FundsCap, winner of two FundedTrading Awards 2025, offers 2-step, instant, and unlimited accounts with profit splits up to 90%. Trusted by over 38,000 traders worldwide, especially in Brazil, it combines fair rules, a MetaQuotes MT5 license, and Tier-1 liquidity to deliver fast, professional trading conditions.

FundsCap has grown rapidly, with more than 38,000 traders on its platform in 2025, most of them from Brazil and the Portuguese-speaking community. This regional strength has helped it form an active, supportive trader base that shares strategies and experiences.

Feedback often highlights the accessible entry fees, fast payouts, and clarity of rules. Beginners especially value the no-time-limit 2-step challenge, which makes passing evaluations less stressful.

With three account types — 2-step, instant, and unlimited — plus profit splits up to 90%, FundsCap is now competing with the industry’s biggest names.

Is FundsCap a safe prop trading firm?

FundsCap combines regulatory transparency with technology-backed safeguards. Founded in 2023, it has offices in Saint Lucia and Costa Rica, and in 2025 secured a MetaQuotes license for MT5 with direct Tier-1 liquidity.

This infrastructure is one reason FundsCap won Best Two Step Challenge at the 2025 FundedTrading Awards. FundedTrading highlighted its professional-grade trading environment and clearly defined risk parameters.

Safety checklist:

- Licensed MetaTrader 5 (MetaQuotes)

- Tier-1 liquidity providers

- Automated rule validation dashboard

- Award-winning 2-step program

Compared with competitors, FundsCap scores strongly on transparency of rules, though it lacks the long track record of more established firms like FTMO and The 5%ers.

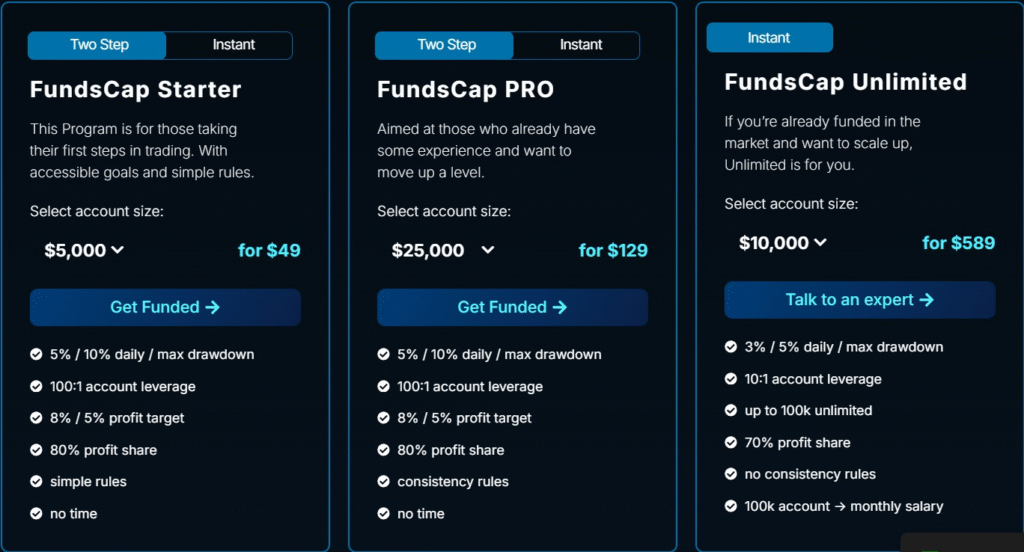

What funding programs does FundsCap offer?

FundsCap supports three funding paths: 2-step challenge accounts, instant funding, and unlimited scaling accounts.

| Program Type | Account Sizes | Profit Target | Drawdown | Profit Split | Leverage | Fee |

|---|---|---|---|---|---|---|

| 2-Step Starter | $5k | 8% → 5% | 10% / 5% daily | 80% | 1:100 | $49 |

| 2-Step Pro | $25k | 8% → 5% | 10% / 5% daily | 80% | 1:100 | $129 |

| Instant Starter | $3k | 2% cap | 6% / 3% daily | 70% | 1:10 | $69 |

| Instant Pro | $10k | 2% cap | 6% / 3% daily | 70% | 1:10 | $189 |

| Unlimited | $10k → 100k | None | 5% / 3% daily | 70% | 1:10 | $589 |

Key points:

- Awards-backed 2-Step: Targets (8% → 5%) with no time limits earned FundsCap the Best Two Step Challenge 2025 award.

- Beginner-friendly: Low entry cost ($49) and straightforward rules led to the Best Prop Firm for Beginners 2025 award.

- Instant and Unlimited: Launched in 2024–2025 to appeal to advanced traders who want flexibility.

Compared to rivals, FundsCap balances accessibility and structure better than most. FundingTraders, for example, enforces tighter risk controls and consistency scores, while MasterFunders focuses on ultra-low entry costs ($25–$40).

How much are FundsCap’s challenge and reset fees?

FundsCap applies upfront, refundable fees for challenge accounts. Reset fees are discounted compared with starting fresh, giving traders a second chance without paying full price.

Challenge Fees

- Starter 5k: $49

- Pro 25k: $129

- Unlimited: $589

Instant Fees (non-refundable)

- Starter 3k: $69

- Pro 10k: $189

This structure is competitive. By comparison, FunderPro charges significantly higher for its one-phase challenges (starting at $549).

What are FundsCap’s trading rules?

FundsCap applies clear risk limits across its three account types, with automatic monitoring in the dashboard.

2-Step Challenge Rules

- Profit target: 8% (Phase 1), 5% (Phase 2)

- Max drawdown: 10%

- Daily drawdown: 5%

Instant Account Rules

- Profit cap: 2%

- Max drawdown: 6%

- Daily drawdown: 3%

Unlimited Account Rules

- No targets

- Max drawdown: 5%

- Daily drawdown: 3%

Additional safeguards include lot consistency, floating loss ratio, and a trade value score limit of 33%, which prevent single oversized trades from skewing performance.

🔎 Comparison: FundingTraders enforces stricter consistency rules (15–25% max daily PnL share) and bans high-frequency or grid trading, making it tougher for scalpers. By contrast, FundsCap focuses on simple drawdown limits, which beginners find easier to manage.

How do FundsCap payouts and profit splits work?

FundsCap traders earn 70% on instant and unlimited accounts, and 80% on 2-step accounts. Payouts are approved automatically once risk rules are verified, removing the manual review delays common at other firms.

Payout highlights:

- 80% profit split on challenge accounts

- 70% profit split on instant/unlimited accounts

- Fee refunds on first payout for 2-step challenges

- Fast processing after dashboard checks

🔎 Comparison:

- FunderPro pays 80% with the option to upgrade to 90%, and traders can request daily rewards once accounts are 1% in profit.

- FundingTraders pays 80–100%, but enforces strict consistency scores and has 14-day cycles.

- MasterFunders pays 80–90% with biweekly payouts.

FundsCap doesn’t yet offer daily or on-demand withdrawals like FunderPro, but its fast auto-validation makes payouts smoother than firms relying on manual checks.

What makes FundsCap stand out in 2025?

FundsCap has introduced multiple innovations that distinguish it in the prop trading space:

- Instant accounts (2024): Skip evaluation, start trading immediately.

- Unlimited accounts (2025): Scale up to $100k with no profit targets.

- FundsCap 2.0 Dashboard (2025): Redesigned for faster navigation, clearer rule tracking, and better user experience.

- MetaQuotes MT5 license (2025): Full software rights, ensuring a stable platform.

- Tier-1 liquidity: Institutional-grade execution with razor-thin spreads.

On top of this, FundsCap won two categories at the FundedTrading Awards 2025:

🏆 Best Two Step Challenge

🏆 Best Prop Trading Firm for Beginners

What do traders say about FundsCap?

FundsCap has grown quickly, with more than 38,000 traders using its platform by 2025. Feedback highlights the accessible entry fees, quick payouts, and clarity of rules. Many beginners appreciate the no-time-limit 2-step challenge, which helps them pass evaluations at their own pace.

The firm’s recognition at the FundedTrading Awards 2025 reinforced what traders already valued:

- Best Two Step Challenge for structured evaluations.

- Best Prop Firm for Beginners for its supportive conditions.

What are the pros and cons of FundsCap?

FundsCap balances affordability with structure, but like all firms, it has trade-offs.

Pros

- Award-winning 2-step challenge (Best in 2025)

- Beginner-friendly $49 entry fee

- Instant and Unlimited funding options

- MetaTrader 5 full license + Tier-1 liquidity

- Fast auto-verified payouts

Cons

- Instant/unlimited fees are not refundable

- Instant accounts capped at 2% profit per trade cycle

- Unlimited accounts limited to 1:10 leverage

🔎 Comparison: FundingTraders offers up to 100% profit split but enforces stricter consistency rules. FunderPro offers faster payouts, but its starting fees are higher. FundsCap sits in the middle ground: fair pricing, accessible programs, and award-winning credibility.

FAQs about FundsCap

Does FundsCap offer refunds?

Yes, but only on challenge accounts if no trades are placed. Refund requests must be made within 7 days.

What profit splits are available?

FundsCap pays 80% on 2-step accounts and 70% on instant/unlimited accounts.

How quickly are payouts processed?

Once rule compliance is verified in the dashboard, payouts are released without delay.

What platforms can I use?

Trading is offered on MetaTrader 5 with a full MetaQuotes license.

Can beginners trade at FundsCap?

Yes, the firm won Best Prop Firm for Beginners 2025 thanks to low-cost entry accounts and fair rules.

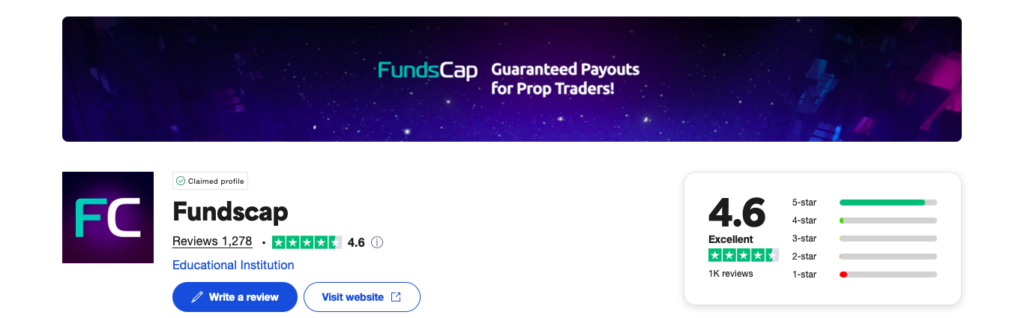

Trustpilot Reviews

When it comes to choosing a prop firm, hearing from real traders can make all the difference. FundsCap has earned a solid reputation in the trading community, and that’s reflected in their Trustpilot reviews.

On Trustpilot, FundsCap maintains a 4.6-star rating, with traders frequently praising the platform for its fast payouts, responsive support, and fair trading conditions. Many reviews mention how helpful the no-time-limit challenge is, especially for those who want to pass evaluations without unnecessary pressure.

FundsCap’s transparency, quick payout system, and positive user experiences make it a trusted name in the prop trading world. These reviews reflect a community of traders who genuinely benefit from the firm’s mission to empower success.

Conclusion

FundsCap has positioned itself as one of 2025’s most forward-thinking prop firms. With its award-winning 2-step challenge, beginner-friendly entry costs, and innovations like instant and unlimited accounts, it appeals to both new and experienced traders.

Its FundedTrading Awards 2025 wins — Best Two Step Challenge and Best Prop Firm for Beginners — validate what traders already see: clear rules, fast payouts, and professional infrastructure backed by a MetaQuotes MT5 license and Tier-1 liquidity.

While competitors like FunderPro (daily payouts), FundingTraders (up to 100% profit splits), and MasterFunders (lowest entry fees) each have strengths, FundsCap strikes a balance between accessibility and structure, making it one of the most reliable choices for traders in 2025.

FundsCap vs Competitors (2025)

| Feature | FundsCap | FunderPro | FundingTraders | MasterFunders | SabioTrade |

|---|---|---|---|---|---|

| Founded | 2023 | 2022 | 2022 | 2022 | 2021 |

| Awards 2025 | 🏆 Best 2-Step Challenge 🏆 Best for Beginners | None listed | None listed | None listed | 🏆 Best Prop Firm (London Trader Show) |

| Account Types | 2-Step, Instant, Unlimited | 1-Phase, 2-Phase, Swing | Pro, Next Gen, Instant | Core, Lite, Speed | One-Step Assessment |

| Entry Fee (lowest) | $49 | $549 | $149 (approx.) | $25 | $119 |

| Max Account Size | $100k Unlimited | $5M scaling | $400k | $200k | $650k |

| Profit Split | 70–80% | 80–90% | 80–100% | 80–90% | 80–90% |

| Payout Speed | Fast auto-validation | 8 hours avg | 7–14 days | 72 hours | Weekly |

| Platform | MetaTrader 5 (licensed) | TradeLocker, cTrader | MT5, TradeLocker | In-house | Sabio Traderoom |

| Unique Strength | Award-winning 2-Step, Unlimited accounts | Daily payouts, 5M scaling | 100% profit split option | Lowest entry fees ($25) | Largest accounts (up to $650k) |

FundsCap Discount Code 15%

Start your journey with FundsCap and enjoy a 15% discount on any account. Use this exclusive code:

FUNDSCAP15-Z3V7V