TradeDayX is the new proprietary trading platform from TradeDay, built specifically for futures traders seeking funded accounts. Powered by ProjectX’s institutional-grade infrastructure, TradeDayX delivers low-latency order execution, real-time CME market data, and integrated risk management dashboards. Designed by professional prop traders, the platform provides analytics, evaluation tools, and seamless integration with Quantower for advanced charting and automation, making it a competitive choice for those navigating prop firm evaluations and funded trading.

As of now, TradeDay is running a 30% off promotion with no activation fee on all accounts. This limited-time offer makes it one of the most cost-effective ways to get started with a futures prop firm evaluation.

What Is TradeDayX and Why Does It Matter for Futures Traders?

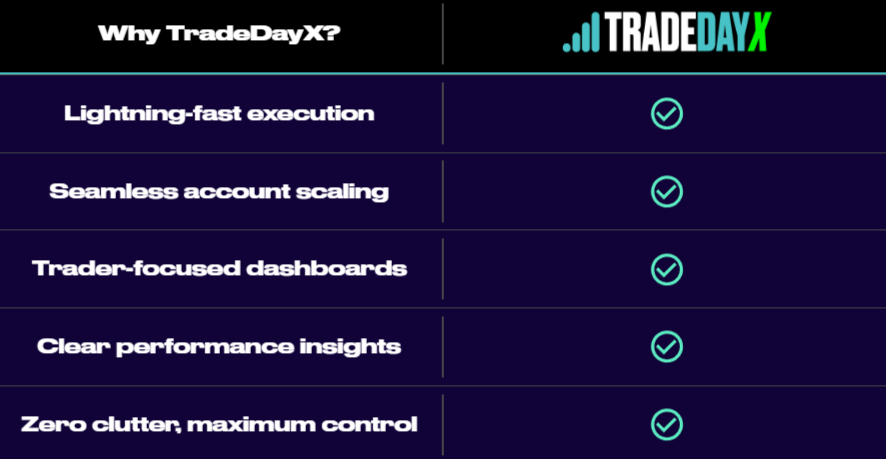

TradeDayX is a platform designed for futures prop traders, offering speed, data transparency, and analytics focused on evaluation and funded trading.

- Designed by individuals with proprietary trading experience, this platform targets traders who require a streamlined environment.

- Operates on ProjectX’s backend, which is built to deliver low-latency order routing, real-time CME futures market data, and high system reliability.

- Offers Quantower integration for traders needing advanced charting, algorithmic trading, or order management.

- Includes live dashboards for performance tracking, covering PnL, risk exposure, and compliance with prop firm evaluation criteria.

- Geared toward the evaluation and funded account process, with features intended to align with the requirements of proprietary trading firms.

Who Uses TradeDayX? (Trader Profiles, Use Cases, Funding Paths)

TradeDayX is used by a range of futures traders, from those seeking funded accounts to individuals employing algorithmic strategies or focusing on performance analytics.

- Prop firm candidates: Use the platform to participate in evaluation programs or trading combines that measure trading performance against preset profit and loss targets.

- Quantitative traders: Employ API connectivity, direct data feeds, and Quantower integration for systematic or automated trading approaches.

- Experienced futures traders: Leverage tools for rapid execution, detailed PnL dashboards, and real-time risk metrics, especially when trading CME futures contracts.

- Traders in education or onboarding phases: May access live webinars, instructional materials, and real-time dashboards to understand evaluation requirements and develop skills.

- Risk managers and trading educators: Monitor account status, performance metrics, and compliance using built-in dashboards and reporting features.

How Is TradeDayX Different from Other Futures Prop Firms?

TradeDayX differs from other futures prop firms by using an institutional-grade backend (ProjectX), offering direct market data, and supporting multi-platform integration.

Several attributes distinguish it from competitors:

- Backend Technology: TradeDayX operates on ProjectX, an infrastructure also used by other proprietary trading firms. This setup is designed for low-latency, direct-to-exchange order routing.

- Market Data: The platform provides unfiltered, real-time CME market data, including full market depth and analytics. In comparison, some competitors rely on delayed or partial data feeds.

- Risk Controls: Features include daily loss limits, auto-liquidation, and built-in performance reporting. These risk management tools are tailored for prop firm evaluations.

- Charting and Platform Support: TradeDayX integrates with Quantower and TradingView, enabling traders to use advanced charting and automation features. Other firms may offer limited or single-platform charting.

- API and Algorithmic Trading: The platform allows for automated trading and custom strategies via API, an option not always available on retail-focused prop firm platforms.

- Account Scaling: Scaling features allow traders to increase account size or access additional capital as performance targets are met.

What Features Do Traders Get with TradeDayX?

TradeDayX provides a range of features commonly required by futures prop traders, emphasizing institutional technology, risk management, and multi-platform support.

Key features include:

- Performance Tracking: Real-time analytics display profit and loss (PnL), drawdown, statistics, and comprehensive trade logs.

- Order Execution: The system is engineered for low-latency trading, typically providing execution times under 100 milliseconds.

- Risk Management: Includes daily loss limits, lockouts, and real-time account health monitoring—designed to meet the requirements of most proprietary trading evaluations.

- Interface: The user interface is focused on simplicity and clarity, available via both web and mobile browsers.

- Charting and Automation: Supports Quantower for advanced charting, automation, and multi-asset trading. Additional charting and strategy tools are available via platform integrations.

- Trader Dashboards: Custom dashboards allow users to focus on metrics and controls relevant to their trading or evaluation requirements.

How Does Funding and Scaling Work on TradeDayX?

TradeDayX uses a structured evaluation process for account funding and scaling, based on transparent trading performance metrics.

The funding process typically includes:

- Account Evaluation: Traders participate in an evaluation phase where they are required to meet specific profit targets while managing daily loss limits and trailing drawdowns. Evaluation parameters are clearly defined, with no hidden resets or ambiguous rules.

- Scaling: As traders demonstrate consistent performance and meet profit targets, they have the option to scale their account size or access higher trading limits. Scaling rules are tied to objective account milestones and performance history.

- Withdrawals: Once funded status is achieved, withdrawal requests can be submitted according to the platform’s payout schedule. Withdrawal rules and timeframes are transparent and available to funded traders.

- Consistency: The rules applied during both the evaluation and funded phases are designed to remain consistent, reducing the likelihood of unexpected changes or requirements.

What is ProjectX and How Does It Power TradeDayX?

ProjectX is a trading technology infrastructure that supports TradeDayX’s backend, focusing on speed, data quality, and risk management.

Key attributes include:

- Industry Use: ProjectX is used by various proprietary trading firms to support account management, data feeds, and trading execution.

- Market Data: The infrastructure provides direct CME market data, offering deep order book visibility and real-time analytics.

- Risk Engine: Features advanced risk controls that enable prop-style account management, including automated daily loss limits, drawdown tracking, and real-time compliance monitoring.

- API Access: REST API endpoints allow for data extraction, automated trading strategies, and reporting integration. This enables traders and third-party platforms to interact directly with account and execution data.

- Cloud Backend: ProjectX operates on a cloud-native backend, which aims to provide both scalability and reliability for high-frequency trading environments.

- Brokerage Integration: The system is designed to connect with registered futures brokerages for real-market trade execution.

Can You Use Quantower and Other Trading Platforms with TradeDayX?

TradeDayX supports integration with Quantower and plans to support additional trading platforms for advanced analytics and order management.

Features include:

- Quantower Integration: Traders can connect funded accounts to Quantower, enabling advanced charting, custom indicator development, and multi-asset trading. The setup process is designed to be straightforward for users with existing Quantower experience.

- Charting and Automation: Full access is provided to Quantower features such as chart trading, bracket order management, and custom scripting for algorithmic trading.

- Additional Platform Support: Upcoming platform updates are expected to include support for TradingView charts and dedicated mobile trading options.

- Web Trading: TradeDayX also offers a web-based trading interface that requires no downloads, supporting rapid access and trade management from any device.

What Support, Education, and Community Does TradeDayX Offer?

TradeDayX provides support, educational resources, and community tools intended to meet the needs of a range of futures traders.

Available features include:

- Daily Webinars: Regular sessions cover futures markets, trading strategies, and platform usage. These are designed to provide ongoing education for both new and experienced traders.

- Research Reports: Proprietary market research and analysis are available, offering actionable insights for trade planning and market understanding.

- CoPilot Add-On: For those seeking further education or mentorship, the optional CoPilot service includes a comprehensive trading course, mentorship access, live squawk (audio market updates), and additional exclusive content.

- Support Channels: Email and chat support are available 24/7, while phone support is provided during business hours (Monday to Friday).

- Community Groups: Traders can access private Discord or Slack channels for Q&A, peer support, and strategy discussions with other users.

What Are the Pros and Cons of Using TradeDayX?

TradeDayX has attributes and limitations that may affect different types of traders, depending on their goals and preferences.

Pros:

- Uses institutional-grade backend technology (ProjectX) for risk controls and order management.

- Offers real-time analytics, fast execution, and detailed account metrics.

- Provides deep market data and supports integration with advanced charting platforms.

- Utilizes a transparent, rules-based approach to prop-style funding and account scaling.

Cons:

- Platform is currently focused on futures contracts; support for stocks or cryptocurrencies is not available.

- Interface is browser- and mobile-based; a dedicated native app is planned but not yet released.

- The platform’s pace and features may present a learning curve for traders with no prior experience in futures or prop trading.

How Does TradeDayX Compare to Other Trading Platforms?

TradeDayX differs from other trading platforms and prop firms in several ways, especially regarding technology, data access, and risk controls.

- Execution and Analytics: TradeDayX emphasizes fast order execution and real-time analytics, which may exceed the offerings of established prop firms such as Topstep or Apex.

- Risk Controls and Interface: The platform includes more granular risk management tools and a user interface designed for clarity, in contrast to the broader feature sets of generic “funding” platforms.

- Integration: Full integration with ProjectX for backend operations and Quantower for charting provides advanced functionality for active futures traders.

Looking for a broader look at the company? Read our full TradeDay Review here for more on their funding process, firm structure, and user experience.

Frequently Asked Questions (FAQ)

What is TradeDayX?

TradeDayX is a proprietary trading platform designed for futures traders, using ProjectX technology to deliver real-time analytics, risk management, and direct market access.

Who can use TradeDayX?

TradeDayX is open to traders seeking funded accounts, those participating in prop firm evaluations, and individuals requiring professional tools for CME futures markets.

Does TradeDayX support automated trading?

Yes. TradeDayX provides API access and supports Quantower integration, enabling algorithmic strategies, custom scripts, and advanced order types.

Is there education or support for new users?

Yes. Users have access to live webinars, the CoPilot education add-on, daily research reports, Discord community channels, and 24/7 support.

Is TradeDayX available outside the US?

Yes. TradeDayX is accessible internationally, though regional CME data fees and remote onboarding processes may apply.