TradingFunds is a reputable prop trading firm that offers traders the essential resources, capital, and technology to succeed in the financial markets while prioritizing simplicity and clear rules.

TradingFunds is a prop firm that has been funding traders since 2022. It offers scalable accounts, bi-weekly payouts, and a straightforward evaluation process. With profit splits of up to 90% and account scaling up to $600,000, it provides traders with a solid opportunity to grow.

Unlike many firms, TradingFunds has no stop-loss requirements, allows news trading, and permits holding trades over the weekend. The evaluation process is simpler than most, with a 6% profit target. It also refunds the registration fee after a trader’s second withdrawal, making it a cost-effective option for those who succeed.

About TradingFunds

TradingFunds was established in 2022 with a mission to create a trader-first funding model. Based in the Netherlands and Dubai, the firm provides traders with capital and a structured pathway to growth. The team behind TradingFunds consists of experienced professionals who understand the challenges of retail and institutional trading.

The firm offers a straightforward approach, allowing traders to focus on their strategies without unnecessary restrictions. With scalable accounts, transparent rules, and a fast payout system, TradingFunds aims to be a reliable option for traders looking to build their careers. Whether you are a beginner or an experienced trader, the firm provides an opportunity to access significant capital without personal risk.

Funding Program Options

TradingFunds now offers three funding models: One-Step, Two-Step, and the newly added Instant Funding. Each path gives traders access to flexible rules, bi-weekly payouts, and scaling up to $600,000.

Instant Funding

The Instant Funding program lets traders start with capital right away—no evaluation required. It has a 5% daily drawdown, 6% trailing max loss, and up to 80% profit split. Traders can hold over weekends, trade during news events, and withdraw profits every two weeks.

One-Step Evaluation

This model offers a direct path to funding with a single evaluation phase. Traders must meet profit targets while adhering to drawdown limits. Once funded, traders receive an 80% profit split with bi-weekly payouts and no restrictions on holding trades overnight or during news events.

Two-Step Evaluation

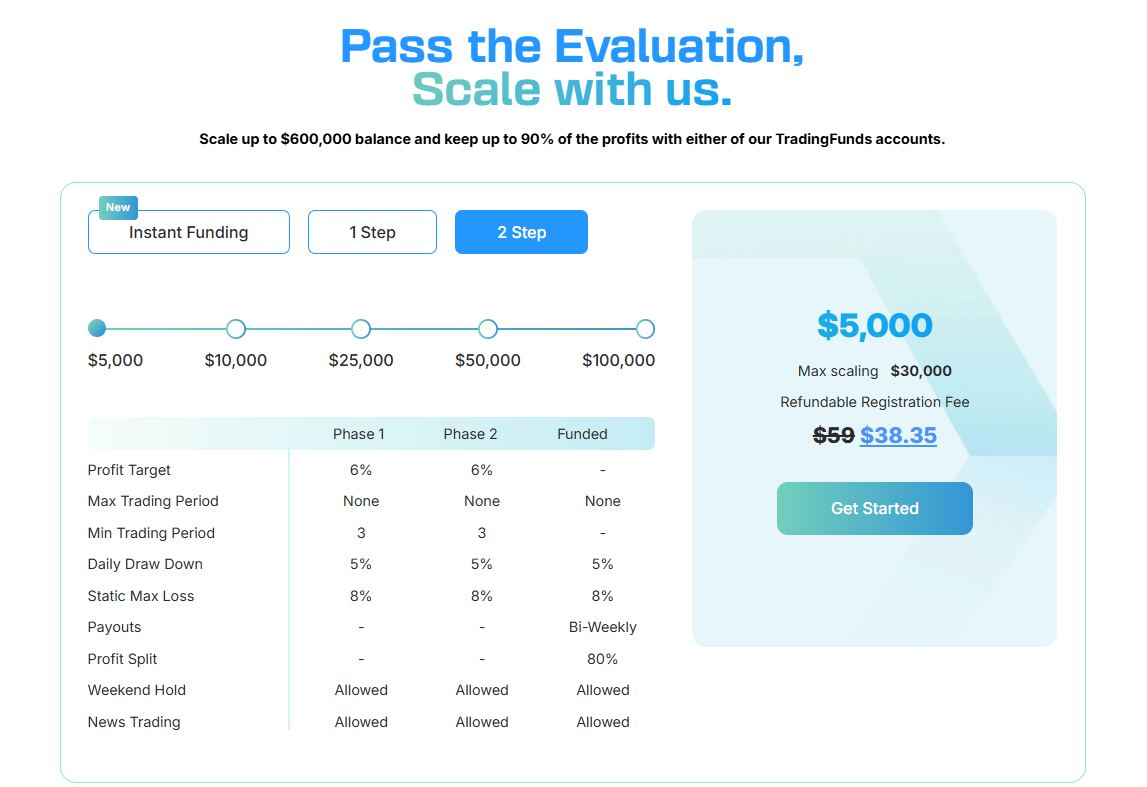

The two-step model requires traders to complete two phases before securing a funded account. Profit targets are lower per phase, making it a gradual process. The funded account offers the same 80% profit split and bi-weekly payouts, allowing traders to scale up as they meet performance targets.

Both funding options come with unlimited trading days, meaning traders can complete the evaluation at their own pace. TradingFunds does not enforce stop-loss requirements or restrictions on trading styles, giving traders the freedom to manage their strategies independently.

Fees

TradingFunds keeps its pricing competitive, making it accessible for traders at all levels. The registration fees range from $41.30 to $342.30, depending on the account size chosen. Since the fee is refundable after the second payout, traders essentially get their investment back once they start earning.

This pricing structure ensures traders can access capital without excessive upfront costs. The affordability makes it easier for new and experienced traders to take on the evaluation without worrying about financial risk.

Tradable Assets

TradingFunds provides access to a broad selection of financial instruments, allowing traders to diversify their strategies. The platform supports trading across Forex, indices, commodities, and cryptocurrencies, catering to various trading styles.

With this range of assets, traders can take advantage of different market conditions and volatility levels. Whether focusing on currency pairs, stock indices, or commodities like gold and oil, TradingFunds ensures flexibility in market opportunities. The ability to trade multiple asset classes enhances the firm’s appeal to traders looking for more than just forex trading.

Restrictions

TradingFunds permits the use of risk management Expert Advisors (EAs) and trading bots, but certain trading strategies are strictly prohibited. These include hedging, martingale, tick scalping, reverse arbitrage, latency arbitrage, hedge arbitrage, and grid trading or high-frequency trading (HFT).

Any trader found using these banned strategies will face immediate account closure and loss of funding eligibility. TradingFunds enforces these rules to ensure a fair trading environment while allowing traders to use approved automated tools to manage their risk effectively.

Challenge

TradingFunds offers two evaluation models: a One-Step Challenge and a Two-Step Challenge. Both challenges allow traders to prove their skills before gaining access to a funded account.

One-Step Challenge

The One-Step Challenge is designed for traders who want a direct path to funding with a single evaluation phase. Traders must achieve a 10% profit target while staying within a 4% daily drawdown limit and an 8% trailing max loss.

Once the challenge is passed, traders receive a funded account with bi-weekly payouts and an 80% profit split. This challenge is ideal for those who prefer a faster evaluation process without multiple stages.

Two-Step Challenge

The Two-Step Challenge provides a structured evaluation with two phases. Traders must reach a 6% profit target in both phases while adhering to a 5% daily drawdown and an 8% static max loss.

After successfully completing both phases, traders gain access to a funded account with bi-weekly payouts and an 80% profit split. This challenge is suitable for those who want a gradual evaluation process with slightly lower profit targets.

Both challenges offer unlimited time for completion, allowing traders to work at their own pace without pressure.

Conclusion

TradingFunds provides traders with a structured and transparent path to funded trading. With One-Step and Two-Step Challenges, traders can choose the evaluation process that fits their style while benefiting from scalable funding up to $600,000 and profit splits of up to 90%.

With no time limits, bi-weekly payouts, and the ability to trade without stop-loss requirements or restrictions on EAs, TradingFunds offers a trader-friendly environment. The firm also provides a full fee refund after the second payout, making it a cost-effective option for those who succeed.

For traders looking for scalable capital, fair trading conditions, and a reliable payout structure, TradingFunds stands out as a strong choice in the proprietary trading industry.

Key Features

- Two challenge options: One-Step and Two-Step

- Profit splits up to 90%

- No time limits for evaluations

- Bi-weekly payouts

- No stop-loss or EA restrictions (except for banned strategies)

- Scalable accounts up to $600,000

Considerations

- Banned strategies include hedging, martingale, arbitrage, and high-frequency trading

- Account inactivity may result in closure

- Trailing and static drawdown rules apply based on challenge type

TradingFunds is a solid option for traders seeking clear funding rules, flexible trading conditions, and the ability to scale capital efficiently.

TradingFunds Discount Code 35%

If you want to join TradingFunds, use our exclusive code for a 10% discount FT35.