface: The platform is intuitive and easy to navigate, making it suitable for both beginners and experienced traders.

- Advanced Trading Tools: Offers a wide range of technical analysis tools and advanced order types.

- High Execution Speed: Known for its fast and reliable trade execution.

- Transparency: Level II pricing and market depth information provide greater transparency in trading.

- Multi-Device Support: Available on multiple platforms, allowing for flexible trading on the go.

Cons

- Limited Broker Support: Compared to MetaTrader, fewer brokers offer cTrader, which may limit its accessibility.

- Learning Curve for Automation: While powerful, cTrader Automate requires knowledge of C# programming, which can be a barrier for some traders.

- Customization Limitations: Although the interface is customizable, some users may find it less flexible compared to MetaTrader’s extensive custom indicators and scripts.

2. TradeLocker

About

TradeLocker is a relatively new trading platform that aims to provide a robust and flexible trading environment for forex and CFD traders. Developed with modern traders in mind, TradeLocker focuses on delivering a seamless and intuitive user experience. It offers advanced charting tools, various order types, and comprehensive market analysis features. The platform is designed to support both manual and automated trading, making it suitable for a wide range of trading strategies.

TradeLocker stands out for its cloud-based infrastructure, which ensures high availability and low latency. This allows traders to access their accounts and trade from anywhere with an internet connection. The platform also offers extensive customization options, enabling users to tailor the interface to their preferences. TradeLocker provides educational resources and support to help traders improve their skills and make informed decisions.

Ready to explore a powerful new trading platform? If a robust and flexible environment for forex and CFDs appeals to you, then discovering the best Tradelocker prop firms could be what you are looking for.

Features

- Advanced Charting: TradeLocker offers a variety of chart types, indicators, and drawing tools for detailed technical analysis.

- Automated Trading: The platform supports automated trading strategies, allowing users to develop, backtest, and deploy algorithms.

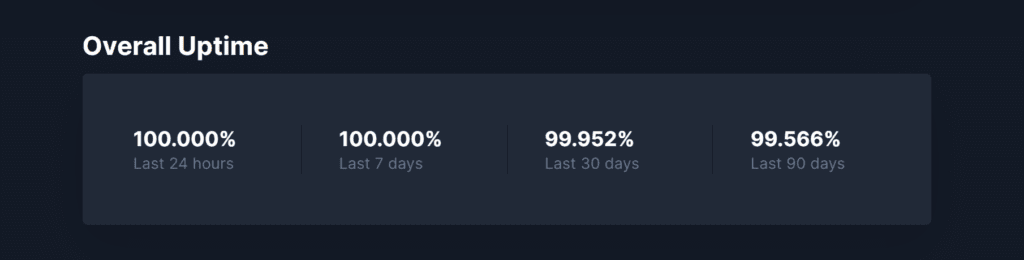

- Cloud-Based Infrastructure: Ensures high availability and low latency for reliable trading access.

- Customizable Interface: Users can personalize the layout and appearance to match their trading style.

- Educational Resources: Provides tutorials, webinars, and other resources to help traders enhance their skills.

Pros

- User-Friendly Interface: Intuitive and easy to navigate, suitable for traders of all experience levels.

- Advanced Trading Tools: Offers comprehensive charting and analysis tools.

- Reliable Access: Cloud-based infrastructure ensures high availability and low latency.

- Customization: Extensive options to tailor the platform to individual preferences.

- Educational Support: Provides resources to help traders improve their knowledge and skills.

Cons

- Limited Broker Support: As a newer platform, TradeLocker is not yet widely supported by brokers.

- Learning Curve: The advanced features and customization options may require some time to master.

- Less Established: As a newer entrant in the market, TradeLocker lacks the long-standing reputation of more established platforms.

3. Match Trader

About

Match Trader is a cutting-edge trading platform developed to offer a highly customizable and user-friendly experience for forex and CFD traders. It aims to provide a comprehensive suite of trading tools and features that cater to both novice and professional traders. The platform is known for its advanced technology, which includes real-time market data, fast execution speeds, and a high level of security.

Match Trader stands out with its social trading capabilities, allowing users to follow and copy the trades of successful traders. This feature is particularly beneficial for beginners who want to learn from experienced traders. The platform also offers a range of analytical tools and indicators, making it suitable for detailed technical analysis. Match Trader is accessible through desktop, web, and mobile applications, ensuring that traders can manage their accounts and trade from anywhere.

Features

- Social Trading: Allows users to follow and copy trades from successful traders.

- Advanced Analytical Tools: Offers a variety of chart types, indicators, and drawing tools for technical analysis.

- Fast Execution: Known for its quick order execution speeds, reducing slippage and ensuring accurate trade placement.

- Customizable Interface: Users can personalize the platform’s layout and appearance to match their trading style.

- Multi-Device Access: Available on desktop, web, and mobile devices, providing flexibility in trading.

Pros

- User-Friendly Interface: Intuitive and easy to use, suitable for traders of all experience levels.

- Social Trading Features: Enables users to learn from and copy successful traders.

- High Execution Speed: Provides quick and reliable trade execution.

- Customizable Layout: Extensive options to tailor the platform to individual preferences.

- Multi-Device Support: Accessible on various devices, allowing for flexible trading.

Cons

- Limited Broker Availability: Not all brokers offer support for Match Trader, which may limit accessibility.

- Learning Curve for Advanced Features: Some advanced features may take time to master, particularly for beginners.

- Relatively New: As a newer platform, it may lack the established reputation of older, more well-known trading platforms.

4. DXtrade

About

DXtrade is a versatile trading platform developed by Devexperts, aimed at providing a customizable and efficient trading experience for both retail and institutional traders. The platform supports trading in various financial instruments, including forex, CFDs, stocks, options, futures, and cryptocurrencies. DXtrade stands out due to its advanced technology and integration capabilities, offering seamless integration with TradingView for enhanced charting and market analysis.

DXtrade is designed to cater to the needs of brokers and traders by offering a user-friendly interface and a high level of customization. Brokers can white-label the platform, making it their own by adding their branding and specific features. The platform’s cloud-based infrastructure ensures high availability and low latency, which is crucial for timely trade execution. Additionally, DXtrade provides robust risk management tools and comprehensive market data, making it a reliable choice for serious traders.

Features

- Advanced Charting: Integration with TradingView allows access to a wide range of charting tools and indicators.

- Customizable Interface: Brokers can white-label the platform and customize it according to their needs.

- Order Types: Supports market orders, limit orders, stop orders, and OCO (One Cancels the Other) orders.

- Automated Trading: Offers tools for developing, backtesting, and deploying automated trading strategies.

- Multi-Device Access: Available on desktop, web, and mobile devices for flexible trading.

- Risk Management: Comprehensive tools for managing trading risks and ensuring compliance.

- Integration with PSPs: Seamless integration with payment service providers for easy fund management.

Pros

- User-Friendly Interface: Easy to navigate and suitable for traders of all experience levels.

- Advanced Trading Tools: Offers a wide range of analytical and charting tools.

- Flexible and Scalable: Can be customized and scaled to fit the needs of both small and large brokerages.

- High Availability: Cloud-based infrastructure ensures reliable access and low latency.

- Integration with TradingView: Enhances charting capabilities and market analysis.

Cons

- Limited Broker Support: As a newer platform, not all brokers support DXtrade yet.

- Learning Curve: Some advanced features may take time to master, especially for beginners.

- Less Established: As a newer entrant in the market, it lacks the long-standing reputation of more established platforms like MetaTrader.

Summary of Comparison

| Feature | cTrader | TradeLocker | Match Trader | DXtrade |

|---|---|---|---|---|

| About | Comprehensive trading platform for forex and CFD traders. | New platform focused on flexibility and a user-friendly experience. | Advanced platform with social trading capabilities. | Versatile platform supporting various financial instruments. |

| Advanced Charting | Yes, with a wide range of tools and indicators. | Yes, with multiple chart types and drawing tools. | Yes, with detailed technical analysis tools. | Yes, integrated with TradingView for enhanced charting. |

| Automated Trading | Yes, via cTrader Automate using C#. | Yes, supports automated strategies. | Yes, offers tools for developing and deploying automated strategies. | Yes, supports automated trading strategies. |

| Order Types | Market, limit, stop, OCO orders. | Market, limit, stop orders. | Market, limit, stop, OCO orders. | Market, limit, stop, OCO orders. |

| Customizable Interface | Yes, highly customizable. | Yes, extensive customization options. | Yes, allows personalizing layout and appearance. | Yes, brokers can white-label and customize the platform. |

| Mobile and Web Platforms | Available on desktop, web, and mobile devices. | Accessible via desktop, web, and mobile. | Available on multiple platforms, including mobile. | Available on desktop, web, and mobile devices. |

| Social Trading | No | No | Yes, allows copying trades of successful traders. | No |

| Risk Management | Standard risk management tools. | Comprehensive risk management tools. | Offers robust risk management features. | Advanced risk management tools included. |

| Integration | Integrates with various brokers and services. | Seamless integration with PSPs. | Good integration with other services. | Integrates with TradingView and other services. |

| Broker Support | Limited compared to MetaTrader. | Limited broker support as it’s a newer platform. | Limited broker support but growing. | Not widely supported yet, but expanding. |

| Learning Curve | Moderate, especially for automated trading. | Some advanced features require learning. | Some features may take time to master. | Some advanced features may require time to learn. |

| Strengths | Fast execution, advanced charting, automated trading. | User-friendly, flexible, educational resources. | Social trading, high execution speed, customizable layout. | Advanced charting with TradingView, flexible, scalable. |

| Weaknesses | Fewer brokers support it, learning curve for automation. | New platform with limited broker support. | Newer platform, limited broker availability. | Newer entrant, limited broker support, learning curve. |

Conclusion

In choosing the best MetaTrader alternative, it’s crucial to consider the features and tools you need most in a trading platform. cTrader is ideal for those who require advanced charting tools and automated trading capabilities, offering fast execution speeds and a customizable interface. TradeLocker is perfect for traders who prioritize a user-friendly experience and extensive customization options, along with solid educational resources and robust risk management tools.

Match Trader stands out for its social trading features, allowing users to follow and copy successful trades, making it suitable for those who want to leverage community insights. DXtrade is a versatile platform that supports various financial instruments and integrates seamlessly with TradingView for enhanced charting. It is scalable and flexible, making it suitable for both small and large brokerage firms.

Ultimately, the best MetaTrader alternative will depend on your specific trading needs, whether it’s advanced analytical tools, social trading, ease of use, or integration capabilities. Each platform provides a robust trading environment that can enhance your trading experience.