Get funded with fair rules, static drawdowns, and profit splits up to 80%. Pick your challenge, reach your goals, and trade Forex, crypto, and commodities with no time limits. Ready to trade your way? Tradexprop makes it happen.

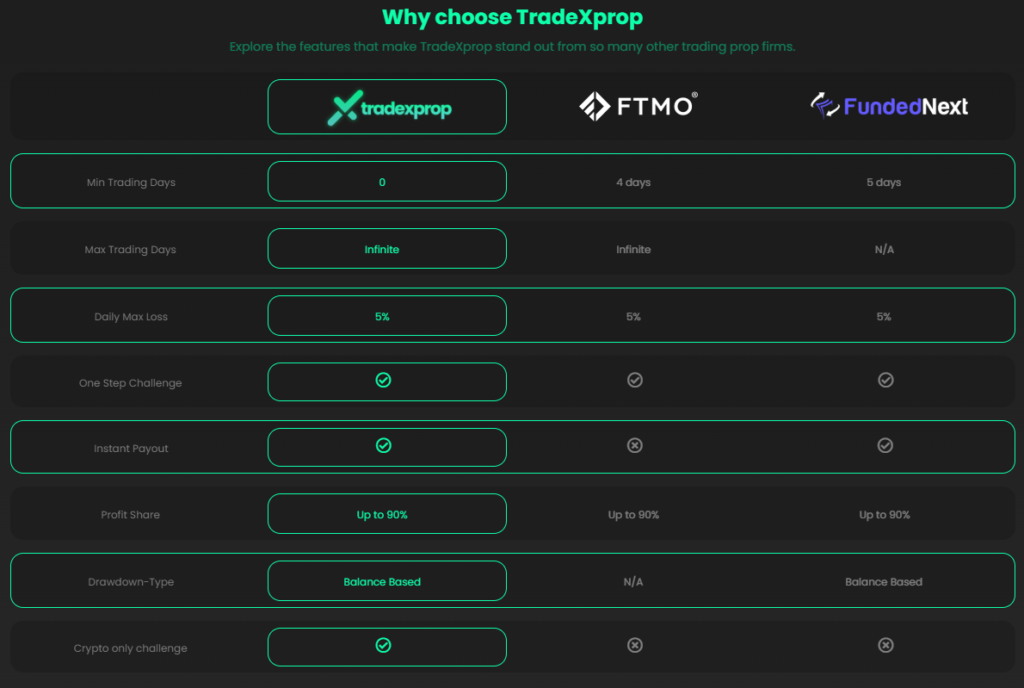

Tradexprop is a proprietary trading firm that offers traders access to funded accounts through straightforward evaluation programs. With features like balance-based drawdowns, it aims to accommodate various trading styles while maintaining a clear set of rules. The firm provides profit splits and timely payouts, making it an option worth considering for traders seeking simplicity and reliability.

About Tradexprop

Based in Kuching, Malaysia, Tradexprop is officially registered as Prop Account, LLC. The firm focuses on creating a fair and transparent trading environment, catering to traders at all experience levels. Its evaluation programs include 1-Step and 2-Step options, designed to meet different preferences and approaches while adhering to ethical practices and effective risk management.

Tradexprop’s policies, such as no minimum or maximum trading days and static-based drawdowns, give traders flexibility in managing their accounts. Although it lacks a scaling plan, the firm supports traders with consistent communication and fast payout processing. This focus on simplicity and efficiency makes it a practical choice for those exploring funded trading opportunities.

Funding Program Options

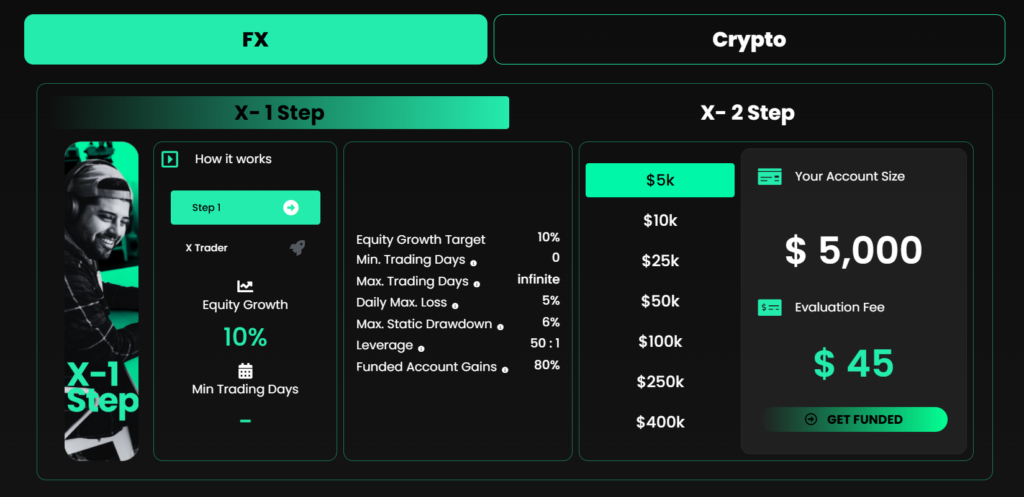

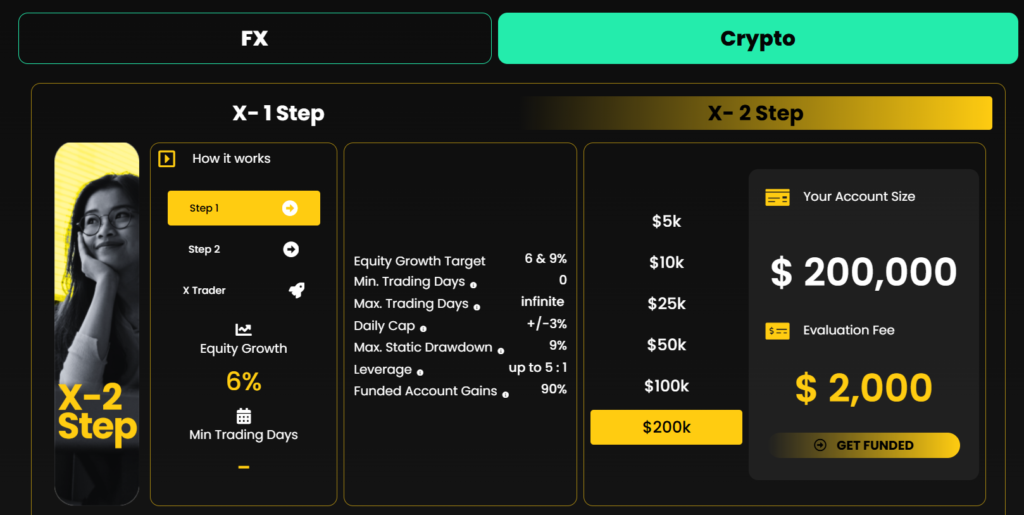

Tradexprop provides two evaluation programs: Forex Evaluation and Crypto Evaluation. Both options include a choice between a 1-Step and 2-Step process, giving traders the flexibility to align their evaluation path with their trading preferences.

Forex Evaluation

The Forex Evaluation is tailored for traders focused on currency markets. The 1-Step process offers a single-phase evaluation for those looking for a quicker way to secure funding. The 2-Step process requires traders to demonstrate short- and long-term consistency across two phases, providing a more thorough assessment. Neither option enforces minimum or maximum trading days, giving traders control over their pace.

Crypto Evaluation

The Crypto Evaluation is designed for traders specializing in cryptocurrencies. Similar to the Forex program, it offers a choice between a 1-Step evaluation, which focuses on achieving targets in a single phase, and a 2-Step evaluation, which requires consistency over time. Both formats come with rules designed for the high volatility and unique demands of crypto trading.

Both programs include static drawdowns and leverage options suited to various trading strategies. The rules are straightforward and designed to support traders in managing risk while navigating their preferred markets. These evaluations aim to provide a structured path to funded accounts, with tools and guidelines tailored to different trading environments.

Fees

Tradexprop’s evaluation programs offer a range of pricing options designed to accommodate different account sizes and trader preferences. Fees vary based on the evaluation type and account size, providing flexibility for traders seeking funded accounts in either Forex or Crypto markets.

For the 1-Step Evaluation, fees start at $45 for a $5,000 account and go up to $3,755 for a $400,000 account. This program’s single-phase structure may appeal to traders who prefer a quicker path to funding, though it comes with a higher cost compared to the 2-Step option.

The 2-Step Evaluation features lower fees, starting at $35 for a $5,000 account and reaching $2,455 for a $400,000 account. This option provides an affordable alternative for those willing to complete a more detailed evaluation process across two phases.

All fees are one-time payments with no hidden costs or ongoing charges, offering a clear and predictable pricing model for traders.

Tradable Assets

Tradexprop gives traders access to a variety of markets, enabling diverse strategies and portfolio management. Both Forex and Crypto evaluations allow flexibility in choosing preferred markets.

In Forex, traders can access a wide range of currency pairs, including major pairs like EUR/USD, minor pairs, and more volatile exotic pairs. This variety supports different trading strategies and risk profiles.

For cryptocurrency traders, options include major digital assets such as Bitcoin and Ethereum, alongside other well-known coins. These offerings cater to traders seeking opportunities in dynamic, high-volatility markets.

Additional tradable assets include indices, commodities, and metals, expanding opportunities for diversification. Tradexprop provides access to popular indices like the S&P 500, commodities like gold and crude oil, and other assets to suit various trading styles.

Restrictions

Tradexprop enforces a set of restrictions aimed at fostering a secure and fair trading environment. These rules are designed to ensure traders operate ethically and compete on equal terms.

Country Restrictions

Participation in Tradexprop’s programs is not permitted for traders from countries listed on the OFAC sanctions list. This restriction aligns with global regulatory compliance and applies to regions with strict trade limitations. Tradexprop may update its eligibility criteria as international regulations evolve.

News Trading Rules

To prevent exploitation of market volatility, Tradexprop prohibits opening positions within three minutes before or after major news events. This rule helps maintain fairness during evaluations, minimizing the impact of unpredictable price swings caused by economic announcements.

Prohibited Trading Strategies

Tradexprop disallows trading strategies that exploit platform mechanics or create an unfair advantage. Prohibited activities include:

- Arbitrage between accounts

- Latency exploitation

- Front-running

- Insider trading

- Manipulating platform errors

- Using unauthorized third-party strategies

Violations may lead to account suspension and the loss of earned profits.

EA Usage and Account Sharing

While the use of Expert Advisors (EAs) is permitted, they must not employ banned strategies or be used to trade on multiple accounts simultaneously. Tradexprop also strictly forbids account sharing, requiring only the registered trader to access and manage their account.

Challenge

Tradexprop’s evaluation programs assess traders’ performance and consistency through two distinct paths: the 1-Step Evaluation and the 2-Step Evaluation. These programs provide structured opportunities to qualify for funded accounts, accommodating a range of trading styles and experience levels.

1-Step Evaluation

The 1-Step Evaluation is a single-phase program where traders must achieve a 10% profit target while adhering to strict risk management rules. These include a 6% overall drawdown and a 5% daily drawdown limit. There are no minimum or maximum trading days, allowing traders to proceed at their own pace.

With static-based drawdowns, the program offers a straightforward and fast route to securing funding. This structure may appeal to traders looking for a simpler challenge with fewer steps to completion.

2-Step Evaluation

The 2-Step Evaluation is a more detailed process that tests both short-term and long-term trading skills. Phase one requires an 8% profit target, while phase two reduces the target to 5%. Traders must maintain discipline under an 8% overall drawdown and a 5% daily drawdown limit.

As with the 1-Step Evaluation, there are no time constraints, allowing traders to manage the process flexibly. This program is suited for those willing to demonstrate consistency over a longer assessment period.

Both evaluation paths apply the same rules to Forex and Crypto accounts, ensuring fairness across different asset classes. Upon successful completion, traders receive a funded account with an 80% profit split, with opportunities for higher payouts as their accounts grow.

Conclusion

Tradexprop positions itself as a prop trading firm offering evaluation programs designed for traders of all experience levels. With Forex and Crypto evaluations, it provides opportunities to showcase trading skills, manage risk effectively, and earn funded accounts. The 1-Step Evaluation offers a streamlined route to funding, while the 2-Step Evaluation tests consistency and performance over a longer period.

Key Features

- Evaluation Options: Offers Forex and Crypto evaluations through 1-Step and 2-Step programs to suit different trader preferences.

- Static Drawdowns: Fixed drawdowns provide clear risk parameters without the complications of trailing limits.

- No Time Limits: Allows traders to progress at their own pace with no restrictions on trading days.

- Diverse Markets: Includes Forex, cryptocurrencies, indices, commodities, and metals, enabling a range of trading strategies.

- Profit Splits: Starts at 80%, with the potential for increases as accounts grow.

Considerations

- Country Restrictions: Traders from OFAC-listed countries are ineligible to participate.

- Restricted Strategies: Practices like latency arbitrage, insider trading, and exploiting platform mechanics are prohibited.

- News Trading Rules: Opening trades within three minutes of major news events is not allowed.

Tradexprop combines structured evaluation programs with a range of tradable assets and transparent risk management rules. Features like static drawdowns and flexible time limits make it accessible, while clear restrictions maintain a fair environment. For traders seeking funded account opportunities with straightforward conditions, Tradexprop offers a balanced approach.