Crypto Futures Trading

The futures market could initially seem mysterious, dangerous, or best suited to individuals with steel nerves. That’s reasonable as futures trading is not ideal for everyone, and some futures contracts tend to be more volatile in price than many traditional stocks and bonds.

However, we often experience fear and anxiety when confronted with the unfamiliar. Discover how futures contracts operate, the various types of crypto futures, their role in the financial market, their advantages, and how to trade crypto futures in the article below.

What is a Futures Contract?

A futures contract is an arrangement in which a buyer and a seller each commit to buying from the other a predetermined quantity of shares or an index at a predetermined price in the future. Futures contracts can be freely traded on exchanges since they are standardized in terms of contract sizes and expiration dates.

A variety of assets are accessible as futures contracts, including equities, indexes, commodities, currency pairs, and more. Here, we’ll examine cryptocurrency futures, which are among the most popular futures products.

Types of Cryptocurrency Futures Contracts

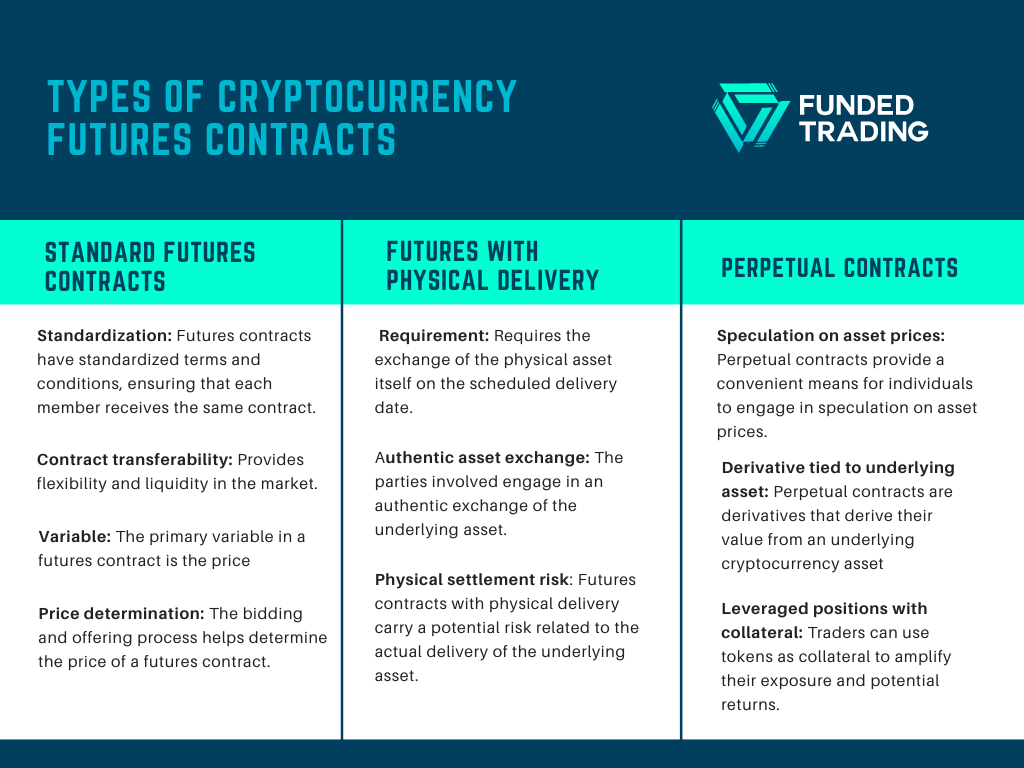

Standard Futures Contracts

Each member will receive the same contract terms and conditions. Futures contracts include a feature that makes it simple for the buyer or seller to transfer the contract ownership to another party. Due to the standardization of contract parameters, the only variable in the contract is the price. Price is determined through bidding and offering, also known as quotation, until a match or trade occurs.

Futures with Physical Delivery

Physical delivery is a condition in an options or futures contract that specifies the actual underlying asset must be delivered on the designated delivery date rather than being swapped away with offset contracts. When a physical delivery is made, the derivatives contract’s underlying asset is physically delivered on the scheduled delivery date.

Perpetual Contracts

Perpetual contracts are a sort of derivative that allows you to effortlessly speculate on asset prices. A perpetual contract, like a futures contract, is a derivative whose value is derived from the underlying cryptocurrency asset. To open a leveraged position, you use tokens as collateral.

Commodity vs. Crypto Futures: Similarities and Differences

Cryptocurrencies like Bitcoin would probably be subject to less regulation if they were categorized as commodities. Initial coin offerings (ICOs) have been compared to other capital-raising strategies in the securities markets, such as IPOs, even though some regulators have said that cryptocurrencies are not securities. Let’s take a closer look at the similarities and differences.

Similarities

Commodities are raw materials used in the production of other commodities or services. The cash market is where you can buy and sell them. Additionally, investors can express their opinions on the pricing of commodities through futures contracts or derivatives tied to the future price of a commodity.

The underlying assets are not involved in futures on cryptocurrencies or commodities, only their price. Futures from both markets have the same settlement and expiration dates. The prices of the underlying assets and derivatives are typically very close to one another.

Differences

Instead of being exchanged for speculative purposes, many commodities futures are traded for actual purposes. For example, businesses that manufacture goods or provide transportation services would be interested in purchasing oil at the current price but would buy oil futures with future delivery. In fact, because perpetual contracts don’t have an expiration date or a settlement date like commodity futures do, they differ from some cryptocurrency futures like commodity futures.

Futures vs Options Differences

Futures trading is regarded as being extremely dangerous due to their minimal margin requirements and closing guarantee. Consequently, this kind of trading is often reserved for experienced investors. Similar to futures, options are most frequently purchased and sold by institutional investors, who typically incorporate them into intricate trading methods to protect their assets. The details of how futures and options differ are provided below.

- Portfolio Protection

Futures and options can both be used to protect a portfolio against hazards. As a result, an index fund, such as the S&P 500, can be used as the underlying asset of either a futures contract or an options contract.

- Managing Risk

A futures contract has an endless potential for profit or loss. However, An options contract lowers the likelihood of loss while allowing for unlimited profit.

- Index Futures and Valuation

S&P 500 futures are valued at the index’s value multiplied by $250. Accordingly, the futures contract price would be 5,000 times $250, or $1.25 million, if the S&P 500 was at 5,000 points. You should know that the investor is not required to provide the entire sum.

- Risk Control

To find prospective purchasers for their Bitcoin at levels allowing them to continue operating economically, miners might resort to the futures market. Contrarily, because there are fewer downside risks with options contracts, they are more suited for speculative traders.

- Contract Execution and Completion

A futures contract is put into effect on the specified date. The buyer acquires the underlying asset on this date. In the meantime, the buyer of an options contract is free to execute the agreement at any point before the expiration date.

- Upfront Costs

A futures contract has no up-front costs, but the buyer must eventually pay the asset’s agreed-upon price. In an options contract, the buyer is required to pay a premium which means the buyer of the options is given the right to choose not to purchase the asset in the event that it becomes less appealing in the future.

The Benefits of Crypto Futures Trading

Convenience

Even for beginners, trading futures is simpler than trading actual cryptocurrencies, which calls for access to a liquid market and possession of a secure digital wallet. Trading in cryptocurrency futures even gives traders access to detailed open interest data, which can make their transactions more transparent.

Higher Potential Profits

Profits are often greater when using leverage to trade crypto futures. You should be aware, nevertheless, that using leverage also entails greater loss risks. Furthermore, trading futures typically have lower costs than traditional assets, making them available to a broader spectrum of traders.

Flexible Trading Strategies

Crypto futures can be traded 24/7, allowing traders to respond to market events and opportunities. Because traders can take both long and short positions and safeguard against market downturns, crypto futures can be used to hedge against market volatility. There are more opportunities for you to use various trading tactics to increase profits as a result.

No Funding Rate

Since there is no financing rate for futures, the prices are frequently in contango, which means they are higher than the current spot prices. A chance known as cash and carry arbitrage, a market-neutral strategy combining a long position in the spot market and a short one in futures, is made possible.

Risks of Crypto Futures Trading

Market Volatility

Given that cryptocurrency futures are one of the instruments with the highest potential leverage, even a little price change can provide significant gains or losses. Cryptocurrency futures are exposed to market risk because an asset’s value can fluctuate quickly and unexpectedly, resulting in substantial losses for traders.

High Leverage Risk

Leverage is frequently used in cryptocurrency futures trading, increasing profits and losses. This means that if the market goes against traders, they could lose more money than they invested. Trading in cryptocurrency futures may also involve counterparty and liquidity concerns, particularly if the contract is not kept at an exchange that is subject to regulation.

Exchange Risks

Trading crypto futures requires traders to have faith in the counterparty to maintain their end of the bargain in the case of a successful trade.

What to Consider Before Trading Crypto Futures?

Leverage Trading

While trading crypto futures, margin requirements and leverage should be considered. Higher degrees of leverage can raise both profits and losses, therefore, it is crucial to carefully review the terms of each transaction.

Liquidity Assessment

There are three major indicators to gauge liquidity while trading futures. Asset, exchange, and market liquidity are all included. The general condition of an asset and market, as well as the number of buyers, sellers, makers, and takers, should be considered by traders.

Hedging

Institutional investors prefer Bitcoin futures as a hedging strategy. Given that the futures contract has an established price for the expiry date, trading Bitcoin futures protects you from experiencing the significant BTC price losses experienced in the spot market.

Diversification

With cryptocurrency futures, you may spread out your capital. You can open numerous positions in Bitcoin(BTC), Ethereum(ETH), and many other tokens to build a well-diversified futures portfolio. By doing this, you can reduce the likelihood of exposure to a single asset whose value might suddenly drop.

Market Volatility

Although this is primarily portrayed as a risk, additional opportunities exist. That is particularly true for short-term traders who favor speculating on rapid price changes. Investors should diversify their capital holdings and use trading methods appropriate for the volatile markets they are engaged in.

Expiration Date

The expiration date should be noted because it is when you will receive your cash or stablecoin funds after settling the contract. Even so, you have until the expiration date to sell any open futures contracts.

How to Trade Crypto Futures?

The majority of the guidelines focus on risk management and identifying optimal entry and exit points. Below are the key steps to effectively start your experience in trading crypto futures.

- Mastering the Basics: Learning the Essential Components

The essential components of the market must be understood to properly prepare for trading. Learn about the operation of blockchains and potential applications for cryptocurrency. Spend time learning about futures trading, identifying the best entry points, and keeping an eye on your open positions.

- Setting a Budget: Managing Risk and Investments

One of the most important risk management guidelines is never to invest more money than you can afford to lose.

- Technical Chart Interpretation: Understanding Market Trends

The growth of media and technology has significantly impacted Bitcoin values. Also worth knowing about candlesticks, supports, resistances, and indicators like relative strength indices and moving averages. Knowing this will make it easier for you to decide whether to buy or sell.

- Stay Informed: Following News and Market Developments

When important news is released, coin and token prices frequently increase. As a result, you must keep up with news, announcements, and rumors. Check well-known blockchain publications and online communities frequently to ensure this is done correctly. Reddit, CoinDesk, and CoinTelegraph all offer cryptocurrency-related content.

- Engage in Discussions: Evaluating Exchanges and Altcoins

If you want to trade a lot of different altcoins, using various exchanges is crucial. Evaluate potential exchanges based on their trading volumes, dependability, costs, number of assets, and user experience to decide which ones are best for you.

- Practice with a Demo Account: Virtual Trading Experience

In a demo account, you can start trading with virtual money. Before moving on to futures, it often imitates the spot price of Bitcoin or any other cryptocurrency.

- Reputable Platforms to Kickstart Your Crypto Futures

When selecting a cryptocurrency exchange, reputation holds significant importance. Therefore, if you are a beginner, opt for a reliable exchange and start with small investments.

The demand for cryptocurrency-based futures products has surged in the past five years. There are several conventional and crypto-specific platforms where you can begin trading crypto futures. Some reputable platforms offering this type of trading include TD Ameritrade, Binance, Kraken, and eToro.

Who Should Trade Crypto Futures?

Futures trading is better suited to professional traders, institutional investors, risk-tolerant investors, and those with experience who can predict price movements pretty accurately. Despite how alluring it may seem, if you have little prior experience in the field, you should try to avoid futures trading.

How Profitable Is Crypto Futures Trading?

Crypto futures trading futures can be profitable, and many people do so comprehensively. But, to do it safely and with more rewards than losses, it takes time and experience. Trading cryptocurrency futures have the potential to be very rewarding with careful risk management. Not to mention, significant hazards associated with trading, in general, should not be disregarded.

Conclusion

Cryptocurrency futures contracts can be a smart choice if you want to trade on the cryptocurrency market but won’t need to utilize cryptocurrencies as a payment method. You won’t need to create a digital wallet or have a safe address to trade them. Futures contracts offer leverage, but highly volatile assets like Bitcoin constrain the amount of leverage.

Traders can improve their crypto future trading by following the recommended principles described in this article. Conduct your own research and, if necessary, speak with a competent financial advisor.