Explore Express Funded’s unique trading challenges, educational resources, and secure trading environment with Purple Trading partnership.

Express Funded Review

As a new player in the dynamic field of proprietary trading, Express Funded has quickly captured the spotlight within Africa’s expanding financial market. This review aims to dissect the unique attributes of Express Funded, examining its potential to reshape the prop trading scene. With its roots in Africa’s most vibrant economies, Express Funded is not just another entrant in the industry but a firm that promises a world-class trading experience that goes beyond borders.

This review looks at what Express Funded offers, delving into its funding programs, fees, tradable assets, and more, to give you a comprehensive understanding of their services.

About Express Funded

Express Funded stands out in the prop trading landscape with its roots in Ghana and South Africa, bringing a blend of local expertise and global reach to the trading world. The firm caters to a diverse range of traders, from beginners taking their first steps in the financial markets to seasoned professionals seeking more challenging trading environments.

“Accelerate your financial goals with Express Funded” is not just their slogan, but their mission. The firm offers a range of funding options designed to suit various trading styles and risk tolerances, highlighted by their 1 and 2 Phase Challenges.

Express Funded’s collaboration with Purple Trading, a reputable and well-regulated broker, ensures that you trade on a secure and reliable platform. This partnership reflects their commitment to offering a safe trading environment in compliance with financial regulations.

In addition to funding programs, Express Funded places a strong emphasis on education and support. Collaborations with FX GOAT FOREX TRADING ACADEMY and KOJO FOREX ACADEMY provide traders with valuable educational resources, enhancing their trading skills and knowledge.

Funding Program Options

Express Funded offers a range of funding program options designed to cater to different trading styles and preferences. These programs are structured to provide traders with the flexibility and opportunity to showcase their trading skills under varying conditions. Below, we explore the key features of the 1 Phase and 2 Phase Accounts, as well as the evaluation process and challenges involved.

1 Phase Account

The 1 Phase Account by Express Funded is tailored for traders who prefer a more straightforward path to funding. This single-phase program is designed for efficiency, allowing traders to demonstrate their skills without the need for multiple evaluation stages. Key features of the 1 Phase Account include:

- Multiple Account Sizes: Traders can choose from account sizes ranging from $5,000 to $200,000.

- Refund Policy: The fees for the challenge are refundable after the second withdrawal from a funded account.

- Diverse Tradable Markets: This account provides access to a variety of markets, including Forex, Commodities, Crypto, and Indices.

- Profit Split: Traders can enjoy up to a 90% profit split, which is among the higher tiers in the industry.

- Leverage Options: The account offers leverage of 1:100.

- Scaling Plan: Consistent performance can lead to eligibility for scaling the account up to $5 million.

- Weekend Holding: The ability to hold positions over the weekend.

- News Trading Allowed: Traders have the freedom to trade around market-moving news events.

- No Stop Loss Requirement: This unique feature allows traders to operate without the constraint of mandatory stop loss.

2 Phase Account

For those seeking a more comprehensive evaluation process, the 2 Phase Account presents a two-step challenge. The 2 Phase Account shares many of the same benefits as the 1 Phase Account, with a few key differences primarily in the structure of the evaluation process:

- Structured Evaluation: The two-phase structure provides a comprehensive assessment of a trader’s skills and strategies over different market conditions.

- Progressive Challenge: This account is ideal for traders who prefer a more gradual progression and a thorough evaluation of their trading capabilities.

The rest of the benefits, including multiple account sizes, refund policy, diverse tradable markets, profit split, leverage options, scaling plan, weekend holding, news trading allowance, and no mandatory stop loss, are consistent with the 1 Phase Account.

Evaluation Process and Challenges

The evaluation process at Express Funded is designed to be rigorous yet fair, ensuring that only skilled traders are provided with funding. Key aspects of the evaluation include:

- Risk Management: Traders must adhere to strict risk management rules, including loss limits and drawdown restrictions.

- Trading Days Requirement: A minimum number of trading days is required to ensure traders are tested across different market scenarios.

- Performance Review: Traders’ performance is continuously monitored, with evaluations based on their ability to meet profit targets while adhering to the set rules.

The structure of these programs ensures that traders are focused not only on their ability to generate profits but also on their risk management and consistency.

Fees

The firm offers distinct fee structures for their 1 Phase and 2 Phase Accounts, tailored to the specific challenges and capital options of each program.

1 Phase Account Fees

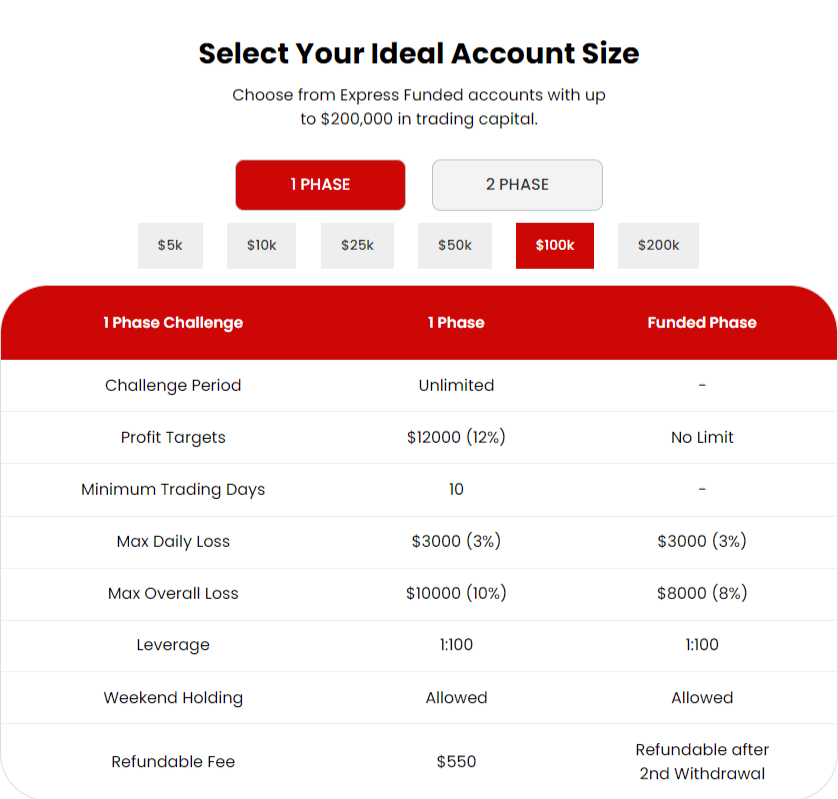

The 1 Phase Account at Express Funded features a tiered fee structure, varying based on the chosen capital size. Here’s the detailed fee breakdown:

- $5,000 Capital: Fee – $60

- $10,000 Capital: Fee – $110

- $25,000 Capital: Fee – $180

- $50,000 Capital: Fee – $350

- $100,000 Capital: Fee – $550

- $200,000 Capital: Fee – $1,100

These fees are a one-time charge for the evaluation phase. Notably, the fees are refundable after the second withdrawal from a funded account.

2 Phase Account Fees

The 2 Phase Account, with its extended evaluation process, also adopts a tiered fee structure, reflecting the different account sizes:

- $5,000 Capital: Fee – $70

- $10,000 Capital: Fee – $120

- $25,000 Capital: Fee – $200

- $50,000 Capital: Fee – $390

- $100,000 Capital: Fee – $600

- $200,000 Capital: Fee – $1,200

Similar to the 1 Phase Account, these fees are payable for the evaluation stages and are refundable after the trader’s second withdrawal from a funded account.

Tradable Assets

Express Funded offers a diverse range of tradable assets, catering to various trading styles and preferences. This variety ensures that traders have ample opportunities to engage with different markets and asset classes.

Forex

Forex trading is a cornerstone of Express Funded’s offerings. Traders have access to a wide range of currency pairs, encompassing major, minor, and exotic pairs. This diversity allows traders to capitalize on the volatility and liquidity inherent in the forex market.

Commodities

Commodities trading with Express Funded includes popular options like gold, silver, oil, and other natural resources. This asset class is known for its stability and is often used as a hedge against inflation or currency fluctuations.

Crypto

The rapidly evolving world of cryptocurrencies is also accessible through Express Funded. Traders can engage with popular cryptocurrencies, tapping into the dynamic and potentially lucrative crypto market.

Indices

For those interested in broader market movements, trading indices is an excellent option. Express Funded provides access to various global indices, enabling traders to speculate on the performance of entire sectors or economies.

Restrictions

Understanding the restrictions in place is crucial for traders to align their strategies accordingly. Express Funded has set specific guidelines to ensure fair and responsible trading.

Trading During News Events

Express Funded allows trading during news events. This policy enables traders to take advantage of the significant volatility and price movements that news events can cause in the financial markets.

Overnight and Weekend Trading

Traders with Express Funded are permitted to hold positions overnight and over the weekend. This flexibility is particularly beneficial for those who employ longer-term trading strategies or wish to capitalize on market gaps that might occur at the opening of the trading week.

Swap Free

Express Funded offers swap-free accounts, catering to traders who wish to avoid swaps or rollover interests on overnight positions. This feature is especially relevant for traders who follow Islamic finance principles, which prohibit earning interest on trades.

Challenge

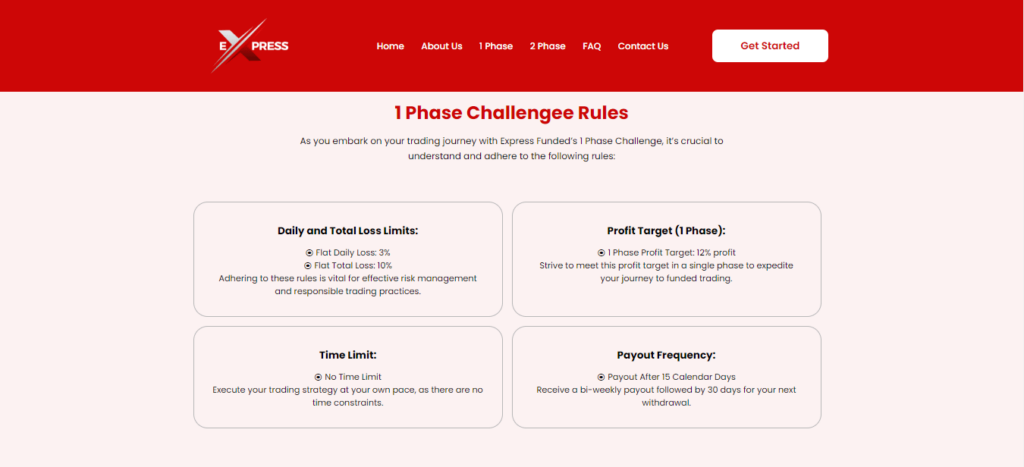

1 Phase Challenge

The 1 Phase Challenge at Express Funded is tailored for traders who prefer a direct and efficient path to funding. Here are the key rules:

- Challenge Period: Unlimited.

- Profit Targets: 12% in the challenge phase, with no limit once funded.

- Minimum Trading Days: 10 days.

- Max Daily Loss: 3%.

- Max Overall Loss: 10%.

- Leverage: 1:100.

- Weekend Holding: Allowed.

This challenge is ideal for traders confident in their ability to hit a significant profit target in a relatively short period, emphasizing both skill and risk management.

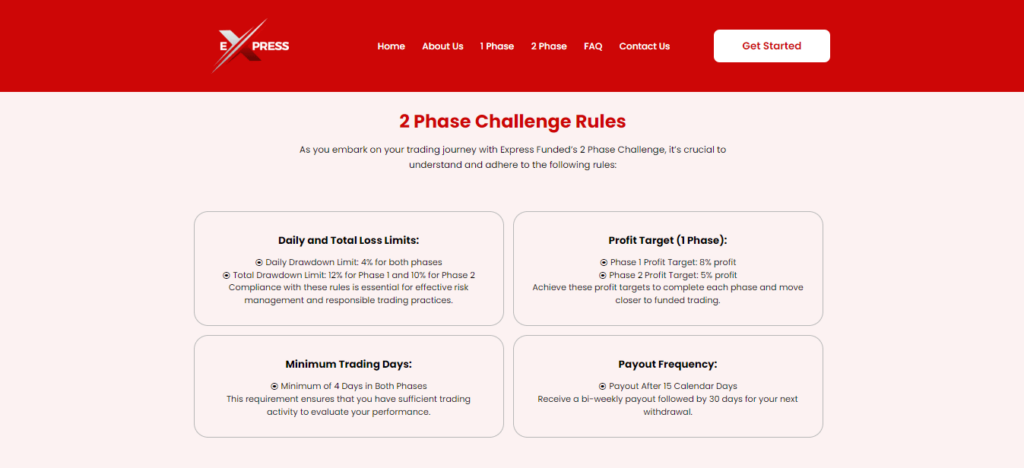

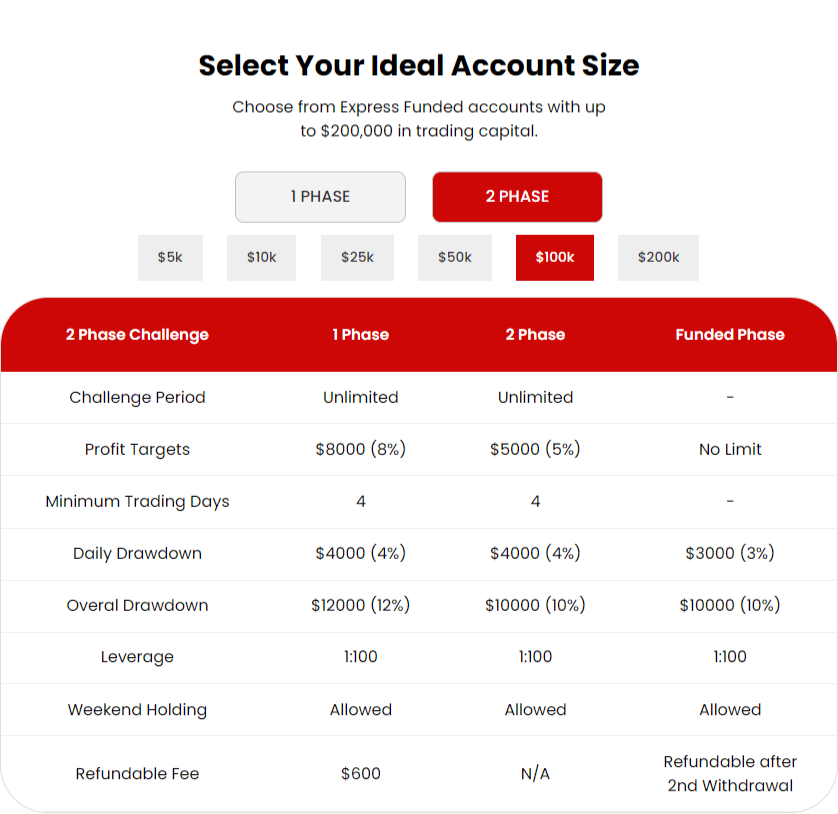

2 Phase Challenge

The 2 Phase Challenge involves a more gradual and detailed evaluation process:

Phase 1:

- Challenge Period: Unlimited.

- Profit Target: 8%.

- Minimum Trading Days: 4.

- Daily Drawdown: 4%.

- Overall Drawdown: 12%.

- Leverage: 1:100.

Phase 2:

- Challenge Period: Unlimited.

- Profit Target: 5%.

- Minimum Trading Days: 4.

- Daily Drawdown: 4%.

- Overall Drawdown: 10%.

- Leverage: 1:100.

This challenge is suitable for traders who prefer to demonstrate their trading skills and risk management over two distinct phases, offering a comprehensive assessment of their trading abilities.

A Well-Established Broker: Purple Trading

Express Funded has partnered with Purple Trading, a well-established broker known for its reliable technology and premium services. Purple Trading offers a wide selection of currency pairs, low spreads, and lightning-fast execution of trade orders, making it an ideal choice for serious traders. This partnership ensures that Express Funded traders have access to high-quality trading conditions.

Regulatory Oversight

Purple Trading is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with stringent financial standards and providing traders with a secure trading environment. This regulatory oversight adds an extra layer of security and trust for traders using Express Funded’s services.

What This Means for You

For traders at Express Funded, the partnership with Purple Trading means access to a secure and efficient trading platform. The regulatory oversight by CySEC ensures that your trading activities are conducted in a safe and transparent environment. This collaboration reflects Express Funded’s commitment to providing its traders with the best possible trading conditions and support.

Educational Advantages

Express Funded recognizes the importance of education in trading success. They partner with renowned academies like FX GOAT FOREX TRADING ACADEMY and KOJO FOREX ACADEMY, providing traders with essential learning resources. This commitment to education ensures traders have access to both theoretical knowledge and practical insights, crucial for navigating the financial markets effectively.

FX GOAT FOREX TRADING ACADEMY

Express Funded recognizes the importance of quality education in trading. They collaborate with FX GOAT FOREX TRADING ACADEMY, a renowned institution offering comprehensive and free forex training. This academy stands out for its commitment to student success, providing 24/7 assistance and full student support.

Key Features of FX GOAT FOREX TRADING ACADEMY :

- Real Trader Coaches: Coaches are experienced traders with proven results, offering practical insights and real-life trading examples.

- Diverse Learning Materials: Catering to various learning styles, FX GOAT provides videos, slides, quizzes, voice-overs, and PDFs.

- Full Mentorship: After course completion, students receive lifetime mentorship and support, ensuring continuous learning and improvement.

FX GOAT’s approach is holistic, focusing not just on technical skills but also on market insights and practical trading tips, making it an ideal educational partner for Express Funded traders.

KOJO FOREX ACADEMY

Another educational pillar for Express Funded is the KOJO FOREX ACADEMY, led by a professional forex trader with a rich background in financial trading since 2016. This academy offers a more personalized touch, with a focus on helping struggling traders through various services.

Services Offered by Kojo Forex:

- Beginner Session: Tailored for new traders, providing foundational knowledge in forex trading.

- Kojoforex (Advanced) Sniper Sessions: Advanced training sessions for more experienced traders.

- Prop Trading Desk: A platform for traders to apply their skills in real market conditions.

Kojo Forex’s approach is grounded in personal experience and a deep understanding of the forex market, complemented by a strong YouTube presence with over 200,000 subscribers. This aligns well with Express Funded’s ethos of providing accessible and quality trading education.

Both FX GOAT FOREX TRADING ACADEMY and KOJO FOREX ACADEMY offer unique advantages, making them excellent educational partners for Express Funded. Their comprehensive training programs and mentorship opportunities are invaluable resources for traders at all levels, aligning with Express Funded’s commitment to nurturing skilled and knowledgeable traders.

In Conclusion

Express Funded distinguishes itself as a versatile prop trading firm, ideal for both new and seasoned traders. Their 1 and 2 Phase Challenges offer tailored trading experiences, while the partnership with Purple Trading ensures a secure, regulated environment. The firm’s focus on education, through collaborations with FX GOAT FOREX TRADING ACADEMY and KOJO FOREX ACADEMY, underscores their commitment to trader development.

With competitive fees, a wide range of tradable assets, and flexible trading rules, Express Funded caters to diverse trading styles and strategies. The firm’s clear guidelines and restrictions reflect their dedication to transparency and fairness.

As an added bonus, those interested in joining Express Funded can benefit from an exclusive 15% discount by using the code [CODE], courtesy of FundedTrading. This offer makes their programs more accessible.

In summary, Express Funded is a compelling choice for traders looking for a comprehensive, education-focused, and flexible trading environment.

Express Funded Discount Code

If you want to join Express Funded, use our exclusive discount code FT15 for a 15% discount!