The 5%ers are based in London and traders can manage account sizes of up to $4,000,000 and signing up for three accounts at the same time

- Scale up to $4M

- Multiple accounts allowed

- News trading and EA allowed

- Overnight and Weekend holding allowed

- Low leverage

- No crypto trading

- Only Forex, gold, and silver trading

- Max stop loss 1.5%

Table of Contents

The 5%ers Review

There are a lot of prop firms to choose from. We only review reputable prop firms with good ratings, because there have been a lot of prop firm scams. But The 5%ers is not one of them. They have been active since 2016.About The 5%ers

The 5%ers are a legally registered UK company established in London. Their headquarters is located at 14 Haroshet st, Raanana, Israel. You can make a lot of money trading in The 5%ers by managing account sizes of up to $4,000,000 and signing up for three accounts simultaneously. What distinguishes them from many other prop firms is that they provide immediate funding account models with low-risk or aggressive risk features. You may pick between quick funding account sizes of $6,000, $10,000, and $20,000, which can be scaled up to $1,280,000.

Funding Program Options

The Low Risk Program is designed for self-disciplined traders; it is an excellent choice for traders who desire a more relaxed challenge. The 5%ers give faster targets for those traders. This program requires your funded forex account to maintain a net profit of roughly 6%, with a maximum loss of 4%, a required stop loss, and the use of low leverage as high as 10:1. The Growth Rate is set to double the account at a net gain of 10%.

The Aggressive Program is designed for traders who like to trade on their own terms. They have removed all rules for freestyle trading. They provide high leverage trading (up to 30:1) and no required stop loss. Given the absolute trading flexibility, the trader must achieve a 12 percent net profit for a level 1 funded account, and a 25 percent net profit for doubling the account for higher levels of the program.

The 5%ers are actively promoting their instant funding program. When we initially looked into them, this funded program was not available. The most recent addition to their program is known as instant funding. The least costly program in The 5%ers costs 235 euros for a total of 6,000 dollars in funding. The largest amount of funding, $20,000, is being offered, and the fee is 745 euros. It is available in two distinct types of models. Low Risk and Aggressive. The low-risk model is the one to choose if you want to play it safe, but if you’d rather have more leeway, the aggressive model is the one to go for. You are not limited in any way in your capacity to trade in the manner that best suits you, and you are also permitted to trade with a high leverage level without being forced to place stop orders.

Fees

For their low-risk $6,000 instant funding account, the fee starts at €235 and is as high as €745 for $20,000. But this low-risk account has smaller leverage of 1:6 with a maximum stop loss of 1.5% and a 50% profit split.

Their high-risk account fee costs the same as low-risk with the same amount of funding. The difference is the high risk has higher leverage of 1:30 and no maximum stop loss requirements, but the same 50% profit split as the low risk.

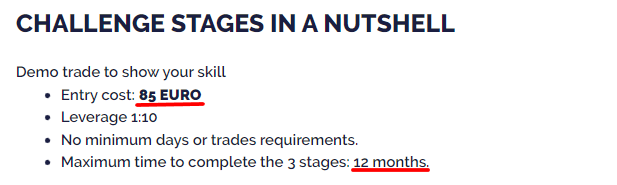

There’s also their newer $100K Bootcamp challenge model, which can scale up to $4,000,000. You pay a portion of the whole fee as an entry fee, and the remainder after you complete your demo stages. The demo stages are merely €85 to enter.

Tradable Assets

All Forex Majors and Crossings, Gold and Silver, and Indices

Restrictions

The rules are flexible at The 5%ers. You can trade on weekends, nights, and during news, and employ expert advisors and indicators.

Challenge

The challenge in The 5%ers is not as hard as that in FTMO. You have up to 180 days to complete the Low-Risk challenge and 60 days to complete the High-Risk challenge.

The 5%ers have a $100K Bootcamp challenge with 3 challenge stages to complete. You may trade with a leverage of 10:1, and no minimum days or trades are required. Your profit target for each of the three stages is 6%, with a maximum loss limit of 5%. The challenge’s demo stages have a maximum completion period of 12 months. This will allow traders to deal with a variety of markets and even alter their trading strategies along the process. In summary, this challenge is good for traders that don’t want to pay the full fee amount because if they fail they will lose all that one-time fee. This challenge only costs €85, but you will be charged the full fee only after you pass. By that time, you will already guarantee to have the funding.

*They had a Freestyle challenge. It is based on the completion of 100 trades. The freestyle program costs €550 and a starting balance of $50,000. Your goal is 100 trades with two objectives: a performance factor of 2 or higher and a winning factor of 30 or higher. You may trade with a leverage of 1:30 for this. Completing the Freestyle assessment successfully earns you a $50,000 funded account.

The Freestyle challenge has been disabled. You can still continue for those already in this program, but they stop offering this to new traders.

In Conclusion

The good thing about The 5%ers is that you can hold trades on the weekend, their huge scaling, and the amount of time given to complete the challenge. Their Bootcamp challenge might interest those that want to try their challenge but don’t want to pay full price just in case they fail and have to lose 100% of the one-time fee. Most traders might not be able to pass these challenges. But if you have skills and are confident, then their different funded trading programs and their huge scaling options might interest you.

Talking about the scaling option, The 5%ers offer profit sharing of “up to”. There is a chance that the high-profit split will entice a lot of traders to participate. Nevertheless, the fact is that to receive their high-profit share of 70 to 80 percent; you will need to secure capital in the amount of at least one million dollars. It may take some time before you reach that amount. Because the maximum loss that may be incurred is just 4%, it will be quite challenging for them to obtain an investment of $4 million. You would need to accomplish a profit objective of 10 percent for the low-risk account and 25 percent for the aggressive account before you could scale. Some people may find it rather high. When it comes to immediate funding, the profit share is often 50/50. The 5% also don’t permit the trading of cryptocurrencies.

If you are looking for instant funding, there are other better options. But it’s not to say that The 5%ers is not a good choice.