StriveFX is a trading firm that claims to offer access to more than 10,000 financial instruments, including forex, indices, commodities, metals, bonds, and cryptocurrencies. It presents itself as a global brokerage built around fast execution, real-time pricing, and the use of established trading platforms like Match-Trader and cTrader.

The company’s public material emphasizes transparent pricing, competitive spreads, and technology designed to reduce latency and improve order accuracy. It also stresses “trading with confidence,” pairing this with language about safety, education, and trader support.

What Is StriveFX?

StriveFX is registered as an International Business Company (IBC) in the Union of the Comoros.

- Company name: StriveFX

- Company number: 15978

- License number: L15978/SFX

- Regulatory authority: CSF – Anjouan, Comoros

- Registered address: PO Box 1212, Hamchako, Mutsamudu, The Autonomous Island of Anjouan, Union of the Comoros

The firm’s stated mission is to “lead the next wave of online trading” by combining technology, transparency, and client support. Its website describes three core values: integrity, innovation, and client focus.

StriveFX also mentions several social-responsibility initiatives, including financial literacy work with schools, environmental programs, and charitable partnerships. These statements are broad and not backed by specific data or third-party verification, so it’s unclear how active or large those projects are.

StriveFX Key Features and Benefits

StriveFX structures its offer around access, execution, and transparency. The firm lists the following core features:

Broad market access

Traders can reach more than 10,000 instruments from a single account. The product range covers forex pairs, global indices, commodities, precious and base metals, bonds, and major cryptocurrencies.

Execution speed

Orders are handled through an ECN setup that StriveFX says executes in milliseconds. The goal is to limit slippage and improve order accuracy during fast market conditions.

Modern trading platforms

The company supports both Match-Trader and cTrader. Each platform includes advanced charting, 100 plus indicators, customizable layouts, and tools for algorithmic or automated strategies.

24-hour multilingual support

Customer service is available every day through live chat, email, or phone. The site lists coverage in multiple languages to match different regions.

Fund segregation and basic safeguards

Client funds are held in segregated accounts and kept separate from company operating capital. Negative balance protection applies to all accounts, meaning traders cannot lose more than their deposits.

Learning and market resources

StriveFX hosts tutorials, written guides, and daily market analysis. It also provides an integrated economic calendar and live order-book data inside its trading platforms.

StriveFX Account Types — Which One Is Right for You?

StriveFX offers four main account setups: Standard, Professional, Islamic, and Demo. Each one targets a different type of trader, but all operate under the same general framework of ECN execution, high leverage, and support for automated strategies.

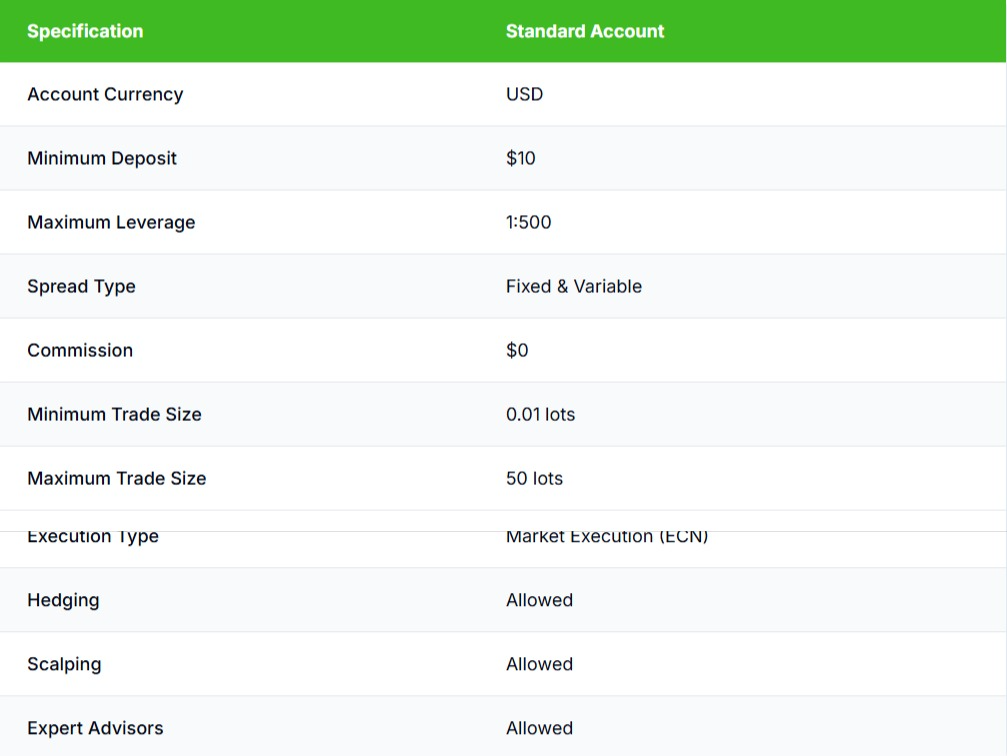

Standard Account

The Standard Account is the basic entry point. It is designed for new or casual traders who want low barriers to entry.

- Minimum deposit: $10

- Maximum leverage: 1:500

- Spreads: from 0.3 pips

- Commission: none

- Execution: market (ECN)

- Permitted strategies: hedging, scalping, Expert Advisors

The account trades more than 100 instruments, with zero commission on most assets. It includes the same access to platforms, market data, and customer support as other tiers.

Professional Account

The Professional Account targets experienced traders or small investment groups who want tighter pricing and deeper market visibility.

- Minimum deposit: $1,000

- Maximum leverage: 1:200

- Spreads: raw from 0.0 pips

- Commission: $7 per lot round turn ($3.50 each side)

- Execution: ECN with Level II market depth

- Permitted strategies: hedging, scalping, Expert Advisors

Professional clients receive raw institutional spreads and faster order routing. The account also includes advanced charting, algorithmic-trading options, and access to premium market reports. Verification requires proof of trading experience and enhanced KYC documentation.

Islamic Account

This option is structured for traders who follow Islamic finance principles and wish to avoid riba (interest).

- Minimum deposit: $10

- Maximum leverage: 1:500

- Spreads: from 0.3 pips

- Commission: $7 per lot round turn

- Swap fees: none for the first 5 days

- Admin fee: applies after 5 days to cover operational costs

Positions can be held without interest charges, maintaining compliance with Sharia trading rules. The account includes full platform access, negative-balance protection, and support for hedging and scalping strategies.

Demo Account

The Demo Account provides a risk-free environment for testing strategies and learning the platforms.

- Virtual balance: $100,000

- Market data: live and real-time

- Duration: unlimited

- Risk: none

Users can simulate live conditions, practice order management, and explore technical tools without committing real funds. The demo also links to educational materials and analysis to help beginners gain familiarity before trading live.

Trading Platforms

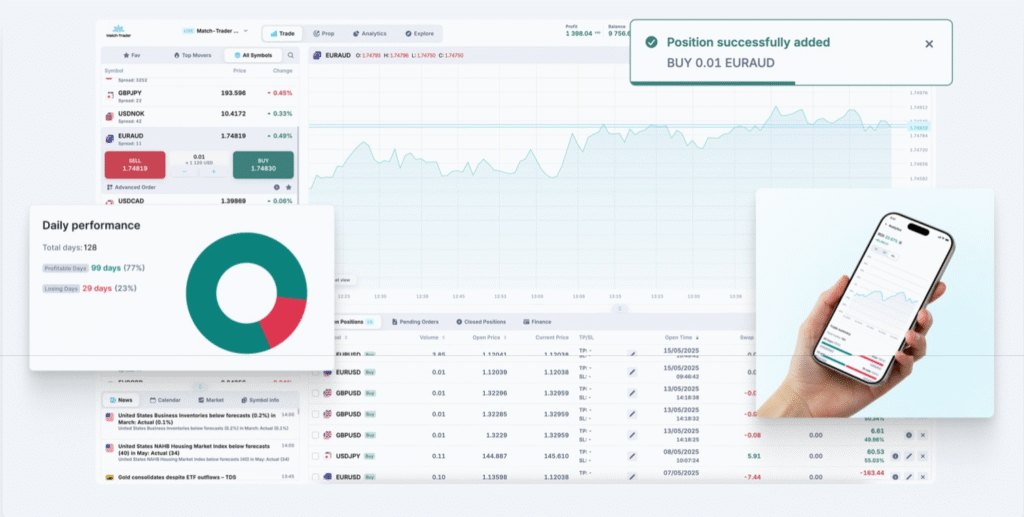

StriveFX provides two trading platforms: Match-Trader and cTrader. Both support multi-asset trading and cover the company’s full product range, including forex, indices, commodities, metals, bonds, and crypto. The difference lies in complexity and user depth.

Match-Trader

Match-Trader serves as the default platform for most clients. It is built to combine accessibility with speed, offering a single interface for all tradable instruments. It can be used through a web browser, desktop app, or mobile device.

Key features:

- Advanced charting package with more than 100 indicators and drawing tools

- Fast order execution with minimal slippage under ECN conditions

- Support for automated trading via Expert Advisors (EAs)

- Integrated risk controls, including stop-loss, take-profit, and trailing-stop functions

- Full device synchronization so trades can be monitored across desktop, web, and mobile

The desktop version allows multiple screens and customizable layouts, making it suitable for users running algorithmic strategies or multi-asset portfolios.

cTrader

The cTrader platform targets users who want deeper technical tools and transparent market data. It supports forex, stocks, futures, and bonds, with Level II pricing and full Depth of Market visibility.

Key features:

- More than 70 built-in indicators and up to 67 timeframes

- Full DOM display for order transparency

- cTrader Automate for algorithmic trading using C# (cBots)

- Built-in strategy tester for back-testing and optimization

- Access to the cTrader Community with free and paid indicators and scripts

- Integrated economic calendar and market news feed

Like Match-Trader, cTrader is available on desktop, web, and mobile. The desktop edition includes advanced analysis tools and direct integration with automated-strategy modules, making it the more data-driven option of the two.

What Can You Trade on StriveFX? Full Market Coverage

StriveFX provides access to global financial markets through CFDs on currencies, indices, commodities, metals, bonds, and digital assets. The firm states that more than 10,000 instruments are available, all tradable through its supported platforms with live pricing and ECN execution.

Forex Trading

The forex section lists over 70 currency pairs, including major, minor, and select exotic pairs.

- Spreads: from 0.3 pips on major pairs

- Leverage: up to 1:500

- Trading hours: continuous from Monday to Friday

The platform displays live quotes, order-book depth, and an economic calendar for upcoming macro events. Traders can use more than 100 built-in indicators, alerts, and risk controls such as stop-loss and take-profit orders.

Indices Trading

Index CFDs cover leading global benchmarks, including the Dow Jones 30, S&P 500, NASDAQ 100, DAX 40, FTSE 100, and Nikkei 225.

- Spreads: from 0.4 index points

- Extended hours: available for pre- and post-market sessions

Each index feed includes both cash and futures pricing, with added tools for market depth and volatility tracking.

Commodities Trading

StriveFX lists a range of energy, metal, and agricultural contracts, including gold, silver, oil, coffee, and corn.

- Features: real-time energy and agriculture news feed

- Analytics: seasonality charts, forward-curve visualisation, and a rollover-cost calculator

The data suite is built for traders who follow supply-demand cycles, inventory changes, or seasonal pricing trends.

Metals Trading

Metal CFDs include both precious and base metals such as gold, silver, platinum, palladium, copper, and aluminium.

- Pricing: LBMA and COMEX data sources

- Tools: gold-silver ratio monitor, correlation analysis, auto-adjusting Fibonacci levels

Traders can use metals for portfolio diversification or as hedges during currency volatility. Overnight positions show estimated financing and swap costs in real time.

Bond CFDs

The bond section allows trading in global government and corporate debt instruments, including U.S. Treasuries, U.K. Gilts, German Bunds, and Japanese JGBs.

- Analytics: live yield-curve displays, duration and convexity metrics, and DV01 calculations

- Extras: central-bank rate-decision tracker and bond-auction calendar

These tools are aimed at traders monitoring interest-rate risk or diversifying into fixed-income exposure.

Cryptocurrency Trading

Crypto CFDs cover major assets such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), Litecoin (LTC), and Cardano (ADA).

- Trading hours: 24/7

- Liquidity: deep order-book feeds for tighter spreads

- Data tools: blockchain-network metrics like exchange flows and active addresses

Margin requirements adjust dynamically with volatility to help limit risk.

StriveFX Bonuses and Promotions Explained

StriveFX runs a few promotional programs that reward new deposits and ongoing trading activity. All rewards are issued as trading credits, not cash. Credits can convert into real funds only after meeting a set trading volume, and they expire if the promotion ends or if funds are withdrawn early.

Welcome Bonus

A 50 percent credit is applied to qualifying deposits. The firm does not list a fixed maximum, describing the offer as “no cap.” Multiple deposits within three business days of the first deposit can be combined for bonus calculation.

Cash-Back Bonuses

Professional accounts can receive up to 15 percent in cash-back credit on deposits above $20,000, while Standard accounts can receive up to 12 percent on deposits starting from $1,000.

Monthly Interest Bonus

Accounts that maintain an average balance above $10,000 qualify for what StriveFX calls an “interest bonus,” paid as trading credit rather than real yield. Rates range from 3 to 5 percent annualized, depending on balance size. The credit is posted monthly and expires after thirty days if not converted through trading volume.

While these programs increase available margin, they are effectively temporary credits. They can boost trading power but do not represent withdrawable profit until the stated requirements are met.

Start Trading on StriveFX

Learn, Trade, and Grow — StriveFX Education and Market Insights

StriveFX includes a dedicated education section alongside its live-data tools. The material aims to help traders interpret markets and use the platforms efficiently.

- Live data and order-book visibility: Real-time quotes and depth information appear directly inside the platforms.

- Guides and webinars: The broker provides written tutorials and periodic live sessions that cover platform use, risk control, and strategy basics.

- Market calendar and analysis: A built-in economic calendar and daily updates summarize upcoming events and major market moves.

- Testing and practice tools: Users can back-test strategies or use the demo account to rehearse trades in real-time conditions without financial risk.

Together, these tools give traders a continuous feed of pricing data and reference material, though the level of analysis remains general rather than proprietary research.

How StriveFX Protects Traders — Regulation, Safety, and Compliance

StriveFX lists a set of policies meant to protect client funds and promote fair trading practices. The company operates under license number L15978/SFX, registered in Anjouan, Union of the Comoros, and supervised by the Comoros Financial Services Authority (CSF).

Key Safeguards

- Segregated client funds

Client deposits are held in separate accounts from company operating funds. This separation is intended to protect traders’ capital if the firm faces financial issues. - Negative balance protection

Traders cannot lose more than their deposited balance, even in the event of high market volatility or gapping. - Transparent pricing

The broker states that all spreads, commissions, and fees are clearly displayed before trade execution. No hidden or retroactive charges are mentioned in its public materials. - Data security

StriveFX says it applies encryption and other cybersecurity measures that align with the Payment Card Industry Data Security Standard (PCI DSS). The site also notes regular vulnerability and penetration testing to safeguard user data. - Independent audits

The firm mentions periodic reviews by third-party auditors to confirm operational compliance and financial reporting, though it does not name specific audit partners. - AML and KYC policies

The company applies standard Anti-Money Laundering and Know Your Customer checks during account verification, including proof of identity and source-of-funds documentation.

These measures meet common online brokerage practices.

StriveFX Customer Support and Service Quality

StriveFX advertises 24/7 multilingual customer support, available through live chat, email, and phone.

Support staff handle:

- Account creation and verification

- Platform installation and technical issues

- Questions about trading conditions or education resources

Response time appears to vary by channel, but the support structure is designed to offer continuous coverage during global trading hours.

StriveFX Pros and Cons

Pros

- Low entry threshold

The minimum deposit is $10, which allows beginners to start trading without committing significant capital. - High leverage options

Leverage up to 1:500 is available on most accounts, giving traders flexibility to manage position size and exposure. - Account variety

Four account types — Standard, Professional, Islamic, and Demo — cover a range of needs from practice to advanced trading setups. - Raw spreads for experienced users

The Professional account offers spreads starting from 0.0 pips with a $7 per-lot round-turn commission, which is competitive within the ECN model. - Two professional-grade platforms

Both Match-Trader and cTrader include modern charting, algorithmic trading, and full multi-device access. - Transparent trading conditions

Spreads, leverage, and commission rates are clearly listed, and negative balance protection applies across accounts. - Continuous support

Customer service operates 24/7 and is available in multiple languages.

Cons

- Administrative fee on Islamic accounts

Swap-free trading lasts for five days, after which an admin fee is charged on open positions. - Higher barrier for Professional accounts

The $1,000 minimum deposit limits access for smaller traders. - Bonus limitations

Promotional credits require meeting specific trading-volume targets before conversion into withdrawable funds.

Final Verdict — Is StriveFX a Reliable and Legit Broker in 2025?

StriveFX positions itself as a full-featured online broker that combines high leverage, broad market access, and platform flexibility. The infrastructure is built around ECN execution, real-time data, and established software rather than proprietary systems.

For newcomers, the $10 entry point and demo account make it easy to start. Intermediate traders can scale into higher leverage or swap-free options, while professionals have access to raw pricing, deep liquidity, and Level II market depth on cTrader.

From a safety perspective, StriveFX operates under license number L15978/SFX, regulated by the Comoros Financial Services Authority (CSF). It applies segregated client accounts, negative balance protection, and AML/KYC verification.

StriveFX delivers a technically solid trading setup with clear conditions and accessible entry points. It is suitable for users who value platform quality and broad market coverage but should be approached with the same due diligence applied to any offshore-licensed broker.