Hydra Funding Review

In the world of trading, opportunities abound, but so do the risks. That’s why it’s crucial to know exactly what you’re getting into, especially when it comes to prop trading firms that offer funded accounts.

Enter Hydra Funding, a company with a solid year of operation under its belt. Is it the golden ticket you’ve been searching for? We’re about to find out. In this comprehensive review, we’ll peel back the layers to reveal what you need to know about Hydra Funding. From their funding programs and fees to tradable assets and restrictions, we’ve got you covered. If you’re contemplating whether Hydra Funding is your next move, keep reading. We’re here to give you the information you need to make an informed decision.

About Hydra Funding

So, what sets Hydra Funding apart in the sea of prop trading firms? Firstly, they are committed to creating a level playing field for traders, regardless of their level of experience. Whether you’re a novice or a seasoned trader, they have something for you. They also offer 24/7 live chat support, ensuring that help is always just a click away, no matter what time zone you’re in.

Another thing that sets Hydra Funding apart is their realistic trading environment. They teamed up with ThinkMarkets because they’ve got one of the most realistic trading environments around. They’ve done their homework and tested out a bunch of brokers, and ThinkMarkets came out on top for providing a realistic experience that closely mimics live trading.

The team behind Hydra Funding consists of traders themselves, so they understand your needs and what frustrates you. That’s why they’ve developed a highly customizable platform that caters to your requirements. If you’re a swing trader, you’ll find the 1-phase accounts tailored to your style. For day traders, there are the 2-phase accounts, which offer a more personalized and cost-effective solution. Whether you’re interested in Forex, Cryptocurrency, Stocks or CFDs, Hydra Funding has something specifically designed for you.

One of the brains behind the operation is Cameron Fous. This guy’s been trading professionally since 2005, and he’s not just the co-founder; he’s also a client. Cameron trades on Hydra, goes through the same challenges as the rest of us, and even shares his wisdom on day trading and swing trading in crypto, forex, and stocks. Want to see Hydra Funding in action? Follow Cameron Fous on YouTube for real-time trading insights and a behind-the-scenes look at the platform.

Funding Program Options

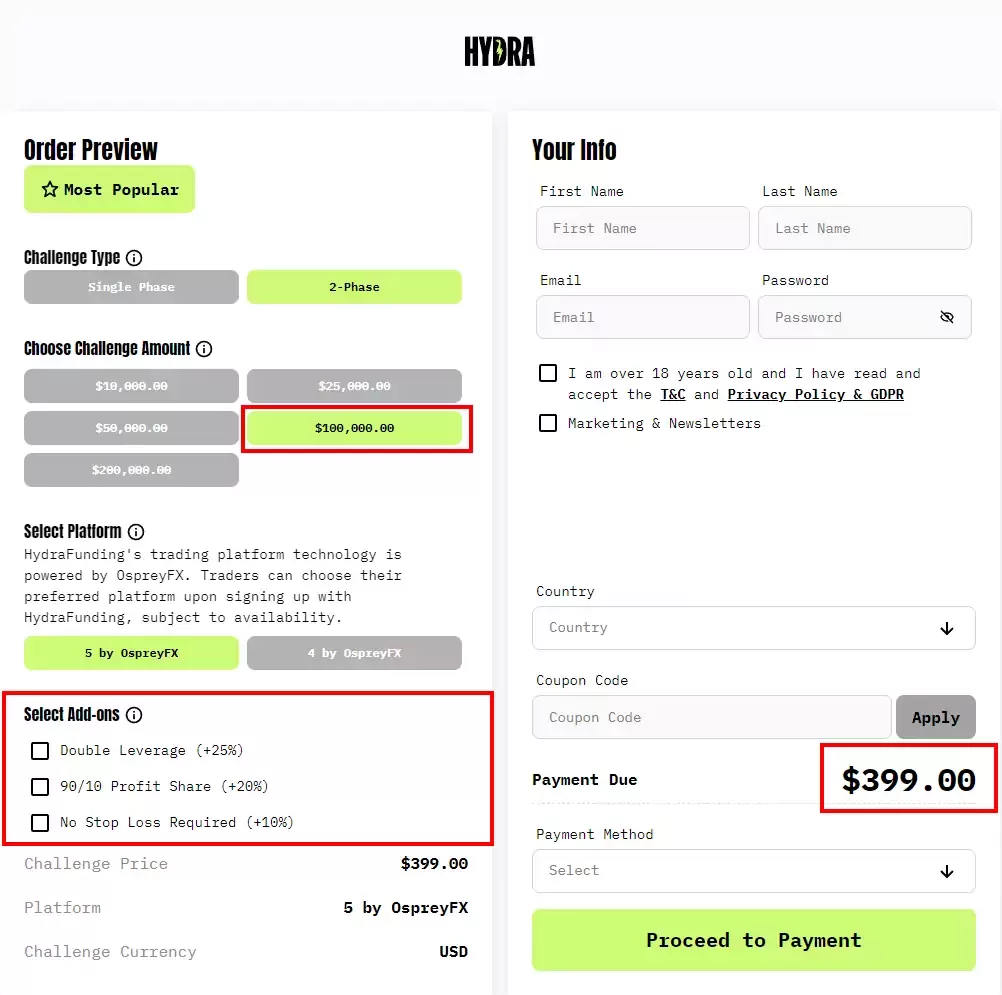

Thinking about getting funded with Hydra Funding? Good choice! They have a variety of funding options for traders of all levels, and their prices are among the best in the industry. Their custom add-ons allow them to offer unbeatable prices. For example, you can start with a $100k account for just $399!

For traders with specific needs, Hydra Funding allows for personalized accounts with options for one or two-phase challenges, up to 100x leverage, and weekend holding.

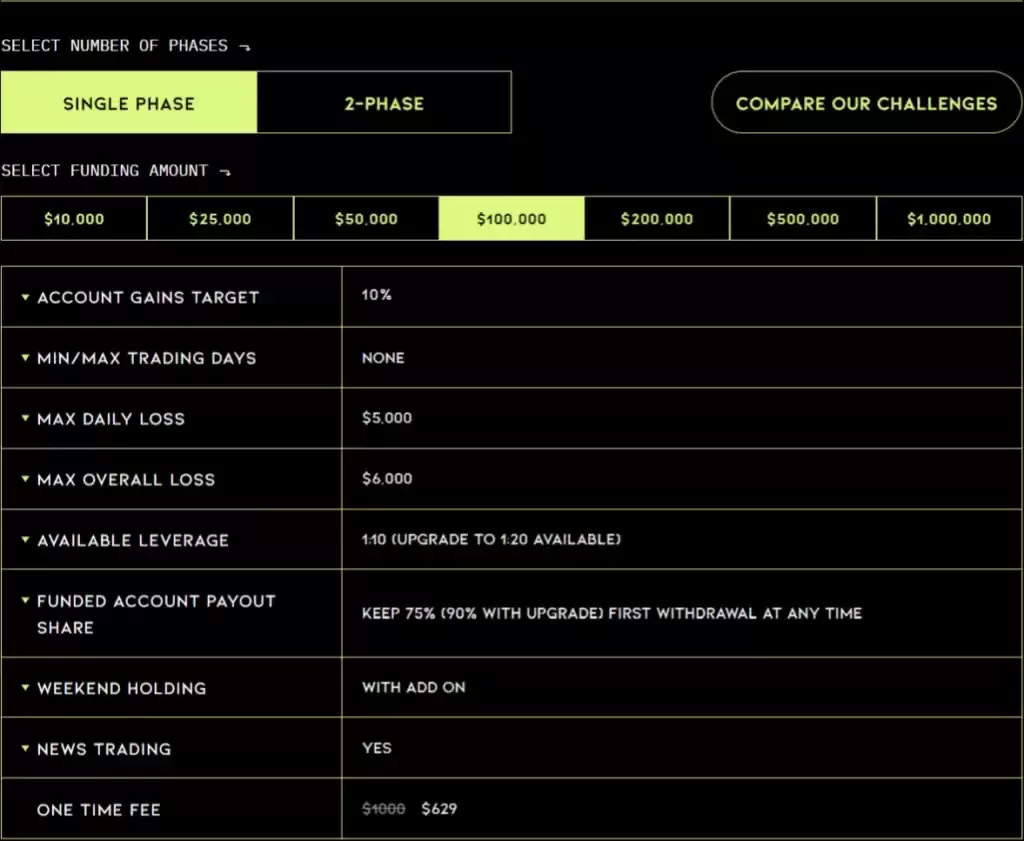

Getting started is easy. First, choose your challenge type – single-phase or two-phase – and decide on the account size you want, up to $1,000,000 USD. Then, make sure you follow their loss rules. For single-phase challenges, the daily loss limit is 5% and the overall loss limit is 6%. For two-phase challenges, it’s 5% daily and 10% overall. Once you reach your profit targets, you’re in! There are no time limits, so take your time.

Start Small, Scale Up

Not ready to invest a lot of money? No problem. You can start with just $97 for a $10,000 funded account. As you gain experience and confidence, you can scale up. And you can access up to $1M in total funding across multiple accounts.

No Time Limit

One of the best things about Hydra Funding is that they don’t rush you. Whether you’re a swing trader who likes to take your time or a day trader who operates on shorter time frames, you’re free to reach your profit targets at your own pace. This flexibility is especially helpful for traders who don’t want to feel pressured by the ticking clock.

Account Sizes and Daily Loss Limits

Hydra Funding offers a range of account sizes, from $10,000 for beginners to a whopping $1,000,000 for professionals. Each account size comes with a daily loss limit of 5% and maximum drawdowns of 6%, ensuring that traders are always aware of their risk parameters. For instance, a $200,000 account has a daily max loss of $10,000 and a maximum drawdown of $12,000. These limits are designed to help you manage your risk effectively while providing enough room for profitable trades.

Fees

When evaluating a prop trading firm, one of the key factors to consider is the fee structure, as it directly impacts your bottom line. In this regard, Hydra Funding stands out for its affordability and flexibility. Their tiered pricing model starts as low as $99 for a $10,000 account, and even a $100,000 account is priced at a competitive $399. To put this in perspective, a similar $100,000 account at FundedNext is priced at $519, FTMO charges $569, and The Funded Trader comes in at $499. Clearly, Hydra Funding offers a cost-effective solution without compromising on features. Just take a look at this table for comparison:

One-Time Fees

To get started with Hydra Funding’s funding programs, there’s a one-time fee.Their 2 phase accounts feature some of the most competitive prices on the market. 2 Phase Challenges start at $99 for a $10,000 account, which is pretty cheap. If you’re interested in larger account sizes, such as $100,000 or $200,000, the one-time fees start from $399 and $699, respectively. Larger account sizes such as $500,000 (priced at $2899) are also available in their Single Phase Challenges. All in all, Hydra Funding has some of the best prices on the market, whether it’s for a Single Phase or 2 Phase Challenge.

Upgrades

Hydra Funding provides optional upgrades during the evaluation phase for an additional fee. These upgrades, such as the ability to hold positions over the weekend, increased leverage, or trading without a stop loss, contribute to the firm’s competitive pricing structure. Importantly, traders only pay for the features they specifically require.

Profit Split

It is worth noting that Hydra Funding provides a profit split that can go up to 90/10. Initially, you’ll receive a 75% profit split, but you can opt for an add-on that gives you a 90% profit split by paying an extra 20%. This is an important factor to keep in mind when calculating your potential net profits.

Withdrawal Process

Hydra Funding allows for easy withdrawals through your Hydra Dashboard, offering the flexibility of making your first payout at any time. While the company doesn’t charge withdrawal fees, it’s advisable to check if there are any third-party fees involved, especially when dealing with international bank transfers.

In summary, Hydra Funding offers a 100% payout success rate, making it a reliable choice for traders who prioritize secure and timely profit withdrawals.

Tradable Assets

One of the key factors to consider when choosing a prop trading firm is the range of tradable assets they offer. A diverse asset portfolio not only provides more opportunities for profit but also allows for effective risk diversification. Beyond the already extensive list of tradable assets, Hydra Funding offers an extensive range of trading instruments from ThinkMarkets, allowing traders to diversify their portfolios across Forex pairs, indices, cryptocurrencies, U.S. and EU stocks, as well as metals and commodities. Here’s what Hydra Funding brings to the table in terms of tradable assets:

Forex Majors

For traders interested in major currency pairs, Hydra Funding offers a selection of seven major pairs, including AUD/USD, EUR/USD, and GBP/USD, among others. These pairs are available in .pro, .var, and .mini account types.

Forex Crosses

Hydra Funding also provides a wide range of cross currency pairs like AUD/CAD, AUD/CHF, and EUR/AUD, available in .pro, .var, and .mini accounts.

Forex Exotics

For those looking for more exotic trading opportunities, the platform offers pairs like CAD/SGD, EUR/CZK, and USD/CNH.

Cryptocurrencies

In the cryptocurrency sector, Hydra Funding offers a variety of digital assets, including Bitcoin, Ethereum, and even lesser-known coins like Shiba Inu and Solana.

Metals

For commodity traders, options include not just gold and silver, but also copper and platinum, available in various account types.

Indices

Indices like the IBEX 35, Euro Stoxx 50, and the Dow Jones 30 are also available for trading.

US and EU Shares

Stock market enthusiasts can trade in shares of major companies like Apple, Amazon, and Boeing in the U.S., as well as Adidas, Allianz, and Bayer in the EU.

Energies

Hydra Funding also offers trading in energy commodities like natural gas, Brent, and crude oil.

Futures

The platform even provides options for trading in futures, although the specific futures available were not listed.

Customization and Trader-First Philosophy

Hydra Funding takes a trader-first approach, offering a high level of customization to meet individual trading needs. This is evident in their collaboration with ThinkMarkets, which provides multiple kinds of assets for many pairs to cater to as many styles of trading as possible.

Account Types

Symbols ending with .pro offer lower spreads but higher commissions. Symbols ending with .var have higher spreads but lower commissions. Symbols ending with .mini offer mini lots, allowing traders to trade with just 1,000 units of a currency instead of the standard 100,000 units.

Commissions

The commission structure is also designed with flexibility in mind. For trading in foreign exchange (FX) and metals, they charge a commission of $7 per lot round trip. For all other trading assets, they offer the benefit of $0 commissions, simplifying the trading experience and maximizing potential returns.

Leverage

When it comes to leverage, Hydra Funding offers a range of options tailored to different types of accounts and trading strategies.

Single-Phase Accounts:

- Forex, Metals, Oils, and Indices: 1:10 leverage

- Cryptocurrencies: 1:2 leverage

- CFD/Stocks: 1:5 leverage

Two-Phase Accounts:

- Forex, Metals, Oils, and Indices: 1:50 leverage

- Cryptocurrencies: 1:2 leverage

- CFD/Stocks: 1:5 leverage

For traders looking for even more flexibility, Hydra Funding provides a “Double Leverage” option at checkout, applicable only to Forex, Metals, Oils, and Indices. Cryptocurrencies and Stocks are excluded. This allows an upgrade to 1:100 leverage. This feature is particularly useful for more aggressive traders who are comfortable with higher risk and reward scenarios.

Restrictions

While Hydra Funding offers many opportunities for traders, it’s essential to understand the restrictions and rules in place. These limitations are designed to manage risk but can also impact your trading strategy. Here’s what you need to know:

Drawdown Rule

One of the key restrictions at Hydra Funding, setting it apart from many other firms, is the Maximum Trailing Drawdown rule based on your balance. It begins at 6% and tracks your account until you earn a 6% return. After that, it locks at your starting balance. For example, if you start with a $100,000 account, you can draw down to $94,000 before violating the rule. This rule is important for risk management, so make sure you get it.

Daily Loss Rule

Hydra Funding also imposes a Daily Stop Loss, calculated from the previous day’s balance. The maximum daily loss is 5%, and it’s essential to note that this compounds with account growth. For instance, if your account balance was $100,000 the previous day, your daily limit remains at $95,000, even if your equity is higher.

Inactivity Rule

Don’t ghost your account. If you’re not trading at least once every 30 days, you’ll lose the account. This one’s crucial for those who might not be trading daily.

Account Breach Conditions

There are only three ways to breach and lose an account with Hydra Funding: violating the Drawdown Rule, breaching the Daily Loss Rule, or inactivity for 30 days. So make sure you are aware of these conditions to avoid losing your funded account.

Required Stop Loss

Unless you’ve opted for the “No Stop Loss Required” upgrade, you’ve got to set a stop loss when you open a trade. If you don’t, the trade auto-closes, but you won’t get penalized.

Running Risk Rule (Max Lot Size Rule)

Check your Trader Dashboard for the Running Risk Rule. If you go over the max lot size, your position gets auto-closed. Keep an eye on this one; it’s key for managing your trades effectively.

Expert Advisors

Hydra Funding allows Expert Advisors (EAs), Scripts, Indicators, and personal copy trading. However, you don’t copy someone else’s trades during your evaluation.

Weekend Holding

Unless you opt for the “Hold Over the Weekend” upgrade, all weekend trades must be closed by 3:45 p.m. EST on Friday. Any open trades get auto-closed, but it’s not a violation.

News Trading

For those of you eyeing the news for trading opportunities, news trading is permitted for traders with one-phase accounts at Hydra Funding. However, those with two-phase accounts cannot engage in news trading or hold positions over news events. And remember, trading around major news can introduce significant volatility, so it’s wise to be prepared for some extra market movement during these times.

Challenge

When it comes to getting funded, the first hurdle you’ll encounter with Hydra Funding is their trading evaluation, commonly referred to as the “Challenge.”

One-Phase Evaluation

The one-phase evaluation at Hydra Funding is pretty straightforward. You’re looking at a +10% profit target without any time pressure. Starting off, you get a 1:10 leverage, but if you’re feeling a bit more adventurous, you can bump that up to 1:20. You can also trade the news and even hold over the weekend if you opt for the add-on. This simple one-phase model allows traders to focus solely on their trading performance without the added pressure of progressing through 2 stages.

Two-Phase Evaluation

Hydra Funding offers a two-phase challenge account that provides traders with a longer evaluation period. You’ve got a 6% profit target in Phase 1 and a 9% target in Phase 2. The standard leverage here is 1:50, but if you want to go big, there’s an option to upgrade to 1:100. Just keep in mind, that weekend holding and news trading aren’t allowed for this one.

Even with the no-weekend-holding and no-news-trading rules, the two-phase evaluation is a pretty good deal, especially for the price. And the option to ramp up your leverage? That’s a nice touch for those looking to be a bit more aggressive. As for the profit split, traders keep 75% of the profits, which can be increased to 90%. Traders can make their first withdrawal at any time.

No Time Limit

One of the standout features of Hydra Funding is that they don’t impose any time limits on their trading challenges, offering flexibility for traders. Whether you’re a day trader or a swing trader, you can take as much time as you need to hit your profit target. This flexibility is a boon for traders who prefer not to be rushed and want to trade at their own pace.

Risk Management Rules

While the evaluation is straightforward, it’s not without its rules. Traders must adhere to a maximum loss of 5% per day and an overall maximum loss of 6%. These risk management rules are in place to assess your ability to manage risk effectively, a critical skill for any successful trader.

What Happens After You Pass?

After you complete the evaluation successfully by achieving the +10% profit target without violating any loss rules, you become eligible for funding. Once funded, you get access to Hydra Funding’s capital through ThinkMarkets trading account. Essentially, you will be using their capital for trading. The funded account will be created within 24-48 business hours, and you will receive account details and software links through email.

The funded account size will mirror that of your challenge account. For example, if you initiate a challenge with a $100,000 account, your funded account will also be set at $100,000. It’s important to note that these are demo accounts with virtual funds, but they offer trading conditions that are as close to live conditions as possible, thanks to Hydra Funding’s partnership with ThinkMarkets. The trading environment is designed to have very little discrepancy from actual market conditions, providing a highly realistic trading experience. This simulation even outperforms raw spreads in mimicking live trading conditions.

Profit Split in Funded Accounts

After passing the challenge, you enter into a profit-sharing agreement where you get to keep up to 90% of the profits you make. The remaining 10% goes to Hydra Funding.

Broker

In the world of prop trading, the choice of broker is crucial to your trading experience. Hydra Funding has partnered with ThinkMarkets, a reputable brokerage firm that provides the trading platform for all Hydra accounts.

ThinkMarkets is an ideal choice for both seasoned and beginner traders, offering a regulated environment for Forex and other trades. The company is headquartered in London and Melbourne, established in 2010, and operates under the regulation of trusted authorities like the FCA, CySEC, ASIC, and FSA Japan. Here’s what you need to know about trading with ThinkMarkets:

Platform Availability

Once you have completed your payment for a Hydra Funding account, you will gain access to the ThinkMarkets trading platform. This process typically takes 15-30 minutes. The platform is accessible via the Hydra Funding dashboard or a direct download link.

Geographic Availability

ThinkMarkets has a global presence, serving clients in over 180 countries. While it is widely available, there may be some geographical limitations. However, Hydra Funding has provisions for traders to use their platform even if ThinkMarkets is not accessible in their location.

Trading Conditions

ThinkMarkets offers trading conditions that are well-aligned with Hydra Funding’s program. This includes various leverage options across different assets and proactive management of factors like slippage.

Commissions

ThinkMarkets has a clear commission structure. For trading in FX and metals, the commission is $7 per lot round trip. For all other assets, ThinkMarkets offers the benefit of $0 commissions.

Conclusion

In conclusion, Hydra Funding distinguishes itself as a prop trading firm that’s truly “by traders, for traders.” This ethos is evident throughout their program offerings, which are designed with a deep understanding of what traders actually need and want—because the people behind Hydra Funding are traders themselves. This insider perspective allows them to offer a platform that is not only competitively priced compared to other prop firms but also highly customizable to suit individual trading styles and strategies.

Their range of funded accounts, flexible evaluation phases, and generous profit-sharing models make prop trading accessible to traders at all levels. While they do have risk management rules in place, such as daily loss limits and drawdown rules, these are designed to help you trade responsibly rather than restrict your strategy.

Moreover, their 24/7 live chat support, truly lives up to its promise of round-the-clock availability and quick response times, and you have a firm that’s committed to supporting its traders at all hours.

The Hydra community further enriches the trading experience, offering a supportive environment where traders can learn from each other and trade alongside seasoned professionals.

In summary, if you’re in the market for a prop trading firm that understands traders because they are traders, Hydra Funding is worth serious consideration. Their competitive pricing, realistic trading conditions, and trader-first philosophy make them a compelling choice for those looking to take their trading career to the next level.

Hydra Funding Discount Code

If you want to join Hydra Funding, use our exclusive discount code FUNDEDTRADING for a huge 20% discount!