Hydra Funding Review

Trading can be rewarding, but it’s also risky—especially when it comes to prop trading firms offering funded accounts. That’s why it’s important to know exactly what you’re signing up for.

Hydra Funding has been in the game for almost two years, but is it worth your time and money? In this review, we’ll break down everything you need to know, from funding programs and fees to tradable assets and restrictions, so you can decide if Hydra Funding is the right choice for you.

About Hydra Funding

Hydra Funding positions itself as a prop firm built by traders, for traders. Their goal? To create a level playing field for everyone, whether you’re a novice or a seasoned pro. They offer 24/7 live chat support, ensuring help is always available no matter where you’re trading from.

The team behind Hydra includes experienced traders, which is reflected in their platform’s design. They offer 1-phase accounts and 2-phase accounts, giving flexibility to match your style. With access to Forex, Cryptocurrency, Stocks, and CFDs, Hydra Funding covers a wide range of markets.

Co-founder Cameron Fous, a professional trader since 2005, plays a hands-on role. Not only does he trade on the platform himself, but he also shares his insights on day trading and swing trading through his YouTube channel, offering a transparent look at how Hydra works.

Funding Program Options

Hydra Funding offers Forex and Crypto funded accounts with options for traders at all experience levels. Forex accounts go up to $1,000,000, while Crypto accounts max out at $200,000. Traders can earn up to a 90% payout share, with no time limits or trailing drawdown. For example, a $100,000 Forex account costs $750 to start.

Traders can choose between one-phase or two-phase challenges, with leverage options tailored to the asset type:

Crypto: Up to 1:5

Forex and Metals: Up to 1:50

Indices: Up to 1:10

Commodities: Up to 1:5

Start Small, Scale Up

For traders not ready for a big commitment, Hydra Funding offers smaller account options. Start with a $10,000 Forex account for $130 or a $5,000 Crypto account for $45. As you build confidence, you can scale up to larger accounts, with up to $1 million in Forex funding or $200,000 in Crypto funding available across multiple accounts.

Hydra Funding offers a scaling plan up to $5M, which is one of the highest in the entire industry. You can request for your funded account balance to be doubled (up to a maximum of $5M) when the following criteria is met:

- A withdrawal must have been processed on your account before we start tracking these months

- 6 consecutive months where your maximum drawdown (balance based) on the account does not exceed 4%

- Within those 6 months, at least 3 months where the gain on the account exceeded 3%

- Gain on the account of at least 10% since inception

Professional Trading Environment

Hydra Funding provides competitive spreads and fast executions on platforms like cTrader, DXTrade, and MatchTrader. Liquidity is sourced from multiple brokers, ensuring stable and reliable conditions. Raw spreads start as low as 0.0 pips for Forex instruments.

Account Sizes and Daily Loss Limits

Account sizes range from $10,000 for beginners to $1,000,000 for professional Forex traders, and up to $200,000 for Crypto accounts. Risk management rules include:

Maximum Drawdowns:

- Two-Phase Forex: 9%

- Single-Phase Forex: 6%

- Two-Phase Crypto: 9%

- Single-Phase Crypto: 6%

Daily Loss Limits:

- Forex Accounts: 5% of starting balance.

Daily Cap (Crypto Accounts):

- Crypto accounts use a 3% Daily Cap on the starting balance. This is the maximum amount your account can move (gain or lose) in a single trading day. Hitting the cap locks the account until 5 PM EST, after which trading resumes.

For example:

- A $200,000 Forex account has a daily loss limit of $10,000.

- A $50,000 Crypto account has a daily cap of +/- $1,500 (3% of $50,000).

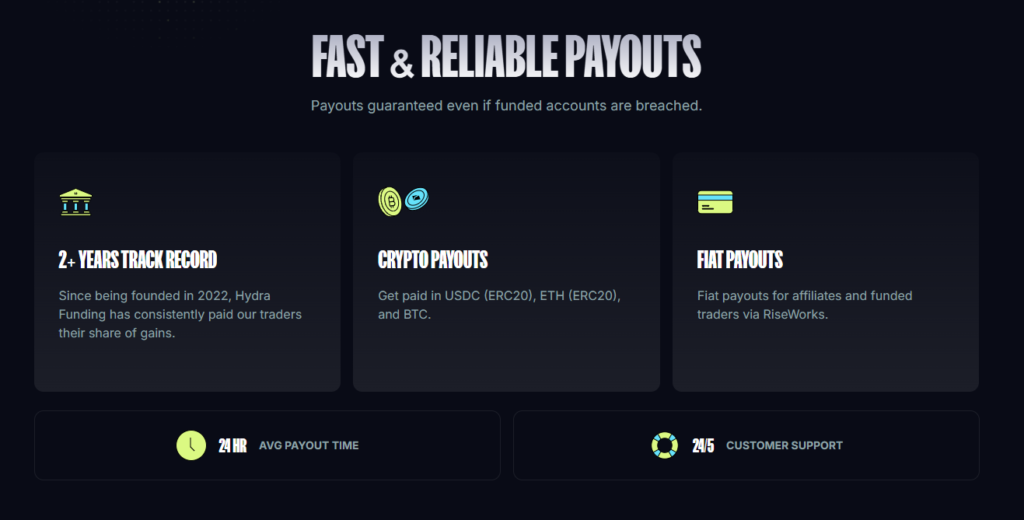

Fast & Reliable Payouts

Payouts are processed within 24 hours on average, with options to receive funds in fiat via RiseWorks or in crypto through USDC, ETH, or BTC. Hydra has maintained a solid track record of consistent, prompt payouts since launching in 2022—even for accounts that have been breached.

Fees

Hydra Funding’s fee structure is straightforward and offers flexibility for traders at different levels. Pricing starts at $130 for a $10,000 Forex account and $45 for a $5,000 Crypto account. For larger accounts, a $100,000 Forex account costs $750, while a $500,000 account is priced at $3,750.

One-Time Fees

Hydra Funding charges a one-time fee to join its funding programs, applicable to both one-phase and two-phase challenges. Examples of pricing include:

- Forex Accounts:

- $10,000 account: $130

- $100,000 account: $750

- $500,000 account: $3,750

- Crypto Accounts:

- $5,000 account: $45

This pricing structure positions Hydra as one of the more cost-effective options in the market, offering affordable entry points without cutting features.

Profit Split

Hydra Funding offers a profit split of up to 90/10. Traders start with a 75% split and can upgrade to 90% by paying an additional 20% fee. This optional add-on gives traders the chance to increase their earnings without hidden costs.

Withdrawal Process

Withdrawals are handled through the Hydra Dashboard, with payouts available as soon as traders qualify. Hydra doesn’t charge withdrawal fees, but third-party fees (e.g., for international transfers) may apply. Hydra has a solid track record for processing payouts quickly, typically within 24 hours.

Tradable Assets

Hydra Funding offers a diverse range of assets, allowing traders to diversify their strategies and manage risk effectively. Their asset classes include Forex pairs, Cryptocurrencies, Metals, Indices, and Commodities, providing options for both short-term and long-term strategies.

Forex

- Exotics: Less common pairs such as EUR/NOK, USD/MXN, and USD/SGD provide unique setups for experienced traders.

- Majors: Popular pairs like AUD/USD, EUR/USD, and GBP/USD, known for high liquidity and stability.

- Crosses: Cross-currency pairs like AUD/CAD, EUR/AUD, and GBP/JPY offer additional trading opportunities beyond majors.

Cryptocurrencies

Trade major digital assets like Bitcoin and Ethereum with leverage up to 5:1. Altcoins, including Litecoin and Chainlink, are also available, with leverage capped at 2:1 for smaller cryptos.

Metals

Hydra Funding supports trading in gold (XAU/USD) and silver (XAG/USD), with raw spreads starting from 0.0 pips.

Indices

Major global indices like the NASDAQ 100, S&P 500, and Euro Stoxx 50 allow traders to speculate on broader market trends.

Energies

Commodities such as Brent and WTI crude oil are available for those focusing on global energy markets.

Customization and Trader-First Philosophy

Hydra Funding emphasizes flexibility and customization, aiming to meet the needs of traders with diverse strategies.

Commissions

The commission structure is simple and transparent:

- All Other Assets: $0 commissions, reducing costs for non-Forex trades and maximizing potential returns.

- Forex and Metals: $7 per lot round trip.

Leverage

Hydra Funding offers leverage options tailored to account types and trading strategies:

Single-Phase Accounts

- Forex, Metals, Oils, Indices: 1:20

- All Crypto Accounts:

- BTC & ETH: 1:5

- Other Altcoins: 1:2

- CFD/Stocks: 1:5

Two-Phase Accounts

- Forex, Metals, Oils, Indices: 1:50

- Cryptocurrencies: 1:2

- CFD/Stocks: 1:5

Restrictions

While Hydra Funding offers many opportunities for traders, it’s essential to understand the restrictions and rules in place. These limitations are designed to manage risk but can also impact your trading strategy. Here’s what you need to know:

Drawdown Rule

- Hydra Funding does not implement trailing drawdowns in any of its challenges. However, there’s an important rule for Forex accounts to keep in mind: once you make your first withdrawal, the maximum drawdown locks at your starting balance. This ensures you cannot go below the initial account balance after withdrawing profits. It’s worth noting that this rule does not apply to Crypto funded accounts, which maintain more flexible drawdown policies.

- Example:

- A $100,000 Single Phase Funded Account has a 6% max drawdown.

- Before the first withdrawal: The account can drop to $94,000.

- After the first withdrawal: The drawdown locks at $100,000, meaning you cannot drop below the starting balance.

- This means the trader must manage their risk carefully and decide how much of a buffer to leave in the account after withdrawing to avoid breaching the funded account.

Daily Loss Rule

- Forex Accounts: A 5% Daily Loss Limit is applied. It’s calculated based on the previous day’s balance and compounds with account growth. Breaching this limit results in account termination. However, Hydra Funding still guarantees all payouts on profits remaining even if the account is breached – which is a plus.

- Crypto Accounts: There is no daily max loss. Instead, crypto accounts use a 3% Daily Cap.

- If the Daily Cap is hit, all trades are closed, and trading is locked until the next trading day at 5 PM EST.

- Hitting the Daily Cap does not breach the account. The only way to breach a crypto account is by hitting the maximum drawdown.

Inactivity Rule

- Accounts must remain active with at least one trade every 30 days, or they’ll be terminated.

Account Breach Conditions

There are only three ways to lose an account:

- Exceeding the Maximum Drawdown (Static):

- Applies to both Forex and Crypto accounts.

- Violating the Daily Loss Limit:

- Applies to Forex accounts only (5% of the previous day’s balance).

- Crypto accounts use a Daily Cap, which does not breach the account.

- Inactivity for 30 Days:

- If no trades are placed for 30 consecutive days, the account will be terminated.

Expert Advisors (EAs)

- EAs, Scripts, Indicators, and personal copy trading are allowed during evaluation, but copying trades from others is not.

Weekend Holding

- Trades must be closed by 3:45 p.m. EST on Friday unless you’ve purchased the “Hold Over the Weekend” upgrade. Open trades will auto-close but won’t violate your account. But Crypto challenges come built in with weekend holding.

News Trading

All Accounts:

Closing positions, stop-losses (SL), and take-profits (TP) during news events are permitted.

Holding positions through news events is allowed.

However, no new positions can be opened within +/- 3 minutes of red-folder news releases.

Challenge

Hydra Funding offers flexible one-phase and two-phase evaluation options for both Forex and Crypto accounts, so you can pick the structure that suits you best.

One-Phase Forex Challenge

The one-phase Forex challenge has a 10% profit target and no time limits, allowing you to trade at your own pace. You start with leverage up to 1:20 on Forex and metals, 1:10 on indices, and 1:5 on commodities. You can also choose add-ons for weekend holding if needed. Fees for this challenge start at $130 for a $10,000 account and go up to $7,500 for a $1,000,000 account. You’ll receive a 75% profit split, with the option to upgrade to 90%.

Two-Phase Forex Challenge

In the two-phase Forex challenge, the profit target is split across two stages: 8% in Phase 1 and 5% in Phase 2, also with no time limits. This challenge includes higher leverage options—up to 1:50 for Forex and metals—while indices and commodities leverage remains the same. Fees start at $110 for a $10,000 account and go up to $900 for a $200,000 account, with the same profit split structure as the one-phase option.

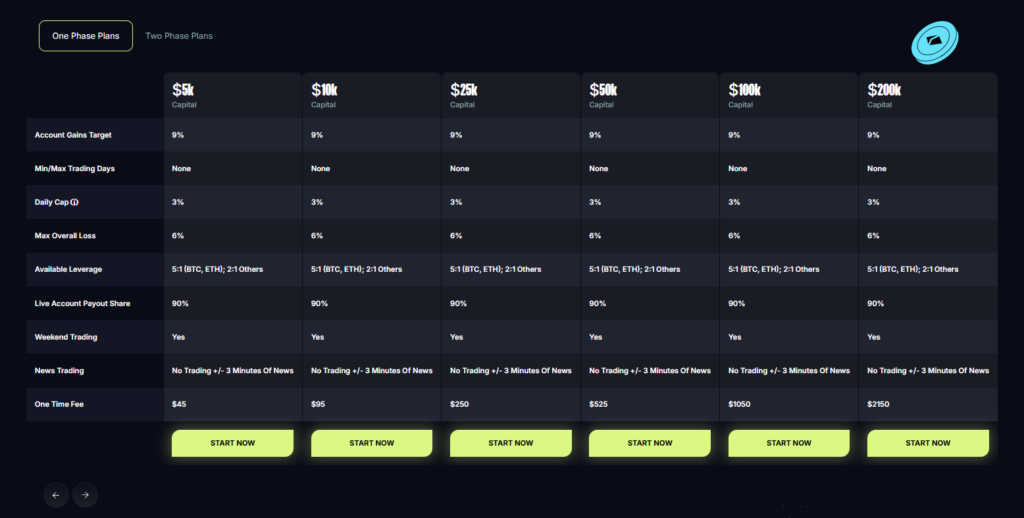

One-Phase Crypto Challenge

For Crypto traders, the one-phase challenge has a 9% profit target and a 3% daily cap, giving you freedom to meet targets without rushing. Leverage is 5:1 on BTC and ETH, and 2:1 on other cryptos. Weekend trading is allowed, along with optional news trading add-ons. Fees for Crypto accounts start at $45 for a $5,000 account and go up to $2,150 for a $200,000 account. Successful traders keep 90% of profits.

Two-Phase Crypto Challenge

The two-phase Crypto challenge also has two stages: 6% profit target in Phase 1 and 9% in Phase 2, with a 3% daily cap. Leverage and weekend trading conditions are the same as the one-phase Crypto option. Fees range from $35 for a $5,000 account to $2,000 for a $200,000 account, and you’ll keep 90% of profits once funded.

Conclusion

Hydra Funding positions itself as a prop trading firm built by traders, for traders. With flexible account options, customizable evaluation phases, and competitive profit-sharing up to 90%, it caters to traders of all levels. Their commitment to realistic trading conditions, along with features like 24/7 live chat support, demonstrates a dedication to providing a supportive trading environment.

The firm’s risk management rules—such as daily loss limits and daily cap on crypto accounts—are strict but aim to promote responsible trading rather than restrict flexibility. Additionally, their transparent fee structure and fast payouts make Hydra Funding a viable option for traders seeking reliability and affordability.

For those looking to grow their trading careers with a firm that understands the challenges of the market, Hydra Funding offers a competitive and trader-focused platform worth considering.

Hydra Funding Discount Code

If you want to join Hydra Funding, use our exclusive discount code FT10 for a 10% discount!