Unlock Trading Success with Lux Trading Firm. Experience structured growth, personalized mentoring, and a verified track record.

Lux Trading Firm Review

Got the skills and trading know-how but short on funds? Prop trading might be your solution. However, selecting the right prop firm is crucial, as each comes with its own pros and cons. Let’s dive into one such prop firm: Lux Trading Firm.

About Lux Trading Firm

Based in London, UK, Lux Trading Firm is a premier proprietary trading company. Their expertise lies in empowering experienced prop traders with essential tools and capital for navigating financial markets.

What sets Lux Trading Firm apart? Their team comprises seasoned professionals skilled in quantitative modeling and cutting-edge technology. From risk management to technology support, every aspect of the trading process is meticulously handled.

The founders, boasting over three decades of experience in commodities, futures, and forex, have managed trading desks, embraced calculated risks, and excelled in currency strategy.

In an exciting development, Lux Trading Firm has partnered with Global Prime to introduce two groundbreaking platforms: “The Lux Trader” and “Lux MetaTrader 5.” These platforms are designed to elevate trading capabilities and open new avenues for success.

Funding Program Options

Before getting funding from Lux Trading Firm, you must go through the Evaluation Stage using a Demo account. The Evaluation Stage consists of two stages, Evaluation and Advanced.

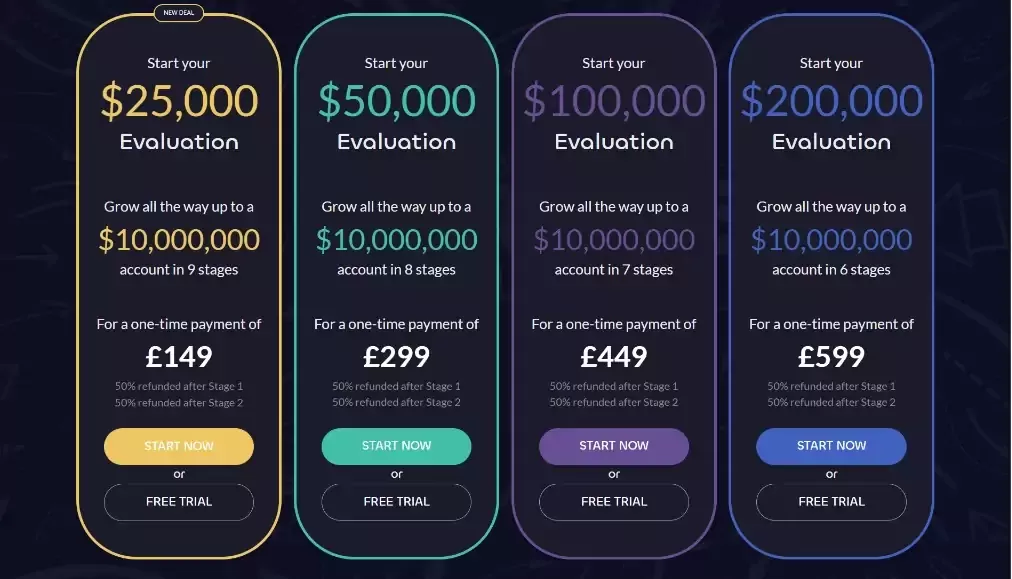

There are four types of evaluation accounts with different amounts of money: $25,000, $50,000, $100,000, and $200,000. Each type has its own steps.

For the $25,000 evaluation account, if you want to turn it into $10,000,000, you have to go through 9 steps. In the Evaluation Stage, you need to make $1,500 or grow by 6%, and your losses can’t go over $1,250. If you succeed, you get back half of the fees.

Then comes the Advanced stage. Here, your goal is $1,000 or a 4% increase, and the max loss is still $1,250. You’ll get another half of the fees back if you do well.

For the $50,000 account, it’s 8 steps to turn it into $10,000,000. In the Evaluation Stage, you must make $3,000 or grow by 6%, and losses can’t exceed $2,500. You’ll get half the fees back for this stage.

Now, the $100,000 account needs 7 steps to reach $10,000,000. In the Evaluation Stage, you should aim for $6,000 or a 6% increase, and losses should stay under $5,000. You’ll get back half of the fees as well.

In the Advanced stage, the goal is $4,000 or around 4%, and losses are capped at $5,000. If you pass, you get half the fees again.

Lastly, for the $200,000 account, it takes 6 steps to reach $10,000,000. In the Evaluation Stage, you need to make $12,000 or grow by 6%, and losses can’t go over $10,000. You’ll get half of the fees back.

For the Advanced stage, the target is $8,000 or 4%, and the max loss remains at $10,000. If you succeed, you get half the fees once more.

So, it’s like a game of stages. Complete each stage’s targets, and you’ll earn back a portion of the fees.

Fees

Discover a range of trading tools available through Lux Trading Firm, including MT4, Trading View, and Trader Evolution platforms, along with a trader dashboard and professional risk analysis. These valuable resources are accessible through an enrollment fee.

Start by choosing your account size, beginning from $25,000, and advance through thoughtfully designed stages towards the remarkable $10,000,000 target. You can kickstart your journey with just 149 GBP. Alternatively, opt for 8 stages at 299 GBP, 7 stages at 449 GBP, or a swift 6-stage route with the $200,000 account, available for 599 GBP.

For those signing up after October 10, 2021, there’s a special perk: a 50% refund of the enrollment fee after completing the Evaluation (Demo) Account stage, with the remaining 50% given post-Advanced stage.

Remember, beyond the enrollment fee, no additional costs arise. However, if you surpass the Max 4% Draw-down Limit, a reset becomes necessary to maintain eligibility for funding. Reset fees vary: $25,000 account is 89 GBP, $50,000 account is 179 GBP, $100,000 account reset is 269 GBP, and $200,000 account reset is 359 GBP.

You can also start with the highest account size of $1,000,000 and enjoy all the perks. You can trade using a custom-built platform powered by TradingView. If you prefer, you can also opt for the trusted MT5 platform.

Here’s the exciting part – you can grow your account up to an impressive $10,000,000 in just 4 stages. This plan costs £1,499, and is a one time payment.

Tradable Assets

In the Lux Career Trading Program, you have the freedom to trade any symbol available on their trading platforms, provided by their current broker, Global Prime. You’ll be able to delve into Forex, Indices, and Commodities (metals and energies), all while adopting your preferred trading style. Plus, the Lux Trader platform, linked straight to the liquidity provider, opens doors to Forex, Indices, Metals, Energy (Commodities), Single Stock CFDs, and Cryptos.

Restrictions

Lux Trading Firm prohibits the use of third-party expert advisors (EA) as it does not showcase individual trading skills. However, you can use a third-party EA as a supportive tool for your strategy if it does not have a trade execution option and places a stop order with the order.

Copy trading services are also not allowed at Lux Trading Firm, and duplicating trades to other trading accounts is prohibited. Any violation of these rules will result in expulsion from the program without the possibility of a refund or reset.

Additionally, trading the accounts of friends, family, or other relationships managed by you at Lux is prohibited.

Challenge

Before you decide to proceed with Lux Trading Firm, we want to ensure that you have a clear grasp of the trading rules and guidelines. We understand that these rules can sometimes be intricate and overwhelming. That’s why we’re here to simplify them for you, making it easier to understand before you make your decision.

At Lux Trading Firm, there are five account sizes:

- $200,000 Account: During the Evaluation stage, the target is $12,000 profit. In the Advanced stage, the target is $8,000 profit.

- $100,000 Account: During the Evaluation stage, aim for $6,000 profit. In the Advanced stage, aim for $4,000 profit.

- $50,000 Account: During the Evaluation stage, aim for $3,000 profit. In the Advanced stage, aim for $2,000 profit.

- $25,000 Account: During the Evaluation stage, aim for $1,500 profit. In the Advanced stage, aim for $1,000 profit.

- $1,000,000 Account: During the Evaluation stage, aim for $150,000 profit. In the Profesional stage, aim for $100,000 profit.

- Traders receive a 50% fee refund after passing the Evaluation stage, and another 50% refund after passing the Advanced stage.

For the Professional stage and beyond, the goal is to make a 10% profit to progress to the next stage. There are no set time limits to achieve these profit targets.

Profit Sharing and Payouts

Profits are split in a 75% to the trader and 25% to Lux Trading Firm. In higher stages, traders can withdraw profits once a month, with processing taking 3-5 business days.

Maximum Loss Limits

To ensure risk management, the maximum relative drawdown is 5% in the early stages. This means your losses can’t exceed 5% less than your account balance.

For later stages, the maximum hybrid drawdown is 4%. It’s a combination of fixed and relative drawdown. Withdrawals reset your account and drawdown level.

Hitting your maximum loss disables your account. You can start anew by paying a reset fee, going back a few stages in the program.

Risk Manager

From stage 2 onward, a personal risk manager guides traders. It’s essential to follow their advice. Neglect might lead to account closure.

Stop Loss

Every trade needs a stop loss. It must be within the 4-5% drawdown limit and not exceed your max risk capital. Profits and active trading days won’t count beyond these limits.

Minimum Trading Days

There are no time limits for Evaluation, Advanced, or Professional stages. But you need at least 29 active trading days in Evaluation. Swing traders need 15 days. Active days are Monday to Friday.

Allowed Securities to Trade

Traders can trade symbols offered by Lux Trading Firm’s broker, Global Prime. These are limited to Forex, Indices, Debt, and Commodities, using any style.

The Lux Career Trading Plan

After Evaluation, the Advanced Account is funded with the same amount. Passing that, a live account is funded. Profits can double the account size.

Leverage

Leverage varies for different accounts and asset classes.

Allowed Trading Strategies

Most strategies are allowed. Stick to consistent risk per trade. Traders can use EAs they’ve created. Third-party EAs aren’t allowed.

Withdrawals

After passing stages, traders can withdraw profits. Fill a form, wait 3-5 days. Withdrawals don’t affect the profit target.

Fee Structure

Enrollment fee covers tools, platforms, and analysis. After passing Evaluation, traders get a 50% refund. Reset fees apply for exceeding drawdown limits.

You’ve just gained a clear picture of their trading rules in simplified terms. Feeling more confident? Now that you understand the rules, you’re in a great position to determine if they align with your goals.

Your journey starts with informed choices. Are these rules what you’re searching for? Take your time, think it over, and when you’re ready, take the next step towards your trading aspirations.

Features

Unlock Your Trading Potential

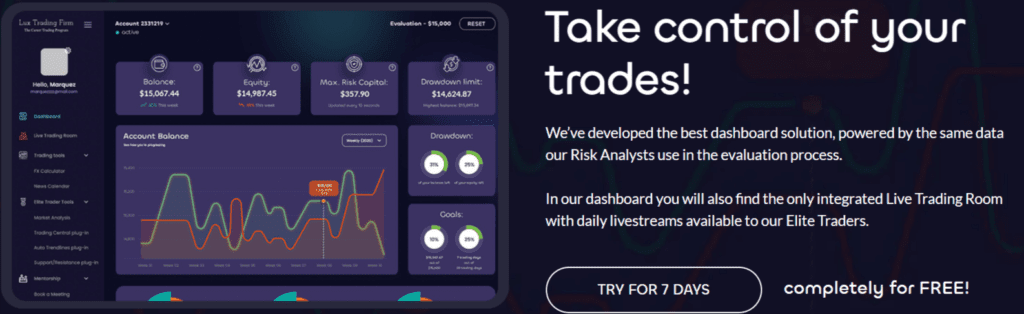

Lux Trading Firm has developed an easy-to-use dashboard powered by the same data their experts use. This dashboard gives you the upper hand in your trading.

Plus, there’s more – their dashboard includes a special Live Trading Room. Elite Traders get access to daily livestreams filled with helpful insights.

Personalized Mentorship Awaits

Lux Trading Firm offers a chance to connect with expert mentors. Choose your mentor and enjoy unlimited 1-on-1 sessions. Gain essential insights into their Funded Program, refine your strategy, and ensure you understand and adhere to their trading rules.

Verified by KPMG

Lux Trading Firm stands as a unique proposition in the prop trading landscape, offering a verified track record audited by KPMG. Unlike mere certificates, this audited track record holds substantial weight.

Are you aspiring to trade for prestigious institutions like big banks, hedge funds, or family offices? With a KPMG-verified track record, these opportunities can become attainable realities.

In Conclusion

Lux Trading Firm is a recognized prop firm offering a clear evaluation process through a demo account. Here’s the deal: achieve 6% in the first phase and 4% in the second to secure funding and enjoy a 75% profit split. The firm also has a rule that limits losses to 5%. The evaluation program also allows traders the potential to grow their account balance up to $10,000,000. If you’re an experienced trader with a solid risk management plan, you’re in the right place. Lux Trading Firm has clear rules, no time restrictions, and strict daily trading requirements, indicating they are looking for consistent traders. They can be a great choice for traders looking to earn consistent profits over time.

Lux Trading Firm Discount Code 5%

If you want to join Lux Trading Firm, use our exclusive code for a 5% discount FundedTrading5