FundYourFX vs The 5%ers

FundYourFX vs The 5%ers. Both are reputable prop firms that offer instant funding to traders. The 5%ers have instant funding as well as an evaluation account, whereas FundYourFX just provides instant funding. Here, we’ll evaluate the two no-challenge funding prop firms so you can decide which prop firm offers the greatest value and the best trading experience.

Introduction to FundYourFX

Let’s start with FundYourFX for those not familiar with this prop firm. A new but reputable prop firm. Their ingenuity has made them the talk of the industry. Most people don’t realize but the number of traders joining just keeps increasing and they are also starting to get active in social media. You can see on their YouTube channel that some professional prop traders agree with us regarding them being the best prop firm. They might not be the most famous, but as more and more people realize that you don’t need to do challenges or evaluations to get a funded account, we can see FundYourFX and other no-evaluation prop firms beating out those prop firms that do require evaluations.

Time is money. The faster you can start trading on your live account, the faster you can start making money.

Introduction to The 5%ers

They have been around for quite a long time. Compared to FundYourFX, which started in 2021, The 5%ers started in 2016. They offer both instant funding and also challenge accounts. They also offer other services, but we won’t get to that and instead just focus on their prop trading programs.

What’s great is that both FundYourFX and The 5%ers offer live accounts and instant funding. No demo accounts.

The Funded Trader Programs

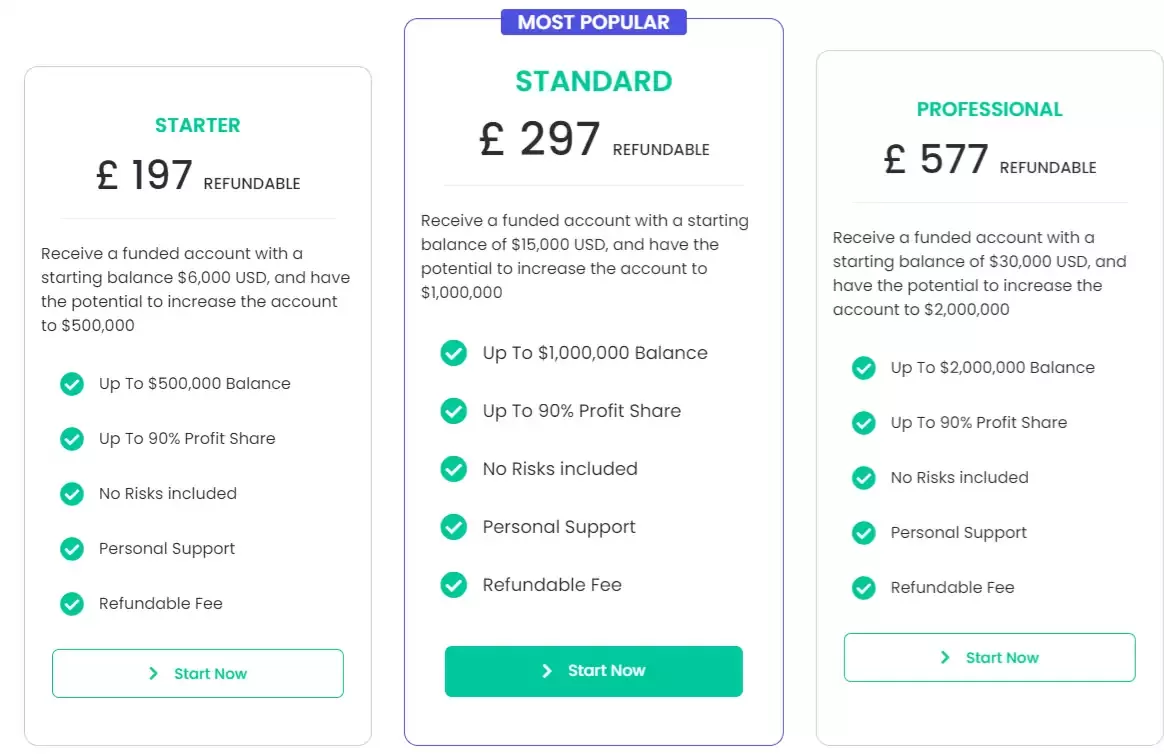

FundYourFX only offers instant funding with 3 programs to choose from. From the cheapest at £197 to the most expensive at £577. Fortunately, FundYourFX doesn’t require challenges or evaluations. Challenges or evaluations can take months to pass, and time focusing on evaluations is time lost when you could be focusing on profiting with live trading. Instant funding will benefit many traders looking to trade as soon as possible.

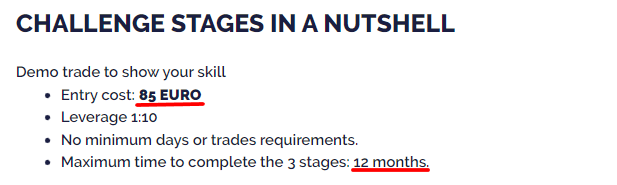

The 5%ers have both, instant funding and challenge. Previously, they had a freestyle program, but it has since been disabled. Their challenge program is called Bootcamp. You pay €85 to take the challenge, and if you pass, you pay another €215 to start live trading. It doesn’t make sense to join that program when it is already hard enough to pass a challenge for many traders. On top of that, when you pass you have to pay another fee.

Another thing we don’t like is the profit split “up to”. The high-profit split has the ability to attract many traders. But the fact is that you could only get a large profit share if you were able to get their high capital funding. To scale up to that much could take a while. Reaching their $4 million funding will be exceedingly challenging with a maximum loss set at only 4%.

With that out of the way, let’s start discussing the instant funding accounts for both prop firms.

The Instant Funding Program

When we last examined FundYourFX, they only offered one sort of product. Due to their rising popularity, many traders have requested various programs to accommodate various traders. As a result, traders may now select from three different programs. The nice thing about this is that their lenient rules haven’t changed; just new programs have been added.

The first and cheapest option is their Starter program. This would be perfect for new traders that want to start trading with sufficient capital but at a lower cost. This program costs £197, and you get $6,000 in real capital. Also, something new they added is that the fee is refundable. Once you can hit the 10% profit 3 times, your fee will be refunded. So there is a benefit to trading in FundYourFX for the long term. If you are an experienced trader and feel confident about your trading abilities, the Professional program that costs £577 with $30,000 capital can be appealing to you since you can recover your registration fee back.

The 5%ers are also actively promoting their instant funding program. In The 5%ers, the cheapest program costs €235 for $6,000 in funding. $20,000 is the highest amount available, and it costs €745.

The Differences

If we were to compare the pricing with FundYourFX, the major difference is the fee and the capital. As you can see for €235 or if we convert it to at this moment the article was written, it is £197. That is about £50 more expensive than FundYourFX.

The leverage here is also much lower. Both accounts in The 5%ers only have 1:10 or 1:30, whereas FundYourFX is 1:100.

The stop loss is a little bit different. In The 5%er, the low-risk account requires a 2% stop loss. A stop loss must be placed in FundYourFX as well. But you must place the stop loss order within 30 minutes of opening your trade. Therefore, if you are a scalper, this would be advantageous for you because you don’t need a stop loss during those 30 minutes.

Another difference is regarding trading crypto. The 5%ers do not allow trading crypto. If you are a crypto trader, you will be disappointed.

The 5%ers do have huge potential funding up to $4M when you reach level 8. But it won’t be easy. The maximum loss is at 6% only from levels 1 and 2. Once you reach level 3 it goes to 4%. According to their website, the drawdown is also 4%.

Regarding the refundable fee, only FundYourFX offers it. As we mentioned before, you can get your fee refunded once you hit 10% profit 3 times.

The Similarities

Both have the same profit split for instant funding, which is 50%. But FundYourFX starts at 50% and can go all the way to 90%. For the low-risk account, the profit target to scale is 10%, which is the same as FundYourFX. But the aggressive account has a much higher profit target of 25%. Most of the rules are quite similar, in that you can trade the news, overnight, weekend trading, and using EA.

Summary

By comparing both FundYourFX and The 5%ers no challenge funding, we can see that the biggest difference is the fees/capital and also the drawdown. For the price that FundYourFX is offering and the amount of capital, they seem to be a better deal. In terms of trading rules, they are pretty similar, so there is not much difference there except for the drawdown, which is relatively low. But overall, if we were going to choose which prop firm is better, it would have to be FundYourFX.