My Funding Account Review 2025: Discover fees, profit split, trading rules, payouts, scaling plan, and trader support. MFA offers up to 90% profit split, fast payouts, and accounts scalable to $2M. Transparent leadership and a strong trader community set it apart from other prop firms.

My Funding Account (MFA) is a proprietary trading firm headquartered in Katowice, Poland, founded by experienced trader and educator Pawel Grądziuk. Unlike many newer prop firms, MFA is backed by a credible shareholder, Polski Fundusz Multimedialny (PFM S.A.), a diversified investment holding company valued at over $31 million. This financial foundation, combined with a transparent leadership team and strong community support, makes MFA stand out in a crowded prop trading space.

The firm’s mission is to provide traders with not only access to capital but also the tools, education, and mentorship needed to grow consistently. Traders benefit from unlimited trading days, a generous 90% profit split, and one of the fastest payout systems in the industry.

Key highlights at a glance:

-

Fees: From $60 to $1,291 depending on account size and plan

-

Profit Split: Up to 90% across all accounts

-

Evaluation: Two-step challenge (Stage 1: 10% target → Stage 2: 5% target)

-

Max Leverage: 1:100 on all accounts

-

Scaling: Grow your account up to $2,000,000 via MFA’s scaling plan

-

Payouts: Ultra-fast withdrawals, often within 1–2 hours (after risk management approval)

-

Trust: Real founders, verifiable backing, and an active trader community

MFA positions itself as more than just a funding provider; it is a trader development ecosystem, combining capital access with mentorship, live trading rooms, and a collaborative community designed to help traders succeed long-term.

Is My Funding Account Legit?

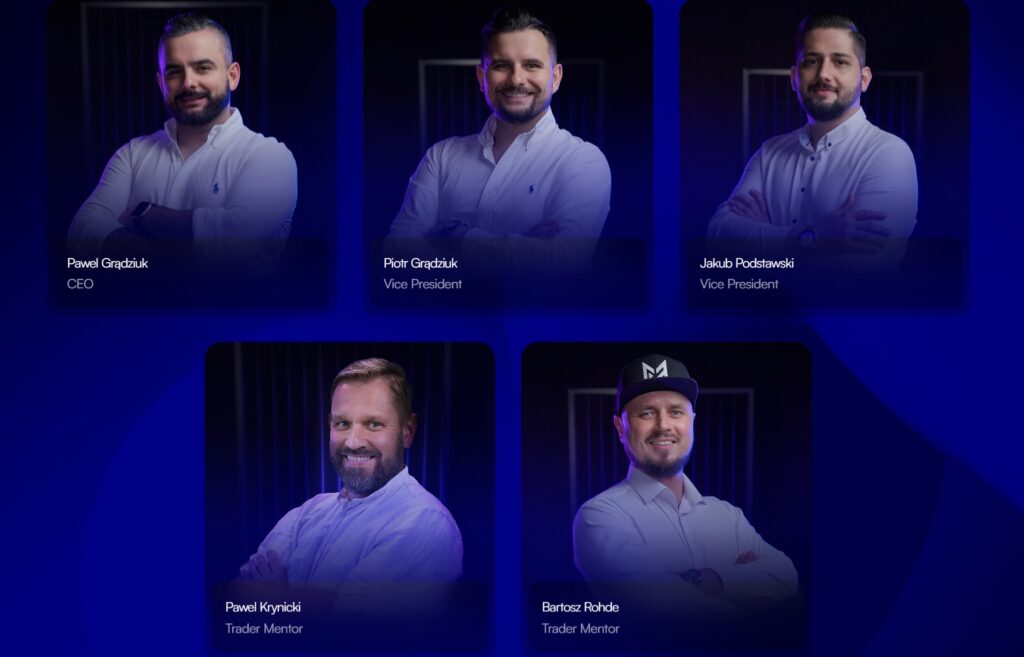

My Funding Account (MFA) is a proprietary trading firm headquartered in Katowice, Poland. The company was founded by Pawel Grądziuk, a trader and educator with nearly two decades of experience in financial markets. The leadership team also includes Piotr Grądziuk and Jakub Podstawski as vice presidents, supported by dedicated departments in finance, legal, customer service, marketing, and mentoring.

One of the strongest legitimacy signals comes from MFA’s connection with Polski Fundusz Multimedialny (PFM S.A.), a diversified investment holding company with a valuation of more than $31 million. PFM S.A. is a key shareholder, which gives MFA financial backing beyond what most prop firms can demonstrate.

Transparency is another factor. MFA provides verified company contact details, including a registered office address in Poland and direct communication channels. The firm also presents its leadership team publicly, which is uncommon in an industry where many prop firms remain anonymous.

In terms of trader sentiment, MFA has an active and growing community on Discord where traders can interact, ask questions, and access support. This open approach contributes to building credibility and trust.

Overall, MFA appears to be a legitimate prop trading firm with verifiable leadership, real offices, corporate shareholders, and transparent operations.

How Much Are the Fees?

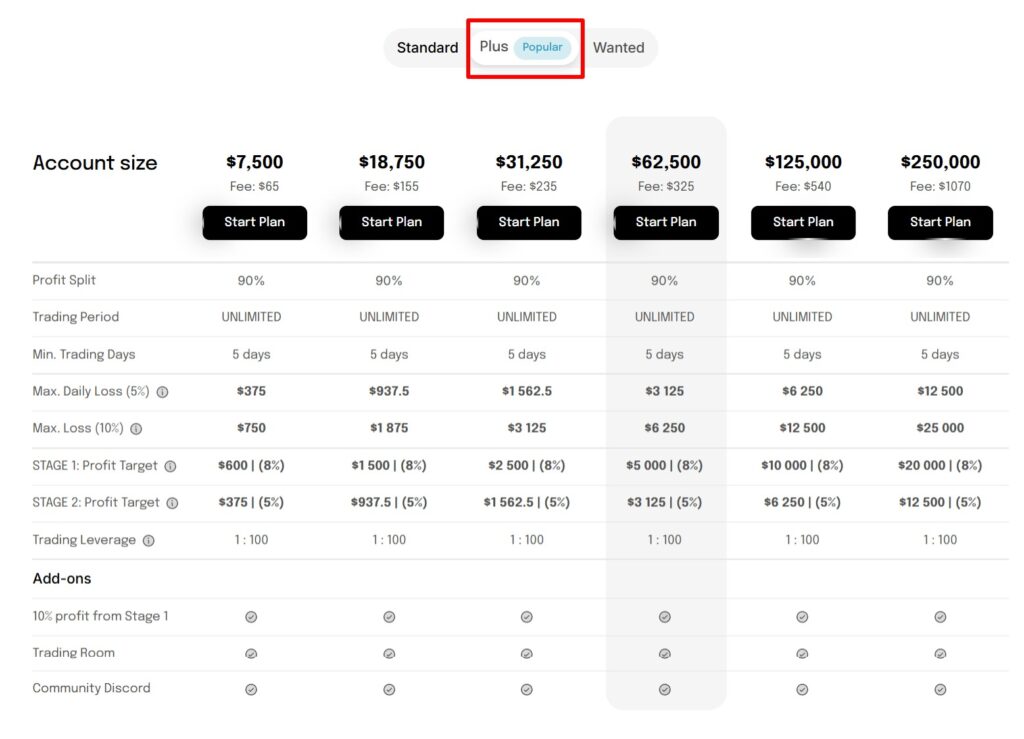

My Funding Account offers three main evaluation plans — Standard, Plus, and Wanted — along with a free trial option. Fees vary based on account size and chosen plan.

Below is a summary table of fees, profit targets, and loss limits for each plan:

| Account Size | Standard Fee | Plus Fee | Wanted Fee |

| $7,500 | $60 | $65 | $81 |

| $18,750 | $135 | $155 | $191 |

| $31,250 | $215 | $235 | $271 |

| $62,500 | $305 | $325 | $381 |

| $125,000 | $495 | $540 | $631 |

| $250,000 | $985 | $1,070 | $1,291 |

Notes:

- Trial account is free, with a 30-day trading period.

- Refund policy: Fees are refundable if the trader passes the evaluation and secures a funded account.

- Profit split is fixed at 90% across all plans.

What Are the Rules?

The MFA trading rules are consistent across account types, with some differences in profit targets and maximum loss depending on the plan.

- Daily Loss Limit: 5% across all plans (calculated from account balance or equity).

- Maximum Loss: 10% for Standard and Plus accounts, 12% for Wanted accounts.

- Profit Targets:

- Standard Plan: Stage 1 requires 10%, Stage 2 requires 5%.

- Plus and Wanted Plans: Stage 1 requires 8%, Stage 2 requires 5%.

- Minimum Trading Days: 5 days per stage.

- Trading Period: Unlimited. There is no set time limit to reach targets.

- Leverage: 1:100 for all account types.

These rules mean traders can progress at their own pace without time pressure. The structure emphasizes discipline and consistency rather than fast, high-risk trading.

How to Pass the MFA Challenge

The evaluation process at My Funding Account follows a three-step structure designed to assess consistency and risk management.

Step 1: Challenge

- Traders begin on a demo account that mirrors live market conditions.

- Profit targets vary depending on the chosen plan (Standard: 10%, Plus/Wanted: 8%).

- A minimum of 5 trading days is required.

- The environment allows mistakes and strategy testing without financial risk .

Step 2: Verification

- Traders who meet the Stage 1 target progress to verification.

- The profit target is reduced to 5% across all plans.

- This stage confirms discipline and risk control before moving to real funds .

Step 3: Funded Account

- Upon passing both stages, traders receive access to a funded account.

- Profits are split 90% to the trader.

- Live capital can be scaled up to $2,000,000 through MFA’s scaling plan .

Tips for passing: Maintain consistent risk management, use the community and live trading room for feedback, and avoid rushing targets.

Pitfalls: Breaching the 5% daily loss rule or overtrading without regard to drawdown limits.

Payouts & Withdrawals

MFA offers one of the faster payout processes in the prop trading industry.

- Frequency: Payouts are available every 14 days.

- Processing Time: Withdrawals can be processed in as little as 60 minutes once approved by the risk management team.

- Methods: Bank wire, crypto, and card payments are supported .

- Approval: All payouts require confirmation from the risk department before funds are released.

- Fees: The firm does not mention any withdrawal fees in its documentation.

This combination of bi-weekly access and fast processing makes MFA’s payout system attractive for traders looking for quicker liquidity.

Scaling Plan (to $2M)

MFA provides a structured scaling program that rewards consistent profitability.

How it works:

- Traders must maintain an average monthly profit of at least 1.5% over four consecutive months.

- Accounts are increased by +25% after each qualifying cycle.

- The process is automatic — no requests are required.

Example with $100,000 account:

| Cycle | Account Size | Avg Monthly Profit | New Balance |

| Start | $100,000 | 1.5% | $125,000 |

| 4 mo | $125,000 | 1.5% | $156,250 |

| 8 mo | $156,250 | 1.5% | $195,312 |

| … | … | … | up to $2M |

The scaling plan emphasizes long-term consistency rather than short bursts of profit. By rewarding steady growth, MFA positions scaling as a pathway for disciplined traders to manage larger amounts of capital safely.

Platforms & Tools

My Funding Account supports several popular trading platforms:

- MetaTrader 4 (MT4)

- Match-Trader

- TradingView

These platforms cover the needs of different trading styles, including expert advisor (EA) users, scalpers, and swing traders.

In addition to trading platforms, MFA provides access to community and learning resources:

- Live Trading Room with daily broadcasts and archives for review

- Community Discord with thematic channels for beginners and advanced traders

- Ongoing access to discussions, analysis, and practical tips shared by experienced mentors

Markets & Leverage

MFA traders can access a range of asset classes through its platforms:

- Forex

- Indices

- Commodities

- Cryptocurrencies

- Stocks

Leverage is set at 1:100 across all account types. The firm does not offer futures trading, which limits options for traders focused on those markets.

This setup is well-suited for FX and CFD traders who use a variety of strategies and instruments within margin trading.

Education & Coaching

My Funding Account emphasizes trader development as much as capital access. Educational resources include:

- Live Trading Room: Daily market sessions where traders can observe professionals, ask questions, and learn in real time

- Community Discord: A collaborative environment with daily analysis, market discussions, and thematic channels for different skill levels

- Mentorship and coaching: Guidance provided by experienced traders within the MFA team

- Partnership with All In Traders: MFA integrates into a larger educational ecosystem that organizes training camps, conferences, livestreams, and webinars to support trader growth

These resources create a structured path for traders who want to improve discipline, technical skills, and psychological resilience while trading.

Who Is MFA Best For?

Best For:

- Traders who want to grow within a community environment and benefit from shared learning

- Forex and indices traders looking for consistent account structures with clear rules

- Traders who appreciate transparent leadership and access to mentorship from real market practitioners

Not Ideal For:

- Gamblers or traders who ignore risk limits, since MFA’s model rewards consistency over short-term spikes

Verdict (Pros & Cons)

Pros

- Profit split of up to 90% across all account types

- Strong focus on education, mentorship, and community support

- Fast payout processing, sometimes within one hour after risk approval

- Scaling plan allows growth up to $2 million

- Transparent leadership team and verifiable corporate backing

Cons

- No single-step evaluation option

- No instant funding program

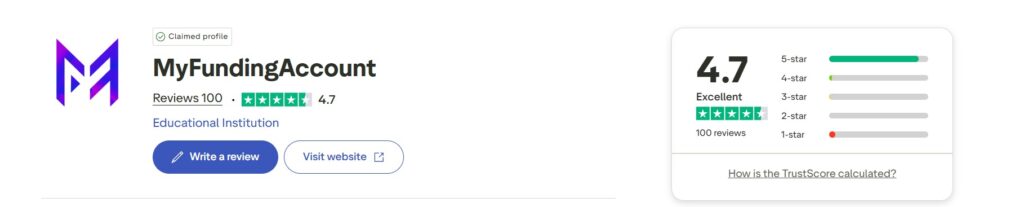

My Funding Account Trustpilot Review

My Funding Account (MFA) holds a strong presence on Trustpilot, where it is rated 4.7 out of 5 based on 104 reviews. This places MFA in the Excellent category, showing high satisfaction among traders who have used the platform. You can view the latest feedback directly on My Funding Account Trustpilot reviews.

Key Trustpilot Highlights:

-

Overall Rating: 4.7 / 5

-

TrustScore: 4.5 / 5

-

Reviews Count: 104

-

5-Star Reviews: ~90% of all feedback

-

1-Star Reviews: ~6%

-

Response Rate: Company replies to around 20% of negative reviews, typically within 24 hours

The majority of reviews highlight fast payouts, transparency, supportive community, and reliable scaling opportunities. A small portion of reviews mention challenges with the evaluation process, which is expected given the strict risk management rules.

Verdict from Trustpilot: MFA is viewed as a legitimate and reliable prop firm, with high praise for payouts, profit splits, and trader support.

My Funding Account Coupon Code

If you are considering joining MFA, you can reduce your evaluation cost with an official My Funding Account coupon code. Currently, MFA is offering a 15% discount on all challenge fees when you use the code:

Coupon Code: MFA15OFF

This discount applies at checkout on the MFA website and can be used across Standard, Plus, and Wanted plans. The coupon is time-limited, so availability may change depending on promotions.

Using a valid coupon code allows traders to start their evaluation at a lower upfront cost, making it easier to test the platform and work toward a funded account.

FAQ

Does My Funding Account really pay?

Yes. My Funding Account processes payouts once approved by its risk management team. Traders report receiving withdrawals in as little as 60 minutes, although timing can vary depending on the method used. MFA emphasizes quick access to profits, which distinguishes it from many other proprietary firms in the industry.

How fast are MFA payouts?

Payouts at My Funding Account are available every 14 days. Once requested and approved, they are often processed within 1–2 business days. In some cases, traders receive funds on the same day, with documented examples of withdrawals completed in under an hour after risk team confirmation.

What is the MFA profit split?

MFA offers a fixed profit split of 90% across all account types, including Standard, Plus, and Wanted plans. This means traders retain the majority of their trading profits while MFA takes only a small percentage. The profit split remains consistent, regardless of account size or plan level.

Is My Funding Account legit?

Yes. My Funding Account is a proprietary trading firm registered in Poland and backed by Polski Fundusz Multimedialny (PFM S.A.), a holding company valued at over $31 million. The firm publishes its leadership team, office address, and contact details, making it more transparent than many competing prop firms.

What happens if you fail the MFA challenge?

If a trader fails the MFA challenge by breaching rules such as the 5% daily loss or max loss limits, they do not advance to a funded account. However, traders can purchase a new challenge and attempt again. MFA does not penalize failed attempts beyond the initial evaluation fee.