Introduction to the Best Match Trader Prop Firms

Are you looking to trade with enhanced resources and top-tier technology? Explore the best Match Trader prop firms and gain immediate access to funding along with advanced trading tools. Choosing the right proprietary trading firm is critical, especially for traders who value the robust and user-friendly features of the Match Trader platform.

The premier Match Trader prop firms distinguish themselves by offering rapid funding solutions, cutting-edge trading tools designed for the Match Trader environment, and comprehensive educational resources. These firms enable you to start trading quickly and improve your trading skills by leveraging significant capital and the advanced features of Match Trader.

As we examine the offerings and benefits of the leading prop trading firms, our focus will be on their distinctive attributes, including their capability to meet the diverse needs of traders. Whether you are a newcomer in the trading sphere or looking to manage larger funds, understanding what the top Match Trader prop firms have to offer can help you make an informed decision that aligns with your trading goals and preferences.

What Are The Best Match Trader Prop Firms in 2024?

- Best for Comprehensive Support & Flexible Evaluations: MyFundedFX

- Best for Advanced Platform Features & Partnerships: The 5%ers

- Best for Structured Growth & Diverse Trading Instruments: Forex Prop Firm (FPF)

- Best for High Leverage & Scalable Solutions: Swift Funding

- Best for Flexibility in Evaluation & High Leverage: E8 Markets

- Best for Quick Access and Efficient Funding: Union Wealths Management

- Best for Easy Access to Trading Funds: Goat Funded Trader

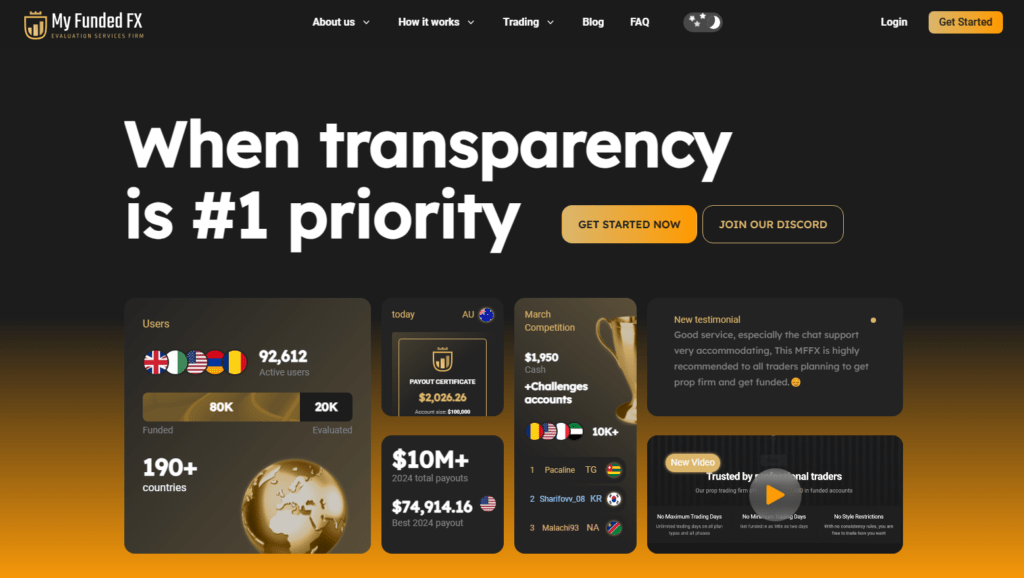

1. MyFundedFX

Overview:

MyFundedFX, led by CEO Matthew Leech and established in June 2022, operates from the United States. This firm is known for its unique approach, providing a simulated virtual trading environment to retail traders. MyFundedFX offers access to a range of trading platforms including DXTrade, cTrader, and Match-Trader, with the latter being exclusively available to US clients. The firm partners with brokers like ThinkMarkets, Purple Trading SC, and MatchTrade to deliver a comprehensive trading experience.

Location:

United States

What Can You Trade:

- Forex

- Commodities

- Indices

- Cryptocurrencies

Profit Share:

Up to 80%

Highlights:

- Platform Accessibility: Provides access to DXTrade, cTrader, and Match-Trader for US clients, ensuring diverse trading experiences.

- Three-Step Trading Evaluation: Offers a progressive challenge system with up to three phases, promoting steady trader advancement.

- Flexible Trading Conditions: Allows news trading with specific restrictions and supports Expert Advisors (EAs), copy trading, and high leverage options up to 100:1.

- Regular and Quick Payouts: Payouts are processed every five days, enhancing trader motivation with quick financial rewards.

- Technological Advancements: Employs cutting-edge technology to simulate real-market conditions in a risk-free demo account setting, encouraging experimental and creative trading strategies.

Summary:

MyFundedFX stands out in the proprietary trading firm market by focusing on risk-free simulated trading environments, making it ideal for beginners and those looking to test strategies without financial risk. With a high Trust Pilot rating of 4.4 and innovative technological infrastructure, it offers a nurturing ground for developing trading skills and strategies.

Pros:

- Offers a unique simulated trading environment.

- Regular payouts with a high profit share of 80%.

- Supports multiple advanced trading platforms.

- Provides flexibility in trading strategies and conditions.

Cons:

- Limited to simulated trading, which might not appeal to traders looking to handle real funds.

- The complex structure of trading challenges might be overwhelming for new traders.

- News trading restrictions could limit specific trading tactics during volatile periods.

2. The 5%ers

Overview:

The 5%ers, established in January 2016 under the guidance of CEO Saul Lokier, operate from Israel and extend their services globally. This proprietary trading firm stands out for its structured three-step trading evaluation, allowing traders to progress and potentially earn up to 100% of the profits. They are committed to trading various instruments including Forex, metals, indices, cryptocurrencies, and commodities, predominantly using the Match Trader platform in collaboration with commercial liquidity providers.

Location:

Israel

What Can You Trade:

- Forex

- Metals

- Indices

- Cryptocurrencies

- Commodities

Profit Share:

Up to 100%

Highlights:

- Exclusive Use of Match Trader Platform: Emphasizes a consistent and stable trading experience with advanced technology features.

- Three-Step Evaluation Process: Challenges traders to enhance their skills with a clear path of progression.

- Low Commissions: Offers competitive trading costs with only $4 charged per round lot on Forex.

- Adaptive Risk Management: No maximum daily loss limits and a static drawdown method encourage strategic trading.

- Educational Support: Provides comprehensive training through its Bootcamp and Hyper Growth programs, tailored to foster disciplined trading.

- Bi-weekly Payouts: Ensures that successful traders receive their profits regularly, enhancing motivation and financial stability.

Summary:

With a high Trust Pilot rating of 4.8, The 5%ers are recognized for fostering a supportive and educational trading environment. They are particularly notable for their implementation of the Match Trader platform, which aligns with their focus on advancing trader skills and managing risks effectively. The firm’s commitment to education and professional growth makes it a standout choice for traders looking to leverage the capabilities of Match Trader.

Pros:

- High profit share potential with up to 100% earnings.

- Low commission structure enhances profitability.

- Focus on comprehensive trader education and development.

- Match Trader platform ensures a reliable and efficient trading experience.

Cons:

- Limited platform choice may not suit all traders.

- Predominantly focuses on Forex and derivatives, which might not appeal to those interested in a wider range of markets.

- The detailed and structured programs might overwhelm beginners.

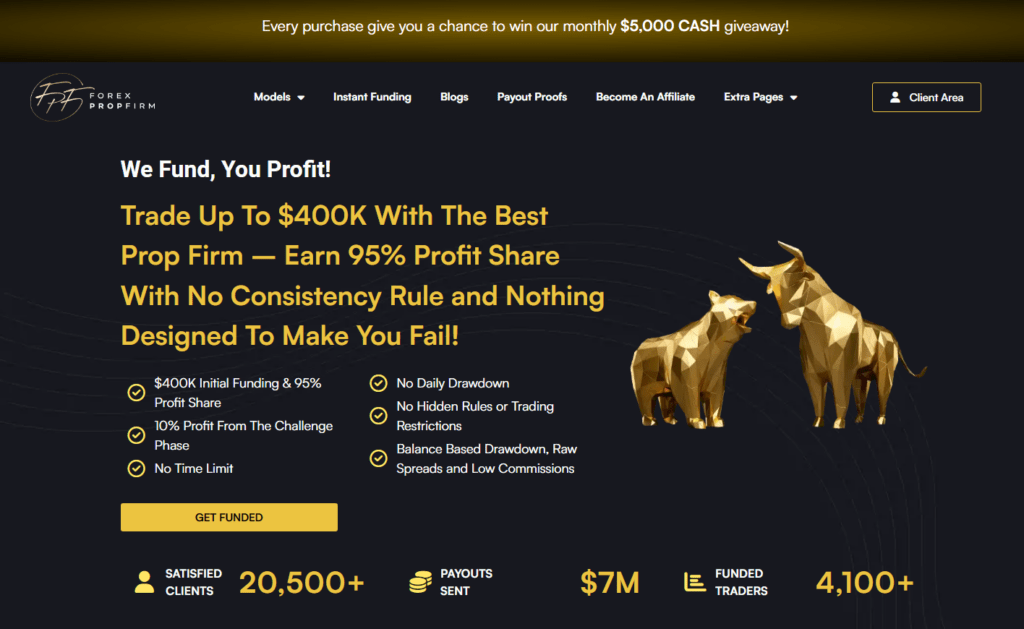

3. Forex Prop Firm (FPF)

Overview:

Forex Prop Firm (FPF), established on January 1, 2022, has quickly ascended to a “TOP PROP FIRM” status by fostering a responsive and adaptable trading environment. Operating under a Canadian company, FPF supports traders with a robust platform designed by traders, for traders, utilizing Match Trader among other platforms. This firm offers a variety of trading programs including 1-Step, 2-Step, 2-Step ∞, and Instant Funding, providing flexibility and opportunity for traders at all levels.

Location:

Canada (Operational Base)

What Can You Trade:

- Forex

- Crypto

- Commodities

- Indices

Profit Share:

- Up to 90% for challenge programs

- 80/20 for instant funding accounts

Highlights:

- Multiple Trading Programs: Offers 1-Step, 2-Step, 2-Step ∞, and Instant Funding accounts to suit various trader needs and strategies.

- High Profit Shares: Commits up to 90% profit share from day one on challenge accounts.

- Flexible Trading Conditions: Supports news trading, weekend holding, use of Expert Advisors, and trade copiers without restrictions.

- Innovative Trading Platforms: Utilizes Match Trader, ensuring a cutting-edge trading experience tailored to modern trader demands.

- Supportive Educational Environment: Aims to educate and support traders through comprehensive feedback and improvement strategies.

- Quick and Flexible Payouts: Processes payouts within 1-5 business days and allows requests every 15 days, using multiple methods including digital assets.

Summary:

FPF stands out for its dynamic and trader-centric approach, offering a high degree of flexibility in trading strategies and conditions. With over $6 million in payouts and a growing community of 3,000+ funded traders, FPF is recognized for its transparent and supportive trading environment. The firm’s use of Match Trader platform underscores its commitment to providing reliable and advanced trading tools.

Pros:

- High profit splits ensuring maximum earnings for successful traders.

- No restrictions on trading styles, allowing full strategic freedom.

- Rapid payouts with a variety of payment methods.

Cons:

- Relatively new in the industry, which might concern traders looking for long-established track records.

- The array of options and flexibility might be overwhelming for novice traders without proper guidance.

4. Swift Funding

Overview:

Swift Funding is renowned for propelling trading careers to new heights with a professional approach, leveraging the Match Trader platform. Established by a team of industry experts, Swift Funding offers traders a range of evaluation plans including Sprint, Pro, and Elite, each designed to cater to different levels of trader expertise. The firm operates globally, supporting traders from over 190 countries, although it adheres to regulatory restrictions that exclude certain nations.

Location:

Global (with specific country restrictions)

What Can You Trade:

- Forex

- Commodities

- Indices

- Cryptocurrencies (specific plans)

Profit Share:

Up to 80% on profits made

Highlights:

- Variety of Account Options: Offers account sizes from $5,000 to $100,000, with potential trading up to $200,000.

- Structured Evaluation Plans: Includes one-step and two-step evaluation plans to suit different trading strategies and levels of experience.

- Advanced Trading Conditions: Utilizes high leverage up to 100:1, allowing traders to maximize their trading potential.

- Flexible Trading Rules: Supports a mix of trading strategies, including the use of trade management EAs and news trading, providing traders with the flexibility to exploit market conditions.

- Comprehensive Support and Compliance: Ensures a secure trading environment with a strict adherence to Anti-Money Laundering and KYC regulations to maintain platform integrity.

Summary:

Swift Funding distinguishes itself with a focus on professionalism and expansive support tailored for consistent and skilled traders. Using the Match Trader platform, it offers robust technology and a broad range of trading conditions designed to accommodate various trading styles. The firm’s commitment to regulatory compliance and global reach makes it a standout choice for traders seeking a reliable and structured trading career pathway.

Pros:

- Supports a wide range of trading strategies and styles.

- Offers competitive profit shares and high leverage options.

- Provides clear, structured paths to funding through various account types and challenge phases.

Cons:

- Excludes traders from several countries due to regulatory restrictions, limiting its global accessibility.

- Does not allow the use of all types of Expert Advisors, which may restrict automated trading strategies.

5. E8 Markets

Overview:

E8 Markets, spearheaded by CEO Dylan Elchami, was established in November 2021 in the United States. This proprietary trading firm has quickly made a name for itself in the industry, particularly notable for its use of both MT5 and Match Trader platforms, with the latter exclusively for U.S. clients. E8 Markets specializes in Forex, commodities, indexes, and cryptocurrencies, offering robust trading conditions and innovative account plans.

Location:

United States

What Can You Trade:

- Forex

- Commodities

- Indexes

- Cryptocurrencies

Profit Share:

Up to 85% (80% base + 5% bonus on first payout)

Highlights:

- Diverse Trading Platforms: Utilizes MT5 and Match Trader, ensuring a versatile trading experience that caters to a broad audience, including exclusive options for U.S. clients.

- Competitive Account Options: Offers accounts ranging from $10K to $200K with three-step and two-step progression models, facilitating growth and advancement in trading careers.

- Zero Commission Trading: Charges no commissions on Forex trades, enhancing profitability for traders.

- Flexible Trading Conditions: Supports advanced trading features like expert advisors, copy trading, and news trading, accommodating various trading styles and strategies.

- Rapid and Incremental Payouts: Features a 14-day payout frequency, encouraging consistent trading activity and performance.

Summary:

E8 Markets is distinguished by its commitment to providing advanced trading tools and a supportive environment for traders aiming to leverage their skills in the financial markets. With a high Trust Pilot rating of 4.8 and a clear focus on technological excellence and trader development, E8 Markets offers substantial opportunities for both novice and experienced traders. The firm’s rebranding to focus more on market dynamics and trader empowerment underlines its progressive approach to prop trading.

Pros:

- Offers a high profit split with a bonus on the first payout.

- Provides strong technological support with two major trading platforms.

- Features a broad range of trading instruments and flexible account structures.

Cons:

- Relatively new in the market, which might be a concern for traders looking for long-established credibility.

- Specific platform restrictions for U.S. clients may limit options for those accustomed to diverse platform experiences.

6. Union Wealths Management (UWM)

Overview:

Union Wealths Management, established in November 2022 by the notable @SandroUWM, operates out of the United Arab Emirates. UWM leverages platforms such as DXTrade, cTrader, and notably MatchTrader—catering extensively to their clients, including specific offerings for different regional needs. The firm offers a wide range of instruments including Forex, indices, metals, and cryptocurrencies.

Location:

United Arab Emirates

What Can You Trade:

- Forex

- Indices

- Metals

- Cryptocurrencies

Profit Share:

Up to 85%, with an additional 5% bonus on the first payout.

Highlights:

- Versatile Trading Platforms: Features DXTrade, cTrader, and MatchTrader, which is a key platform for their operations.

- Advanced Risk Management: Implements a sophisticated, balance-based drawdown reset system to optimize trading outcomes.

- Generous Profit Splits and Bonuses: Offers an 85% profit split and potential bonuses, enhancing trader earnings potential.

- Comprehensive Educational Resources: Provides extensive training courses, including a Mastery Course and psychological trading strategies.

- Global Accessibility: Despite restrictions in OFAC-sanctioned countries, UWM maintains a broad operational base.

Summary:

Union Wealths Management is distinct for its integration of advanced trading platforms and a strong focus on educational support, aiming to equip traders with the skills necessary for success. The firm’s high profit split and the inclusion of MatchTrader platform highlight its commitment to providing flexible and advantageous trading conditions.

Pros:

- High profit share with a bonus on initial payouts.

- Access to multiple top-tier trading platforms, including MatchTrader.

- Strong educational offerings that cover trading strategies and psychological disciplines.

Cons:

- Relatively new in the marketplace, which might affect trust for some potential clients.

- Restricted access for traders from several countries due to regulatory compliance.

7. Goat Funded Trader

Overview:

Established in May 2023 by CEO Edoardo Dalla Torre, Goat Funded Trader operates from Spain, utilizing advanced trading platforms such as Match Trader and ThinkTrader (specifically for US clients). The firm offers trading opportunities in Forex, commodities, indices, equities, and cryptocurrencies, catering to a diverse trader demographic.

Location:

Spain

What Can You Trade:

- Forex

- Commodities

- Indices

- Equities

- Cryptocurrencies

Profit Share:

Up to 95%, starting at 80%, with specific conditions enhancing profitability.

Highlights:

- Specialized Trading Platforms: Utilizes Match Trader prominently, ensuring robust trading solutions.

- Flexible Trading Conditions: Features no minimum trading days and up to 100:1 leverage, providing significant flexibility.

- Innovative Payout Structure: Offers payouts within 24 hours of the first trade, with a monthly continuation.

- Educational Empowerment: Emphasizes trader education and the provision of resources to foster trading acumen.

Summary:

Goat Funded Trader is recognized for its modern approach and flexible trading conditions. The firm’s use of Match Trader underscores its commitment to leveraging technology to benefit its clients. The structure of its profit shares and quick payout options make it attractive to traders looking for rapid returns on their trading strategies.

Pros:

- High leverage options and rapid payouts enhance trading dynamics.

- Access to cutting-edge platforms like Match Trader.

- No restrictions on trading days or styles, promoting a flexible trading approach.

Cons:

- Being a new entity in the market may pose a trust barrier for potential clients.

- Restricted news trading options might limit traders who specialize in news-driven strategies.

Benefits of the Best Match Trader Prop Firms

Partnering with best Match Trader prop firms brings specific benefits tailored to traders who value state-of-the-art technology and substantial support. Here’s a detailed look at the advantages they provide:

- Direct Access to Sophisticated Trading Platforms: Match Trader prop firms offer direct access to the Match Trader platform, renowned for its user-friendly interface and advanced functionalities that cater to both new and experienced traders.

- Enhanced Trading Conditions: These firms are equipped with Match Trader’s integrated tools that support various trading strategies directly on the platform, enabling detailed analysis and efficient execution.

- Lower Risk with Firm Capital: Trading with a prop firm’s capital allows traders to engage in the markets without risking their personal funds. This can encourage more aggressive strategies with higher potential returns.

- Competitive Profit Splits: Match Trader prop firms often offer attractive profit splits, which incentivize traders by letting them keep a large portion of the profits they earn.

- Diversity in Trading Instruments: With Match Trader, prop firms typically provide access to a diverse range of financial instruments, including forex, commodities, indices, and more, allowing traders to diversify their strategies.

- Scalable Trading Opportunities: Successful traders at these firms may have opportunities to manage increased capital, providing a clear path for career progression and higher earnings potential.

- Global Market Access: Match Trader firms often operate on a global scale, giving traders access to international markets and a wider array of trading opportunities.

- Supportive Educational Resources: Top firms also focus on trader education, offering training modules, webinars, and one-on-one coaching that leverage Match Trader’s features to enhance learning.

In Conclusion

Our review of the best Match Trader prop firms underscores that each offers distinct benefits tailored to different trading preferences. These firms excel with their advanced trading platforms like Match Trader, offering substantial leverage options and a broad array of instruments to enhance a trader’s success in the financial markets. Here’s a summary of how the best Match Trader prop firms distinguish themselves based on their key features:

- Best for comprehensive support and flexible evaluations: MyFundedFX

- Best for advanced features and strategic partnerships: The 5%ers

- Best for structured growth and diverse instruments: Forex Prop Firm (FPF)

- Best for high leverage and scalable solutions: Swift Funding

- Best for evaluation flexibility and high leverage options: E8 Markets

- Best for quick access and efficient funding processes: Union Wealths Management

- Best for easy access to trading capital: Goat Funded Trader

This summary aims to help traders identify the best Match Trader prop firm that best matches their specific trading needs and goals. It’s vital for traders to consider key factors such as available trading instruments, preferred trading strategies, and their long-term professional aims when selecting an appropriate prop firm.