Unlock Trading Success with Lux Trading Firm. Experience structured growth, personalized mentoring, and a verified track record.

Founded in 2020 and headquartered in the United Kingdom, Lux Trading Firm has built a reputation as one of the most professional prop trading firms in the industry. Led by CEO Petra Pirova, the firm operates on a true A-book model, providing traders with real capital, direct liquidity through FX Edge, and a clear path to scale up to $10 million in funding.

Unlike many competitors, Lux allows instant withdrawals from funded accounts, enforces a static 6% drawdown for risk consistency, and supports traders with a professional risk desk. The firm also provides an audited performance track record that can be presented to banks and hedge funds, giving traders the opportunity to establish long-term professional credibility.

In recognition of its institutional-style execution and trader-centric structure, Lux was awarded Best A-Book Prop Firm at the 2025 Funded Trading Awards.

Lux Trading Firm at a Glance

|

Attribute |

Details |

|

Founded |

2020, Slovakia and United Kingdom |

|

CEO |

Petra Pirova |

|

Company Registration |

Lux Trading Firm Ltd (2023-00292) — Saint Lucia; Lux Trading Firm Ltd (13160991) — London, UK; Lux Trading Firm MEIL.L.C-F2 (2311235.01) — Dubai, UAE |

|

Headquarters / Offices |

Saint Lucia, London (UK), Dubai (UAE) |

|

Contact Info |

Phone: +44 (0)20 7193 9534 (UK) / +971 4 4070582 (UAE) • Email: info@luxtradingfirm.com |

|

Funding Path |

1-step demo evaluation → funded live account (A-book) |

|

Profit Split |

80% on funded stages |

|

Drawdown Type |

Static |

|

First Payout |

Instant withdrawals from day one, profits withdrawn still count toward targets |

|

Account Sizes & Fees |

$100K — £199 • $400K — £449 • $1M — £999 |

|

Scaling Ceiling |

Up to $10,000,000 |

|

Liquidity Provider |

FX Edge (direct institutional liquidity, real A-book execution) |

|

Track Record |

Audited track record accepted by banks and hedge funds; potential salary for consistent traders |

|

Trading Platforms |

MatchTrader (core), with option to copy trades from any platform or broker |

Quick Verdict: Who Lux Trading Firm Is Best and Not Best For

Lux Trading Firm is best suited for disciplined traders who want to grow with a professional, career-oriented prop firm. With its static 6% drawdown, audited track record, and instant access to payouts, it provides a structure that rewards consistency and proper risk management. The ability to scale up to $10 million in capital and work directly with a professional risk desk makes Lux one of the few firms that truly prepares traders for institutional-level trading.

Best for:

✅ Traders who want real A-book funding with direct liquidity

✅ Professionals looking to build an audited track record accepted by banks and hedge funds

✅ Ambitious traders aiming to scale accounts up to $10 million

✅ Traders who want education, mentorship, and risk-desk guidance to refine their skills

✅ Traders who prefer the option to copy trades from any broker or platform

Not ideal for:

❌ Traders relying on high-frequency trading or news bracketing strategies (explicitly disallowed)

❌ Arbitrage traders exploiting feed latency or mirroring across venues

❌ Traders unwilling to use a pre-set stop loss on every trade (mandatory rule)

Company Model: Real Funding, Real Liquidity, Real Track Record

Lux Trading Firm operates on a true A-book execution model, meaning all trades are sent directly to the market through their institutional liquidity provider, FX Edge. Unlike B-book firms that profit when traders lose, Lux aligns itself with traders’ success by placing them on real live accounts with genuine market fills and spreads. This transparency removes the conflict of interest that traders often face with traditional prop firms.

Lux Trading Firm operates on a true A-book execution model, meaning all trades are sent directly to the market through their institutional liquidity provider, FX Edge. Unlike B-book firms that profit when traders lose, Lux aligns itself with traders’ success by placing them on real live accounts with genuine market fills and spreads. This transparency removes the conflict of interest that traders often face with traditional prop firms.

Another standout feature of Lux is its commitment to building long-term trader careers. Every funded trader builds an audited performance track record, which can be used when applying to banks, hedge funds, or asset managers. This track record carries institutional credibility and makes Lux a rare bridge between retail prop trading and professional finance.

For those who show consistent results, Lux also provides the opportunity to earn a fixed salary while continuing to trade firm capital. This professional pathway, combined with risk desk oversight and education, makes Lux a career development platform for traders who want to be taken seriously in the financial industry.

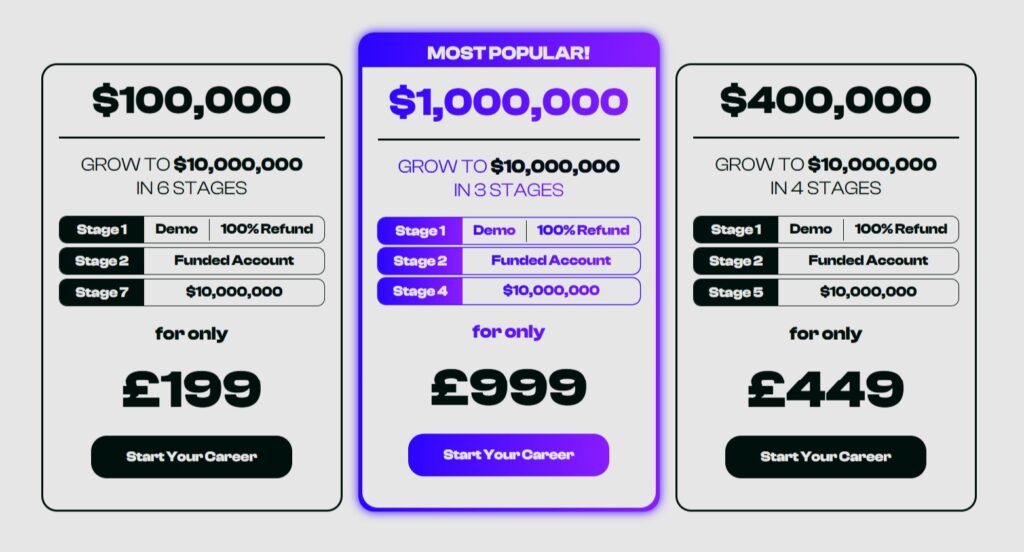

Programs & Pricing (Choose Your Starting Balance)

Lux Trading Firm offers three main account sizes. Each account comes with a static 6% maximum loss, no minimum or maximum trading days, and a 100% refund of the evaluation fee once Stage 1 is passed and approved by the risk desk. Scaling is available up to $10,000,000 with an 80% profit split on funded stages.

$100,000 Evaluation (Most Affordable)

- Fee: £199 (refunded after Stage 1 review)

- Profit Target: 10%

- Max Loss: 6%, fixed drawdown line at $94,000

- Trading Days: No min or max requirements

- Scaling: Seven stages, gradually increasing capital with an 80% profit split once funded

$400,000 Evaluation (Faster Scaling)

- Fee: £449 (refunded after Stage 1 review)

- Profit Target: 12%

- Max Loss: 6%, fixed drawdown line at $376,000

- Trading Days: No min or max requirements

- Scaling Path: $400K → $1M → $2.5M → $10M with 80% profit split

$1,000,000 Evaluation (1-Stage to Serious Capital)

- Fee: £999 (refunded after Stage 1 review)

- Profit Target: 15%

- Max Loss: 6%, fixed drawdown line at $940,000

- Trading Days: No min or max requirements

- Scaling Path: $1M → $2.5M → $10M with 80% profit split

Rules You Must Know (Risk & Compliance)

Lux Trading Firm enforces a strict but transparent set of rules to ensure traders manage risk consistently and professionally. These rules are designed to protect capital, encourage proper position sizing, and prevent strategies that exploit technology or news events.

Stop-Loss Required (Before Entry)

Every trade must have a stop-loss placed before entry. This defines the risk in relation to the trader’s Remaining Risk Capital (RRC). Entering a trade without a stop-loss counts as a breach, and repeated violations may result in failure and the need to restart.

- Stop-losses may be adjusted to breakeven or into profit once a trade moves favorably.

- No stop-loss changes are allowed within 30 seconds of major news events.

- Traders are also warned about slippage during high volatility, which can cause stops to be executed at less favorable prices.

Risk Consistency & RRC Formula

Lux enforces risk consistency through the Remaining Risk Capital formula:

RRC = Current Balance − Drawdown Limit (starting balance − 6%)

- Traders must choose a fixed percentage of RRC to risk per trade.

- Maximum risk allowed: 5% of RRC.

- Combined risk across open trades cannot exceed 5% unless positions are neutralized (closed or moved to breakeven).

- Single-trade profits are capped at 5% of the stage target, reinforcing steady, consistent trading over high-risk “home run” strategies.

Prohibited / Restricted Strategies

To maintain fairness and integrity, the following strategies are not permitted:

- High-Frequency Trading (HFT): Any system generating more than 2,500 server messages per 24 hours, including fully automated EAs or “bot swarms.”

- News Bracketing: Placing simultaneous buy and sell orders around news releases.

- Arbitrage: Exploiting latency, feed discrepancies, or mirroring trades across venues.

Breaching these rules can result in immediate account termination and forfeiture of profits.

Payouts & Withdrawals (Instant Access to Profits)

Lux sets itself apart with one of the most trader-friendly payout systems in the industry. Withdrawals are instant once the account is in profit, with no waiting periods or fixed payout cycles.

- Traders decide when to withdraw, whether after a single winning trade or following a full month of trading.

- Positions must be closed before a withdrawal request can be processed.

- Profits withdrawn still count toward hitting evaluation and scaling targets, ensuring traders are never penalized for taking money out of their account.

This system gives traders full flexibility and immediate access to their earnings, a major advantage over firms that enforce long payout cycles.

Platforms, Copy-Trading & Tech Setup

Lux provides access to its core trading platform, MatchTrader, which offers stable execution and direct integration with FX Edge liquidity.

For flexibility, traders can also copy trades from any broker or platform directly into their Lux account. This means you can continue using your preferred charting or order execution platform while meeting Lux’s rules and funding requirements.

- Copy-trading is fully allowed, as long as risk management and drawdown rules are respected.

- This flexibility makes Lux more accessible to traders with established systems on platforms like MT4, MT5, or cTrader, since they can route trades into MatchTrader without disrupting their workflow.

Resets, Refunds & Fees

Lux Trading Firm’s fee structure is straightforward and designed to reward traders who meet their targets.

- Evaluation Fee Refunds: The evaluation fee is 100% refunded after passing Stage 1 and receiving approval from the risk desk.

- Account Resets: If a trader fails the rules but wants to continue, resets are available:

- £139 for the $100K account

- £299 for the $400K account

- £699 for the $1M account

Each reset comes with a fresh login and account.

- £139 for the $100K account

Pros & Cons (Based on Current Rules and Offers)

Every prop firm has strengths and limitations. Lux Trading Firm is no exception, but its structure makes it stand out in several areas.

Pros

- Real A-book execution with FX Edge liquidity and no dealing desk conflict of interest

- Audited track record path accepted by banks and hedge funds

- Instant withdrawals with profits still counting toward targets

- Static 6% drawdown simplifies risk, supported by a clear RRC framework and risk desk guidance

- Scaling available up to $10,000,000 through structured stages

- Copy-trading allowed from any platform, as long as risk rules are followed

- No minimum or maximum trading day requirements, giving traders full flexibility

Cons

- Mandatory stop-loss discipline and risk consistency rules may feel restrictive for some traders

- No HFT, news-bracketing, or arbitrage strategies allowed

- Reset fees can be relatively high, particularly on the $1M account

- Evaluation fee refunds only apply after passing Stage 1 and risk-desk review

Lux Trading Firm vs FundedNext

|

Feature |

Lux Trading Firm |

FundedNext |

|

Evaluation Model |

1-step, static drawdown |

2-step, 1-step also offered but with trailing drawdown |

|

Scaling |

Up to $10M, and $1M starting account |

Up to $300K (much lower) |

|

Profit Split |

80% |

Up to 95% |

|

Payouts |

Instant withdrawals |

First payout after 21 days (2-step) or 5 days (1-step) |

|

Execution |

A-book |

Simulated funding |

Verdict:

FundedNext promotes 95% profit splits, but caps at $300K with trailing drawdowns. Lux is the better choice with a rare $1M account, static drawdown, instant payouts, and real A-book funding up to $10M.

Lux Trading Firm vs Sabio Trade

|

Feature |

Lux Trading Firm |

Sabio Trade |

|

Evaluation Model |

1-step, static drawdown |

1-step, but trailing-style drawdown |

|

Scaling |

Up to $10M |

Up to $650K |

|

Profit Split |

80% |

80–90% |

|

Payouts |

Instant withdrawals |

Weekly payouts |

|

Execution |

A-book |

Simulated funding |

Verdict:

Sabio is strong on education, but maxes out at $650K with weekly payouts. Lux stands out with faster instant withdrawals, a $1M evaluation option, audited track records, mentorship, and scaling to $10M.

Is Lux Trading Firm Legit?

Lux Trading Firm shows clear signs of being a serious and professional operation. With real capital funding, an A-book execution model, and FX Edge liquidity, traders know their trades are hitting the live market rather than being simulated internally.

The firm’s use of audited track records, combined with the option for long-term traders to receive a salary, provides credibility that goes beyond most prop firms. Lux also places traders under the guidance of professional risk managers, reinforcing its institutional-style structure.

That said, legitimacy comes with tight governance. Traders must be willing to follow rules around stop-loss placement, RRC limits, and prohibited strategies. Lux is best suited for disciplined traders who can work within this framework.

Who Should Choose Lux in 2025

Lux Trading Firm is built for traders who want more than just a shot at temporary funding. Its real A-book execution with FX Edge liquidity gives traders credibility through an audited track record, and the option to start with a $1M evaluation account is very rare in the prop trading space. The firm rewards discipline, consistency, and professionalism with scaling opportunities up to $10 million and even the chance to transition into a salary-based role.

With instant payouts and the ability to scale up to $10M, Lux is built for traders who want more than just short-term funding. It’s designed for those who want a professional, long-term trading career.

For disciplined traders who want serious capital, transparency, and a career path beyond retail prop trading, Lux Trading Firm is one of the strongest choices in 2025.

FAQs

Do I need a stop loss on every trade?

Yes. A stop loss must be placed before entry on every trade. Entering without one counts as a breach.

What’s the drawdown type?

Lux uses a static 6% drawdown based on the starting balance. The limit is fixed and does not trail profits.

When can I request payout?

Payouts can be requested any time the account is in profit, provided all positions are closed. Profits withdrawn still count toward evaluation or scaling targets.

Is copy trading allowed?

Yes, copy trading is allowed as long as all risk and drawdown rules are followed.

What’s the max risk per trade?

Maximum risk per trade is 5% of Remaining Risk Capital (RRC). Combined risk across open trades cannot exceed 5% unless neutralized at breakeven.

Are resets available?

Yes. Reset fees are £139 for the $100K account, £299 for the $400K account, and £699 for the $1M account.

Is the evaluation fee refundable?

Yes, the fee is 100% refunded after passing Stage 1 and risk-desk approval. Otherwise, it is non-refundable.

Lux Trading Firm Discount Code 5%

If you want to join Lux Trading Firm, use our exclusive code for a 5% discount FundedTrading5