Introduction

Proprietary trading firms that employ a 3-Step Evaluation process offer a structured path to funding, testing traders across multiple stages to ensure they can manage risk effectively while meeting profit targets. This methodical approach is beneficial for both the firms and the traders, providing a clear progression path from novice to professional.

These firms cater to those who are serious about their trading career, demanding consistency and discipline through each step of the evaluation. Let’s explore some of the top firms that use this model and what makes each unique in its offerings and requirements.

Why Choose a 3-Step Accounts?

- Offers a comprehensive assessment over multiple trading scenarios, enhancing readiness for professional trading environments.

- Prepares traders for a variety of market conditions, ensuring adaptability and resilience.

- Builds discipline through structured progression and clear, incremental goals.

- Increases the potential for larger account funding upon successful completion of all stages.

- Ideal for developing thorough trading skills and strategies over time.

Best Prop Firms With 3-Step Accounts

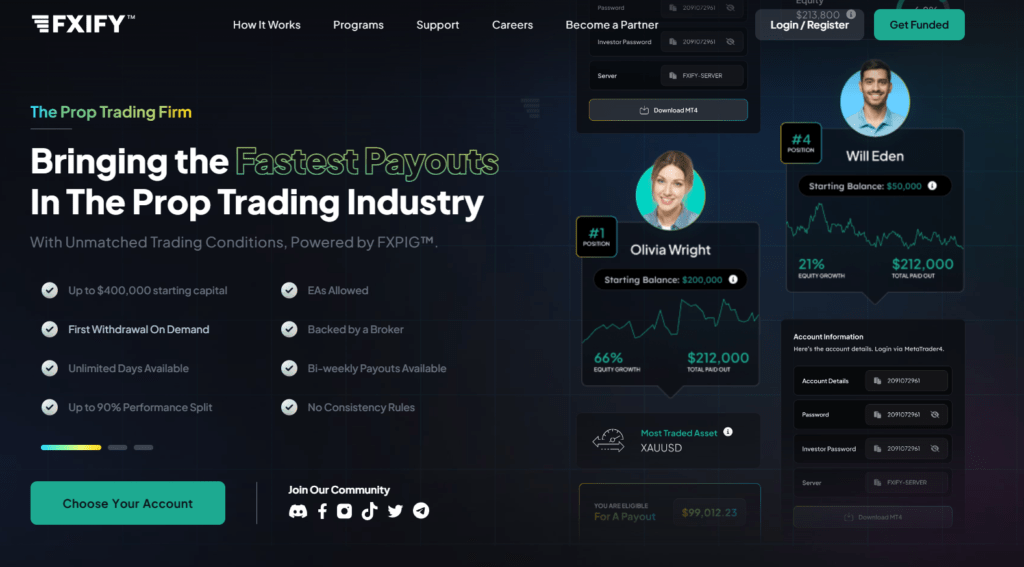

1. FXIFY

Overview:

FXIFY is a proprietary trading firm founded by Peter Brown and David Bhidey in April 2023. Operating from the United Kingdom, FXIFY provides traders with a comprehensive experience through its association with the FXPIG broker. With a focus on MT4 and MT5 platforms, traders have access to over 300 financial instruments, including forex, metals, indices, and stocks. FXIFY emphasizes its unique three-step accounts, allowing traders to progress through challenges that build discipline and strategic thinking.

Location:

United Kingdom

What Can You Trade:

- Forex

- Metals

- Indices

- Stocks

Profit Share:

Up to 90%

Highlights:

- Three-Step Trading Accounts: FXIFY offers three-step accounts that are designed to guide traders through challenges, encouraging progression with realistic targets at each step. This structure aims to help traders build confidence while adhering to strict risk management practices.

- Flexible Trading Conditions: The firm provides flexibility for trading strategies by allowing expert advisors, copy trading, and news trading, ensuring traders can leverage their preferred approach.

- Regular and Transparent Payouts: With payout schedules starting on demand and continuing every 30 days thereafter, traders can rely on steady access to their earnings.

- Comprehensive Instrument Coverage: With over 300 instruments available, traders can diversify across a range of markets, including forex, metals, and stocks.

Summary:

FXIFY, a newcomer in the prop trading industry, distinguishes itself with a focus on three-step accounts that provide structured and progressive challenges. The firm’s transparent payout structure and support for a variety of trading strategies make it appealing to traders of different skill levels. FXIFY’s integration with MT4 and MT5, along with its flexible trading conditions, solidifies its reputation as a forward-thinking trading firm.

Pros:

- Structured three-step accounts provide a clear path for traders to grow.

- Competitive profit split of up to 90%.

- Access to a wide range of trading instruments.

- Supports popular trading platforms MT4 and MT5.

Cons:

- New firm with less than a year of market experience.

- The phased trading approach may not suit all traders’ styles.

2. MyFundedFX

Overview:

MyFundedFX, established by CEO Matthew Leech in June 2022, is a U.S.-based proprietary trading firm. It operates with brokers ThinkMarkets, Purple Trading SC, and MatchTrade, offering access to trading platforms DXTrade, cTrader, and Match-Trader. Notably, MyFundedFX is recognized for its innovative three-step accounts that challenge traders to improve their skills progressively. With a TrustPilot rating of 4.2, the firm caters to various markets, including forex, metals, commodities, indices, and crypto.

Location:

United States

What Can You Trade:

- Forex

- Metals

- Commodities

- Indices

- Cryptocurrencies (BTC, BCH, LTC & ETH)

Profit Share:

Up to 80%

Highlights:

- Three-Step Accounts: MyFundedFX provides three-step accounts that encourage traders to advance through structured phases, each with its own profit targets and risk management guidelines.

- Variety of Platforms and Brokers: Traders can choose from DXTrade, cTrader, and Match-Trader, with exclusive access to Match-Trader for U.S. clients. The firm’s broker partnerships offer traders flexibility in their trading environment.

- Regular Payouts and Fee Reimbursement: Payouts occur every 14 days, with a refund of the challenge fee upon successful completion of the evaluation.

- Scaling Plan: MyFundedFX’s scaling plan allows traders to increase their simulated trading capital by 25% every three months if certain performance criteria are met.

Summary:

MyFundedFX stands out due to its focus on structured three-step accounts and a supportive evaluation program that refunds challenge fees upon passing. The firm offers competitive leverage, reliable payout schedules, and a wide selection of markets. The option to trade across various platforms and brokers makes it ideal for traders seeking a diverse and adaptive environment.

Pros:

- Three-step accounts foster growth and progression.

- Transparent fee structure and profit splits up to 80%.

- Supports trading strategies like copy trading and expert advisors.

- Offers a scaling plan to increase trading capital.

Cons:

- Limited instrument choice compared to some competitors.

- Commission fees apply per round lot on forex trading.

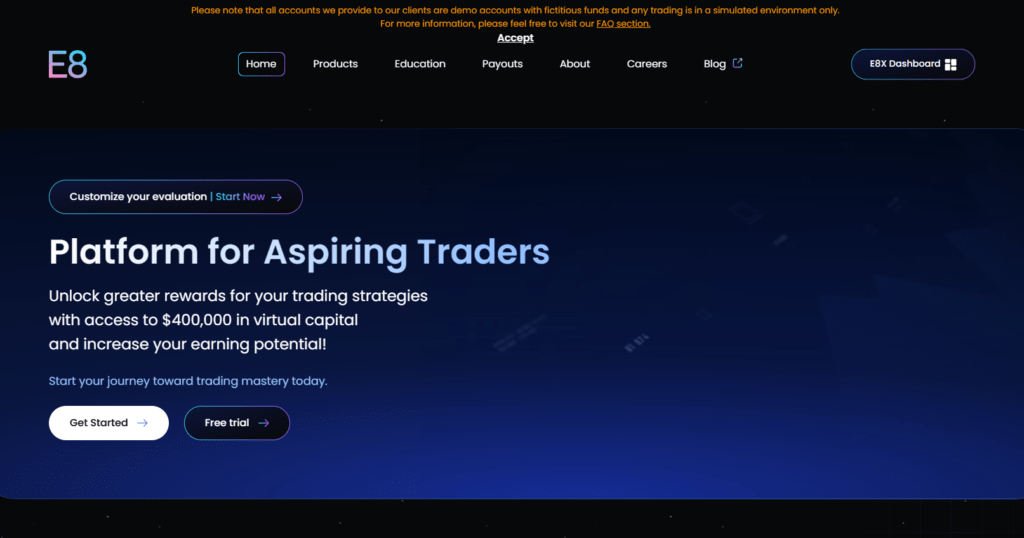

3. E8 Markets

Overview:

E8 Markets, founded by CEO Dylan Elchami in November 2021, is a U.S.-based proprietary trading firm. E8 Markets offers a variety of instruments, including forex, commodities, indices, and cryptocurrencies. With brokers like Virtual Markets and access to platforms MT5 and Match-Trader, this firm boasts a strong TrustPilot rating of 4.7. A distinguishing feature is its three-step accounts, which guide traders through a structured progression plan. The firm seeks to redefine the evaluation process by focusing on market innovation and providing traders with a seamless trading experience.

Location:

United States

What Can You Trade:

- Forex

- Commodities

- Indexes

- Cryptocurrencies

Profit Share:

80% + 5% bonus on the first payout

Highlights:

- Three-Step Accounts: E8 Markets offers three-step accounts designed to guide traders through a structured and progressive evaluation, with realistic profit targets for each phase.

- Trading Platforms: Access to platforms MT5 and Match-Trader allows traders to utilize advanced tools and strategies across multiple markets.

- Payouts and Bonuses: Payouts occur every 14 days, and traders can receive a 5% bonus on their first payout.

- Market Technology and Data Analysis: The firm’s emphasis on cutting-edge technology, market data, and AI strategies empowers traders to refine their skills and achieve consistent growth.

Summary:

E8 Markets stands out for its comprehensive evaluation program, focusing on structured three-step accounts that empower traders to grow through realistic goals. The firm’s rebranding reflects a dedication to providing innovative market tools and analysis, ensuring traders are well-prepared. With strong broker partnerships, advanced trading platforms, and a supportive trading environment, E8 Markets offers a compelling option for traders seeking to enhance their skills in a structured manner.

Pros:

- Structured three-step accounts guide traders through realistic challenges.

- Competitive profit sharing and a 5% first-payout bonus.

- Reliable payouts every 14 days.

- Cutting-edge technology and data analysis tools support trading strategies.

Cons:

- High-impact news trading is limited on funded accounts.

4. The 5%ers

Overview:

Founded by CEO Saul Lokier in January 2016, The 5%ers is an Israeli proprietary trading firm known for offering forex, metals, indices, crypto, and commodities. With a TrustPilot rating of 4.8, The 5%ers provides traders with a variety of funding programs like High Stakes, Hyper Growth, and Bootcamp. Each program offers distinct funding paths to support traders in growing their skills and achieving their trading goals.

Location:

Israel

What Can You Trade:

- Forex

- Metals

- Indices

- Crypto

- Commodities

Profit Share:

- High Stakes: 80%

- Hyper Growth: 75%

- Bootcamp: Up to 100%

Highlights:

- High Stakes: The two-step program includes an 80% profit split, a 5% daily loss limit, and a 10% maximum drawdown.

- Hyper Growth: Offers instant funding with a 75% profit split, a 3% daily loss limit, and a 6% drawdown limit.

- Bootcamp: A three-step progression offering up to 100% profit sharing and tailored challenges.

Summary:

The 5%ers stands out for its structured programs that guide traders through realistic challenges, focusing on skill-building and consistent growth. The programs cater to different trading styles and objectives, providing a range of challenges and progression paths. The firm’s comprehensive approach makes it suitable for traders aiming to improve their strategies in a supportive environment.

Pros:

- Diverse funding programs catering to different trading objectives

- Generous profit sharing, up to 100% in some plans

- Reliable payouts every 14 days

- Offers high leverage, particularly in High Stakes accounts

Cons:

- Stop-loss required in some programs

- News trading restrictions around red news events may limit some strategies

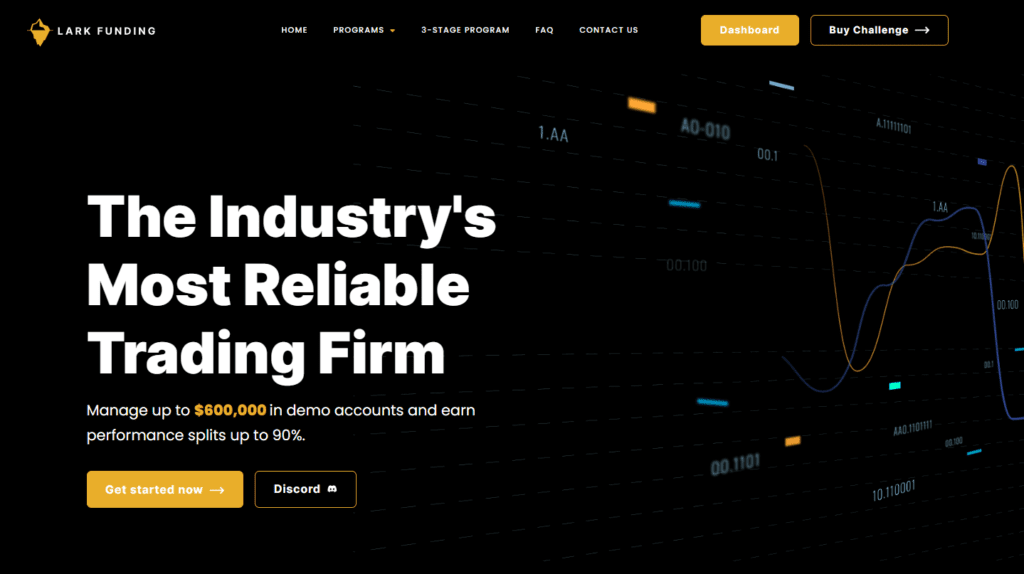

5. Lark Funding

Overview:

Lark Funding, led by CEO Matt L and established in June 2022, is a proprietary trading firm based in Canada. With a TrustPilot rating of 4.6, Lark Funding provides access to a range of instruments, including forex, commodities, indices, stocks, and cryptocurrencies. They partner with the broker ThinkMarkets and provide traders with two trading platforms, DXtrade and cTrader. Their two-step and three-step accounts aim to guide traders through a structured progression plan, enabling them to grow with realistic targets.

Location:

Canada

What Can You Trade:

- Forex: Over 40 major and minor pairs

- Commodities: Gold, silver, and oil

- Indices: Major global stock indices

- Stocks: US, Australian, LSE, and XETRA stocks

- Cryptocurrencies: Over 100 crypto derivatives

Profit Share:

80%

Highlights:

- Two-Stage Evaluation: Designed to offer an 80% profit share, with realistic targets of 8% and 5% across two phases.

- Three-Stage Evaluation: Offers a progression through three steps, with phased targets of 5%, 4%, and 3%.

- Trading Platforms: DXtrade and cTrader provide traders with advanced tools and features.

- Payouts: The first payout occurs after 30 days, followed by payouts every 14 days.

- Leverage: Up to 25:1 is available for two-stage evaluations, while three-stage evaluations provide up to 15:1.

Summary:

Lark Funding is notable for its well-defined evaluation programs that guide traders through realistic challenges and provide access to advanced trading platforms. Their partnerships and structured progression plans ensure traders have the support needed to refine their skills and grow in a sustainable manner.

Pros:

- Flexible evaluation programs with realistic profit targets

- Competitive 80% profit sharing

- Supportive payout frequency and high leverage for forex trading

- Access to advanced trading platforms with robust features

Cons:

- Copy trading is not permitted

- Higher commissions per round lot for forex trading

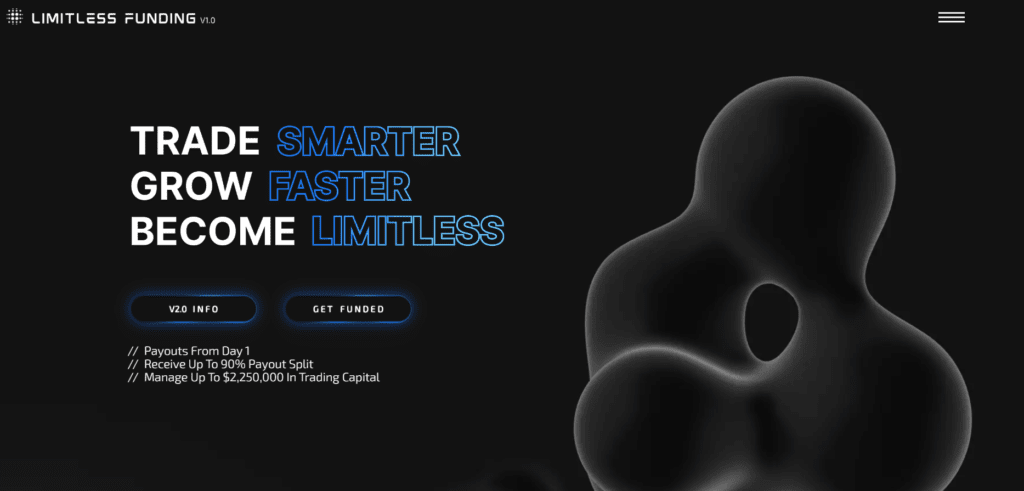

6. Limitless Funding

Overview:

Limitless Funding is a Canadian proprietary trading firm. Established in June 2022, it offers a variety of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. The firm provides access to brokers like ThinkMarkets through platforms DXtrade and cTrader, and holds a TrustPilot rating of 4.6. Its three evaluation programs (1-phase, 2-phase, and 3-phase) allow traders to access different funding amounts by reaching specific growth targets.

Location:

Canada

What Can You Trade:

- Forex

- Commodities

- Indices

- Stocks

- Cryptocurrencies

Profit Share:

- Up to 90%

Highlights:

- 1-Phase Evaluation: Offers quick access to a live account after completing one evaluation.

- 2-Phase Evaluation: Designed for traders with consistency and discipline, providing access to trading capital after reaching specific targets.

- 3-Phase Evaluation: Tailored for novice traders with no daily drawdown, giving affordable access to trading capital.

Summary:

Limitless Funding provides flexible trading programs suitable for different trader levels. With no time limits or minimum trading days, traders can comfortably reach their targets and access funding. The program’s high-profit share, bonuses, and comprehensive evaluations make it an attractive choice for traders looking for varied funding opportunities.

Pros:

- Flexible evaluation programs with no time limits or minimum trading days.

- High-profit sharing of up to 90%.

- Monthly bonuses for consistent traders.

Cons:

- High reset fees apply if trading rules are breached.

- Cryptocurrency is required for payout.

7. RebelsFunding

Overview:

RebelsFunding is a proprietary trading firm led by CEO Marek Soska. With over 15 years of forex experience, the firm offers funding programs that aim to help traders overcome capital limitations. RebelsFunding supports traders with a variety of virtual account sizes, each featuring competitive profit-sharing structures and flexible evaluation phases. Their training programs and risk management strategies empower traders to progress steadily towards profitability.

Location:

Europe

What Can You Trade:

- Forex

- Commodities

- Indices

- Cryptocurrencies

Profit Share:

Up to 90%

Highlights:

- Phased Evaluation: Offers multiple evaluation paths to suit different traders’ needs, including 1-phase, 2-phase, and 3-phase evaluations.

- Comprehensive Risk Management: Daily and overall drawdown limits are in place to help traders maintain disciplined strategies.

- Transparent Payouts: Regular payouts with the ability to withdraw funds on demand.

Summary:

RebelsFunding aims to build a supportive environment where traders can thrive through different evaluation phases tailored to their experience levels. Their phased approach and structured funding plans allow disciplined traders to unlock higher funding. By combining transparent payouts and clear risk management policies, RebelsFunding provides traders with an opportunity to refine their skills and grow their trading capital confidently.

Pros:

- Multiple evaluation phases cater to different trader skill levels.

- Offers high leverage up to 1:200.

- Transparent, flexible payout structure.

Cons:

- Strict drawdown limits require careful adherence to risk management strategies.

3-Step Accounts Prop Firms Comparison

FXIFY

Based in the United Kingdom, FXIFY is a new prop firm founded by Peter Brown and David Bhidey in April 2023. They partner with FXPIG and support trading on MT4 and MT5 platforms. FXIFY offers accounts from $15,000 to $400,000 and provides access to over 300 trading instruments, including forex, metals, indices, and stocks. Their structured 3-Step Evaluation process is designed to help traders progress through challenges, building discipline and strategic thinking.

MyFundedFX

MyFundedFX, established by Matthew Leech in June 2022, operates from the United States. The firm works with brokers like ThinkMarkets, Purple Trading SC, and MatchTrade, providing access to trading platforms such as DXTrade, cTrader, and Match-Trader. Known for its innovative three-step accounts, MyFundedFX offers a variety of markets including forex, metals, commodities, indices, and cryptocurrencies, with accounts ranging from $5,000 to $300,000.

E8 Markets

E8 Markets was founded by Dylan Elchami in November 2021 and is based in the United States. This firm offers trading on MT5 and Match-Trader platforms, partnering with brokers like Virtual Markets. E8 Markets is noted for its variety of trading instruments such as forex, commodities, indices, and cryptocurrencies. They emphasize a structured 3-Step Evaluation process that guides traders through each phase with realistic profit targets to promote consistent growth.

The 5%ers

The 5%ers, led by Saul Lokier since 2016 and based in Israel, offer forex, metals, indices, crypto, and commodities trading on the MT5 platform. They are renowned for their diverse funding programs, including High Stakes, Hyper Growth, and Bootcamp, each providing different progression paths for traders. Their programs feature structured challenges, including a 3-Step Evaluation that caters to various trading styles and objectives.

Lark Funding

Founded in June 2022 by CEO Matt L in Canada, Lark Funding provides traders with access to forex, commodities, indices, stocks, and cryptocurrencies on MT4 and MT5 platforms, supported by the broker ThinkMarkets. With account sizes ranging from $5,000 to $1 million, Lark Funding offers a comprehensive 3-Step Evaluation process to help traders enhance their skills progressively, featuring access to over 40 Forex pairs, more than 100 crypto derivatives, and major global stocks.

Limitless Funding

Limitless Funding established in June 2022 in Canada, partners with brokers like ThinkMarkets and offers trading on platforms such as DXtrade and cTrader. The firm provides various trading instruments including forex, commodities, indices, stocks, and cryptocurrencies. Their evaluation programs, which include 1-phase, 2-phase, and 3-phase options, are designed to meet the needs of traders at different skill levels and provide flexible paths to access funding.

RebelsFunding

RebelsFunding, led by CEO Marek Soska and operating from Europe, supports a variety of trading instruments like forex, commodities, indices, and cryptocurrencies. With over 15 years of forex experience, the firm offers phased evaluation programs tailored to help traders overcome capital limitations and progress towards profitability. Their approach emphasizes risk management and regular, transparent payouts to support trader growth.

In Conclusion

As we explore the offerings of proprietary trading firms with 3-Step accounts, it becomes apparent that these platforms present a structured and beneficial path for traders seeking to demonstrate their trading acumen. These evaluation steps are strategically crafted to foster discipline and ensure that only proficient traders progress to handle substantial capital. Firms like FXIFY, MyFundedFX, E8 Markets, The 5%ers, Lark Funding, Limitless Funding, and RebelsFunding offer a solid foundation for traders to excel by navigating challenges that simulate the dynamics and opportunities of real-world trading environments.

For traders who excel in a structured environment and aim to methodically enhance their skills, the 3-Step Evaluation serves as a definitive guide to success. Whether you are attracted to the extensive instrument variety of E8 Markets, the tailored evaluation pathways of The 5%ers, the adaptive trading conditions of My Funded FX, or the educational support at Lark Funding, each firm provides distinct advantages tailored to different trading preferences and objectives. Selecting the right firm will depend on your individual trading approach, risk management preferences, and long-term professional goals in the competitive world of proprietary trading.