DeiFunded Review

In this DeiFunded review, we will be discussing a prop firm that has become quite popular among traders due to its unique approach and supportive trading environment. DeiFunded sets itself apart from other prop firms by prioritizing fairness, transparency, and providing traders with ample opportunities to succeed in the forex market. They offer a two-phase evaluation model, which is designed to assess a trader’s skill without undue pressure, along with competitive profit splits and the use of MetaTrader 5. By exploring DeiFunded’s features and benefits, this review aims to provide traders with essential insights to help them make informed decisions. Lets uncover whether it’s the right prop firm for you.

About DeiFunded

DeiFunded is a Forex prop trading firm operating under Australian law, known for its focus on fairness and integrity. The firm offers a global platform for traders to enhance their trading skills through a structured two-phase evaluation process. This process is designed to assess and develop trading talent, setting clear profit targets and rules to encourage a disciplined approach to trading. DeiFunded also highlights the importance of ethical trading practices and uses MetaTrader 5 as its trading platform. Although DeiFunded does not have a physical office address, traders can easily reach out for support through email at support@deifunded.com or join their community on Discord at DeiFunded Discord for interactive support and engagement.

Funding Program Options

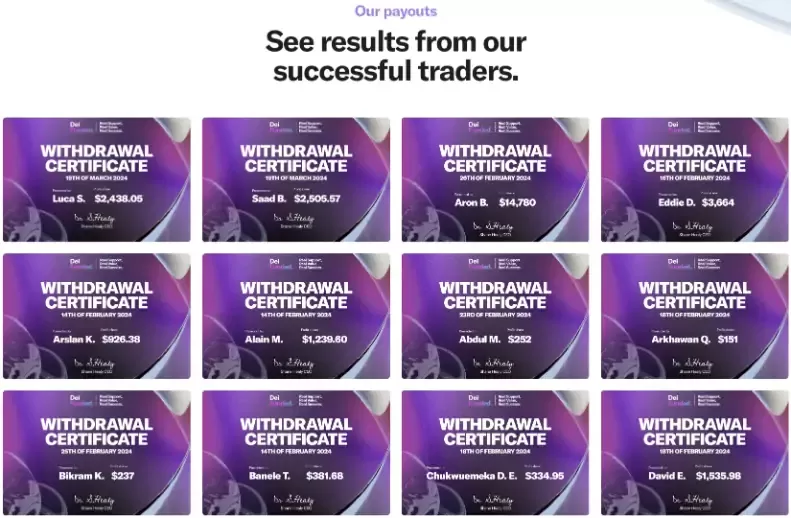

DeiFunded’s 2-step evaluation challenge offers traders an opportunity to earn a funded account. Traders start with an 80% profit share, with the potential to increase to 90%. The challenge requires a one-time fee, which is fully refundable upon successful completion. Once traders attain funded status, they benefit from the convenience of withdrawing their profit share bi-weekly, ensuring a consistent income from their trading activities.

Prices

DeiFunded’s 2-step evaluation challenge fees vary based on the account balance chosen by the trader, starting from $59 for a $5,000 account, and going up to $899 for a $200,000 account. These fees are structured as follows: $59 for $5,000, $129 for $10,000, $229 for $25,000, $329 for $50,000, $469 for $100,000, and $899 for $200,000.

When comparing DeiFunded’s fee structure to The Funded Trader, it’s important to note that DeiFunded’s options are indeed more affordable. For instance, DeiFunded charges $59 for a $5,000 balance and $899 for a $200,000 balance. In contrast, The Funded Trader’s equivalent options are slightly higher, with a $5,000 standard account costing $65 and a $200,000 account priced at $939. This cost comparison highlights DeiFunded’s advantage in terms of pricing, making it a more economical choice.

Tradable Assets

DeiFunded, leveraging the capabilities of MetaTrader 5 (MT5), offers traders a comprehensive range of financial instruments across various asset classes. MT5’s platform supports trading in forex, equities, commodities, contract for differences (CFDs), cryptos, and indices. This wide array of options is designed to cater to the diverse interests and strategies of traders, allowing them to engage in the financial markets with the flexibility to choose instruments that best align with their trading goals.

To explore DeiFunded’s specific tradable assets, the firm provides access to a demo account. This allows potential and current traders to familiarize themselves with the available instruments and the MT5 trading environment without financial risk. The demo account details are as follows:

- Broker Name: Kubera Capital Markets

- Account Name: 2100161112

- Password: DeiFunded_test1

- Server: Kubera Capital Markets Ltd

This demo account is a valuable resource for gaining hands-on experience with the platform and the range of tradable assets offered by DeiFunded. For traders interested in exploring the specific instruments available for trading, using this demo account can provide insightful details and help in strategizing their trading approach.

Rules & Restrictions

DeiFunded implements several rules and restrictions to ensure trading practices align with real market conditions and ethical standards. These include:

Stop Loss

- Traders are not required to use a stop-loss (SL) for every trade, offering flexibility in risk management strategies.

Expert Advisors and Indicators

- EAs and Indicators are allowed for enhancing trading tactics. Traders must adjust settings to match their unique style.

- No restrictions on strategy types, including discretionary and Martingale strategies.

- It’s crucial to personalize the settings of EAs or Indicators used.

Copy Trading

- Copy trading is permitted across DeiFunded accounts, prop firms, or retail brokers, provided all accounts are owned by the same trader.

Martingale Strategy

- Martingale strategies are permitted.

- No single trade can contribute to more than 40% of the total account profit without breaking any rules.

Trading Conditions

- Holding trades over the weekend and trading cryptocurrencies are allowed.

- Traders are permitted to trade during news releases.

Compliance and Restrictions

- Strict prohibition against any form of cheating or exploitation.

- Importance of understanding and following the Terms and Conditions to avoid violations.

- Practices not reflecting real market conditions, leading to immediate account termination for violations.

Prohibited Strategies

- High-Frequency Trading (HFT) and Bot Trading are not allowed due to potential market manipulation and instability.

- Latency Trading is banned for its unethical exploitation of delayed data.

- Arbitrage Trading is prohibited due to the manipulation of price differences across markets.

- Tick Scalping and Grid Trading are restricted due to their potential for market disruption and manipulation.

Account Management

- Hedging is allowed within a single account but not across multiple accounts owned by the same trader.

- Account Sharing is strictly forbidden to ensure security and fairness.

Activity Monitoring

- Excessive trading activity is monitored to maintain platform stability and performance.

- Misuse of platform or data errors is prohibited to ensure fair trading conditions.

This structure breaks down the key aspects of DeiFunded’s trading rules and guidelines into clear, straightforward points, making it easy to understand and follow for anyone engaging with their platform.

For more detailed information and the latest guidance on what is allowed and what is not, please visit DeiFunded’s FAQ page: DeiFunded FAQs.

Trading Challenge

DeiFunded’s trading challenge is designed to identify and fund proficient traders through a two-step account challenge. This detailed overview incorporates the corrected risk management criteria and profit targets.

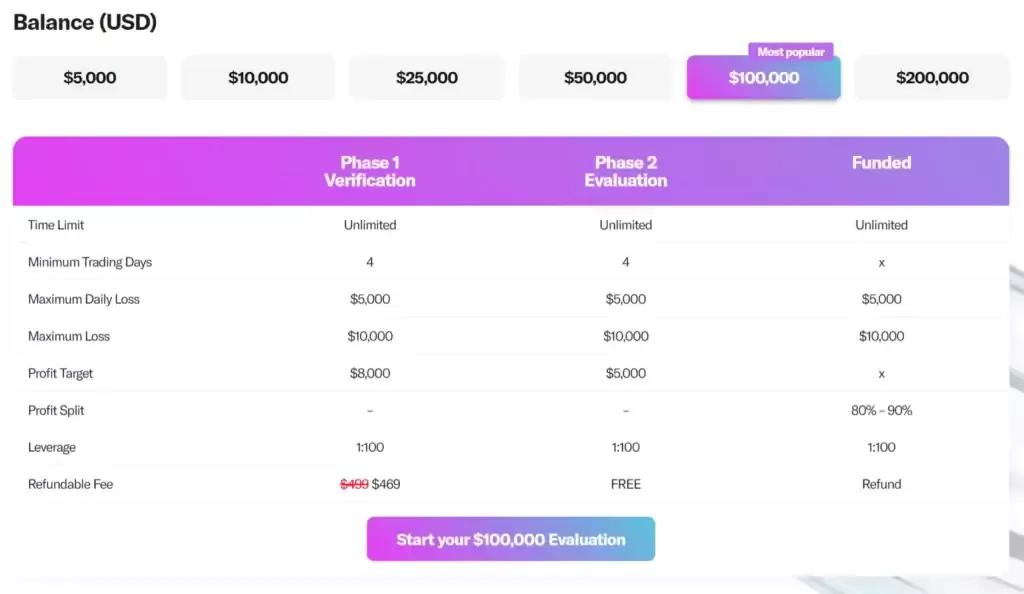

Trading Challenge Key Features

The challenge is characterized by a structured approach, aiming to evaluate traders under realistic market conditions:

- Time Limit: There is no set time limit, offering participants the flexibility to achieve their trading objectives without undue pressure.

- Minimum Trading Days: Traders are required to trade for a minimum of 4 days, ensuring they have sufficient opportunity to demonstrate their trading prowess.

- Maximum Daily Loss and Maximum Loss: The challenge imposes a 5% maximum daily loss and a 10% total maximum loss limit, enforcing disciplined risk management practices among participants.

- Profit Targets: For the verification phase, traders must aim for an 8% profit target, while the evaluation phase sets a 5% profit target. These targets are designed to test traders’ ability to generate consistent profits.

- Profit Split: Successful traders are rewarded with a profit split ranging from 80% to 90%, making the challenge highly rewarding for those who demonstrate exceptional trading skills.

- Leverage: A leverage of 1:100 is provided, allowing traders to amplify their trading strategies and potential returns.

Evaluation Process Explained

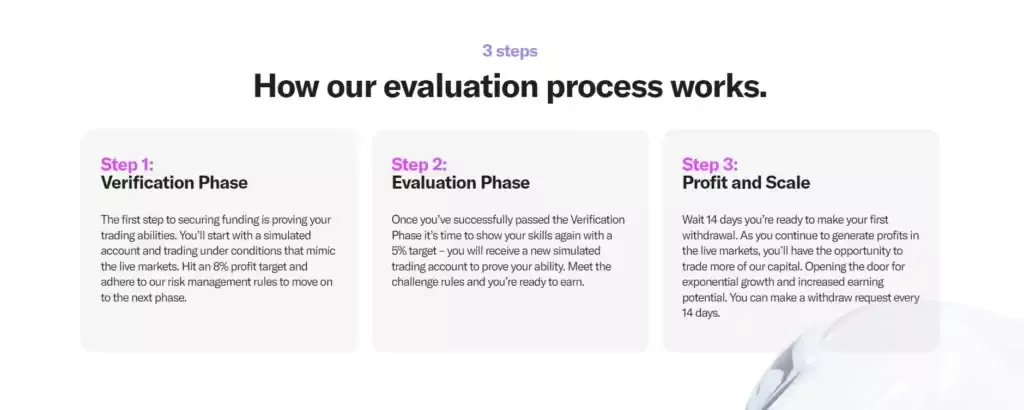

DeiFunded’s evaluation process ensures traders are ready for the challenges of proprietary trading, unfolding in three crucial steps:

- Verification Phase: Begins with a simulated account to mimic live trading environments. Traders need to achieve an 8% profit target while adhering to the 5% maximum daily loss and 10% total maximum loss limits.

- Evaluation Phase: After passing the first phase, traders are given a new challenge with a 5% profit target, continuing to operate under the same risk management constraints.

- Profit and Scale: Upon successful completion of the evaluation phase, traders enter a profit and scale phase where they can start withdrawing profits every 14 days, with the opportunity to manage increased capital for greater potential earnings.

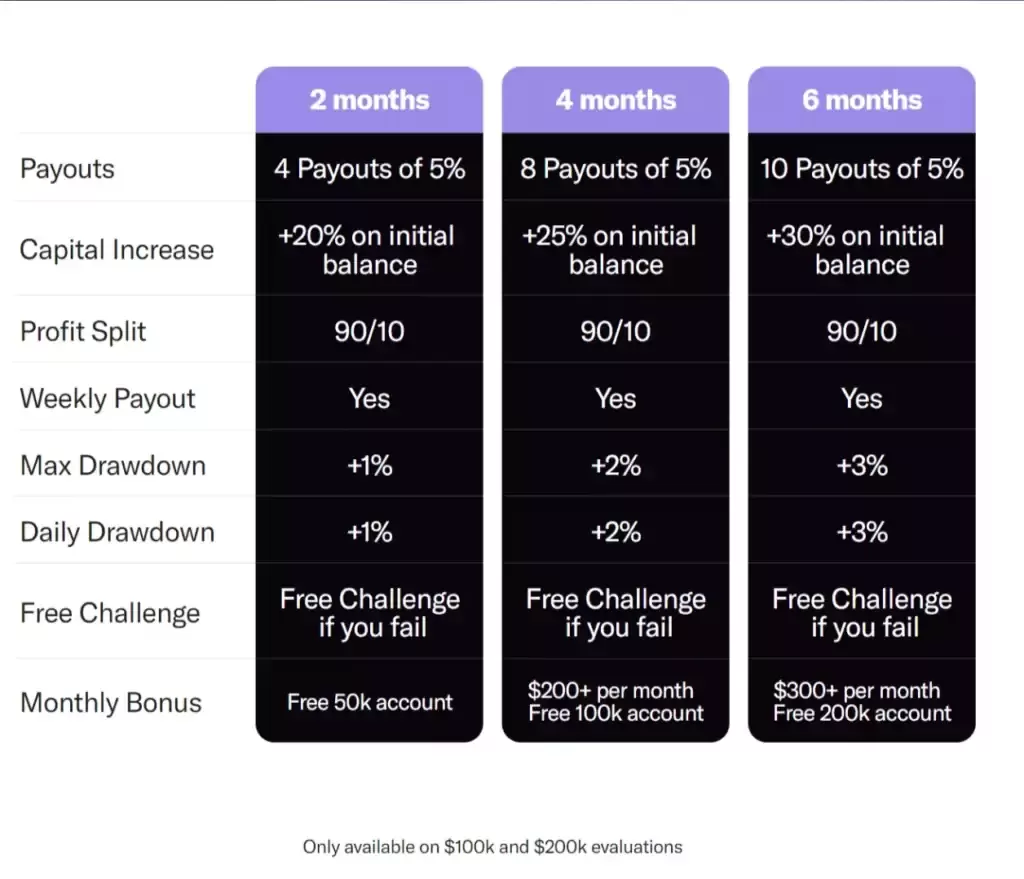

Scaling Plan

Dei Funded’s Scaling Plan is tailored for accounts of $100k and above, focusing on gradual growth and increased benefits over time. In 2, 4, and 6-month increments, traders see capital increases of 20%, 25%, and 30%, respectively. The plan offers a consistent 90/10 profit split, with increased drawdown flexibility: +1% daily and max for 2 months, +2% for 4 months, and +3% for 6 months, offering greater risk tolerance over time.

Additional perks like free challenge retries and monthly bonuses ranging from a free 50k account to $300+ enhance the plan’s appeal, rewarding consistent trading success. Not only do traders have the chance to earn $300+ per month but also qualify for a free $200k account.

Broker & Platform

DeiFunded uses Kubera Capital Markets as its broker, and it’s a smart choice because Kubera is officially recognized and regulated by the Labuan Financial Services Authority in Malaysia. This isn’t just any broker; it’s one that’s got the official thumbs up to operate, ensuring that your trading is in safe hands.

DeiFunded traders use MetaTrader 5 (MT5) as their trading platform and it is still one of the best choices available, despite many prop firms ceasing to support MetaQuotes.It doesn’t matter if you’re on your computer or mobile; MT5 has got you covered with its easy-to-use interface, advanced tools, and real-time data. It’s designed to cater to traders of all levels, with features that help you analyze the markets, manage your trades, and stay on top of the game.

In essence, DeiFunded’s choice to partner with Kubera Capital Markets brings you a seamless trading experience. You get a reliable broker and a powerful trading platform in MT5. It’s all about providing a top-notch trading environment that’s accessible, efficient, and tailored to meet the needs of diverse traders.

Conclusion

DeiFunded offers a promising opportunity for traders to leverage their skills through a structured 2-step evaluation challenge, utilizing the advanced MetaTrader 5 platform in partnership with Kubera Capital Markets. With competitive pricing, a range of tradable assets, and flexible trading conditions, it positions itself as a viable option for those looking to enter the prop trading world. For traders committed to demonstrating their proficiency and managing risk effectively, DeiFunded could be the stepping stone to significant growth and financial reward.