Proprietary trading firms, often called prop firms, play a crucial role in the financial world. They enable traders to operate with significant capital without committing personal funds upfront. Here are some cheap $100K funded accounts that provide substantial capital at a lower cost, making it easier for traders to start with a sizable amount. These firms offer not only funding but also valuable support through educational resources, mentorship, and advanced trading tools.

The $100K funding accounts are particularly noteworthy. They offer a substantial amount of capital, allowing traders to implement larger and more varied trading strategies. This level of funding is especially beneficial for experienced traders looking to maximize their trading potential and financial returns. With $100K at their disposal, traders can explore diverse markets and strategies, enhancing their opportunities for success.

Prop Firm Rating Criteria

When evaluating prop firms, especially those offering the Cheapest $100K Prop Firm Accounts, several key factors should be considered:

- Reputation and Reliability: Review the firm’s historical performance, trader testimonials, and standing within the industry.

- Profit Sharing Structure: Examine how profits are divided between the firm and its traders, looking for generous and fair distribution.

- Support and Resources: Evaluate the extent of support provided, such as analytical tools, market insights, and ongoing educational opportunities.

- Terms and Conditions: Understand the firm’s specific requirements, including maximum drawdown limits, profit targets, and the steps involved in the evaluation process.

- Types of Instruments Offered: Ensure the firm supports trading in the instruments that align with your trading interests and strategies.

Benefits of a $100K Funding Account

- Unlocked Market Access: A larger capital base empowers traders to engage in significantly larger and more diverse trading opportunities.

- Reduced Personal Risk: Traders can pursue high-value trades without the burden of risking their own capital, allowing for more focused decision-making.

- Enhanced Learning and Growth: Access to significant capital provides an excellent platform for experimenting with and refining trading strategies, accelerating skill development.

- Increased Profit Potential: When successful trading strategies are employed, larger account sizes typically translate to a greater profit potential.

5 Cheap Prop Firms with $100K Funding Accounts

1. Maven Trading

Overview:

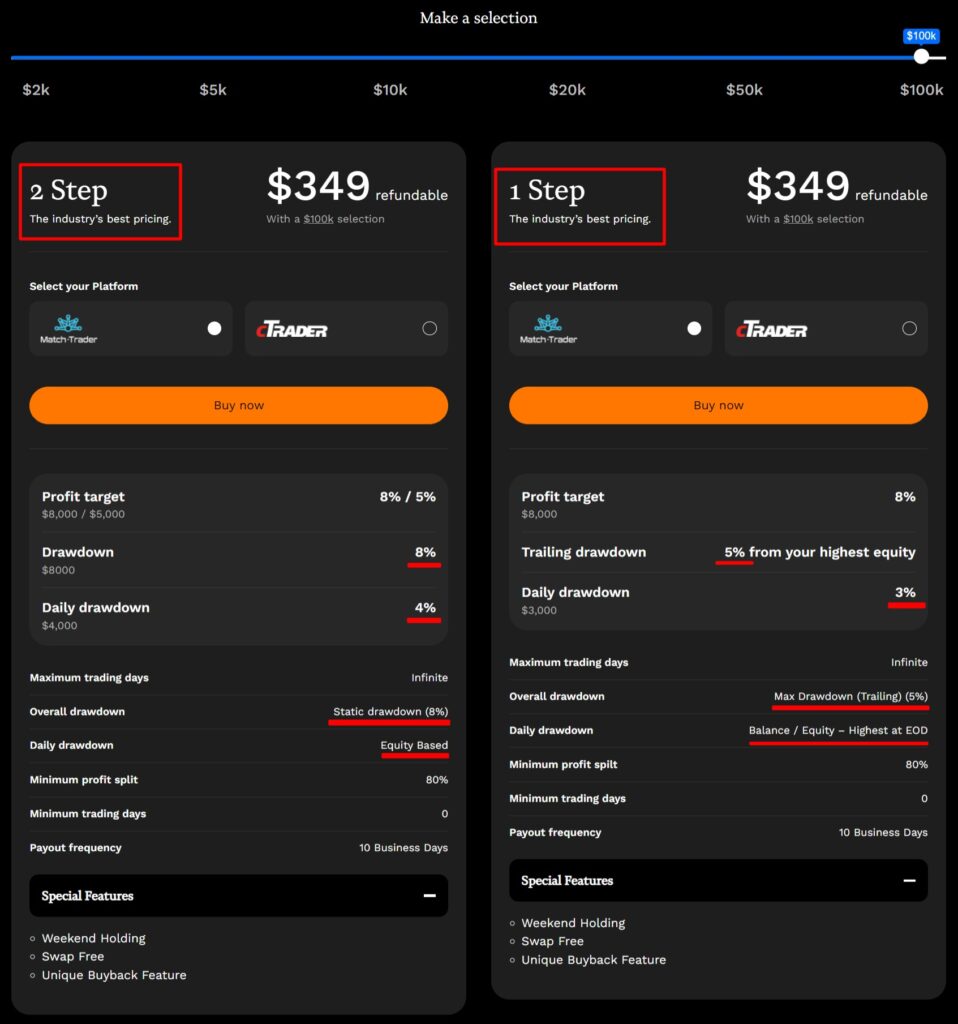

Maven, established in November 2022 and operating from Canada, has rapidly built a strong presence in the proprietary trading sector. The firm offers dynamic trading challenges and competitive conditions, facilitating access to substantial capital. It caters to traders of all experience levels, aiming to boost growth and profitability through well-structured programs. Additionally, Maven stands out as one of the industry’s most affordable proprietary trading firms, offering some of the cheapest $100K funded accounts, $50K accounts, and cheapest $5K accounts. Currently, no prop firm offers the same stability and affordable pricing as Maven. Regarding cheap but reliable prop firms, Maven is always at the top.

Location:

Canada

What Can You Trade:

- Forex

- Crypto

- Indices

- Commodities

Profit Share:

80%

Highlights:

- One-Step Evaluation Process: Simplifies access to trading capital by requiring traders to achieve an 8% profit target within a structured evaluation framework.

- Competitive Commission Rates: Maven charges $4 per round lot, maintaining a balance between cost and quality of trading conditions.

- Equity-Based Leverage: Provides flexibility in trading strategies focusing on effective risk management.

Summary:

Maven offers a $100K funding account for just $349, whether you choose a 1-step or 2-step evaluation, making it an unbeatable choice for serious traders aiming to elevate their trading careers. While a $100K account might seem expensive for some, reviews of Maven are very positive. With over 1,000 people posting their reviews on Trustpilot, Maven boasts an excellent 4.6 score. What sets Maven apart is its generous 80% profit share and a streamlined evaluation process, making it easier for you to achieve significant earnings. With a strong commitment to ethical trading practices and trader education, Maven is dedicated to your success, providing you with the essential tools and opportunities to thrive in a competitive market.

Pros:

- Substantial profit sharing motivates traders to maximize their performance.

- Simplified evaluation process allows quicker access to substantial trading capital.

- Supports a broad spectrum of trading instruments on advanced platforms.

Cons:

- The specific profit targets and risk parameters might not align with every trader’s style.

2. TradeDay

Overview:

Established in early 2020, TradeDay has carved out a niche in the prop trading market by specializing in futures. This U.S.-based firm, under the leadership of James Thorpe, provides a range of trading account sizes, accommodating traders with various capital capabilities from $10,000 up to $250,000. The company prides itself on a straightforward evaluation process that expedites funding accessibility, focusing on tailored profit targets and controlled drawdowns. TradeDay operates using leading platforms like Tradovate, NinjaTrader, TradingView, and Jigsaw, and offers access to significant futures markets including CME, CBOT, NYMEX, and COMEX.

Location:

United States

What Can You Trade:

Only futures products, across exchanges like CME, CBOT, NYMEX, and COMEX.

Profit Share:

Keep the first $10,000 you make, then 90% thereafter.

Highlights:

-

- Focused Futures Trading: TradeDay is specialized, offering expertise in futures markets, facilitating effective trading strategies.

-

- Profit Sharing: Once traders are funded, they can keep the first $10,000 they make and then 90% of the profits thereafter, with no restrictions on withdrawal frequency.

-

- End of Day Trailing Max Drawdown: This feature helps manage risk by limiting the amount a trader’s portfolio can decrease in value over a single day, providing a safety net for evaluation traders.

-

- Community and Resources: TradeDay has a vibrant community with forums and a Discord group, plus a wealth of educational resources to help traders at every stage of their journey.

-

- Free Resets on Subscription Renewal: TradeDay offers free resets of evaluation metrics with each subscription renewal, allowing traders another chance to meet the evaluation criteria without additional cost.

-

- No Monthly TradeDay Membership Fees: Funded traders are not required to pay any monthly membership fees, reducing their overhead costs and maximizing their potential net earnings.

Summary:

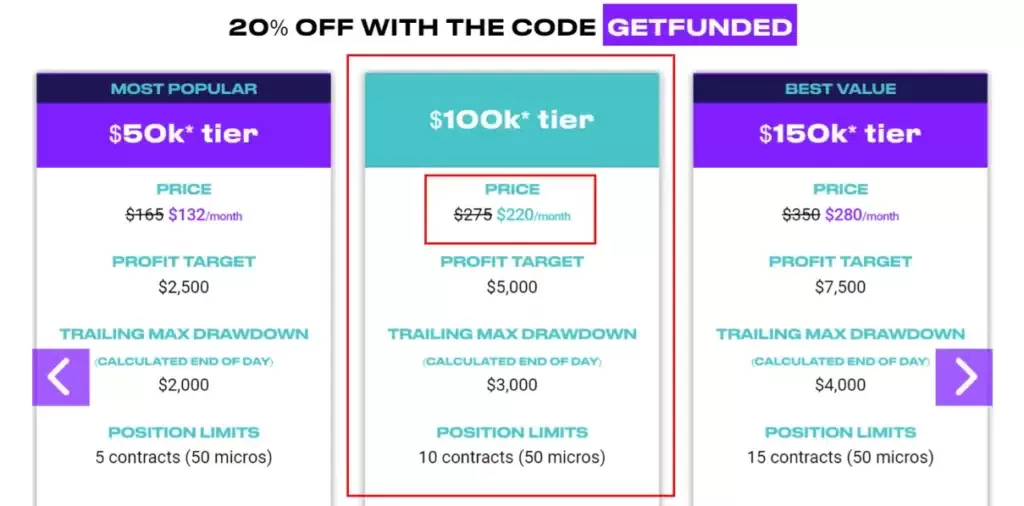

TradeDay presents a robust option for futures traders with its $100K funding accounts offered at an introductory rate of $220/month after discounts. The original price is $275. The firm’s flexibility in account sizes, combined with high profit-sharing and access to premier trading platforms, positions it as a desirable choice for traders looking to leverage futures markets effectively. The simplified funding process and specialization in futures make TradeDay a compelling choice for traders aiming for rapid advancement.

Pros:

-

- EOD drawdown.

-

- High profit share.

-

- Varied account sizes.

-

- Exclusive focus on futures.

-

- Keep the first $10K

Cons:

-

- Only futures

3. My Funded FX

Overview:

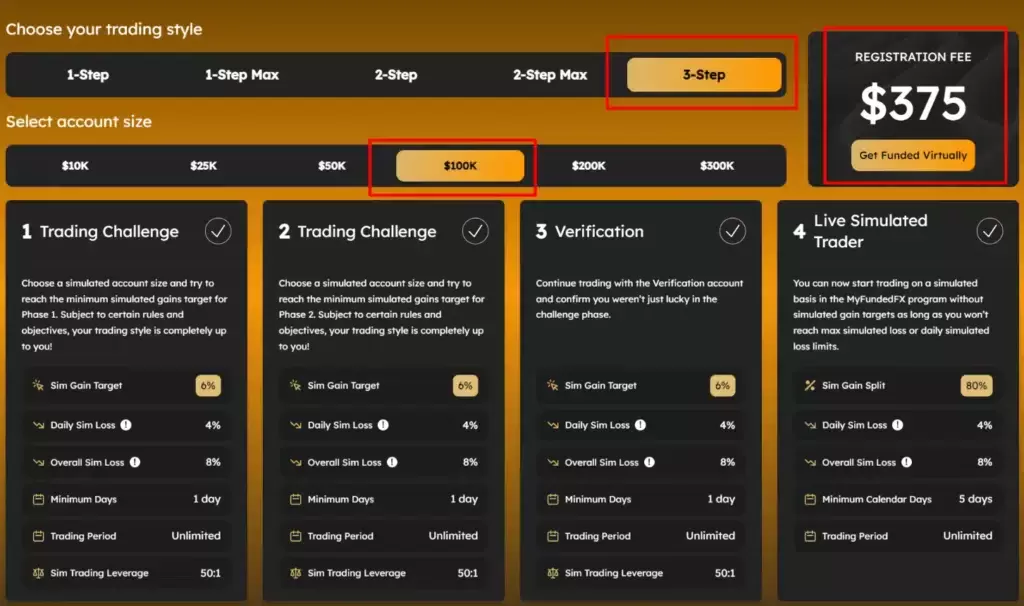

Established in June 2022 and headquartered in the United States, MyFundedFX is led by CEO Matthew Leech. The company provides trading capabilities on platforms such as MatchTrader, cTrader, and DXTrade, working alongside broker like ThinkMarkets. It accommodates a broad range of traders with accounts ranging from $5,000 to $300,000. My Funded FX has implemented a structured, 3-Step evaluation process designed to thoroughly assess and develop the skills of its traders. Each stage demands traders achieve a profit target of 6%, with maximum allowable drawdowns between 6% to 10%. The company offers access to a variety of trading instruments, including Forex, Metals, Commodities, and Cryptocurrencies, and provides flexible leverage options.

Location:

United States

What Can You Trade:

An extensive selection of instruments, including Forex, Metals like Gold and Silver, Commodities such as Oil, various Indices, and major Cryptocurrencies like Bitcoin and Ethereum.

Profit Share:

Up to 80%

Highlights:

-

- Simulated Funding: Offers up to $600,000 in simulated capital.

-

- Unlimited Trading Days: No maximum trading days across all plan types and phases.

-

- Quick Account Setup: Potential to access your live simulated account within 2 days.

-

- No Trading Style Restrictions: Trade freely within certain rules and objectives.

-

- Daily Simulated Stop-Loss: Enforces a maximum daily simulated loss limit.

-

- Partnership with Swift Journal: Automates trade journaling and copies all your simulated trades.

-

- High Leverage Options: Leverage up to 1:100 on Forex.

Summary:

My Funded FX is recognized for its distinctive 3-Step Evaluation process, tailored for traders who consistently meet specific profit targets within strict drawdown limits. The company, based in the United States, provides diverse trading instruments and leverage options. It offers a robust platform for serious traders aiming for significant growth and profit opportunities. Pricing for accounts includes a $100K account available at $500 for their 1-step and 2-step programs, and a $100K account through a 3-step program at a reduced cost of $375.

Pros:

-

- Swift Journal

-

- Unlimited trading days

-

- Affordable pricing

-

- Up to 100:1 leverage

-

- Responsive support

Cons:

-

- The 3-Step evaluation process may be daunting for less experienced traders.

4. TopStep

Overview:

TopStep, founded in January 2012 by Michael Patak and originally known as Patak Trading Partners before rebranding to TopstepTrader, operates out of the United States. This prop trading firm offers the Trading Combine, a distinctive funding program that allows traders to operate without risking personal savings by providing live capital. TopStep specializes exclusively in futures trading and emphasizes development and success in a risk-managed environment.

Location:

United States

What Can You Trade:

-

- E-Mini S&P 500 (ES)

-

- E-Mini NASDAQ 100 (NQ)

-

- E-Mini Russell 2000 (RTY)

-

- Mini-DOW (YM)

-

- Micro S&P 500 (MES)

-

- Micro NASDAQ 100 (MNQ)

-

- Crude Oil (CL)

-

- Gold (GC)

Profit Share:

90%

Highlights:

-

- Simplified Process: 1 Step. 1 Rule. 1 Goal.

-

- Contract Limits Based on Account Size: Implements a balance-based trading model, allowing traders to handle up to 5 contracts on a $50K Trading Combine, fostering responsible trading practices without traditional leverage.

-

- Multiple Accounts: Manage and earn from up to 3 Express Funded Accounts.

-

- Multiple Accounts: Manage and earn from up to 3 Express Funded Accounts.

-

- Simple Payout Policy: Achieve 5 winning days with gains of over $200 for a payout.

-

- Fast Payout Processing: Daily processing of earnings for quick access.

Summary:

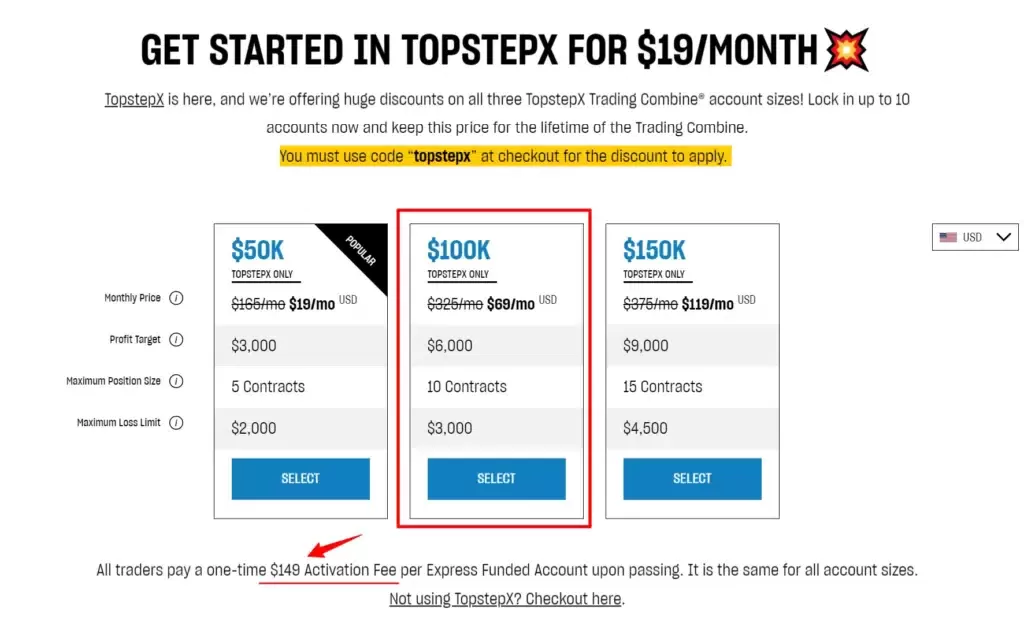

TopStep offers a $100K funding account for $69/month, positioning it as a highly competitive option for traders who wish to develop their skills using live capital in a no-risk setting. However, there is a $149 activation fee once you pass the challenge. The firm’s model does not involve traditional leverage but permits trading up to specified contract limits based on account size, focusing on cultivating sustainable trading behaviors. TopStep is well-regarded for its dedication to trader success and professional growth, making it a prime choice for futures traders seeking to advance their careers.

Pros:

-

- Real trading environment without personal financial risk.

-

- Comprehensive range of futures instruments available.

-

- Frequent payout opportunities.

-

- New traders receive 50% off their first subscription reset.

-

- All trades are flattened at day’s end.

Cons:

-

- Limited to futures trading.

-

- Preset contract limits may hinder traders preferring higher leverage or larger positions.

5. Goat Funded Trader

Overview:

Goat Funded Trader has established a strong reputation in the proprietary trading sector, offering traders a reliable and supportive environment to grow their trading careers. Known for its user-friendly platform and exceptional customer support, Goat Funded Trader provides competitive conditions and robust trading tools. The firm caters to traders of all experience levels, with a focus on fostering growth and profitability through well-structured programs. Goat Funded Trader has become a popular choice among traders seeking a dependable prop firm with a streamlined approach.

Location:

Spain

What Can You Trade:

Forex, Indices, Gold & Commodities, Cryptos

Profit Share:

Up to 95%

Highlights:

-

- Substantial Funding: Offers up to $800,000 in initial funding with the possibility to scale up to $2 million in simulated capital.

-

- Profit Withdrawal On Demand: This option allows for early profit withdrawal—just three days after the first trade—with a minimum of 3% profit.

-

- Flexible Profit Split Options: An initial 40% profit split is available on demand, with up to 95% as traders progress and demonstrate trading expertise.

-

- Versatile Trading Instruments: Trade Forex, Metals, Indices, Stocks, and even Cryptocurrencies.

-

- Advanced Trading Platforms: Utilize popular platforms like MT4, complemented by in-house technology for seamless trading.

-

- Supportive Trading Conditions: No time limits on trading, with the opportunity to trade crypto CFDs over weekends.

-

- Enhanced Trading Tools: 0$ commission on indices and Crypto CFD, and access to MTJ software free for one month.

Summary:

Goat Funded Trader offers a competitively priced $100K trading account for just $398, making it one of the most affordable options available. For traders looking for higher drawdown options, Goat Funded Trader also provides the No Time Limit and Swing accounts, both of which are affordably priced. This prop firm is gaining popularity for its reliability and excellent pricing, positioning it alongside Maven as a top choice in the industry.

Pros:

-

- Access to advanced trading platforms and tools.

-

- Various evaluation and scaling options.

-

- Partnerships with top-tier brokers.

Cons:

-

- 2nd phase profit target is higher than Maven.

Comparison and Analysis

Maven

Maven, established in 2022 in Canada, offers dynamic trading challenges and competitive conditions for traders at all levels. Its $100K funding accounts are available at $299. Maven highlights include an 80% profit share and a streamlined one-step evaluation process. The firm supports a variety of trading instruments like forex, crypto, indices, and commodities, making it a versatile choice for traders seeking broad market access.

TradeDay

TradeDay specializes in futures trading and offers $100K funding accounts starting at $220/month. This firm, established in 2020 and operating out of the United States, supports a wide range of futures products across major exchanges like CME, CBOT, NYMEX, and COMEX. Key highlights include a 90% profit share and an efficient one-step evaluation process, which simplifies the path to funding for both new and experienced traders. TradeDay’s specialized focus may limit its appeal to traders interested in other financial instruments but offers deep expertise in futures.

My Funded FX

My Funded FX, based in the United States and established in June 2022, provides $100K funding accounts at price of $375. It distinguishes itself with a detailed 3-Step evaluation process, targeting traders skilled in maintaining consistent profitability under strict drawdown limits. The firm offers a profit share of up to 80% and supports a wide range of trading instruments, making it suitable for traders who appreciate a structured path to growth and who can handle high leverage options. While offering many opportunities for trader development, the firm’s rigorous evaluation might be intimidating for less experienced traders.

TopStep

TopStep, founded in 2012 in the United States, is distinguished by its Trading Combine program, offering $100K funding accounts for $69/month. The firm exclusively trades futures and is renowned for its emphasis on sustainable trading practices without traditional leverage. TopStep offers a 90% profit share and enables daily payouts, appealing to traders who value frequent liquidity and a real trading environment without personal financial risk.

Goat Funded Trader

Goat Funded Trader offers a $100K trading account starting at $398. It features no time limits on evaluations, allowing trading over weekends and during news without strict restrictions. Profit shares reach up to 95%, with no commissions on indices and cryptocurrency CFDs.

In Conclusion

Choosing the right prop firm is crucial for traders aiming to maximize their potential with a $100K funding account. Firms like TradeDay, Goat Funded Trader, My Funded FX, TopStep, and Maven offer unique advantages and competitive pricing, catering to different trading needs and styles. Each firm’s specific features—from risk management and profit sharing to evaluation processes and trading platforms—provide traders with the tools necessary for success in the financial markets. These prop firms offer substantial opportunities for traders to expand their trading capabilities and achieve their financial goals. Traders are encouraged to consider their specific needs and preferences when selecting a prop firm to ensure the best fit for their trading style and career aspirations. Elevate your trading journey with a partner that not only funds but also fosters your growth in the global financial markets.