- Instant funding available

- Impressive selection of assets

- Meta Trader 4 and 5

- $3M scaling plan

- Refundable Fees

- 30 day inactivity

- Not a lot of reviews

- Max daily loss 5%

Traders With Edge Review

Traders With Edge is a distinguished prop firm that caters to traders with exceptional abilities who seek additional capital to maximize their trading potential. This firm offers a unique two-tiered approach, providing traders with both an evaluation account and an instant funding account.

Before receiving funding from a prop firm, traders typically undergo an evaluation process to ensure that the firm comprehends their trading skills and risk management abilities. While this evaluation step is common among prop firms, Traders With Edge goes the extra mile by offering not only evaluation accounts but also instant funding accounts. This dual offering caters to a broader range of traders, accommodating those seeking immediate funding as well as those looking for a challenge account to showcase their expertise. Whether you need instant capital or want to prove your trading prowess, Traders With Edge has the right account option to suit your needs.

With that in mind, let’s delve into the review of Traders With Edge and explore the unique opportunities they offer to traders with their evaluation and instant funding accounts.

About Traders With Edge

Traders With Edge is a proprietary trading firm based in the US and Hong Kong that aims to educate and fund traders who want to quit their day job and trade full-time or who are already trading full-time and want to increase their income by trading a more significant account.

The firm’s mission is to fund at least 25,000 traders by 2025, changing the lives of many in the process. They plan on achieving this by providing the education, support, and funding to enable traders worldwide to reach their full potential and live on their terms.

Traders With Edge has a board of directors with a track record of starting and growing successful companies globally. Traders With Edge is backed by large private equity companies that fund their successful traders.

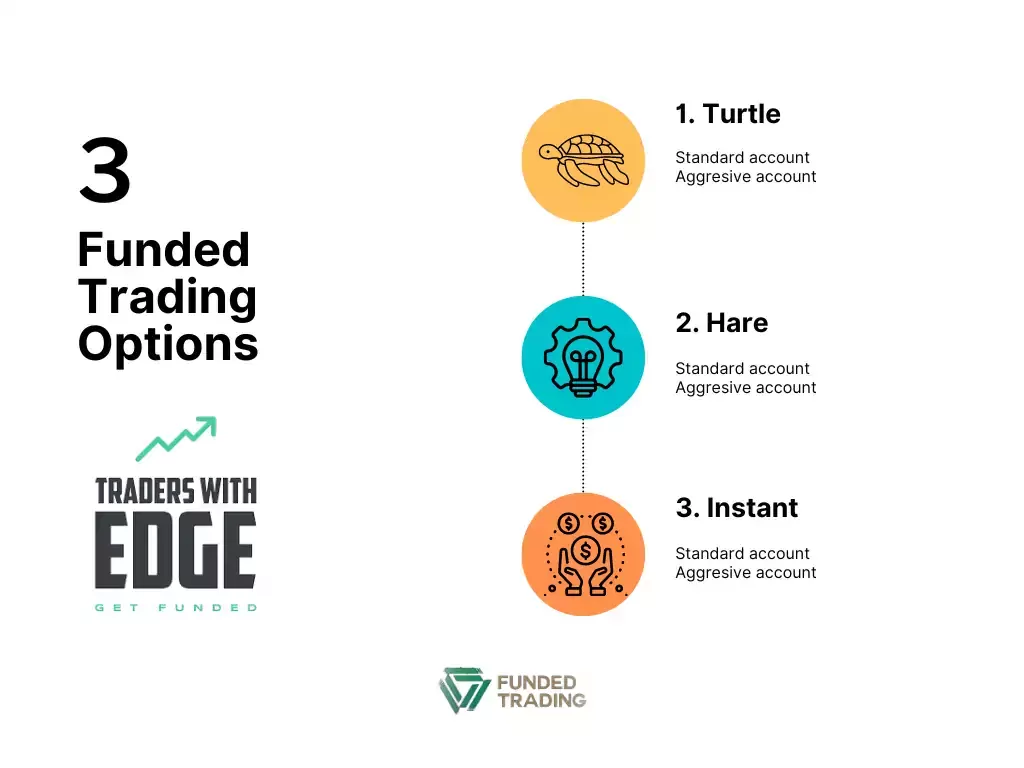

Funding Program Options

There are three account types on Traders With Edge: Turtle, Hare, and Instant. Each account type is further divided into two trading capital types: Standard and Aggressive. The difference between them lies in the percentage of profit targets, maximum loss, and maximum daily loss.

On the Turtle account type, there are eight different starting balances, which are:

- $5,000

- $10,000

- $25,000

- $50,000

- $100,000

- $200,000

- $500,000

- $1,000,000

The Turtle account type only consists of one phase challenge and uses 1:20 leverage.

On the Hare account type, there are five different starting balances, which are:

- $5,000

- $10,000

- $25,000

- $50,000

- $100,000

The Hare account type consists of two phase challenges, where each phase is given 60 days to achieve the profit target. This account type uses 1:50 leverage.

As its name suggests, you can skip the challenge first on the Instant account type. On this account, there is a scaling system where you can develop your balance up to $1,280,000 if you reach specific targets at each level.

There are five types of starting balances on the Instant account type, which are:

- $2,500

- $5,000

- $10,000

- $20,000

This account uses leverage up to 1:20 and a profit share system of 50%.

Fees

Traders With Edge charges a fee to cover operating expenses such as technology, platforms, personnel, customer service, and marketing. These expenses are necessary for the company’s smooth operation and long-term success.

The fee also indicates that the trader is committed to following successful and disciplined trading practices. Here are the details of the fee for each type of account:

Turtle – Standard

- $5,000: $55

- $10,000: $100

- $25,000: $250

- $50,000: $450

- $100,000: $750

- $200,000: $1,500

- $500,000: $3,500

- $1,000,000: $7,500

Turtle- Aggressive

- $5,000: $110

- $10,000: $200

- $25,000: $500

- $50,000: $900

- $100,000: $1,500

- $200,000: $3,000

- $500,000: $7,000

- $1,000,000: $15,000

Hare – Standard

- $5,000: $69

- $10,000: $110

- $25,000: $220

- $50,000: $330

- $100,000: $550

Hare – Aggressive

- $5,000: $138

- $10,000: $220

- $25,000: $440

- $50,000: $660

Instant – Standard

- $2,500: $125

- $5,000: $250

- $10,000: $500

- $20,000: $1,000

Instant – Aggressive

- $2,500: $250

- $5,000: $500

- $10,000: $1,000

There are no hidden fees. The Traders With Edge Challenge fee is the only investment you’ll ever make. There are no recurring monthly or withdrawal fees.

At Traders With Edge, you have the freedom to customize your plan before making a purchase. Take advantage of the following customizations:

- Increase Profit Split to 90.

- Remove Daily Loss Limit.

- Double Leverage (Forex & Metals only).

- Change Trailing Max Loss To Static.

- Remove Required Stop Loss, Max Risk per Trade, Max Total Risk.

- Hold Over Weekend

Furthermore, Traders With Edge offers a wide range of payment methods for your convenience. Whether you prefer bank transfers, credit cards, Payoneer, cryptocurrencies, or Paypal, you have various options to choose from. This flexibility in payment methods ensures that you can start trading with ease and confidence.

Tradable Assets

Traders With Edge is a platform that offers the ability to trade various financial instruments. These assets include foreign exchange (Forex), precious metals such as gold and silver (Metals), physical goods like agricultural products, energy, and industrial metals (Commodities), a basket of stocks representing a specific market or sector (Indices), and shares of ownership in a company (Stocks/Equities).

Restrictions

Traders With Edge has a specific approach to managing risk by conducting all trades on a demo account. This demo account is then connected to a real funded account from which traders are paid. This ensures that trades can be effectively copied to the real account. Traders With Edge does not allow manipulation on any account to maintain this effectiveness.

Manipulation is defined as a wide range of activities, including but not limited to: tick scalping (constantly opening and closing trades in less than 30 seconds), arbitrage, hedging between accounts, delayed or frozen data feeds, unrealistic fills that don’t take into account slippage, allowing others to trade the account, copying others’ trades, and lot size manipulation.

Regarding tick scalping, the firm understands that sometimes trades are closed instantly for one reason or another, so if there are occasional trades that are opened and closed in a short period, your account will not be closed.

Challenge

The Turtle-Standard account has one phase with a profit target of 10% and a daily loss limit of 2.5%. The maximum allowed loss is 5%.

The Turtle-Aggressive account also has one phase with a profit target of 20% and a daily loss limit of 5%. The maximum allowed loss is 10%.

The Hare-Standard account has two phases. In the first phase, the profit target is 10%, and the daily loss limit is 5%. The maximum allowed loss is 1%. In the second phase, the profit target is reduced to 5%, and the daily loss and maximum loss limits remain the same.

The Hare-Aggressive account also has two phases. In the first phase, the profit target is 20%, and the daily loss limit is 10%. The maximum allowed loss is 20%. In the second phase, the profit target is reduced to 10%, and the daily loss and maximum loss limits remain the same.

The Instant-Standard account requires reaching a scaling target of 10% to move to the next level with a larger balance. The maximum static loss for this account is 5%.

The Instant-Aggressive account requires reaching a scaling target of 20% to move to the next level with a larger balance. The maximum static loss for this account is 10%.

In Conclusion

Traders With Edge has a lot of variation in starting balance that you can adjust according to your ability. You can change it according to the fee you are willing to pay. Each account has its advantages and disadvantages, so you must consider them carefully. The rules applied are also quite many, so you must be careful not to make violations that can cause your account to be closed forcibly.

Traders With Edge Discount Code 10%

If you want to join Traders With Edge, use our exclusive code for a 10% discount fundedtrading.com