Managing multiple accounts while keeping your trading strategies consistent can be a tough task in Forex prop trading. This is where the best trade copiers come into play. A trade copier allows traders to automatically replicate trades from one account to multiple others, ensuring all accounts follow the same strategy without needing manual intervention. This automation not only saves time but also ensures uniformity across various accounts, which is vital for managing risk and enhancing trading performance.

As the demand for efficient and reliable tools in Forex prop trading grows, finding the best trade copier is becoming increasingly important. Whether you’re managing multiple accounts for a prop firm or looking to streamline your trading process, choosing the right trade copier can significantly impact your success.

Best Trade Copiers for Forex Prop Traders in 2024

Here are some of the best trade copiers for Forex prop traders, designed to enhance efficiency and consistency in managing multiple trading accounts:

1. MetaTrader 5 (MT5)

MetaTrader 5 is a widely used trading platform that includes built-in trade copying features, making it a top choice for Forex prop traders.

How it works

MT5 allows traders to copy trades across multiple accounts with just a few clicks. The platform offers extensive tools for algorithmic trading, enabling traders to automate strategies and execute trades based on predefined rules.

Features

- Supports algorithmic trading and custom scripts

- One-click trading directly from charts

- Broad market access with a wide range of financial instruments

- Detailed analytics and reporting tools

Pros and Cons

Pros:

- Comprehensive trading tools

- Wide range of markets available

- Reliable and fast trade execution

Cons:

- Interface may be complex for beginners

- Fewer advanced analytics compared to newer platforms

2. Local Trade Copier (LTC)

Local Trade Copier is a specialized software designed to copy trades between MetaTrader accounts on the same computer or VPS.

How it works

LTC allows traders to replicate orders from a master account to multiple slave accounts. It offers customizable options, including proportional and fixed lot sizing, making it flexible for different risk preferences.

Features

- Simple installation and setup

- Supports various lot sizing methods

- Fast and reliable trade execution with low latency

- Compatible with MetaTrader 4 and 5

Pros and Cons

Pros:

- User-friendly and easy to set up

- Customizable risk parameters

- Low latency ensures timely execution

Cons:

- Primarily supports MetaTrader platforms

- Limited to local connections or VPS setups

3. Signal Magician

Signal Magician is a powerful trade copier platform designed for signal providers and trade managers, allowing them to distribute trades to multiple subscriber accounts simultaneously.

How it works

Signal Magician enables providers to send customized signals, including entry points, stop loss, and take profit levels, to multiple accounts. It is designed to manage large-scale signal distribution efficiently.

Features

- Customizable signal parameters

- In-depth risk management tools

- Supports large-scale signal distribution

- Secure and reliable data transmission

Pros and Cons

Pros:

- Extensive customization options

- Ideal for managing multiple client accounts

- Robust security features

Cons:

- Best suited for signal providers rather than individual traders

- Setup may be complex for beginners

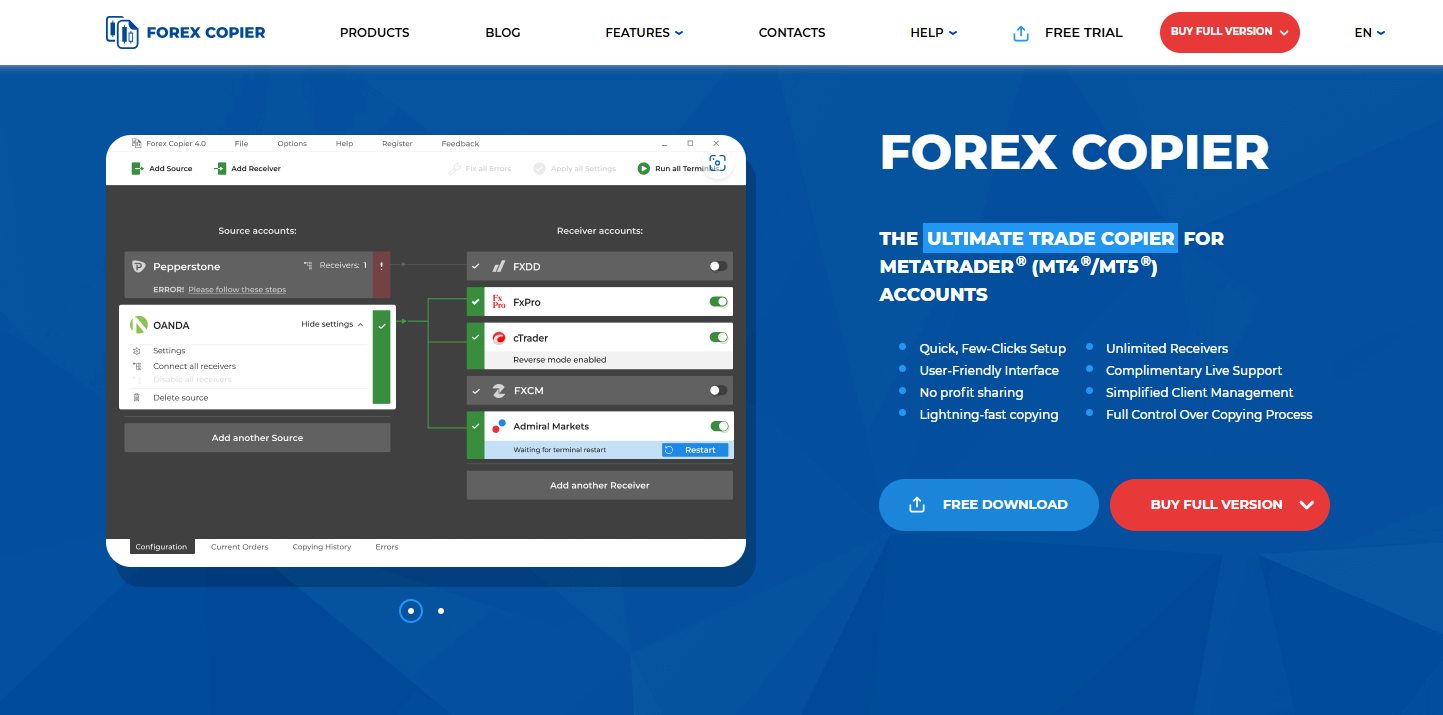

4. Forex Copier

Forex Copier is a dedicated trade copying software specifically for MetaTrader 4, designed to replicate trades between accounts efficiently.

How it works

Forex Copier allows traders to copy trades from one master account to multiple slave accounts, with options for customizing trade parameters such as lot size and direction.

Features

- Multiple copying modes (one-to-one, one-to-many, many-to-one)

- Real-time trade monitoring

- High-speed trade execution with low latency

- Customizable copying parameters

Pros and Cons

Pros:

- Versatile copying options

- Reliable and fast execution

- Easy to set up and use

Cons:

- Limited to MetaTrader 4

- Requires a paid license for full functionality

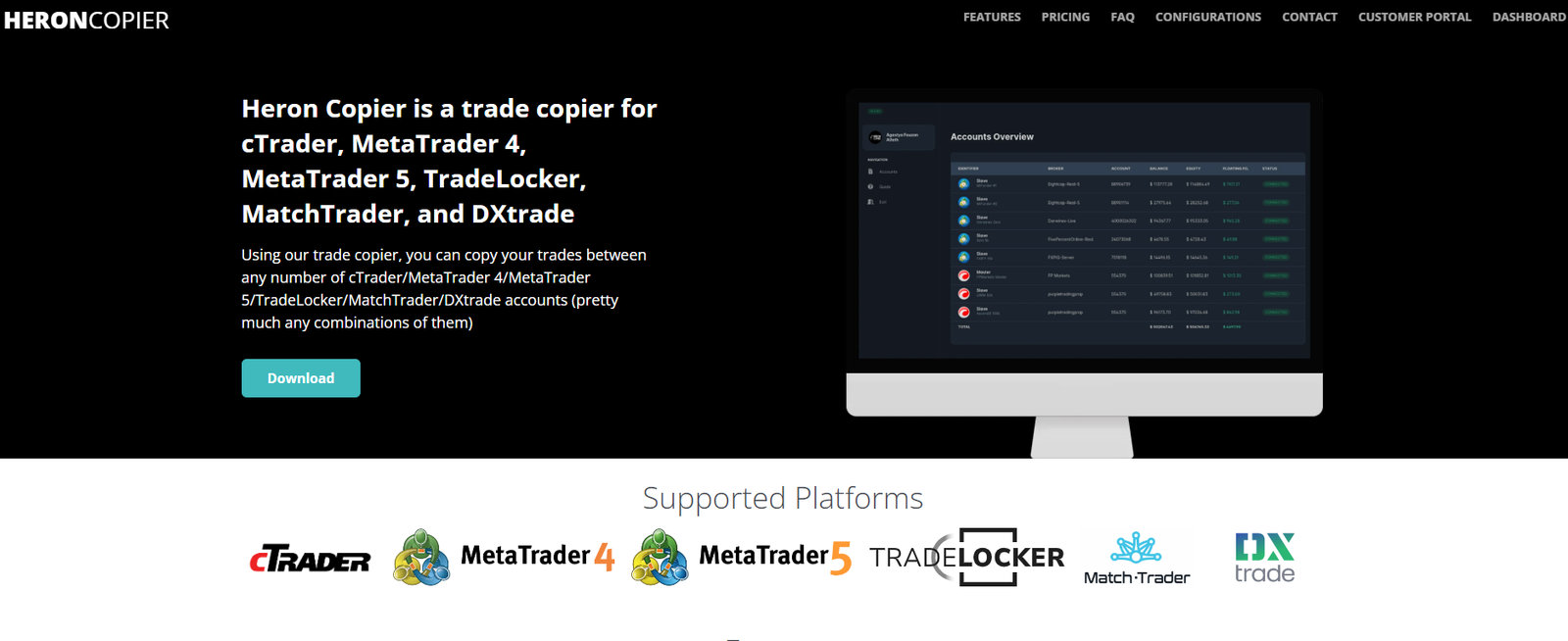

5. Heron Copier

Heron Copier is a robust trade copying software that caters to both retail and professional traders, particularly those involved in Forex prop trading.

How it works

Heron Copier allows traders to synchronize trades across multiple accounts, ensuring that all accounts follow the master account’s strategy. It is known for its high-speed execution and flexibility in managing different trading conditions.

Features

- Multi-platform compatibility, including MetaTrader and cTrader

- Advanced risk management settings

- High-speed trade replication with minimal latency

- User-friendly interface with customizable settings

Pros and Cons

Pros:

- Supports multiple trading platforms

- Highly customizable for different trading strategies

- Reliable execution speed and performance

Cons:

- May require a learning curve for advanced features

- Subscription-based pricing may be a consideration for budget-conscious traders

These trade copiers offer a range of features to suit different trading needs, making them some of the best choices for Forex prop traders looking to streamline their trading processes. Whether you need simplicity, customization, or advanced features, there’s a trade copier in this list to fit your requirements.

What is a Trade Copier?

A trade copier is a software tool that automatically duplicates trades from one account, known as the “master” account, to one or more other accounts, referred to as “slave” accounts. This tool is essential for traders who need to manage multiple accounts simultaneously or for those who want to mirror the trading activities of a more experienced trader.

Trade copiers work by transmitting trade signals from the master account to the connected slave accounts. When a trade is executed in the master account, the copier replicates this trade across all linked accounts, including details like the trade size, stop loss, and take profit levels. This replication happens quickly, ensuring that all accounts follow the same trading strategy with minimal delay.

Trade copiers are particularly valuable in Forex trading, where market conditions can change rapidly. They allow for consistency in trading strategies across multiple accounts, whether in a proprietary trading firm or a personal trading setup. Additionally, trade copiers are commonly used in social trading platforms, where less experienced traders can automatically copy the trades of seasoned professionals.

Key features of trade copiers typically include compatibility with popular trading platforms like MetaTrader 4 and 5, options for customizing risk management, and fast execution to keep accounts synchronized. This makes trade copiers an essential tool for maintaining uniform trading strategies across multiple accounts in the fast-paced Forex market.

Why Forex Prop Traders Need a Trade Copier

Forex prop traders manage multiple accounts and must maintain consistency in their trading strategies across all these accounts. A trade copier becomes an indispensable tool for achieving this, providing several key benefits that are crucial to the success of prop traders.

1. Efficient Management of Multiple Accounts

Forex prop traders often handle multiple accounts simultaneously, whether they are managing their own accounts or those of clients. Manually replicating trades across several accounts can be time-consuming and prone to errors. A trade copier automates this process, ensuring that every trade executed in the master account is immediately mirrored in the linked accounts. This automation saves significant time and effort, allowing traders to focus more on strategy and less on the logistics of trade execution.

2. Consistency in Trade Execution

One of the most critical aspects of successful trading is consistency. When trades are executed manually across different accounts, slight delays or variations in execution can lead to discrepancies in performance. A trade copier ensures that all trades are executed uniformly across all accounts, maintaining consistency in strategy and execution. This uniformity is especially important for prop traders who need to meet specific performance metrics and risk management criteria.

3. Risk Management

Maintaining consistent risk parameters across multiple accounts is vital for prop traders. A trade copier allows traders to set specific risk management rules that apply to all copied trades, such as stop loss and take profit levels, as well as trade sizes. This helps ensure that all accounts adhere to the same risk management framework, reducing the chances of unexpected losses and improving overall performance.

4. Scalability

As a prop trader’s portfolio grows, managing an increasing number of accounts can become challenging. A trade copier provides the scalability needed to handle this growth without sacrificing efficiency or performance. By automating the trade replication process, prop traders can easily manage more accounts as their business expands, without a proportional increase in workload.

5. Adaptability

The Forex market is highly dynamic, and conditions can change rapidly. A trade copier allows prop traders to quickly adapt to these changes by executing trades across all accounts simultaneously. This ability to respond swiftly to market movements is crucial in maintaining a competitive edge and achieving consistent profitability.

Trade copier is an essential tool for Forex prop traders who need to manage multiple accounts while maintaining consistency, efficiency, and strict risk management. It enables traders to scale their operations effectively and adapt quickly to market conditions, all while ensuring that every account is aligned with their overall trading strategy.

Top Features to Look for in a Trade Copier for Forex Prop Traders

When selecting a trade copier for Forex prop trading, it’s important to choose one that meets your specific needs and enhances your trading efficiency. Here are the top features to look for in a trade copier:

1. Compatibility with Trading Platforms

The trade copier must be compatible with popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Since many Forex prop traders use these platforms, ensuring seamless integration is crucial for smooth trade execution and management. Compatibility also ensures that you can easily implement your existing trading strategies without needing to switch platforms.

2. Low Latency and High Speed

Speed is essential in Forex trading, where market conditions can change in an instant. A good trade copier should have low latency to ensure that trades are copied and executed across all accounts without delay. High-speed execution helps maintain synchronization between accounts, which is vital for executing time-sensitive trades effectively.

3. Customizable Risk Management

Risk management is a critical aspect of successful trading, especially in a prop trading environment. Look for a trade copier that allows you to customize risk parameters such as lot sizes, stop loss, and take profit levels. This flexibility lets you tailor the copier to align with your specific risk tolerance and trading strategy, ensuring that all accounts adhere to the same risk management rules.

4. User-Friendly Interface

An intuitive and easy-to-use interface is important for managing multiple accounts efficiently. The trade copier should offer clear, straightforward navigation and easy access to key features. This allows you to set up and monitor trades with minimal hassle, ensuring that you can focus on trading rather than managing the software.

5. Advanced Reporting and Analytics

Detailed reporting and analytics are valuable for evaluating the performance of copied trades. A trade copier that offers in-depth performance tracking, such as win/loss ratios, drawdowns, and profit factors, can help you analyze the effectiveness of your trading strategy. These insights are essential for making informed adjustments and optimizing your overall trading performance.

6. Security and Data Protection

Since trade copiers handle sensitive trading data, security is a top priority. Ensure that the trade copier you choose offers robust encryption and secure data transmission to protect your information. Additionally, look for features that safeguard against unauthorized access and potential data breaches.

7. Scalability

As your trading portfolio grows, your trade copier should be able to scale with it. The ability to manage an increasing number of accounts without compromising performance or speed is crucial for long-term success in prop trading. Choose a trade copier that can handle high volumes of trades and accounts while maintaining efficiency.

8. Reliable Customer Support and Updates

Access to reliable customer support is essential, especially if you encounter issues or need assistance with the trade copier. Additionally, the software should receive regular updates to stay compatible with the latest trading platforms and to introduce new features that enhance functionality.

9. Flexible Pricing Options

Consider the cost of the trade copier in relation to the features it offers. Some trade copiers charge a one-time fee, while others may require a monthly subscription. Evaluate your budget and trading needs to choose a pricing model that offers the best value for the features you require.

By focusing on these key features, you can select a trade copier that best meets the demands of Forex prop trading, ensuring that you can manage multiple accounts effectively while maintaining consistency and control over your trading activities.

How to Choose the Best Trade Copier for Your Forex Prop Trading Needs

Choosing the best trade copier for your Forex prop trading needs requires careful consideration of various factors to ensure that the tool aligns with your trading strategy and goals. Here’s a step-by-step guide to help you make an informed decision:

1. Assess Your Trading Strategy

- Understand Your Trading Style: Are you a day trader, swing trader, or long-term investor? The type of trades you execute will determine the features you need in a trade copier. For example, day traders may require low-latency execution, while swing traders might prioritize advanced risk management tools.

- Volume and Frequency: Consider how many trades you make daily and how many accounts you manage. A high-frequency trading strategy will demand a trade copier that can handle large volumes of trades with minimal delay.

2. Check Platform Compatibility

- Supported Platforms: Ensure that the trade copier you choose is compatible with the trading platforms you use, such as MetaTrader 4, MetaTrader 5, or cTrader. Seamless integration with your trading platform is crucial for smooth trade execution.

- Cross-Platform Support: If you use multiple platforms or plan to switch, select a trade copier that supports a variety of platforms, allowing for flexibility in your trading activities.

3. Evaluate Latency and Execution Speed

- Low Latency: In Forex trading, where market conditions can change in seconds, low latency is essential to ensure that trades are copied quickly and accurately across all accounts.

- Execution Reliability: Look for a trade copier that guarantees high-speed execution and minimal slippage, particularly if you’re trading in volatile markets.

4. Consider Customization Options

- Risk Management: Choose a trade copier that allows you to customize trade parameters, such as lot size, stop loss, and take profit levels. This flexibility is vital for aligning the copier with your risk management strategy.

- Tailored Settings: The ability to set specific copying rules, such as excluding certain trades or adjusting risk on a per-account basis, can help you better control your trading outcomes.

5. Security and Data Protection

- Encryption: Ensure the trade copier uses encryption to protect your trading data and account information. Security is crucial, especially when handling multiple accounts with significant capital.

- Data Integrity: Look for features that prevent unauthorized access and ensure that your data is securely transmitted between accounts.

6. Look for Advanced Reporting and Analytics

- Performance Tracking: A trade copier with detailed reporting and analytics can provide insights into your trading performance. Look for tools that offer reports on win/loss ratios, drawdowns, and overall profitability.

- Historical Data: Access to historical data can help you analyze past trades and refine your strategy for future trades.

7. Evaluate Scalability

- Account Management: If you plan to expand your trading activities, choose a trade copier that can scale with your needs. It should handle an increasing number of accounts without compromising performance.

- Growth Potential: Ensure that the trade copier can support more complex trading strategies as your portfolio grows.

8. Check Customer Support and Updates

- Responsive Support: Reliable customer support is essential, especially if you encounter issues or have questions about the software. Look for providers that offer 24/7 support.

- Regular Updates: The trade copier should receive regular updates to stay compatible with the latest trading platforms and to incorporate new features.

9. Review Pricing and Costs

- Budget Considerations: Trade copiers can come with a range of pricing models, including one-time fees, monthly subscriptions, or commission-based charges. Evaluate your budget and trading frequency to choose a model that offers the best value.

- Cost vs. Features: While it’s important to consider cost, make sure that the trade copier provides all the features you need to enhance your trading performance.

10. Read User Reviews and Testimonials

- Feedback from Other Traders: User reviews can provide valuable insights into the trade copier’s reliability, ease of use, and overall performance. Look for reviews from other Forex prop traders to get an idea of how well the tool works in a real-world setting.

By following these steps, you can select the best trade copier that fits your Forex prop trading needs, helping you to manage multiple accounts efficiently, maintain consistency in your trading strategy, and ultimately achieve better trading outcomes.

Conclusion

Selecting the best trade copier for your Forex prop trading needs is a crucial decision that can significantly impact your trading success. By focusing on the key features such as platform compatibility, low latency, customization options, and strong security, you can ensure that the trade copier you choose will align with your trading strategy and goals. Additionally, considering factors like scalability, advanced reporting, and reliable customer support will help you manage multiple accounts efficiently and adapt to changing market conditions.

Ultimately, the right trade copier will not only streamline your trading process but also enhance your ability to maintain consistency and control across all your accounts. Take the time to assess your specific needs, evaluate the options available, and choose a trade copier that will support your growth and success as a Forex prop trader.