In a significant industry update, MyFundedFX has announced a strategic shift in response to ThinkMarkets‘ recent decision to discontinue offering MetaTrader products to the evaluation services industry. This move by ThinkMarkets affects numerous companies that have relied on ThinkMarkets as a provider for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Continued Support for DXtrade Users

Traders currently using DXtrade will not be impacted by this change and can continue their trading activities without interruption. This stability ensures that a segment of MyFundedFX’s clientele remains unaffected by the broader industry shifts.

Transition Plans for MT4 and MT5 Users

For traders utilizing MT4 and MT5 platforms, there is an immediate assurance of continuity. Trading can proceed as usual for the time being. However, MyFundedFX has outlined a transition plan that requires any new challenges purchased on these platforms to be migrated to a new platform by February 29th. Subsequently, all accounts on ThinkMarkets MT4 and MT5 will be transitioned to DXtrade later this month.

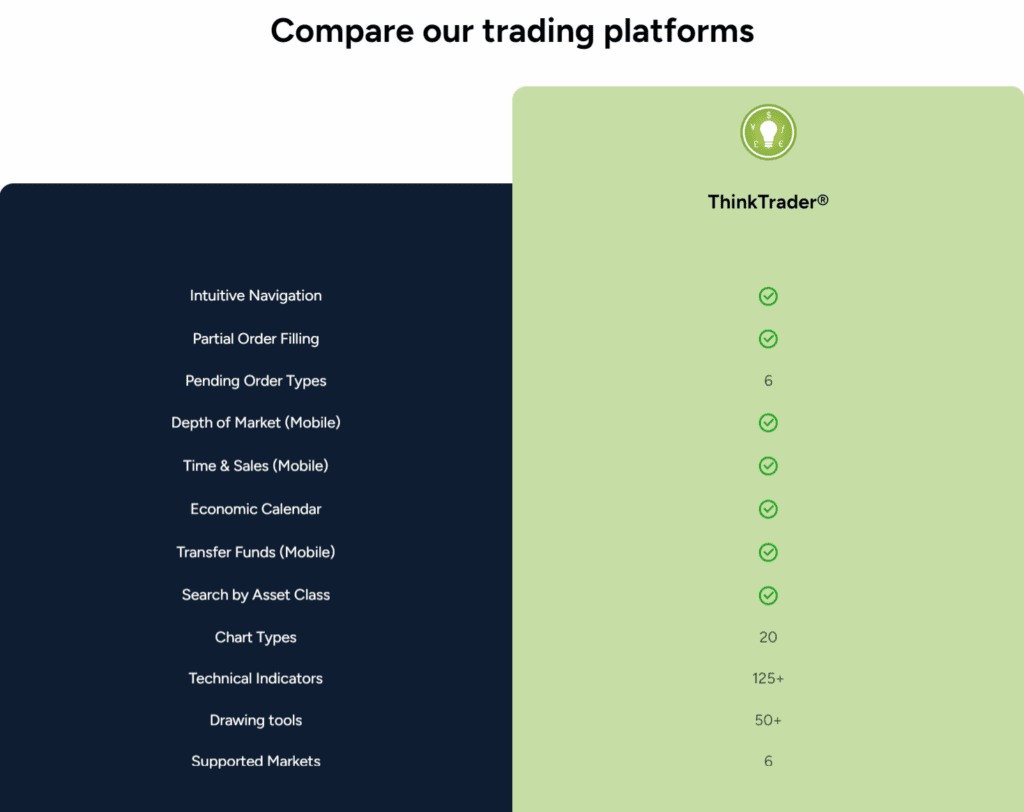

Introduction of ThinkTrader

Instead of MetaQuotes platforms, ThinkMarkets has developed its proprietary trading platform, ThinkTrader. This innovative platform, compatible with a range of trading tools including DXtrade, is designed to offer traders an advanced, flexible trading experience. MyFundedFX is exploring integration opportunities with ThinkTrader, alongside cTrader and Match Trader, offering its traders the option to switch to these platforms in the future. Efforts to obtain MyFundedFX’s own license for MT4 and MT5 further reflect a commitment to providing versatile and reliable trading solutions.

Analysis of the Impact

The decision by ThinkMarkets to cease support for MetaTrader products in the prop firm sector has raised concerns about the potential impacts on both evaluation prop firms and their customers. However, the anticipated impact on evaluation prop firms is considered negligible to very low. Many firms, including MyFundedFX, have already planned migrations to alternative platforms such as DXtrade, mitigating potential disruptions.

For customers accustomed to MetaTrader platforms, the transition may present initial challenges, including adaptation to new interfaces and functionalities. Despite potential teething troubles due to the short testing period at many firms, the industry is expected to adapt swiftly, maintaining the continuity of trading activities.