Klein Funding is a new crypto-focused prop firm founded in 2024. In this review, we cover its trading programs, features, rules, and why it won Best Crypto Prop Firm 2025.

This Klein Funding review takes a closer look at one of the best prop firms in the industry. Founded in 2024, Klein Funding is designed specifically for crypto traders and has already built a global presence.

The firm recently won the FundedTrading Award for“Best Crypto Prop Firm 2025”, which highlights its rapid growth and innovative approach to crypto funding.

In this review, we’ll cover the company’s background, trading programs, rules, payout process, and key features. The goal is to help you decide whether Klein Funding is the right choice for your trading style.

Company Overview

Klein Funding is a crypto-focused prop firm that launched in 2024. Despite being new, the firm has expanded quickly. According to its own figures, Klein Funding has:

- Paid out over $320,000 to traders.

- Built a community of more than 11,000 traders.

- Reached 130+ countries worldwide.

The company partners with Bybit, one of the leading cryptocurrency exchanges, to provide traders with access to 700+ crypto pairs, deep liquidity, and institutional-grade conditions.

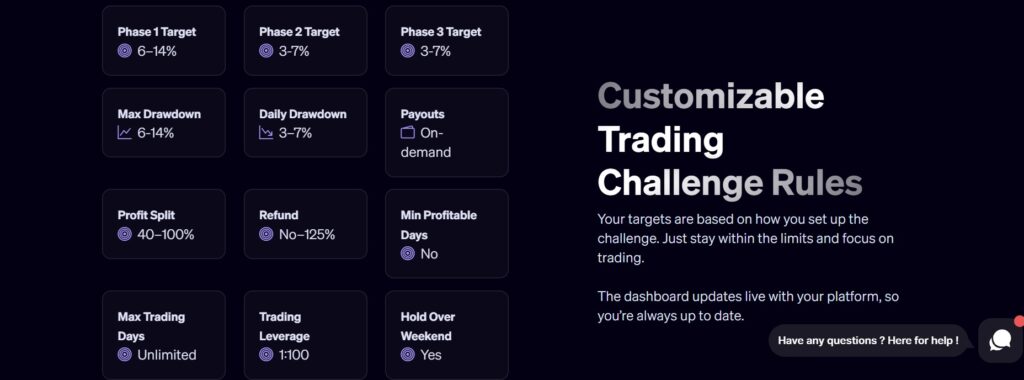

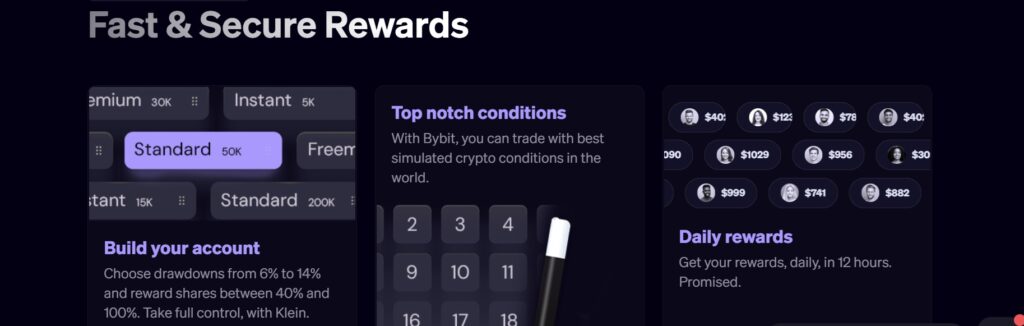

Unlike traditional prop firms that mainly support forex or futures trading, Klein Funding stands out as a crypto prop firm, partnering with Bybit. Traders can choose between multiple evaluation paths, profit splits ranging from 40% to 100%, and customizable drawdown levels between 6% and 14%.

Klein Funding’s focus on crypto hasn’t gone unnoticed. In 2025, it was recognized with the FundedTrading award for Best Crypto Prop Firm, thanks to its customizable accounts, Bybit partnership, and fast payouts.

Trading Programs at Klein Funding

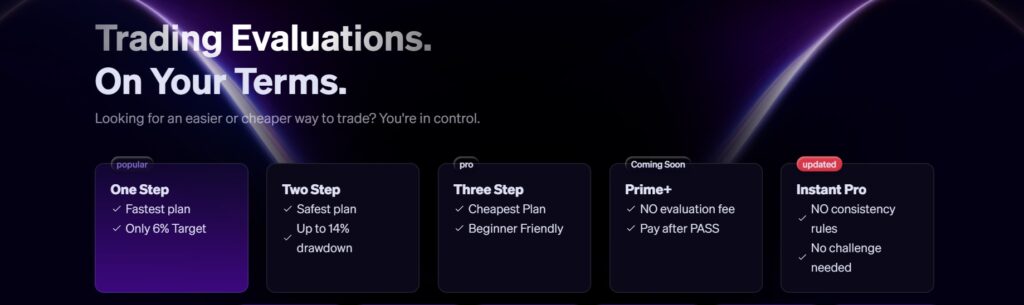

Klein Funding offers several different trading programs designed to fit different types of traders. Each plan has its own rules, targets, and costs. Here’s a breakdown of the options:

One-Step Evaluation

The One-Step Evaluation is the fastest way to qualify for a funded account. Traders only need to hit a 6% profit target without breaking the rules.

- Pros: 1:1 drawdown to profit target ratio and static (balance based) drawdown. Drawdown options up to 14% and payout shares up to 100%.Quick entry, no minimum trading days.

- Cons: Comes with a lower stability score (30%), which means payouts can be delayed if profits are not consistent.

This plan works best for traders who can hit targets quickly and want to avoid a long evaluation process.

Two-Step Evaluation

The Two-Step Evaluation is the most balanced program. Traders must complete two phases, each with a profit target (6% in Phase 1, 3% in Phase 2).

It allows for a higher maximum drawdown (up to 14%), making it safer for traders who want more room for error. The stability score is 45%, which rewards consistency.

- Pros: Higher drawdown, more safety.

- Cons: Takes longer than the one-step plan.

This option is best for risk-averse traders who prefer a slower and steadier path.

Three-Step Evaluation

The Three-Step Evaluation is the cheapest program Klein Funding offers. Traders complete three phases with smaller targets (6%, 3%, 3%).

- Pros: Low entry cost, beginner friendly.

- Cons: Slower to reach a funded account.

This plan is a good fit for newer traders who want to start small and learn the process without spending much upfront.

Instant Pro (No Challenge)

The Instant Pro account removes the evaluation altogether. Traders get access to trading immediately and keep 70% of profits.

This plan includes two types of drawdowns:

- Trailing Drawdown: Moves with your profits, starting at 8% below the balance and adjusting as equity grows.

- Smart Drawdown: Locks at -3% once the account reaches +3% profit, giving a permanent safety net.

Scaling is also available, allowing traders to grow accounts up to $2 million.

- Pros: No challenge, no consistency score, fast access, strong scaling.

- Cons: Higher upfront cost than evaluation programs.

This program is best for experienced traders who want to trade a funded account right away.

Prime+ (Coming Soon)

Klein Funding has announced a Prime+ program, which is not live yet. The key difference is that there will be no evaluation fee upfront. Traders only pay after passing the challenge.

If launched, this will be a unique offering compared to other prop firms, as most require payment before the evaluation begins.

Features and Tools

Klein Funding provides several features to support traders once they join:

- Bybit Platform – All trading is done through Bybit, one of the largest crypto exchanges. Traders get access to 700+ crypto pairs, deep liquidity, and tight spreads starting from 0.0 pips.

- Leverage – Klein offers leverage up to 1:100, giving traders the ability to manage larger positions while still controlling risk.

- Trading Journal & Dashboard – Each account comes with a built-in journal and a custom dashboard that updates in real-time, so traders can track their progress and stay on top of their rules.

- Community Support – Klein has an active Discord community, giving traders the chance to connect, share strategies, and ask questions.

- Fast Payouts – Withdrawals are processed within 4–24 hours, with most payouts completed in just 4 hours.

Rules and Restrictions

Like all prop firms, Klein Funding has rules to make sure trading is fair and consistent:

- Stability Score – Depending on the plan, traders must follow a 30% or 45% stability score. This means no single day’s profit can be too large compared to the total profits made. It encourages steady growth.

- Prohibited Trading Styles – Certain strategies are not allowed, including arbitrage, latency trading, high-frequency trading (HFT), hedging between accounts, scalping under 50 seconds, and the use of trading bots or Expert Advisors (EAs).

- Weekend Trading – Unlike some firms, Klein allows trading over weekends, which is important since the crypto market runs 24/7.

These rules are designed to keep trading fair and to make sure payouts are sustainable over the long term.

One of the most common pain points for new Klein traders is connecting the Bybit API correctly. Many traders run into errors by creating the wrong type of API key. To help with this, Klein provides a step-by-step guide and we’ve also included a recommended video below.

How to Connect Your Bybit Demo API to Klein Funding

Many traders trip up here: use Bybit’s Demo Trading on a sub-account before you create API keys. Don’t generate “normal” API keys. Go demo first, then connect to Klein.

Watch the walkthrough

Quick Steps

-

Create a Bybit sub-account

-

Go to Bybit → Sub-accounts → Create (e.g., name it “Klein Challenge”).

-

Switch into that sub-account.

-

-

Turn on Demo Trading

-

While in the sub-account, click Demo Trading (paper trading mode).

-

-

Create API keys for the Demo sub-account

-

Profile → API → Create New Key.

-

Permissions: read-write with Trading and Assets.

-

Add a remark (e.g., “Klein Challenge”).

-

Copy API Key and API Secret.

-

-

Connect in Klein Dashboard

-

Paste the API Key and Secret into your Klein Funding dashboard → Connect.

-

Wait a few seconds for it to link.

-

That’s it. You’re connected.

Important Rules

-

Demo API only, on a Bybit sub-account — other formats will fail and show “API is invalid.”

-

One API per dashboard — once connected, you can’t add a second API for the same dashboard. If you delete/change it on Bybit, your account will be closed immediately.

-

No “requesting demo funds” after you connect — doing so causes an immediate, non-reversible breach. Don’t press that button in Bybit after the API is linked.

-

Only USDT-perpetual markets via Bybit — trading USDC, spot, options, margin, or borrowing USDT will breach the account.

-

API access lasts ~90 days — Bybit’s sub-account demo API expires; Klein emails reminders starting 10 days before expiry. If you don’t renew, your account will be restricted and can’t be reactivated.

Pros and Cons

Like any prop firm, Klein Funding has strengths and weaknesses. Here’s a quick breakdown:

Pros

- Flexible accounts – Choose between 40% and 100% profit splits, with drawdowns from 6% to 14%.

- Fast payouts – Withdrawals processed within 4–24 hours, often in just 4 hours.

- Global reach – Over 11,000 traders from 130+ countries are already using Klein.

- No country restrictions – Traders can join regardless of Bybit’s own limitations.

Cons

- Stability score – Required consistent profits to be eligible for payouts.

- Crypto only – No forex, indices, or stock trading.

Who is Klein Funding Best For?

Klein Funding is built for a specific type of trader: the crypto trader. While traditional prop firms lean heavily on forex and futures, Klein focuses only on crypto. Here’s who it fits best:

- Crypto Day Traders – If you trade short-term setups and want tight spreads with high leverage (1:100), Klein provides strong conditions.

- Swing Traders Looking for Flexibility – The customizable drawdown and profit split options make it easier to match the rules to your personal risk style.

- Beginners – The Three-Step Evaluation is cheap and forgiving, making it a good entry point for new traders who want to test prop trading without big upfront costs.

- Experienced Traders – The Instant Pro account lets skilled traders skip evaluations and trade immediately with up to a 70% profit split and scaling up to $2M.

In short, Klein is best for crypto traders who want flexibility and fast payouts, but not ideal for those who mainly trade forex, indices, or stocks.

Klein Funding Compared to Other Prop Firms

Klein Funding is very different from most traditional prop firms because it focuses only on crypto trading. While firms like FunderPro give traders access to more markets such as forex, indices, stocks, metals, and oil, Klein specializes in crypto and offers much higher leverage 1:100 compared to FunderPro’s 1:2 on crypto.

Here’s a side-by-side comparison of the two:

| Feature | Klein Funding | FunderPro |

| Market Coverage | Crypto-only (700+ pairs via Bybit, leverage 1:100) | Forex, Stocks, Indices, Metals, Oil, Crypto (crypto leverage 1:2) |

| Profit Splits | 40% – 100% | 80% standard, 90% with add-on |

| Drawdown Rules | Customizable (6% – 14%), Stability Score 30–45% | Fixed: 5% daily, 10% overall, No trailing drawdown |

| Payouts | On-demand, 4–24 hours (usually 4h) | Anytime at 1% profit, avg. 8h processing |

| Evaluation Models | One-Step, Two-Step, Three-Step, Instant Pro, Prime+ (coming soon) | One-Phase, Regular Two-Phase, Swing Two-Phase |

Key Takeaways

- Klein Funding is best if you are a crypto-focused trader who wants high leverage, customizable profit splits, and flexible drawdowns.

- FunderPro is better if you want multi-market access with traditional prop firm rules and the ability to trade forex, stocks, and indices.

Final Verdict

Klein Funding is a strong choice if you want crypto prop trading with fast payouts and adjustable account setups. The firm stands out for its high leverage in crypto (1:100), customizable drawdowns, and profit splits up to 100%. Payouts are quick, usually processed within just a few hours, and the evaluation programs give traders several ways to qualify.

Its recognition as FundedTrading’s “Best Crypto Prop Firm 2025” reinforces its position as one of the leading new names in the industry.

While Klein Funding is a robust platform, it’s important to note its focus on cryptocurrency. Traders who prefer other asset classes like forex, indices, or stocks may find it doesn’t align with their needs.

Overall, Klein Funding is best suited for crypto traders who appreciate adaptable options and want a modern prop firm built around digital assets, and its recent award shows that it’s already gaining serious respect in the prop trading world.