Apex Trader Funding offers futures traders a one-step evaluation with no daily drawdown limits, high profit splits, and payouts every eight trading days.

Apex Trader Funding is one of the fastest-growing futures prop firms in the industry. Founded in 2021 and headquartered in Austin, Texas, the company has built its reputation by offering traders a simple one-step evaluation, quick payouts, and some of the most generous profit splits available. Unlike many competitors, Apex removes unnecessary restrictions, letting traders focus on consistency and discipline.

But is Apex Trader Funding legit? With more than $570 million paid out since 2022, and thousands of traders funded across 150+ countries, the numbers suggest that this is one of the most established futures funding firms. In this review we will break down the rules, payouts, account types, and real trader feedback so you can decide if Apex is right for you.

Quick Facts

- Founded: 2021

- Headquarters: Austin, Texas

- Global reach: 150+ countries

- Total payouts: $570,247,470 since 2022

- Recent payouts: $51,095,296 in the last 90 days

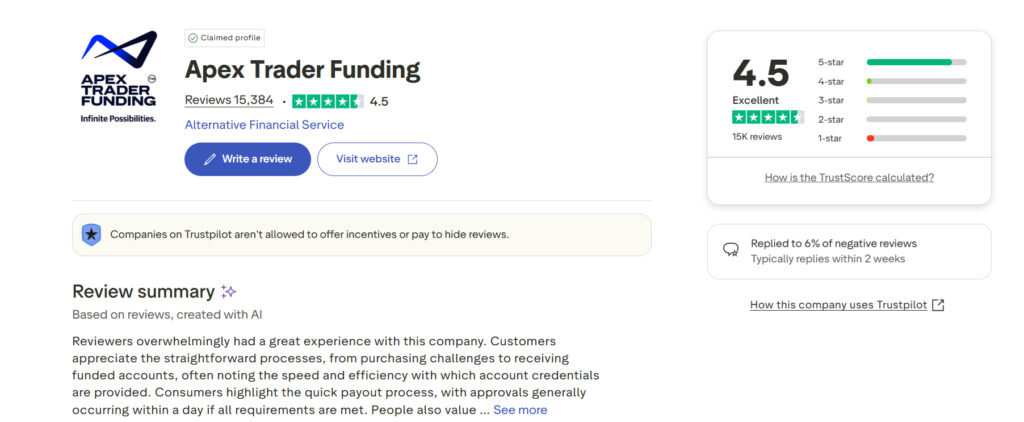

- Trustpilot rating: 4.5/5 from over 15,000 reviews

Is Apex Trader Funding Legit?

Apex Trader Funding was created in 2021 by Darrell Martin, a trader and educator who previously launched Apex Investing. Frustrated with the restrictive rules of traditional funding companies, he built Apex to offer traders a fairer model with larger payouts, fewer limitations, and access to real futures markets.

The company has quickly grown into one of the most recognized names in the futures prop space. Apex has been featured in multiple interviews and financial publications and has received awards such as the 2023 Benzinga Award and the Financial Services Review Award, highlighting its credibility in the industry.

Most importantly, Apex has backed up its promises with results. The firm has paid out more than $570 million since 2022, including over $51 million in the last 90 days alone. On Trustpilot, Apex maintains an Excellent rating of 4.5/5 based on more than 15,000 reviews, with traders praising the speed of payouts and simplicity of the evaluation process.

With a proven payout track record, third-party recognition, and strong trader feedback, Apex Trader Funding is considered a legitimate and reliable prop firm.

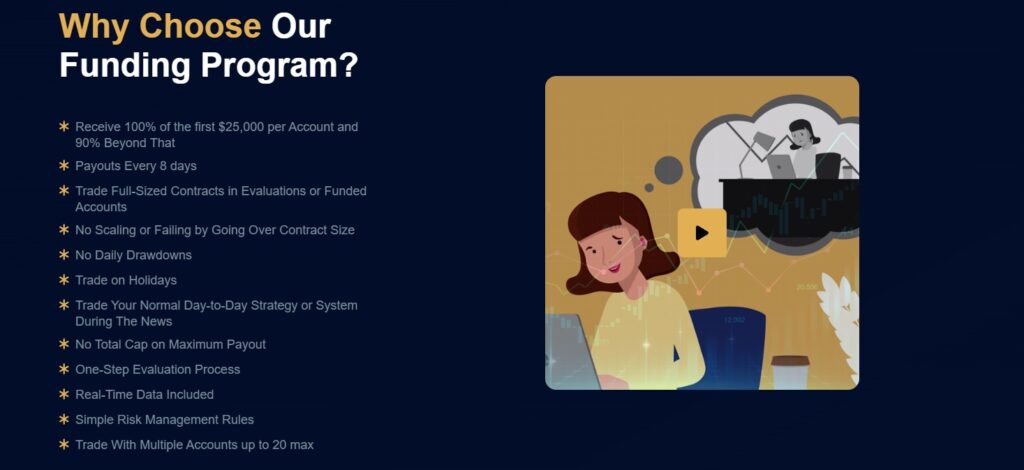

Apex Trader Funding Account Highlights

Apex is known for offering trader-friendly conditions that are rare in the prop trading world. Here are the core highlights of the program:

- One-step evaluation: Pass a single evaluation in as little as 7 trading days.

- High profit splits: Keep 100 percent of your first $25,000 in profits, then 90 percent after that.

- No daily drawdown: Accounts use a trailing threshold instead of strict daily loss limits.

- No scaling rules: Trade full contract sizes from the start without restrictions.

- Frequent payouts: Eligible for payouts every 8 days, with up to 2 per month.

- Multiple accounts: Manage up to 20 performance accounts at the same time.

These features make Apex a strong option for traders who want flexibility, quick access to capital, and frequent opportunities to withdraw profits.

Apex Trader Funding Rules (2025)

Apex Trader Funding keeps its rules straightforward compared to many other prop firms. Instead of layering on restrictive conditions, the company focuses on a few core requirements that test discipline and risk management.

Core Rules

- Profit target: Each account has a set profit goal based on account size (for example, $3,000 on a $50K account).

- Trailing threshold: Accounts use a trailing drawdown that moves with balance until the target is reached.

- No daily drawdown: Unlike most firms, Apex does not use daily loss limits.

- No scaling rules: Traders can use full contract sizes from the start without restrictions.

Trailing Threshold Explained

For example, in a $50,000 evaluation account, the profit goal is $3,000 with a $2,500 trailing threshold. If your balance increases to $52,000, the threshold rises to $49,500. If the balance then drops back to $50,500, you would still be above the limit and remain safe. The trailing threshold gives flexibility but requires traders to lock in profits and avoid giving back large unrealized gains.

News Trading Rules

Apex allows traders to use their normal strategies during news events in evaluation accounts, but news-based strategies that are specifically designed to exploit announcements are prohibited.

Maximum Position Size

Traders can open positions up to the maximum contract limit for their account size. If you attempt to exceed that limit, the system automatically blocks the trade instead of failing the account.

Minimum Trading Days

To qualify, traders must complete a minimum of 7 trading days, with each trading day defined as 6 PM ET to 5 PM ET the following day.

Payout Rules & Profit Split

Apex Trader Funding is well-known for its fast payout schedule and trader-friendly profit split.

- Payout frequency: Traders can request payouts every 8 trading days, up to two times per month.

- Profit split: Traders keep 100 percent of their first $25,000 in profits, then 90 percent on everything beyond that.

- No payout cap: Apex does not impose a total limit on how much you can withdraw.

Example Payout

A trader in a $50K account who builds up a $5,000 cushion could request a $2,000 payout after their eighth trading day. The remaining balance would provide a buffer for continued trading.

Withdrawal Methods

All withdrawals are processed through Deel, with funds available via bank transfer, Wise, PayPal, or crypto, depending on trader preference.

Apex Trader Funding Pricing (Evaluation & Funded Account Fees)

Apex accounts are priced by platform and size, with frequent promotions that reduce costs by 80–90 percent.

Evaluation Accounts

- WealthCharts Plans: $147 to $597 per month depending on account size.

- Rithmic Plans: Include a NinjaTrader license and real-time data fees, ranging from $157 to $597 per month.

- Tradovate Plans: Include TradingView compatibility and a Tradovate license, ranging from $167 to $597 per month.

Static Accounts

- 100K Static Account: $137 per month, $2,000 profit goal, and a $625 max drawdown.

Resets

- Traders can reset a failed evaluation account for $80 to $100, with no limit on resets.

Funded Account Fees

- Once funded, traders pay $85 to $105 per month per account for data and platform access, with a maximum of 20 PA accounts.

Promo Tip: Apex frequently runs sales, with evaluation accounts discounted by up to 90 percent. Many traders start accounts for as little as $30–$50 during promotions.

Platforms & Trading Tools

Apex Trader Funding gives traders a choice of several major futures platforms:

- NinjaTrader – industry standard with a free license included

- Tradovate – web, desktop, and mobile access; TradingView compatible

- Rithmic – low-latency execution with NinjaTrader license included

- WealthCharts – exclusive platform built with Apex in mind, offering built-in tools and performance tracking

All accounts come with real-time market data included at no extra charge.

Traders can also scale with copy trading across up to 20 accounts at the same time, allowing them to multiply profits from a single trade setup.

In addition to platform access, Apex offers optional third-party trading tools and resources, including:

- Trade copier for simultaneous execution across accounts

- Trading psychology training to improve discipline

- Tick Strike for order flow audio/visual alerts

- Automated trading bots and indicators for strategy testing

These features make Apex a good option for traders who want both professional-grade execution and extra tools to refine their strategies.

Tradable Instruments

Apex Trader Funding is focused exclusively on futures markets, giving traders a wide range of asset classes to work with:

- Equity futures: S&P 500 (ES), Nasdaq 100 (NQ), Dow Jones (YM), Russell 2000 (RTY)

- Currency futures: euro (EUR), British pound (GBP), Japanese yen (JPY)

- Agricultural futures: corn, wheat, soybeans, coffee

- Energy futures: crude oil, natural gas, gasoline

- Metals futures: gold, silver, copper, platinum

- Micro futures: lower-capital versions of major contracts, ideal for building consistency

This variety allows traders to diversify strategies across indices, commodities, and currencies, all while staying within the futures market framework.

Trustpilot Reviews & Trader Feedback

Apex Trader Funding has one of the strongest reputations in the industry with a 4.5 out of 5 TrustScore on Trustpilot, based on more than +15K reviews.

Common Positives

- Fast payouts, often processed in 24–48 hours

- Affordable evaluations, especially during 80–90 percent sales

- Ability to manage multiple accounts at once

- Clear and simple rules that give traders flexibility

Common Negatives

- Customer support can be slow to respond at times

- First payout may take longer to process compared to later withdrawals

Overall, traders describe Apex as a legit and reliable firm, especially valued for its low-cost access and consistent payouts.

Apex Referral & Affiliate Program

Apex Trader Funding offers one of the more attractive referral programs in the industry. Affiliates earn a 15 percent lifetime referral fee, which means ongoing passive income as long as referred traders keep their accounts active.

This program applies to evaluation accounts, resets, and other purchases, giving affiliates the chance to build a steady income stream simply by recommending Apex to other traders.

Who Is Apex Best For?

Apex Trader Funding is designed with flexibility, but certain types of traders benefit the most:

✅ Futures day traders and scalpers who want to maximize contract size without restrictive scaling rules

✅ Traders focused on consistency who can take advantage of frequent payouts every 8 days

✅ Those who want multiple accounts to increase profit potential by copy trading across up to 20 accounts

❌ Swing and overnight traders may find Apex limiting since positions must be closed before the 5 PM ET session close.

Apex Trader Funding vs Competitors

Topstep Review (2025)

Topstep is one of the most established futures prop firms, best known for its Trading Combine®, a multi-step evaluation that includes consistency requirements and daily drawdown rules. Payouts are flexible, and traders keep 100% of their first $10,000 in profits before moving to a 90/10 split. Topstep also provides access to Tilt, a trader sentiment tool, along with coaching and community support.

👉 Check our full Topstep Review for more details.

TradeDay Review (2025)

TradeDay allows traders to request payouts from day one and offers multiple account types with different drawdown options: Intraday, End-of-Day, or Static. Profit splits start at 80% and can go as high as 95% for long-term funded traders. Accounts begin at $59 per month with no activation fee. In addition to funding, TradeDay places strong emphasis on trader education with daily webinars, mentoring, and a community chatroom.

👉 Check our full TradeDay Review for more details.

Savius Review (2025)

Savius takes a different approach with its Instant Funded Accounts. There is no evaluation or challenge, traders start funded immediately after purchase. Accounts range from $25K to $300K in size, with profit targets of 7% and a maximum drawdown of 5%. Traders must trade for at least 10 days before requesting their first payout. Payouts are on-demand and can be processed within 24–48 hours. Traders can also clone up to 3 accounts at once to scale their strategies.

👉 Check our full Savius Review for more details.

Futures Prop Firm Comparison Table (2025)

| Feature | Apex Trader Funding | Topstep | TradeDay | Savius |

| Evaluation | One-step, min. 7 trading days | Trading Combine® (2-step) with consistency rules | Evaluation with 3 objectives, min. 7 days | No challenge – instant funded account |

| Profit Target (50K) | $3,000 | $3,000 | $3,000 | $3,500 (7% of balance) |

| Drawdown | Trailing threshold, no daily DD | Daily loss limits ($1K on 50K) + trailing DD | Choice of Intraday, End-of-Day, or Static | 5% max drawdown, consistency rule (20%) |

| Scaling | None – full contracts allowed from start | Scaling required | Position size limits by account type | Contract caps (e.g. 4 minis on 50K) |

| Minimum Trading Days | 7 | 2 (but needs consistency) | 7 | 10 |

| Payouts | Every 8 trading days, up to 2x/month via Deel | Request after 5 profitable days ($150+) | Day-one payouts available | On-demand payouts, processed in 24–48h |

| Profit Split | 100% of first $25K, then 90% | 100% of first $10K, then 90% | 80% up to $50K, 90% up to $100K, 95% beyond | Up to 90%, max payout per cycle depends on account size |

| Costs (Eval/Account Fees) | $137–$597/mo (frequent 80–90% discounts). PA fee: $85–$105/mo. Resets: $80–$100 | $49–$149/mo depending on account. $149 activation fee once funded. Resets cost same as monthly fee | $59–$375/mo depending on account & drawdown. No activation fee. Resets $99 (sometimes free on rebill) | One-time cost: $329 (25K), $679 (50K), $939 (100K), $1,169 (150K), $1,639 (300K). Discounts for bulk accounts |

| Platforms | NinjaTrader, Tradovate (TradingView), Rithmic, WealthCharts | TopstepX, TradingView, NinjaTrader, Rithmic | NinjaTrader, Tradovate, Rithmic | NinjaTrader, Rithmic |

Pros & Cons of Apex Trader Funding

| Pros | Cons |

| One-step evaluation process | News trading restrictions on specific strategies |

| 100% payout on first $25K profit | First payout can take longer than subsequent ones |

| No daily drawdown and no scaling rules | Ongoing monthly fees for performance accounts |

| Platforms and real-time data included | Customer support response time can be slow |

| Frequent promotions with 80–90% discounts |

Apex’s structure favors traders who want quick access to capital and simple rules, but it does come with some trade-offs around news trading, fees, and support speed.

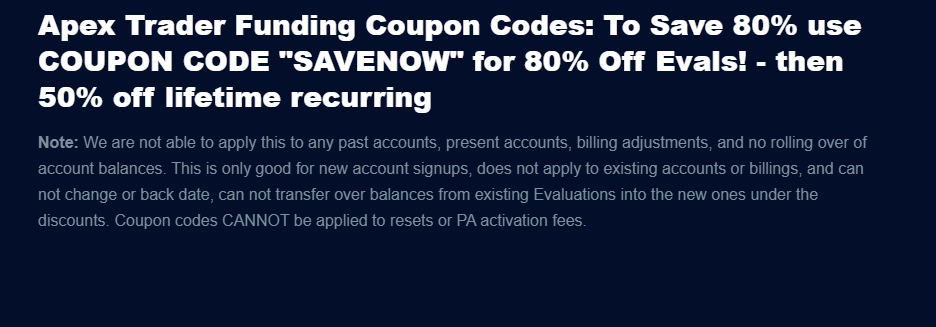

Apex Funding Coupon Code

Apex Trader Funding Coupon Codes: To Save 80% use coupon code “SAVENOW” for 80% Off Evals! – then 50% off lifetime recurring. This is only good for new account signups. Click here.

Verdict – Should You Choose Apex?

Apex Trader Funding has quickly become one of the most popular futures prop firms for a reason. Its one-step evaluation, fast payouts, and generous 100% profit split on the first $25,000 make it highly attractive to traders who want a straightforward path to funding. The ability to manage up to 20 accounts and trade without daily drawdowns or scaling restrictions adds further appeal.

There are some limitations. Traders cannot hold positions overnight, support replies can be slow, and ongoing monthly performance account fees may add up over time.

Overall, Apex is the best choice for futures traders who want high payouts, minimal restrictions, and low-cost evaluations. For scalpers and intraday traders looking to scale quickly, Apex is one of the strongest options in 2025.

FAQs

Is Apex Trader Funding legit?

Yes. Apex has been operating since 2021, has paid out more than $570 million since 2022, and maintains a 4.5/5 Trustpilot rating from over 15,000 reviews. The company has also won industry awards including the 2023 Benzinga Award.

How does the trailing drawdown work?

The trailing drawdown moves with both realized and unrealized profits until you reach the profit target. For example, in a $50,000 account with a $2,500 trailing threshold, if your balance rises to $52,000, the threshold increases to $49,500. If the balance drops back, you must stay above that limit to avoid failure.

How fast are payouts processed?

Payouts are available every 8 trading days and processed through Deel. Most payouts are approved within 24–48 hours, though the very first withdrawal may take longer.

What platforms can I use?

Apex supports NinjaTrader, Tradovate, Rithmic, and WealthCharts. Real-time data and platform licenses are included.

Can I trade Forex at Apex?

No. Apex focuses exclusively on futures markets such as equities, commodities, currencies, energy, and metals.

How much does Apex cost?

Evaluation accounts start from around $137 to $597 per month, depending on size and platform. Static accounts cost $137 per month, resets range from $80 to $100, and performance accounts carry a monthly fee of $85 to $105. Frequent promotions can reduce costs by 80–90 percent.

Can I hold trades overnight?

No. All positions must be closed before 5 PM ET each day. Apex is best suited for day traders, scalpers, and intraday strategies.

What is the Apex coupon code?

Apex regularly runs discounts of up to 90 percent. Coupon codes vary depending on the promotion period. Current active codes are listed directly on the Apex Trader Funding website.