City Traders Imperium encourages its traders to achieve financial freedom, no matter their background or where they come from.

Pros

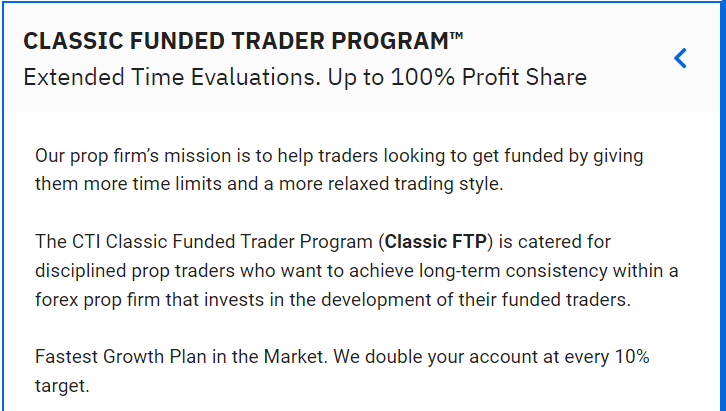

- Good scaling

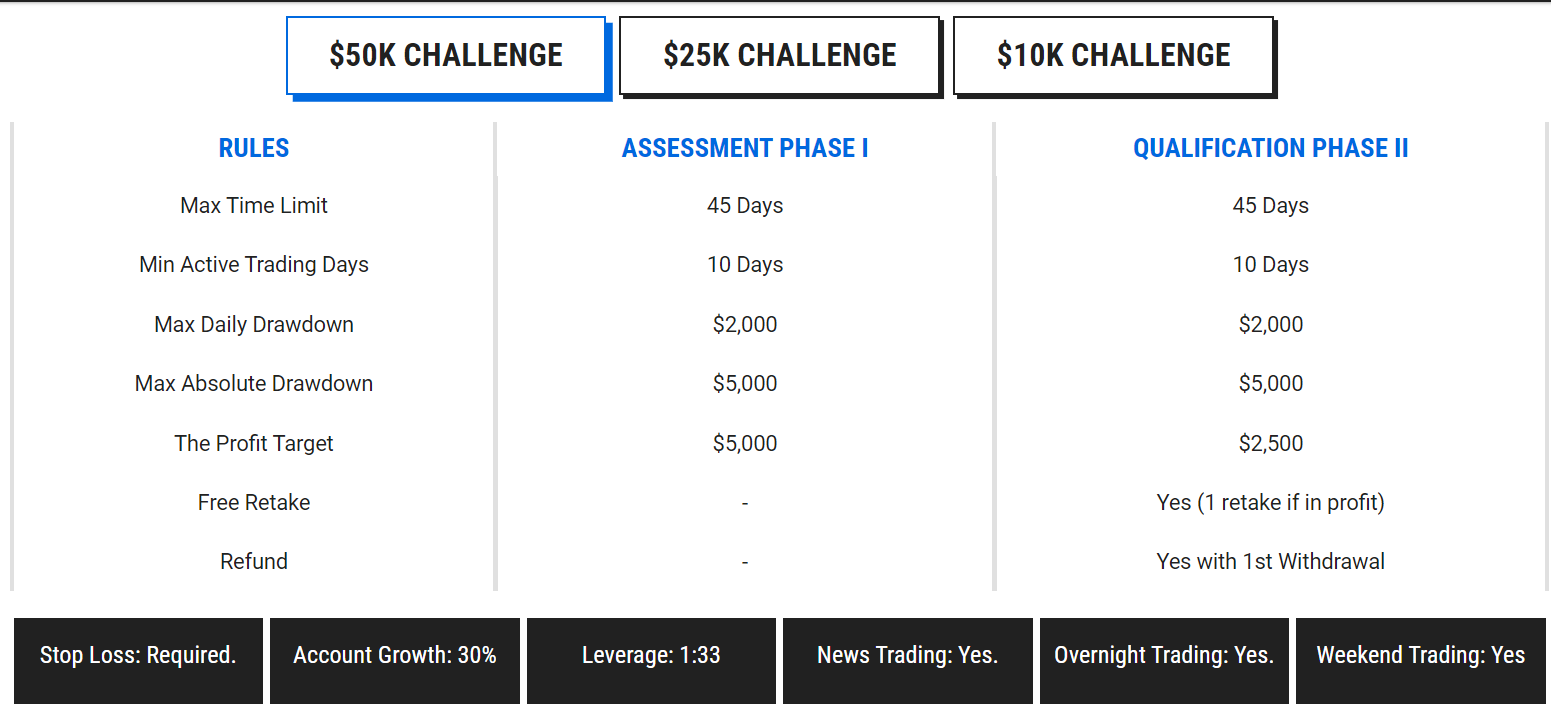

- Straightforward rules

- Allows news trading and weekend holding

- Offers Instant Funding Accounts

- Very long evaluation time for some accounts

Cons

- 5% Drawdown on Classic, Standard, and Direct Funding Accounts

- Payment only using credit/debit card

- Lack of assets to trade

City Traders Imperium Review Details

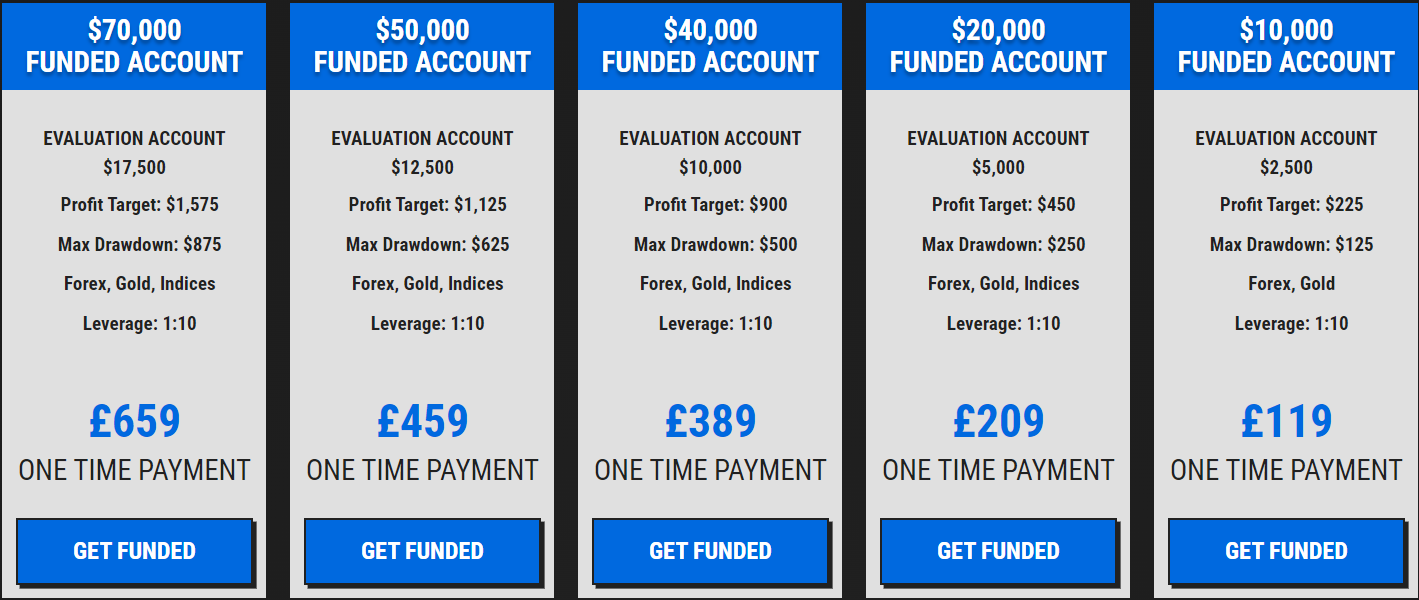

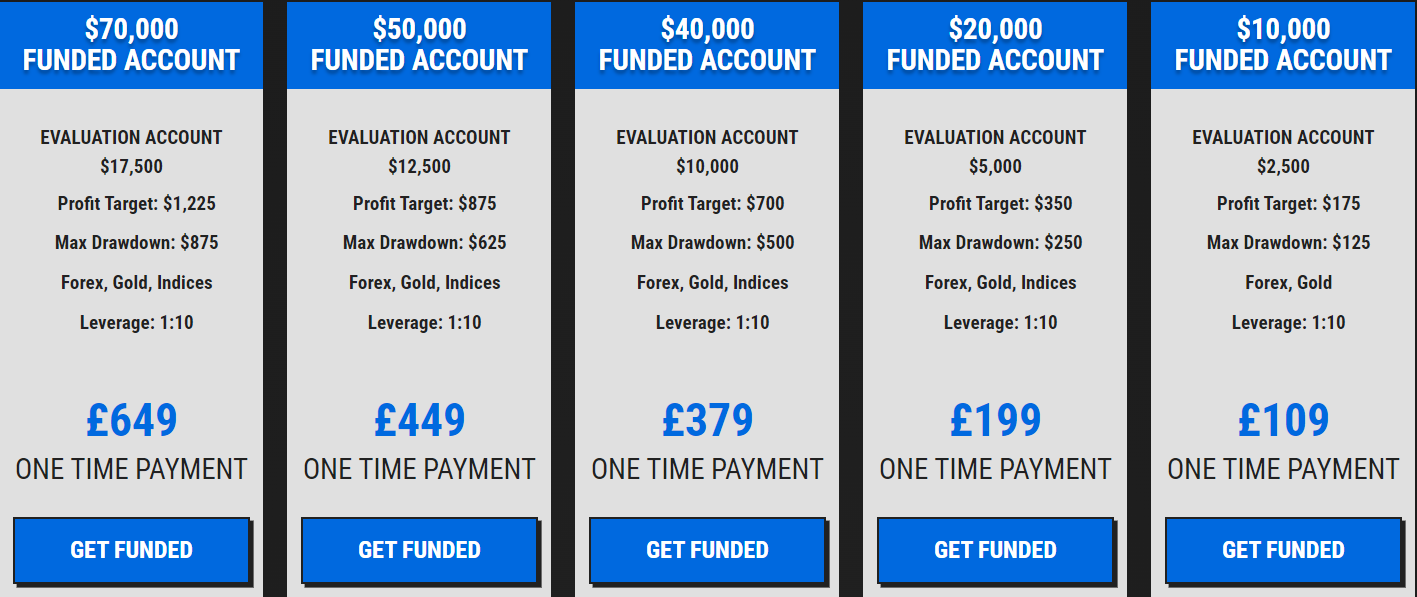

Tradable Instruments:

Forex

Indices

Metals

Rules:

Account Currencies:

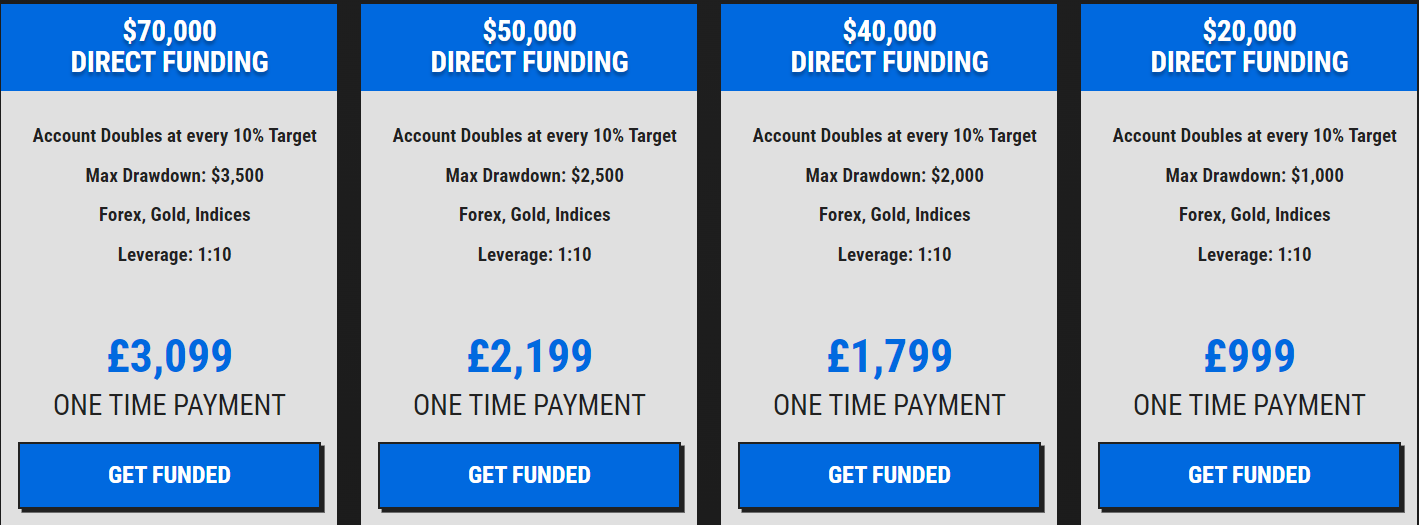

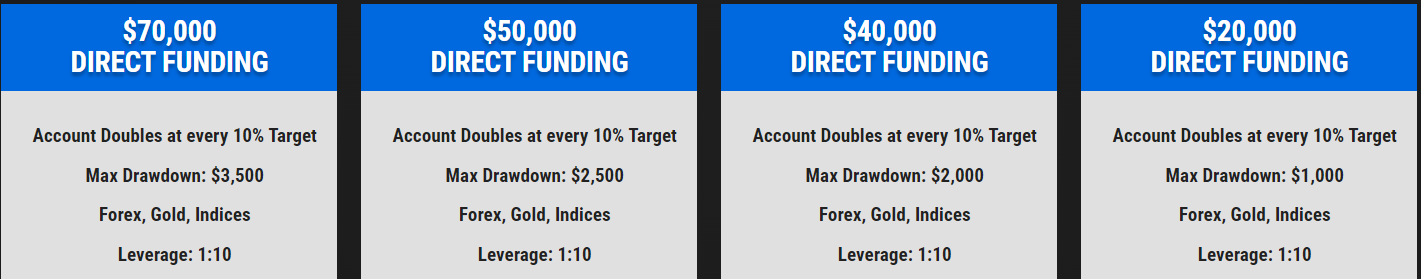

Price:

Maximum Capital Allocation: