Introduction

Proprietary trading firms that employ a 3-Step Evaluation process offer a structured path to funding, testing traders across multiple stages to ensure they can manage risk effectively while meeting profit targets. This methodical approach is beneficial for both the firms and the traders, providing a clear progression path from novice to professional.

These firms cater to those who are serious about their trading career, demanding consistency and discipline through each step of the evaluation. Let’s explore some of the top firms that use this model and what makes each unique in its offerings and requirements.

What is a 3-Step Evaluation?

A 3-step evaluation is a rigorous testing process used by proprietary trading firms to assess a trader’s capabilities across multiple phases before granting them a funded account. This method contrasts with the simpler 1-step evaluation, requiring traders to meet specific targets and adhere to risk management protocols in each phase to progress.

Why Choose a 3-Step Evaluation?

- Offers a comprehensive assessment over multiple trading scenarios.

- Prepares traders for a variety of market conditions.

- Builds discipline through structured progression and clear, incremental goals.

- Increases the potential for larger account funding upon successful completion of all stages.

- Ideal for developing thorough trading skills and strategies over time.

Best Prop Firms With 3-Step Evaluation

1. FXIFY

Overview:

FXIFY operates out of the United Kingdom and was co-founded by Peter Brown and David Bhidey in April 2023. Known for its adoption of mainstream trading platforms MT4 and MT5, the firm partners with FXPIG as its broker. FXIFY caters to a range of traders with account sizes from $15,000 to $400,000. It offers a unique 3-Step Evaluation process, where traders must meet a series of profit targets: 5% in each step, with maximum total drawdowns kept between 5% to 10%. This meticulous evaluation path ensures that only the most disciplined traders manage to progress. FXIFY is also commendable for its provision of over 300 trading instruments, including FX, metals, indices, and stocks, and varied leverage options that cater to different risk profiles.

Location:

United Kingdom

What Can You Trade:

With access to more than 300 trading instruments including FX, metals, indices, and stocks, FXIFY allows traders a wide range of markets to engage with, all through MT4 and MT5 platforms.

Profit Share:

FXIFY offers a 75% profit split to its traders, promoting a strong incentive for achieving the stringent targets set out in its evaluation process.

Highlights:

Rigorous 3-Step Evaluation: Tailored for traders who can consistently meet profit targets while managing a tight control on drawdowns.

Broad Range of Trading Instruments: Enables trading across diverse markets, enhancing trading opportunities.

Customizable Leverage Options: Leverage tailored to asset classes with an option to increase leverage on FX and Gold during checkout.

Attractive Profit Split: A high profit share of 75% rewards successful trading strategies and discipline.

Summary:

FXIFY distinguishes itself in the proprietary trading firm landscape with its specialized 3-Step Evaluation process designed for traders who demonstrate consistent profitability and effective risk management. Its commitment to providing advanced trading platforms and a diverse array of trading instruments aligns with its goal of fostering a supportive environment for trader growth and profitability. Based in the UK and led by experienced founders, FXIFY is set to expand its influence in the global trading community.

Pros:

- Structured Evaluation Pathway: Emphasizes trader consistency and risk management through a detailed 3-Step Evaluation process.

- Extensive Instrument Availability: Offers comprehensive market access, appealing to a variety of trading preferences.

- High Profit Sharing Ratio: Encourages optimal trader performance with a competitive profit split.

- State-of-the-Art Trading Platforms: Access to MT4 and MT5 caters to traders who prefer industry-standard tools.

Cons:

- Complex Evaluation Process: The 3-Step Evaluation might be challenging for new traders.

- Newly Established: As a recent entrant, it may need more time to prove its long-term viability.

FXIFY is poised to become a key player for serious traders, particularly those who excel in rigorous trading conditions. Its structured evaluation process and high profit-sharing ratio offer a potent combination for achieving substantial trading success.

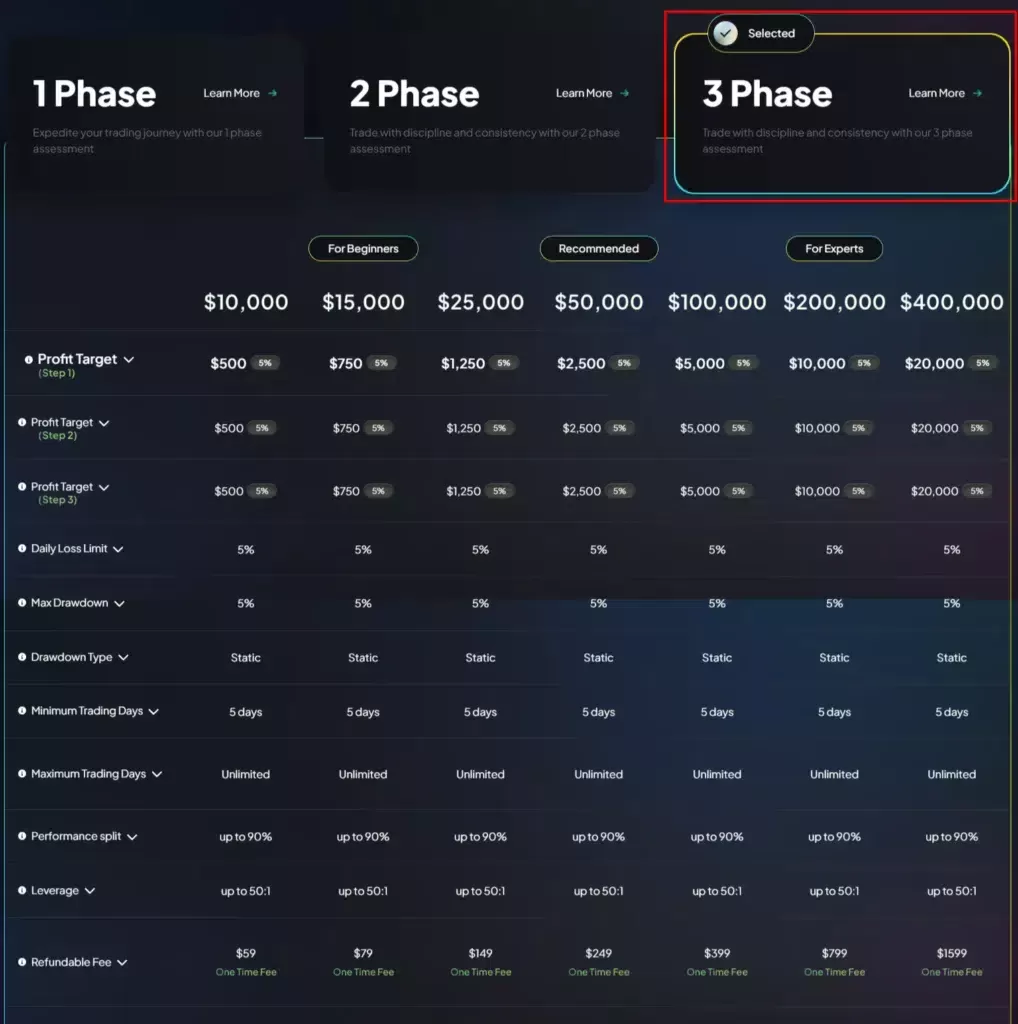

FXIFY 3-Step Evaluation

FXIFY’s 3-step evaluation caters to traders at different levels with flexible account sizes, profit targets, and trading conditions. Account sizes range from $10,000 to $400,000. Profit targets are set consistently at 5% of the account size for each of the three steps. Trading conditions include a daily loss limit of 5%, a maximum drawdown of 5% (static), and a minimum trading period of 5 days, with no maximum trading days. Traders can achieve up to 90% profit split with leverage up to 50:1. The refundable fees vary by account size, starting at $59 for a $10,000 account and going up to $1,599 for a $400,000 account.

2. The 5%ers

Overview:

The 5%ers, led by CEO Saul Lokier, is an established proprietary trading firm based in Israel. Founded in January 2016, the firm operates on the MT5 platform and partners with commercial liquidity providers. It accommodates a wide array of traders with account sizes ranging from $5,000 to $250,000. The 5%ers are known for their flexible evaluation processes, offering 1 Step, 2 Step, and specifically the 3 Step processes which suit a variety of trading strategies. The 3-Step Evaluation process requires traders to achieve a 6% profit target in each phase, with maximum total drawdowns ranging from 5% to 10%. This rigorous evaluation process aims to identify traders who can consistently perform under strict conditions. The firm’s offerings include Forex, Metals, Indices, and more, with different leverage options available across its trading programs.

Location:

Israel

What Can You Trade:

Traders at The 5%ers can trade a diverse range of instruments including Forex, Metals, Indices, Crypto, and Commodities. These options cater to a broad spectrum of trading preferences and strategies.

Profit Share:

The profit share structure is dynamic, with the possibility to reach up to 100% in certain programs, emphasizing the firm’s commitment to rewarding successful traders generously.

Highlights:

- Structured 3-Step Evaluation Process: This methodical approach is designed to rigorously test a trader’s ability to generate consistent profits while effectively managing risk.

- Variety of Trading Instruments: Offers extensive options to trade across several asset classes.

- Diverse Leverage Settings: Leverage varies significantly among the programs, with extremely high leverage available in the High Stakes program, which can go up to 1:100 for Forex.

- High Profit Split: Potential for high profit sharing, enhancing the incentive for traders.

Summary:

The 5%ers distinguish themselves with a robust 3-Step Evaluation process that thoroughly assesses traders’ proficiency. With seven years of operation, the firm has cemented its reputation through a strong focus on trader development and an array of trading instruments. The combination of high leverage options and a tiered evaluation process makes The 5%ers a notable choice for serious traders aiming to maximize their trading potential.

Pros:

- Extensive Experience: Over seven years in the industry provides a stable and reliable platform for traders.

- Highly Structured Evaluation: Ensures only the most skilled traders progress, maintaining high standards of trading performance.

- Competitive Profit Shares: Offers up to 100% profit splits under certain conditions, highly motivating for traders.

- Advanced Trading Platform: Utilizes MT5, catering to advanced trading functionalities.

Cons:

- Stringent Evaluation Criteria: The 3-Step Evaluation process may be daunting for newer or less experienced traders.

- Variable Leverage Risks: High leverage in certain programs could pose significant risks if not managed properly.

The 5%ers continue to thrive by adapting to trader needs and maintaining a focus on rigorous evaluation, making it a prominent player in the global proprietary trading firm arena.

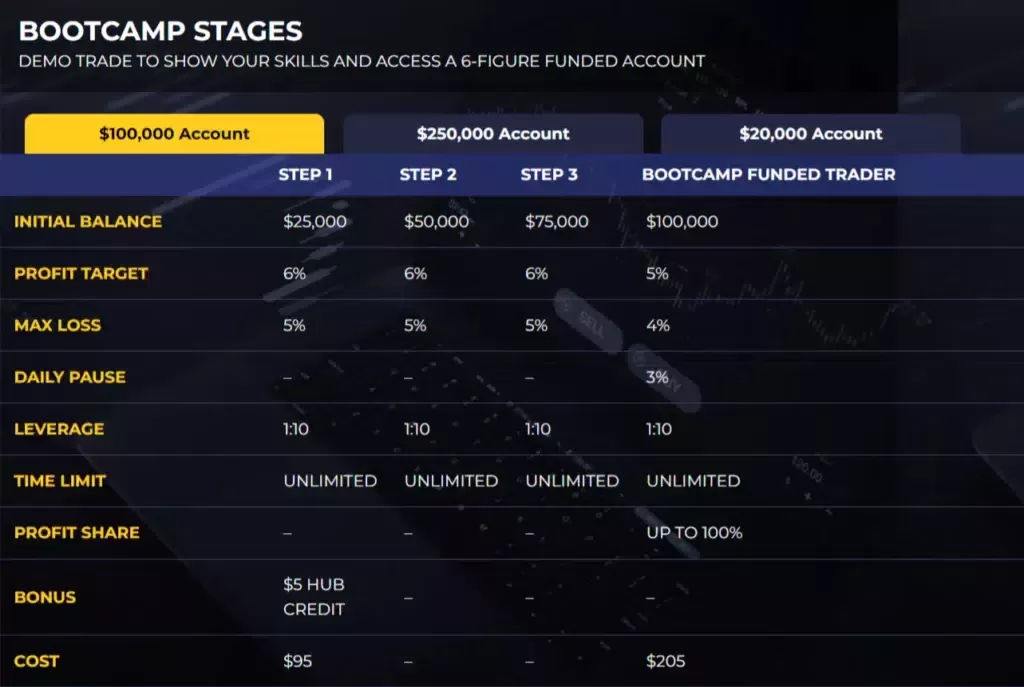

The 5%ers 3-Step Evaluation

The 5%ers $100K 3-Step Account involves demonstrating trading skills through a series of stages to access a six-figure funded account. For the $100K account, the stages include Step 1 with a $25,000 initial balance, Step 2 with a $50,000 initial balance, and Step 3 with a $75,000 initial balance, culminating in the Bootcamp Funded Trader stage with a $100,000 initial balance. Each step requires achieving a 6% profit target, except for the Bootcamp Funded Trader stage, which has a 5% profit target. The maximum loss allowed is 5% for the initial steps and 4% for the final stage, with a daily pause limit of 3% applicable only in the Bootcamp Funded Trader stage. All stages offer a leverage of 1:10 and have no time limit. Profit sharing is available up to 100% for Bootcamp Funded Traders. Additionally, Step 1 includes a $5 HUB credit bonus and costs $95, while the final stage costs $205. The 5%ers also offer 250K and 20K accounts.

3. My Funded FX

Overview:

My Funded FX, under the leadership of CEO Matthew Leech, is a relatively new proprietary trading firm in the United States, established in June 2022. The firm provides trading on the MT4 and MT5 platforms, partnering with reputable brokers such as ThinkMarkets and Blueberry Markets. Offering account sizes from $5,000 to $300,000, My Funded FX is designed to accommodate a diverse group of traders. Their structured evaluation includes a 3-Step process designed to challenge and validate the skills of ambitious traders. Each step in this process has a profit target of 6%, with total maximum drawdown limits set between 6% and 10%. The firm provides access to a wide range of trading instruments, including Forex, Metals, Commodities, and Cryptocurrencies, with various leverage options.

Location:

United States

What Can You Trade:

Traders at My Funded FX have the opportunity to engage with an extensive selection of instruments, including Forex, Metals like Gold and Silver, Commodities such as Oil, various Indices, and major Cryptocurrencies like Bitcoin and Ethereum.

Profit Share:

The profit split at My Funded FX is competitive, offering traders up to an 80% share of the profits, which underscores the firm’s trader-centric approach.

Highlights:

- Robust 3-Step Evaluation Process: Specifically designed to test a trader’s resilience and ability to manage risk effectively across multiple phases.

- Comprehensive Instrument Portfolio: Enables trading across a versatile range of markets, thus accommodating diverse trading styles and preferences.

- High Leverage Options: Offers substantial leverage, up to 1:100 for Forex, tailored to the needs of aggressive trading strategies.

- Supportive Trading Environment: Includes advanced trading platforms and a supportive framework for scaling success.

Summary:

My Funded FX stands out due to its tailored 3-Step Evaluation process, catering to traders who are capable of consistently achieving set profit targets under stringent drawdown constraints. With its range of trading instruments and leverage options, it provides a flexible yet challenging platform for serious traders. Based in the United States and steered by Matthew Leech, My Funded FX aims to carve out a significant presence in the proprietary trading space, offering substantial growth and profit opportunities for its traders.

Pros:

- Dynamic Evaluation System: Offers multiple stages of evaluation, culminating in a 3-Step process that rigorously tests trading acumen.

- Variety of Leverage Options: Tailored leverage settings enhance trading strategies across different asset classes.

- Generous Profit Sharing: Up to 80% profit split incentivizes traders to maximize their trading performance.

- Access to Major Platforms: Integration with MT4 and MT5 ensures a reliable and robust trading experience.

Cons:

- New Market Entrant: As a newer firm, might lack the established track record of its more seasoned counterparts.

- Complex Evaluation for Novices: The 3-Step process may be intimidating for less experienced traders, potentially limiting its appeal to newcomers.

My Funded FX is poised to attract skilled traders through its competitive and structured approach to proprietary trading, emphasizing performance, discipline, and strategic risk management.

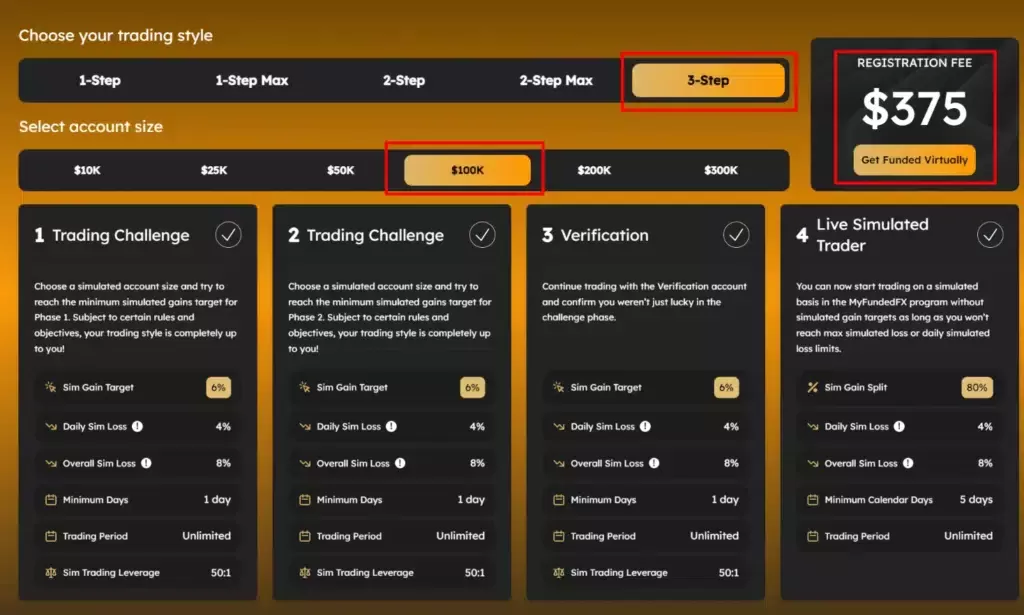

MyFundedFX 3-Step Evaluation

MyFundedFX offers a 3-Step account plan allowing traders to manage accounts up to $300K. Traders choose an account size and aim to reach a simulated gains target, trading all available instruments with their preferred style. The plan includes a profit target of 6% for each step, with an unlimited trading period. The requirements include a minimum of 1 trading day, a simulated maximum initial account balance loss of 8%, and a simulated maximum daily loss of 4%. Simulated profit payouts occur every 5 days. Account sizes range from $10K to $300K. The available trading platforms and brokers are DXTrade using ThinkMarkets, cTrader using Purple Trading, MatchTrade using Match Trader, and MetaTrader 5 using Quality FX Ltd.

4. E8 Markets

Overview:

E8 Markets, founded by CEO Dylan Elchami in November 2021, is a U.S.-based proprietary trading firm. E8 Markets offers a variety of instruments, including forex, commodities, indices, and cryptocurrencies. With brokers like Virtual Markets and access to platforms MT5 and Match-Trader, this firm boasts a strong TrustPilot rating of 4.7. A distinguishing feature is its three-step accounts, which guide traders through a structured progression plan. The firm seeks to redefine the evaluation process by focusing on market innovation and providing traders with a seamless trading experience.

Location:

United States

What Can You Trade:

- Forex

- Commodities

- Indexes

- Cryptocurrencies

Profit Share:

80% + 5% bonus on the first payout

Highlights:

- Three-Step Accounts: E8 Markets offers three-step accounts designed to guide traders through a structured and progressive evaluation, with realistic profit targets for each phase.

- Trading Platforms: Access to platforms MT5 and Match-Trader allows traders to utilize advanced tools and strategies across multiple markets.

- Payouts and Bonuses: Payouts occur every 14 days, and traders can receive a 5% bonus on their first payout.

- Market Technology and Data Analysis: The firm’s emphasis on cutting-edge technology, market data, and AI strategies empowers traders to refine their skills and achieve consistent growth.

Summary:

E8 Markets stands out for its comprehensive evaluation program, focusing on structured three-step accounts that empower traders to grow through realistic goals. The firm’s rebranding reflects a dedication to providing innovative market tools and analysis, ensuring traders are well-prepared. With strong broker partnerships, advanced trading platforms, and a supportive trading environment, E8 Markets offers a compelling option for traders seeking to enhance their skills in a structured manner.

Pros:

- Structured three-step accounts guide traders through realistic challenges.

- Competitive profit sharing and a 5% first-payout bonus.

- Reliable payouts every 14 days.

- Cutting-edge technology and data analysis tools support trading strategies.

Cons:

- High-impact news trading is limited on funded accounts.

E8 3-Step Evaluation

E8 Track offers trading on MetaTrader 5 or Match Trader ranging from $10,000 to $400,000. The 3-step evaluation includes an 8% profit target in Phase 1 with a 4% daily drawdown and 8% overall drawdown, unlimited time, and a minimum of 1 trading day. Phases 2 and 3 require a 4% profit target, maintaining the same drawdown limits and trading conditions. In the Trader Stage, traders adhere to a 4% daily drawdown and 8% overall drawdown, with an 80% profit split and bi-weekly payouts. News trading is prohibited in the Trader Stage, but weekend holding, and expert advisors, are allowed throughout all phases.

5. Lark Funding

Overview:

Lark Funding, under the leadership of CEO Matt L, represents a notable presence in the Canadian prop trading sector. Founded in June 2022, the firm operates on the MT4 and MT5 platforms with support from broker EightCap. It caters to a wide range of traders by offering account sizes from $5,000 to $1 million. Lark Funding stands out with its structured 3-Step Evaluation process, designed to meticulously assess and advance traders through increasingly challenging trading conditions. The profit targets start at 5% for Phase 1 and gradually decrease, with maximum drawdown limits set thoughtfully between 5% to 10% to encourage disciplined trading strategies.

Location:

Canada

What Can You Trade:

Lark Funding provides a diverse trading environment with access to over 40 Forex pairs, more than 100 crypto derivatives, and extensive options in major stocks from US, Australian, LSE, and XETRA markets, along with commodities and indices.

Profit Share:

Traders enjoy a profit split of 80%, which underscores the firm’s commitment to rewarding successful trading practices and risk management.

Highlights:

- Diverse 3-Step Evaluation Process: Allows traders to progressively demonstrate their skills under varying market conditions.

- Extensive Leverage Options: Ranging up to 25:1, providing traders with significant market exposure.

- Broad Array of Trading Instruments: Offers flexibility and comprehensive access to global markets.

- Advanced Trading Platforms: Utilizes both MT4 and MT5 platforms, enhancing trading capabilities with robust technological support.

Summary:

Lark Funding emerges as a progressive prop trading firm with a strong focus on providing traders with extensive tools and opportunities for growth. The 3-Step Evaluation process is particularly notable for its comprehensive structure, preparing traders for different levels of market engagement. Based in Canada, Lark Funding is poised to expand its impact in the global trading scene with its detailed approach to trader development and risk management.

Pros:

- Wide Range of Trading Instruments: Supports a variety of trading preferences and strategies.

- Structured Evaluation Path: Carefully calibrated to foster skill development and risk management.

- Generous Profit Split: Encourages traders by aligning the firm’s success with their financial achievements.

Cons:

- Newly Established: As a newer firm, it may lack the long-standing reputation of older firms.

- Complex Evaluation Stages: The tiered evaluation process may be daunting for less experienced traders.

Lark Funding is ideal for traders seeking a rigorous and supportive trading environment that encourages growth through a structured path and rewards success with a high profit share.

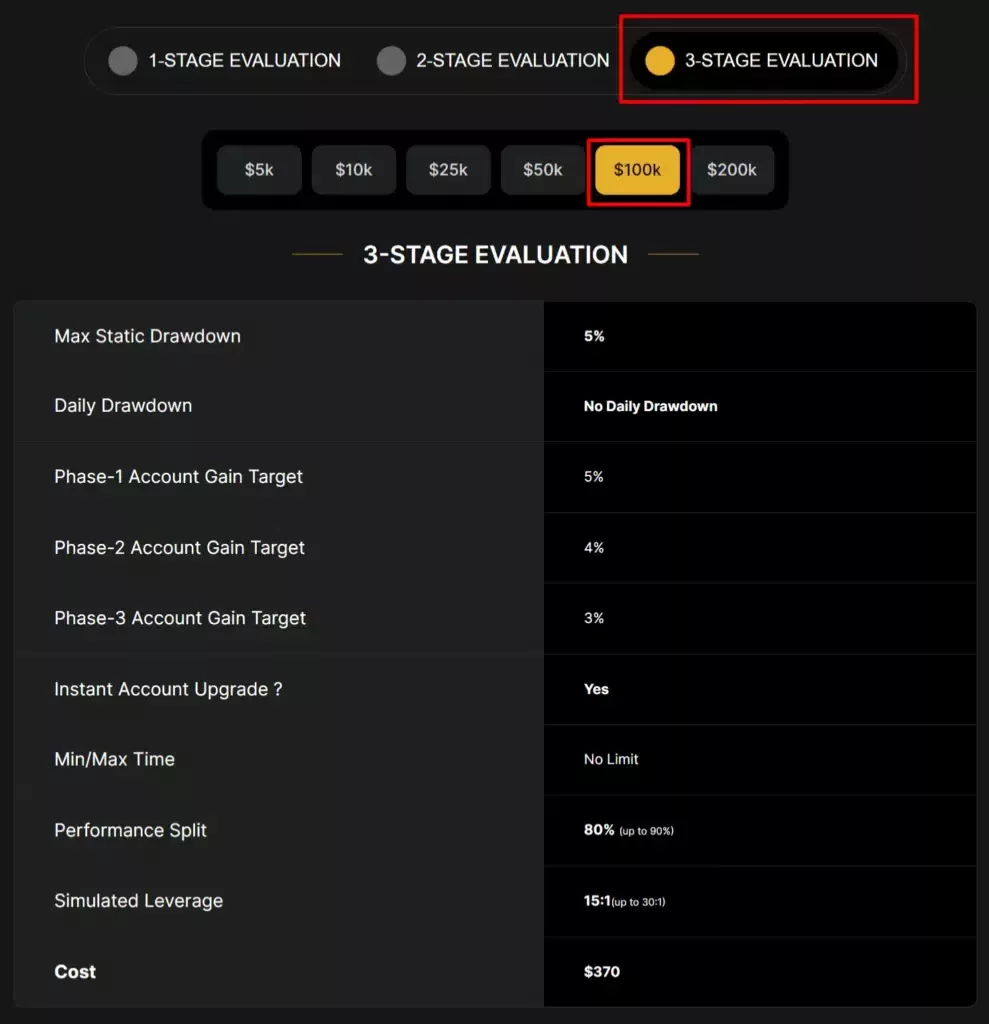

Lark Funding 3-Step Evaluation

Lark Funding’s multi-phase account plan allows traders to progress through set gain targets with specific drawdown limits. Phase 1 requires a 5% gain target with a 5% maximum drawdown, no minimum trading days, and unlimited trading period. Phase 2 has a 4% gain target under the same conditions, while Phase 3 sets a 3% gain target with identical parameters. Upon completing these phases, traders become Virtual Funded Traders with an 80% profit split, potentially increasing to 90%, and profit payouts every 14 days, with subsequent payouts every 7 days. The plan includes instant account upgrades, no daily drawdown limit, and simulated leverage ranging from 15:1 to 30:1.

3-Step Evaluation Prop Firms Comparison

FXIFY

Based in the United Kingdom, FXIFY is a relatively new prop firm offering a structured 3-Step Evaluation process. Founded by Peter Brown and David Bhidey, FXIFY partners with FXPIG and supports trading on MT4 and MT5. They provide accounts from $15,000 to $400,000 and access to over 300 trading instruments, including FX, metals, indices, and stocks.

The 5%ers

The 5%ers, established in 2016 and led by CEO Saul Lokier in Israel, offer a versatile trading setup with 1, 2, and 3-Step Evaluations on the MT5 platform. Known for flexibility in account sizes ranging from $5,000 to $250,000, they cater to forex, metals, indices, and more. Their 3-Step Evaluation demands a 6% profit target per phase.

My Funded FX

Operating from the United States since June 2022 under CEO Matthew Leech, My Funded FX utilizes MT4 and MT5 with support from ThinkMarkets and Blueberry Markets. They offer accounts from $5,000 to $300,000. Their 3-Step Evaluation process targets a 6% profit at each step, with an emphasis on a variety of trading instruments and leverage options.

E8 Markets

E8 Markets was founded by Dylan Elchami in November 2021 and is based in the United States. This firm offers trading on MT5 and Match-Trader platforms, partnering with brokers like Virtual Markets. E8 Markets is noted for its variety of trading instruments such as forex, commodities, indices, and cryptocurrencies. They emphasize a structured 3-Step Evaluation process that guides traders through each phase with realistic profit targets to promote consistent growth.

Lark Funding

Canada’s Lark Funding, led by CEO Matt L and started in June 2022, offers a significant range of account sizes from $5,000 to $1 million. They operate on MT4 and MT5 supported by EightCap, featuring a 3-Step Evaluation process designed to progressively challenge traders. Lark Funding is noted for its comprehensive access to over 40 Forex pairs, more than 100 crypto derivatives, and major global stocks.

In Conclusion

As we examine the landscape of 3-Step Evaluation proprietary trading firms, it’s clear that they offer a rigorous yet rewarding pathway for traders aiming to prove their prowess in the financial markets. This tiered evaluation process is designed to cultivate discipline and ensure that only the most capable traders advance to manage significant trading capital. These firms, such as FXIFY, The 5%ers, My Funded FX, and Crypto Fund Trader, provide a robust platform for serious traders to flourish by facing challenges that mimic the pressures and opportunities of real-world trading.

For traders who thrive under strict conditions and are keen on developing their skills progressively, the 3-Step Evaluation provides a clear roadmap to success. Whether you are drawn to the diverse trading instruments of Crypto Fund Trader, the rigorous process at The 5%ers, the comprehensive market access of My Funded FX, or the strong educational structure of Lark Funding, each firm offers unique benefits to suit various trading styles and goals. The right choice will depend on your personal trading strategy, risk tolerance, and career aspirations in the vast world of proprietary trading.