Elites Funding provides traders with funded accounts up to $200,000, offering profit splits starting at 80% and increasing to 90%. With no time limits, access to MetaTrader and TradeLocker, and a scaling option up to $300,000, it caters to those seeking a straightforward trading experience.

Elites Funding provides a simple and straightforward way to access funded trading accounts. Their programs, ranging from $10,000 to $200,000, offer unlimited trading time, which can be beneficial for traders who prefer a less pressured environment. The profit-sharing starts at 80% and can increase to 90%, which is fair and competitive in the proprietary trading space.

Tools like TradeLocker and MetaTrader are reliable and widely used, making them familiar options for most traders. The opportunity to scale accounts to $300,000 may appeal to those aiming for higher funding levels, though the firm doesn’t necessarily stand out for offering unique features. Overall, Elites Funding provides a practical option for traders, though it may be better suited for those seeking simplicity rather than advanced tools or exclusive benefits.

About Elites Funding

Elites Funding, registered as Masterlabs Limited in Spain, offers an opportunity for traders to access funded accounts through a straightforward model. The firm provides account sizes ranging from $10,000 to $200,000, with the option to scale up to $300,000 for consistent performers. Their unlimited trading time and use of platforms like MetaTrader and TradeLocker cater to traders who value flexibility and familiar tools.

The profit-sharing structure starts at 80% and can increase to 90%, which is competitive within the industry. While the emphasis on simplicity and transparency may appeal to many, some experienced traders might find the features more geared toward accessibility than advanced strategies or unique benefits. Overall, Elites Funding offers a solid platform for those looking to prove their trading skills, but as with any prop firm, it’s worth reviewing the terms carefully to ensure it aligns with your goals.

Funding Program Options

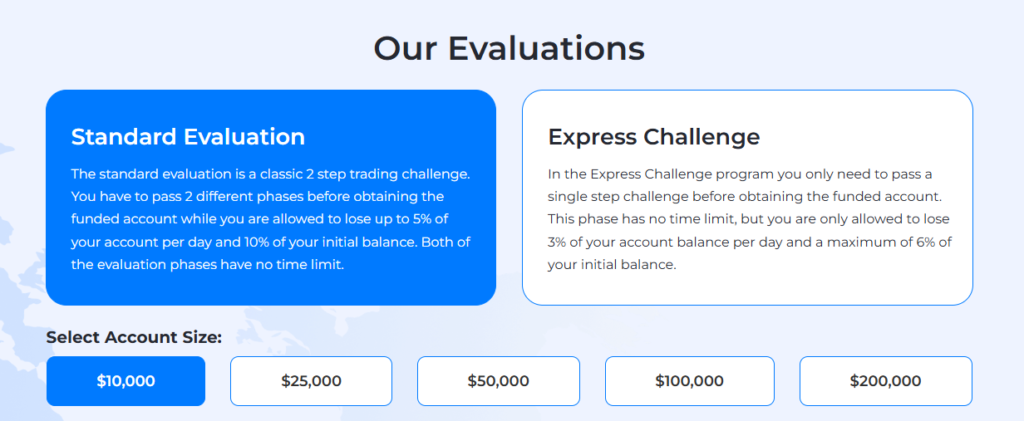

Elites Funding offers two evaluation programs to match different trading styles: the Standard Evaluation and the Express Evaluation. Both options aim to provide a straightforward path to securing funded accounts while allowing traders to work at their own pace.

Standard Evaluation

This two-phase program focuses on assessing long-term consistency and risk management. In Phase 1, traders must reach a 9% profit target, followed by a 5% target in Phase 2. With no time limits and a 10% overall loss limit (5% daily), the program is well-suited for traders who prioritize discipline and steady growth.

Express Evaluation

The Express Evaluation is a one-phase option designed for those seeking a faster route to funding. Traders need to achieve a 10% profit target while staying within a 6% overall loss limit and 3% daily limit. Like the Standard program, there are no time restrictions, allowing participants to focus purely on meeting their goals.

Both programs offer accounts ranging from $10,000 to $200,000, with profit-sharing starting at 80% and scaling to 90% for successful traders. The flexibility and clear rules may appeal to traders looking for accessible ways to test and prove their skills, though it’s always a good idea to review program details to ensure they align with your trading approach.

Fees

Elites Funding offers a clear and upfront fee structure for its Standard and Express Evaluation programs. The fees are based on the chosen account size and require a one-time payment, with no additional or hidden costs.

Standard Evaluation Fees

- $10,000 Account: $99

- $25,000 Account: $220

- $50,000 Account: $320

- $100,000 Account: $530

- $200,000 Account: $1,000

Express Evaluation Fees

- $10,000 Account: $110

- $25,000 Account: $250

- $50,000 Account: $370

- $100,000 Account: $600

- $200,000 Account: $1,150

Both programs include a refundable fee for traders who successfully complete the evaluation and receive a funded account. This approach ensures transparency and allows traders to understand their financial commitment upfront. While the fees are reasonable, traders should evaluate whether the program’s terms and resources meet their specific trading needs.

Tradable Assets

Elites Funding provides traders with access to a diverse range of tradable assets, ensuring flexibility and opportunities across various market conditions. The firm supports trading in the following asset classes:

- Forex: A wide variety of major, minor, and exotic currency pairs, allowing traders to capitalize on global currency market movements.

- Stocks: Popular stocks from global markets, providing opportunities for traders to invest in individual companies and sectors.

- Indices: Global indices like S&P 500, NASDAQ, and FTSE 100, offering exposure to broader market trends and economic shifts.

- Commodities: Key commodities such as gold, silver, crude oil, and natural gas, enabling traders to diversify their portfolios.

All assets are available on advanced trading platforms, including MetaTrader and TradeLocker. This variety ensures that traders can implement their preferred strategies, whether they focus on currency pairs, equity markets, or commodity trading, making Elites Funding a versatile choice for a broad range of traders.

Restrictions

Elites Funding enforces specific restrictions to maintain a fair, secure, and transparent trading environment. These rules Elites Funding has specific policies in place to maintain the integrity of its funding programs and promote ethical trading practices. These guidelines aim to create a fair environment for all participants.

Country Restrictions

Traders from certain regions cannot participate, including Afghanistan, Belarus, Cuba, Iran, North Korea, Russia, Syria, Venezuela, and other countries sanctioned by OFAC. Those from eligible countries can join, provided they comply with their local regulations and Elites Funding’s terms.

Prohibited Trading Strategies

To ensure fairness, the following trading practices are not allowed:

- Grid Trading: Placing opposing trades with similar risks simultaneously.

- Tick Scalping: Closing trades within extremely short timeframes to manipulate activity.

- High-Frequency Trading (HFT): Executing numerous trades within milliseconds.

- Martingale Strategies: Increasing trade sizes after losses to recover previous losses.

- Hedging Across Accounts: Using multiple accounts for opposing trades to reduce risk.

- Account Sharing or Selling: Unauthorized use or transfer of accounts.

Violations of these policies may lead to account suspension, forfeiture of profits, or termination.

IP Address Rules

Traders must use a consistent IP address when accessing their accounts to prevent unauthorized activity. If using multiple locations or a VPS, prior notification to Elites Funding is required, and proof of activity may be requested.

These rules are designed to foster a professional and ethical trading environment while ensuring that all participants operate on a level playing field. Traders are encouraged to review and follow these policies closely to avoid penalties.

Challenge

Elites Funding provides two evaluation programs, the Standard Evaluation and Express Evaluation, tailored to assess traders’ skills and consistency. These programs offer options for traders with different preferences and timeframes, with clear rules to help participants work toward funded accounts.

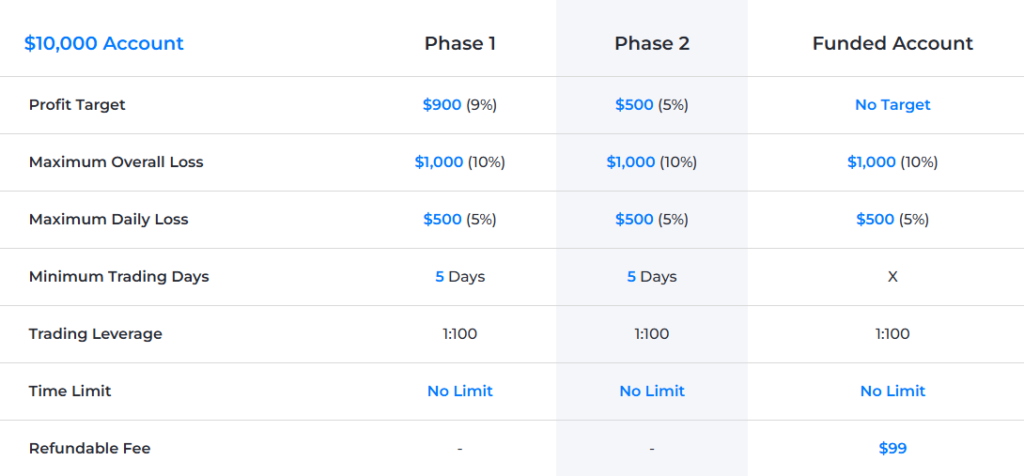

Standard Evaluation

This two-phase program evaluates a trader’s ability to meet profit targets while maintaining discipline. In Phase 1, traders need to achieve a 9% profit target, followed by a 5% target in Phase 2. The program enforces a 10% overall loss limit and a 5% daily loss limit, encouraging sound risk management. With unlimited trading time and a minimum of five trading days per phase, this option is well-suited for those who prefer a steady and structured evaluation process.

Express Evaluation

For traders looking for a faster option, the Express Evaluation condenses the process into one phase. Traders must hit a 10% profit target while staying within a 6% overall loss limit and a 3% daily loss limit. Like the Standard Evaluation, it offers unlimited trading time but requires only a minimum of four trading days, making it a quicker path to a funded account.

Account Details and Rewards

Both programs are available for account sizes from $10,000 to $200,000, with leverage up to 1:100. Traders who complete the evaluations successfully receive funded accounts with profit sharing starting at 80%, which can increase to 90% through the scaling plan. These programs offer a structured and fair opportunity for traders to prove their skills and grow their trading capital.

Conclusion

Elites Funding provides a structured platform for traders seeking access to funded accounts and opportunities to grow their trading capital. With two evaluation options—Standard and Express—traders can choose a program suited to their style and preferences. Features like unlimited trading time, a profit split starting at 80% (scaling up to 90%), and access to MetaTrader and TradeLocker offer tools and conditions that appeal to a wide range of traders.

The platform supports a variety of tradable assets, including Forex, stocks, indices, and commodities, broadening opportunities for diverse trading strategies. Its transparent policies, focus on ethical practices, and clear guidelines create a fair and secure trading environment for participants.

Key Features:

- Two Evaluation Programs: Standard (two-phase) or Express (one-phase) evaluations tailored to trader needs.

- Unlimited Trading Time: Trade without deadlines for greater flexibility.

- Profit Sharing: Earn up to 90% of profits through a scaling plan.

- Variety of Assets: Trade Forex, stocks, indices, and commodities.

- Advanced Platforms: Work with MetaTrader and TradeLocker for intuitive trading experiences.

Considerations:

- Country Restrictions: Traders from OFAC-sanctioned and FATF-blacklisted countries cannot join.

- Prohibited Strategies: Methods like grid trading, tick scalping, and account hedging are not allowed.

- IP Address Policy: Consistent IP use is required, or prior notification must be provided for multiple locations.

Elites Funding combines simplicity, flexibility, and essential trading tools to support traders in achieving their goals. While it offers strong features, prospective users should review the rules and restrictions to ensure the platform fits their trading approach.