Audacity Capital has built a strong reputation for sponsoring traders with Forex trading potential.

Audacity Capital has been funding traders since 2012, providing a trusted and transparent trading environment. With access to institutional capital, live trading accounts, and zero-risk funding, traders can grow their accounts up to $2 million without using their own money. The firm is recognized globally, supporting over 150,000 traders across 146+ countries with bi-weekly payouts, institutional liquidity, and profit-sharing up to 90%. Audacity Capital stands out with fast funding, premium spreads, and flexible trading conditions.

About Audacity Capital

Audacity Capital was founded in March 2012 by Karim Yousfi and has since grown into a globally recognized proprietary trading firm. Headquartered in the United Kingdom and Dubai, the firm is built on transparency, fairness, and long-term trader development.

The company provides a structured and scalable approach to funding, allowing traders to increase their accounts up to $2 million through consistent profitability. With monthly payouts exceeding $3.2 million, Audacity Capital ensures traders receive reliable, fast, and fair payments.

Why 150,000+ Traders Choose Audacity Capital:

- Scaling Plan Up to $2 Million

- No Monthly Fees or Hidden Charges

- Live Trading Accounts with Zero-Risk Capital

- Profit Share Up to 90%

- Fast Payouts Every Two Weeks

- Institutional Liquidity and Premium Execution Speeds

Funding Program Options

Audacity Capital offers two funding programs, allowing traders to choose between an evaluation process or instant funding.

Ability Challenge

A 2-step evaluation designed for traders who want to prove their skills before managing live capital.

- Unlimited Time to complete the challenge.

- Profit Share Up to 90% once funded.

- 100% Fee Refund upon successful challenge completion.

- Leverage: 1:100 during evaluation.

- Payouts Every 14 Days after the first month.

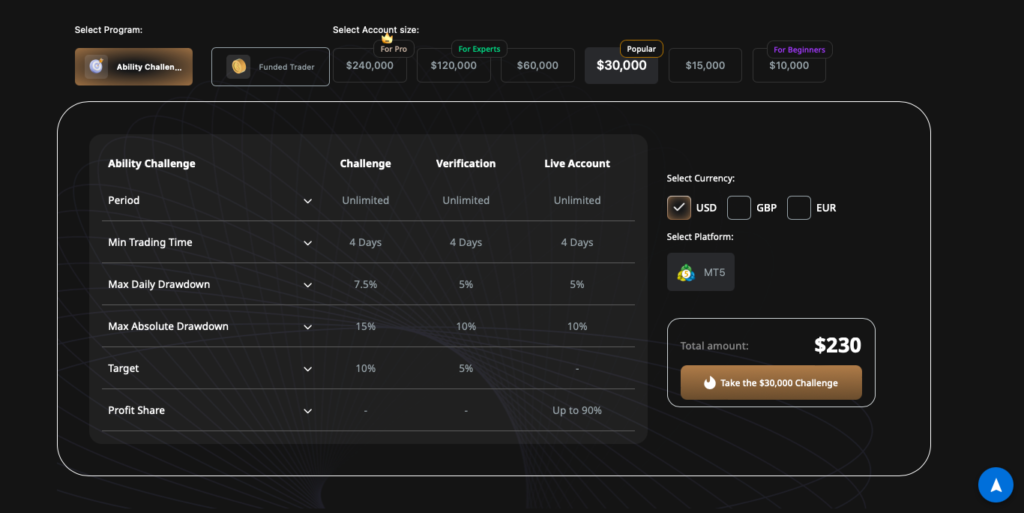

Ability Challenge Requirements

| Stage | Profit Target | Max Daily Loss | Max Absolute Drawdown | Min Trading Days |

| Phase 1 | 10% | 7.5% | 15% | 4 |

| Phase 2 | 5% | 5% | 10% | 4 |

| Live | No Target | 5% | 10% | 4 |

Scaling Plan: Traders who show consistent profitability can increase their account size up to $2 million.

Funded Trader Program

For traders who want instant access to capital, this program offers a live funded account without an evaluation phase.

- Start Trading Immediately with up to $240,000 in capital.

- Profit Split Starts at 50% and Increases to 60% after reaching the first profit target.

- Withdrawals on Demand once the 10% target is reached.

- Leverage: 1:30 for risk management.

Funded Trader Program Requirements

| Account Size | Initial Profit Split | Max Daily Loss | Max Absolute Drawdown | Scaling Plan |

| $10K–$240K | 50%, up to 60% | 5% | 10% | Up to $2M |

Both programs provide traders with scaling opportunities, fast payouts, and professional trading conditions.

Fees

Audacity Capital offers one-time fees with no recurring monthly charges.

Ability Challenge Fees

| Account Size | Fee |

| $10,000 | $90 |

| $15,000 | $130 |

| $30,000 | $230 |

| $60,000 | $320 |

| $120,000 | $540 |

| $240,000 | $1,090 |

100% refund upon successful challenge completion.

Funded Trader Program Fees

| Account Size | Fee |

| $15,000 | $649 |

| $30,000 | $1,099 |

| $60,000 | $1,499 |

| $120,000 | $2,399 |

Traders also pay $3 per round lot commission on forex trades.

Tradable Assets

Audacity Capital provides access to forex, indices, and metals, offering diverse market opportunities.

- Forex Pairs: Major and minor currency pairs.

- Indices: NAS100, US30, S&P 500, and DAX.

- Metals: Gold (XAU/USD).

Competitive spreads, fast execution, and institutional-grade liquidity ensure optimal trading conditions.

Restrictions

To maintain market integrity and fair trading, Audacity Capital strictly prohibits:

- High-Frequency Trading (HFT)

- Martingale Strategies

- Hedging Across Multiple Accounts

- Dollar Cost Averaging (DCA)

Violating these rules may result in account suspension or termination.

Challenge

Audacity Capital provides two challenge-based funding options:

- Ability Challenge: 2-step evaluation with scaling opportunities up to $2 million.

- Funded Trader Program: Instant funding with up to $240,000 in capital.

Both programs include fast payouts and competitive profit-sharing models.

Fast Payout System

Audacity Capital ensures bi-weekly payouts, processed within 2-4 days.

- $3.2M+ in Monthly Payouts.

- Scaling Plan Up to $2 Million.

- Certificates for Traders to Showcase Achievements.

Traders can scale accounts quickly and reinvest earnings for long-term growth.

A Message From Management

Karim Yousfi, Founder & CEO:

“As traders ourselves, we understand the journey. We are committed to providing funding, transparency, and security, helping traders reach their full potential.”

Federica D’Ambrosio, CFO:

“Our goal is to support traders in achieving financial freedom through fair and structured trading conditions.”

Trustpilot Reviews

Audacity Capital has received positive feedback from traders worldwide. On Trustpilot, the firm holds a strong rating, reflecting its commitment to transparency and trader support.

Conclusion

Audacity Capital offers two funding models: the Ability Challenge for traders who prefer an evaluation process and the Funded Trader Program for those who want immediate capital. With no monthly fees, institutional liquidity, and a profit share up to 90%, the firm provides a strong, low-risk opportunity for traders to grow their accounts.

With fast payouts, scaling plans up to $2 million, and a transparent funding process, Audacity Capital is a trusted choice for traders seeking long-term success