Traders With Edge Review

Traders With Edge is a proprietary trading firm that supports skilled traders with up to $3 million in capital. It offers both a challenge model and instant funding. Traders can keep up to 80% of profits, with payouts every two weeks.

About Traders With Edge

Traders With Edge operates out of the US and Hong Kong. Its goal is to fund 25,000 traders by 2025. Backed by Symbiosis Capital and other private firms, they help traders become full-time professionals or grow their existing accounts. After two years of consistent trading, eligible traders may access institutional capital of up to $30 million.

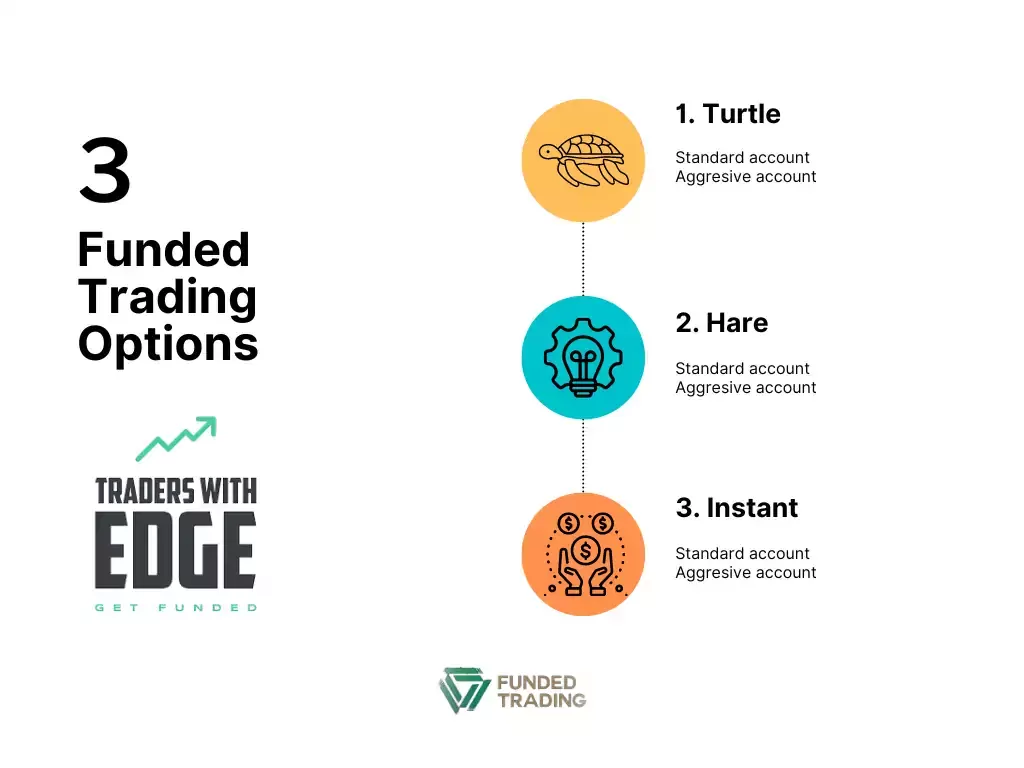

Funding Program Options

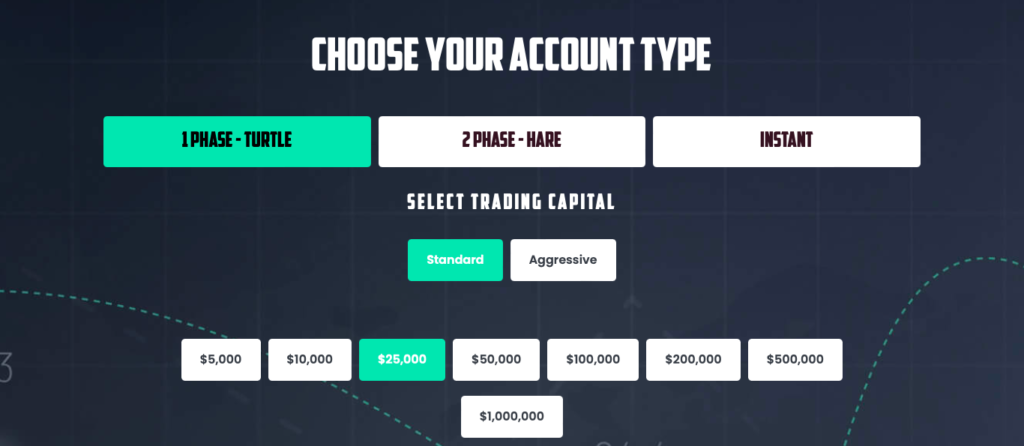

There are three programs: Turtle (1 phase), Hare (2 phase), and Instant Funding.

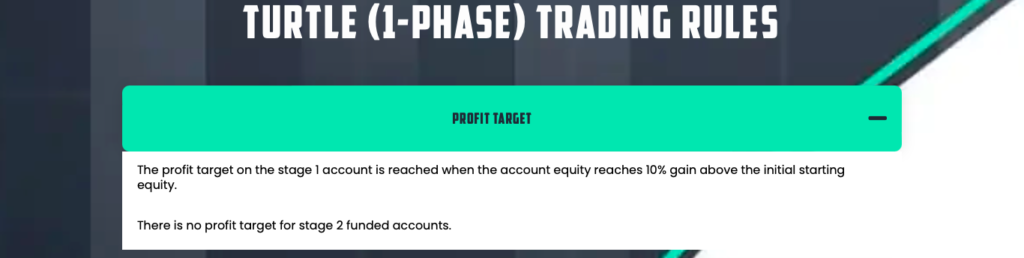

- Turtle: One-phase challenge with 10% profit target, 1:100 leverage, and scaling up to $3 million.

- Hare: Two-phase challenge (10% then 5% targets), 60 days per phase, leverage up to 1:50.

- Instant: No challenge. Profit split starts at 50%, with scaling available to $1.28 million.

Accounts come in both Standard and Aggressive plans, depending on risk and drawdown preferences. You can select balances ranging from $2,500 to $1 million.

Fees

Example entry fees:

- Turtle 1-Phase: $250, currently discounted to $199.

- Instant Standard: $125 to $1,000 depending on balance.

- Instant Aggressive: $250 to $1,000.

Fees cover platforms, customer service, technology, and account management. There are no monthly or withdrawal fees.

You can also customize your challenge:

- Profit split up to 90%

- No daily loss limit

- Double leverage (Forex/Metals)

- Static drawdown

- Weekend holding allowed

- No stop loss rules

Tradable Assets

You can trade across:

- Forex (majors, minors, exotics)

- Global indices

- Metals

- Commodities

- Crypto and other digital assets

Restrictions

All trading is done on demo accounts connected to real funded accounts. Prohibited tactics include arbitrage, tick scalping, copy trading, unrealistic fills, or allowing others to trade your account.

Challenge

- Turtle-Standard: One phase, 10% profit target, 3% daily loss, 6% max loss, 10-day minimum.

- Turtle-Aggressive: Higher risk version, same structure.

- Hare Accounts: Two-phase challenge (Standard: 10% and 5%; Aggressive: 20% and 10%).

- Instant: Hit 10% (Standard) or 20% (Aggressive) to scale. Max loss: 5% (Standard), 10% (Aggressive).

Trustpilot Reviews

Traders With Edge has earned strong praise from traders on Trustpilot, where the firm holds a consistently high rating. Verified users highlight fast support responses, reliable payouts, and fair challenge rules.

Who Founded Traders With Edge?

Traders With Edge was founded by Samuel Junghenn, an experienced entrepreneur and digital strategist. Samuel has spent over two decades building and scaling businesses in finance, digital marketing, and eCommerce. His work has helped companies grow online reach, increase revenue, and build global communities.

He brings that same approach to Traders With Edge combining capital access, transparent trading rules, and tech-driven infrastructure to support serious traders worldwide. Under his leadership, the firm has funded hundreds of traders and built strong partnerships with investment firms like Symbiosis Capital.You can view Samuel’s profile on Crunchbase for more background on his work and ventures.

In Conclusion

Traders With Edge provides a clear path for traders to start small and grow toward multi-million dollar accounts. The firm supports serious traders with flexibility, scaling, and consistent payouts. Make sure to follow the rules and monitor your metrics carefully.

Traders With Edge Discount Code 10%

Use fundedtrading.com at checkout for 10% off your challenge fee.