Discover if Hantec Trader is right for you in 2025. This review covers funding challenges, drawdown rules, payout speed, AI InsightPro tools, and how it became Africa’s Best Prop Firm.

Hantec Trader is a broker-backed prop firm offering 1-step, 2-step, and instant funding with payouts up to 90 percent. It combines Hantec Group’s legacy with AI-driven tools, flexible withdrawals, and region-focused accessibility.

Is Hantec Trader a legitimate prop firm?

Hantec Trader launched in December 2023 as the proprietary trading arm of the Hantec Group. It operates simulated accounts, pays performance-based rewards, and is powered by Hantec Markets Mauritius, part of a regulated broker group.

Founded: Mauritius, December 2023

Parent group: Hantec Group, operating since 1990, with FCA and ASIC-regulated entities across London, Sydney, and Tokyo

Structure: Not a regulated broker itself, but broker-backed by Hantec Markets Mauritius, providing institutional-grade execution for simulated accounts

Unlike many new “prop only” startups that launched in 2021–2022, Hantec Trader leverages three decades of global brokerage experience. That means tighter spreads, proven infrastructure, and multi-region payout support. This foundation is why Hantec Trader earned FundedTrading Awards Best Prop Firm in Africa 2025. It stood out by combining broker stability with local-first accessibility, including mobile money, regional wire transfers, and multilingual support.

- Is Hantec Trader a scam or legit?

Yes, it is legit. It runs simulated accounts backed by Hantec Markets’ infrastructure, with clear rules and documented payout policies. - Who regulates Hantec Trader?

Hantec Trader itself is not regulated. However, it is broker-backed by Hantec Markets Mauritius, part of the Hantec Group which is regulated by the FCA (UK) and ASIC (Australia). - Is Hantec backed by a broker?

Yes, unlike many standalone firms, it has the credibility of Hantec Markets behind it.

What challenges does Hantec Trader offer in 2025?

Hantec Trader runs three evaluation tracks: Express (1-step), Enhanced (2-step), and Instant Funding. Each has fixed daily and total drawdown rules, transparent costs, and profit splits that scale up to 90 percent.

Express Challenge (1-step)

- Profit target: 10%

- Daily loss limit: 5%

- Total loss limit: 6% (trailing until 6% profit, then locks at starting balance)

- Program fees: $39–$999, depending on account size

- Minimum trading days: None

- Best for: Traders who want rapid funding without time restrictions

This is the most flexible option, letting traders pass in a single day if they hit the 10 percent target. The trailing-to-static total loss rule encourages consistency but offers breathing room once you’ve proven profitability.

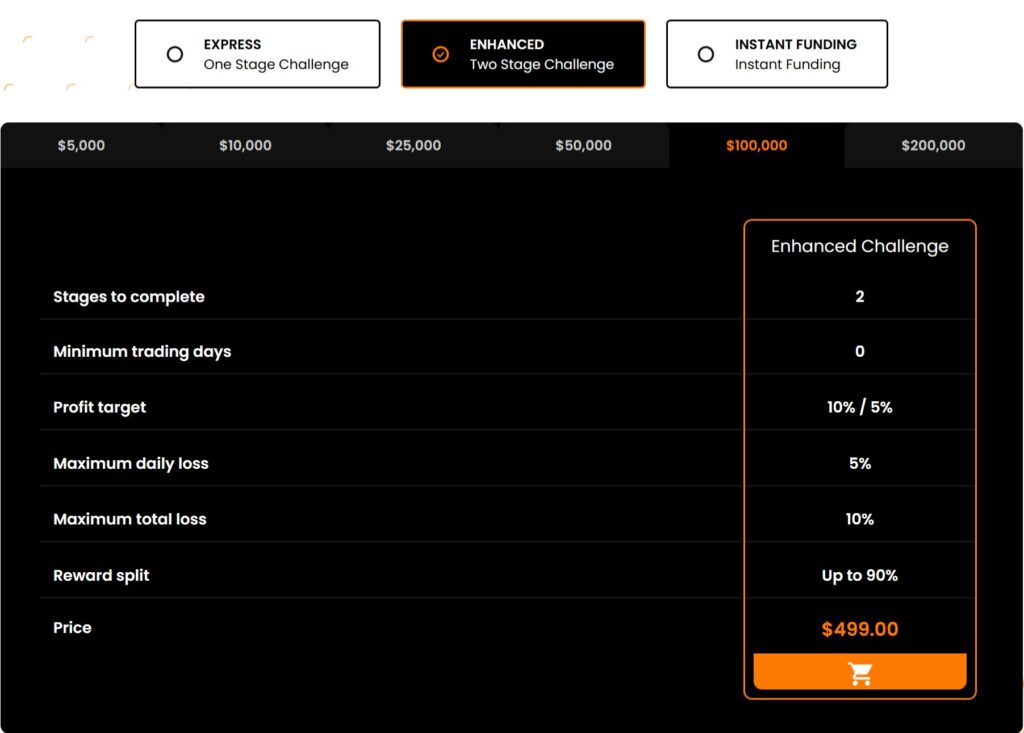

Enhanced Challenge (2-step)

- Profit targets: 10% (Stage 1), 5% (Stage 2)

- Daily loss limit: 5%

- Total loss limit: 10% static

- Program fees: $49–$969

- Minimum trading days: None, but structure favors longer evaluation

- Best for: Traders who prefer a slower, more thorough verification

This two-stage setup mirrors traditional prop firm evaluations but at a lower entry cost. The static 10 percent buffer makes it forgiving for traders who use steady, controlled risk across longer timelines.

Instant Funding (no evaluation)

- Profit target: None

- Daily loss limit: 6%

- Total loss limit: 6% (locks after payout request)

- Program fees: $43–$2,139

- Restrictions: No EAs or automated trading, no weekend holding, no trading within 3 minutes of major news events

- Best for: Skilled traders who want live funded capital immediately

Instant Funding is designed for seasoned traders who don’t want to wait. While the rules are stricter, the upside is immediate access to funded capital and the same 90 percent payout potential.

Comparison Table – Hantec Challenges

| Feature | Express (1-step) | Enhanced (2-step) | Instant Funding |

| Profit Target | 10% | 10% → 5% | None |

| Daily Loss | 5% | 5% | 6% |

| Total Loss | 6% trailing→static | 10% static | 6% |

| Min. Trading Days | None | None | None |

| Fees Range | $39–$999 | $49–$969 | $43–$2,139 |

| EAs Allowed | Yes | Yes | No |

| Weekend Holding | Allowed | Allowed | Not Allowed |

| Best For | Fast-track traders | Structured traders | Experienced pros |

Hantec Trader Scaling Plan – Grow to $200,000

After passing a Hantec Trader challenge, you can scale your funded account balance up to $200,000 without extra fees. The plan doubles account size at each requalification milestone.

How scaling works:

- Pass your challenge and maintain consistent profitability.

- Request your first payout to unlock scaling eligibility.

- Requalify by completing a payout cycle profitably.

- Your balance doubles at each tier, up to $200k.

Example of scaling progression (Express or Enhanced):

- Initial funded account: $25,000

- After 1 requalify: $50,000

- After 2 requalify: $100,000

- After 3 requalify: $200,000

This scaling roadmap gives traders a performance-based path to manage institutional-size capital. Instead of buying larger accounts upfront, you grow progressively, which reduces risk while rewarding long-term discipline.

How do drawdown rules work at Hantec Trader?

Daily loss caps reset from the previous day’s equity, while total loss rules are trailing until profit thresholds are met. After your first payout, drawdown buffers lock at the starting balance.

Express Challenge (1-step) Example

- Account size: $100,000

- Daily max loss: $5,000 (5% of prior day’s equity)

- Total loss: Trailing 6% ($94,000) until 6% profit, then locks at $100k

This trailing-to-static system gives traders more room as they prove profitability. Once the profit threshold is reached, the account stabilizes with a static loss buffer.

Enhanced Challenge (2-step) Example

- Account size: $100,000

- Daily max loss: $5,000

- Total loss: 10% static ($90,000)

Enhanced is simpler: the total loss buffer never trails, offering predictable guardrails.

Instant Funding Example

- Account size: $100,000

- Daily max loss: $6,000

- Total loss: Fixed 6% ($94,000)

Instant rules are tighter than most broker-backed competitors like FXIFY, which gives traders slightly more breathing room on funded accounts.

These mechanics promote consistent risk management. Traders who treat their accounts like professional capital—avoiding reckless overleveraging—are rewarded with account stability and scaling opportunities.

How do Hantec Trader payouts and profit splits work?

Hantec starts traders at a 75% profit split, which can be increased to 90% through add-ons. First payout requests are allowed at any time, followed by withdrawals every 14 days or weekly with the payout add-on.

Payout Workflow

- Close all trades – no open positions allowed when requesting a reward.

- Request payout in dashboard – accessible via client portal.

- Processing time: 1–2 business days.

- Buffer locks: when you withdraw, the total loss buffer locks at the account’s starting balance. Leaving cushion funds is critical to keep the account tradable.

Payment Options

Hantec supports one of the widest ranges of payout methods among broker-backed prop firms, including:

- Bank transfers (local and international)

- E-wallets: PayPal, Skrill, Neteller

- Crypto payments: BTC, ETH, USDT

- Mobile Money (popular across Africa)

- PIX (Brazil), SPEI (Mexico), Thai QR for regional support

Example

- Trader starts with $100k account.

- Profits $6,000 → requests $3,000 payout.

- Remaining buffer = $3,000 before hitting static drawdown.

- If trader had withdrawn full $6,000, account would be at immediate risk of breach.

The payout system is designed to balance trader flexibility with risk control. You get access to profits quickly, but must manage withdrawals strategically to maintain trading room.

Comparison with other broker-backed firms

- Hantec Trader: Flexible, first payout anytime, as early as week one. Starts at 75% split, scales to 90%, supports Mobile Money and local African rails (unique in 2025).

- FXIFY: Also broker-backed via FXPIG. First payout on demand, no minimum amount, and bi-weekly thereafter. Profit split also scales to 90%. Offers advanced add-ons like “Performance Protect” that lets traders keep gains even after a breach.

- Fintokei (by Purple Trading Group): Bi-weekly payouts standard, with some traders reporting processing in under 24 hours. Profit split ranges 50–95%, depending on program. Payouts are fast, but crypto is not supported, and availability is skewed toward Europe and Japan.

✅ Why Hantec stands out: Its Africa-first accessibility (Mobile Money, regional transfers) plus the InsightPro AI signals bundled into the dashboard make it more approachable for emerging market traders compared to FXIFY’s institutional dashboard or Fintokei’s Europe/Japan-centric design.

Payout & Profit Split Comparison

| Feature | Hantec Trader | FXIFY | Fintokei |

| Backing | Hantec Markets (Mauritius) | FXPIG broker | Purple Group (brokerage & fintech) |

| First Payout | Anytime after closing trades | On-demand after first funded trade | After first 2 weeks |

| Frequency | Every 14 days (weekly add-on) | Every 2 weeks, on-demand first | Every 14 days |

| Profit Split | 75% → 90% | Up to 90% | 50% → 95% |

| Processing Time | 1–2 business days | Instant for first payout, then 1–2 days | Often <24h |

| Payment Methods | Bank, PayPal, Skrill, Neteller, crypto, Mobile Money | Bank, PayPal, crypto, cards | Bank, PayPal, cards (no crypto) |

| Unique Advantage | Supports Mobile Money, crypto, Africa-first rails | Performance Protect add-on safeguards profits | Free restarts, payout speed under 24h |

Takeaway:

- Hantec: Strongest for Africa and emerging markets with Mobile Money and crypto.

- FXIFY: Best for instant first payouts and protective add-ons.

- Fintokei: Best for EU/Japan traders needing very fast processing and restart flexibility.

What platforms and tools does Hantec Trader provide?

Hantec Trader offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) with raw spreads, low commissions, and fast execution. Expert Advisors (EAs) are supported on Express and Enhanced accounts, but restricted on Instant Funding.

Unique advantage: InsightPro Intelligence

Hantec provides free access to its proprietary InsightPro suite, which is rare in the prop firm space:

- AI-powered trading signals across 50+ assets (forex, indices, metals, crypto)

- Real-time market sentiment with positioning data from live markets

- Verified trade ideas integrated directly into the trader dashboard, email alerts, and Discord community

This toolset gives funded traders institutional-level analytics without extra cost. Broker-backed rivals like FXIFY and Fintokei provide dashboards and metrics, but not bundled AI intelligence of this depth.

How does Hantec Trader compare to broker-backed competitors?

Hantec is often compared with FXIFY and Fintokei, two other broker-backed firms. While all three deliver regulated broker infrastructure, their focus areas differ.

| Feature | Hantec Trader | FXIFY | Fintokei |

| Parent Group | Hantec Group (est. 1990, multi-jurisdiction broker) | FXPIG (regulated broker) | Purple Group (fintech + broker network) |

| Platforms | MT4, MT5 | MT4, MT5, DXTrade, TradingView | MT4, MT5, cTrader |

| Tools | InsightPro AI signals, sentiment, trade ideas | Proprietary dashboard, advanced analytics | Trading education + competitions |

| Funding Options | 1-step, 2-step, Instant | 1-step, 2-step, 3-step, Instant, Lightning | StartTrader (3-step), ProTrader (2-step), SwiftTrader (instant-like) |

| Profit Split | 75% → 90% | Up to 90% | 50% → 95% |

| Scaling | Up to $200,000 | Up to $400,000 | Up to €4,000,000 |

| Payout Style | Anytime → 14d, weekly add-on | First payout on-demand | Standard bi-weekly, fast processing |

| Unique Edge | AI-driven InsightPro + Africa-first payment rails | On-demand payouts + Performance Protect add-on | Huge scaling + free restart offers |

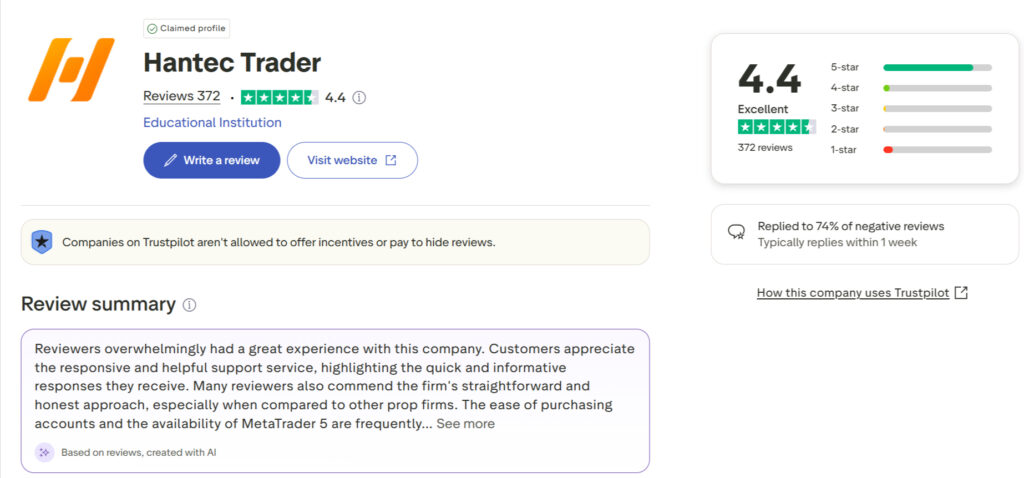

Hantec Trader reviews on Trustpilot (2025)

Traders praise Hantec’s low-cost challenges, prompt payouts, and responsive support. The most common critiques mention buffers locking after withdrawals and tighter rules on some instruments. Overall TrustScore: 4.4/5 from 372 reviews (2025), with the company replying to 74% of negative reviews. (Hantec Trader Trustpilot page, 2025)

What traders like

- Fast payouts and helpful support. Multiple recent reviewers report first withdrawals processed within hours and quick, informative replies from staff.

- Flexible evaluations and no minimum trading days. Express 1-step lets traders pass quickly if they hit the target.

- Built-in tools and access. AI InsightPro signals, sentiment, and trade ideas are included, plus broad payment coverage such as bank, PayPal, crypto, and Mobile Money for many African markets.

What traders dislike

- Buffers after withdrawals. Several reviews complain that, once you take a payout, max loss locks at the starting balance, shrinking risk room unless you leave a cushion. This rule is documented in Hantec’s materials and is common among broker-backed prop firms.

- Tighter leverage on some symbols. Users note stricter margins (for example on gold) versus pure broker accounts. (Reflected in user reviews; specifics vary by instrument.)

- Instant accounts have extra limits. No EAs, no weekend holding, and news-time restrictions on Instant Funding.

If you plan withdrawals wisely and leave a buffer, Hantec’s mix of fast support, AI tools, and broad payout rails can work very well, especially for Africa-based traders.

Why did Hantec Trader win Best Prop Firm in Africa 2025?

Hantec Trader stood out by blending global broker stability with regional access. Its support for Mobile Money, local transfers, and crypto payouts makes it uniquely positioned for African traders, while InsightPro provides AI-powered market tools.

Best Prop Firm in Africa 2025 – Key reasons

- Trusted foundation: Powered by Hantec Markets Mauritius, part of the Hantec Group, which has been active since 1990 and holds multiple global regulatory licenses.

- Flexible programs: Traders choose Express (1-step), Enhanced (2-step), or Instant funding, with scaling plans that double balances up to $200,000.

- Seamless access: Beyond bank and PayPal, Hantec supports crypto payouts and region-specific options like Mobile Money, addressing underserved markets.

- InsightPro advantage: All accounts include free AI signals, real-time sentiment, and verified trade ideas via dashboard, email, and Discord.

Many African traders face payout restrictions with international prop firms. Hantec bridges that gap by offering region-first rails and education while still carrying the credibility of a 30+ year broker group.

Scaling plan

Hantec accounts can scale from small funded accounts to $200,000 through a requalification model. Each profitable cycle and payout doubles the trader’s balance, providing a clear growth roadmap.

Asset coverage

Funded accounts include access to major forex pairs (EUR/USD, GBP/USD, USD/JPY), indices (US30, NAS100, GER40), metals (gold, silver), and cryptos (BTC, ETH, XRP, LTC). This mix allows traders to diversify strategies across asset classes.

Education & support

Hantec offers 24/5 live chat, a Discord community for strategy sharing, and a data-rich dashboard for rule tracking and InsightPro integration. While less extensive than some European competitors’ academies, its regional presence and real-time guidance appeal to new African traders.

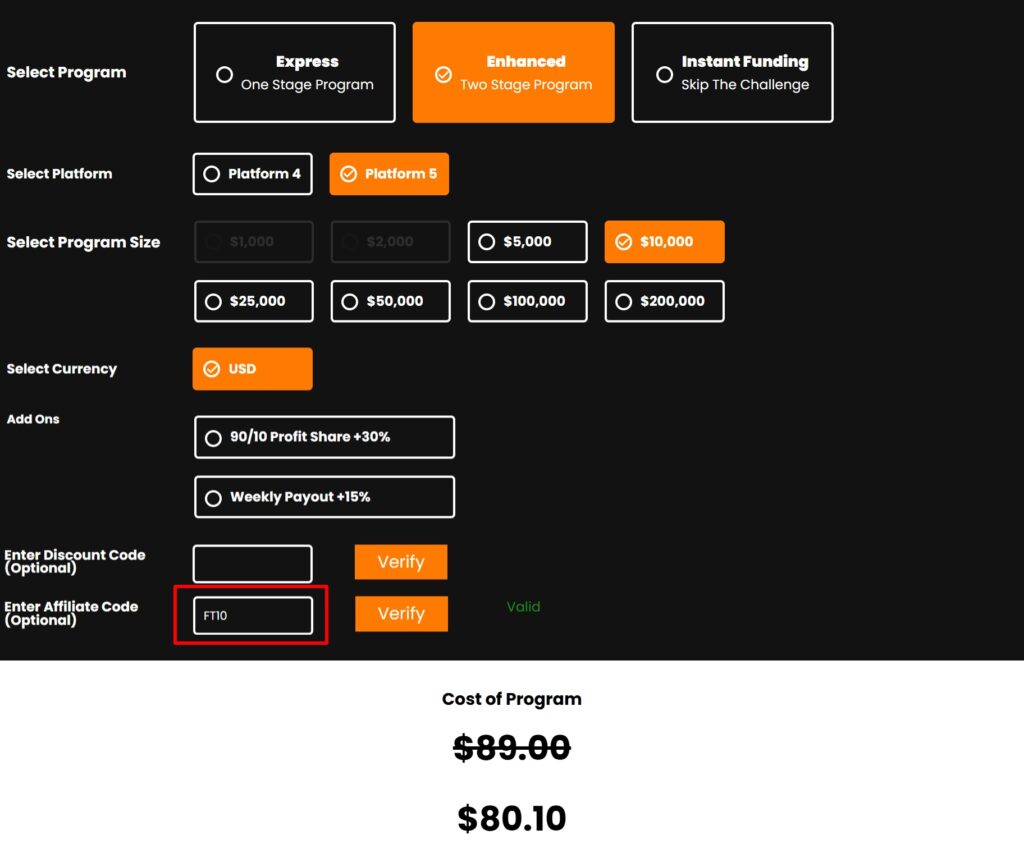

Does Hantec Trader offer a discount code in 2025?

Yes. New traders can save 10% off any challenge fee with the exclusive discount code FT10. The coupon applies to Express, Enhanced, and Instant Funding programs at checkout.

How to use the code

-

Go to the Hantec Trader website.

-

Select your challenge type (Express, Enhanced, or Instant Funding).

-

Enter FT10 at checkout to unlock your 10% discount.

Why use a discount code?

-

Lowers entry cost on challenges (Express from $39 drops to about $35).

-

Works on higher-tier accounts, saving up to $200+ on larger packages.

Note: Always apply them at checkout to confirm your discount.

FAQs

Is Hantec Trader a broker or a prop firm?

Hantec Trader is a prop firm. It runs simulated accounts and pays rewards based on trading performance. The firm is powered by Hantec Markets Mauritius, part of the globally regulated Hantec Group.

What is the maximum funding size?

Traders can scale accounts up to $200,000 through Hantec’s requalification model, which doubles balances after each successful payout cycle.

How much does a Hantec challenge cost?

Entry prices vary by account type: Express from $39, Enhanced from $49, and Instant Funding from $43, with fees scaling by account size.

Does Hantec allow weekend holding?

Yes, traders in Express and Enhanced accounts can hold positions over weekends. Instant accounts must close trades by Friday 23:45 GMT+3.

What makes Hantec the best prop firm in Africa?

Hantec supports Mobile Money, crypto payouts, and bundled AI InsightPro tools, while leveraging broker-level infrastructure. These features helped it win Best Prop Firm in Africa 2025.