Global Forex Funds, a UK-based proprietary trading firm, has officially launched its Private Account Challenge — a funding model designed to solve the core issues traders face with most prop firms today. From unfair rules to impossible targets, the prop space has become flooded with evaluation traps. GFF is flipping the script.

This new challenge gives traders a rare 15% max drawdown, one of the highest in the industry, alongside a realistic 8% profit target, high leverage, and a generous 90% profit split. It’s designed not to catch traders out, but to fund them fairly.

Why This Challenge Stands Out

While most prop firms push multi-phase challenges or overload traders with strict daily limits and consistency rules, GFF’s Private Challenge is clean and aggressive:

- 15% Max Drawdown – major breathing room for active traders

- 8% Profit Target – achievable without risking everything

- 1:100 Leverage – scale positions confidently

- 1 Minimum Trading Day – pass in a single session if you’re ready

- Free Retry – if you don’t make it, you get another chance with no extra cost

- 90% Profit Split – one of the highest in funded trading

This model gives traders more control, more margin for error, and a better shot at passing. If you’ve failed challenges by 1–2% before, this is the type of setup that changes the outcome.

Built for Traders — Not Just Profits

Global Forex Funds isn’t just another prop firm. It was built to challenge the broken system the industry has become known for.

“Most firms make money when traders fail. We built Global Forex Funds to change that,” says Sam, CEO of Global Forex Funds.

At a time when other firms are tightening the rules and ramping up challenge fees, GFF focuses on simplicity, sustainability, and transparency.

About Global Forex Funds

Global Forex Funds is a UK-based proprietary trading firm focused on offering straightforward, performance-based funding models. The aim is to provide traders with access to capital under fair, realistic, and clearly defined conditions.

The firm is built around:

✅ Trader-focused rules

✅ Sustainable and consistent payout models

✅ Achievable profit targets

✅ Fast access to funded accounts

✅ Transparent terms with no hidden conditions

Rather than relying on aggressive marketing tactics or complicated refund policies, GFF prioritises clear communication, risk-managed funding options, and a reliable path to withdrawals, helping traders focus on what matters most: performance and growth.

A Look at GFF’s Challenge Models

Private Challenge — High Drawdown, Built to Win

- 15% Max Drawdown

- 8% Profit Target

- 1:100 Leverage

- 90% Profit Split

- 1 Trading Day Min

- One Free Retry

✔️ Up to 20% higher pass rates than typical one-phase challenges

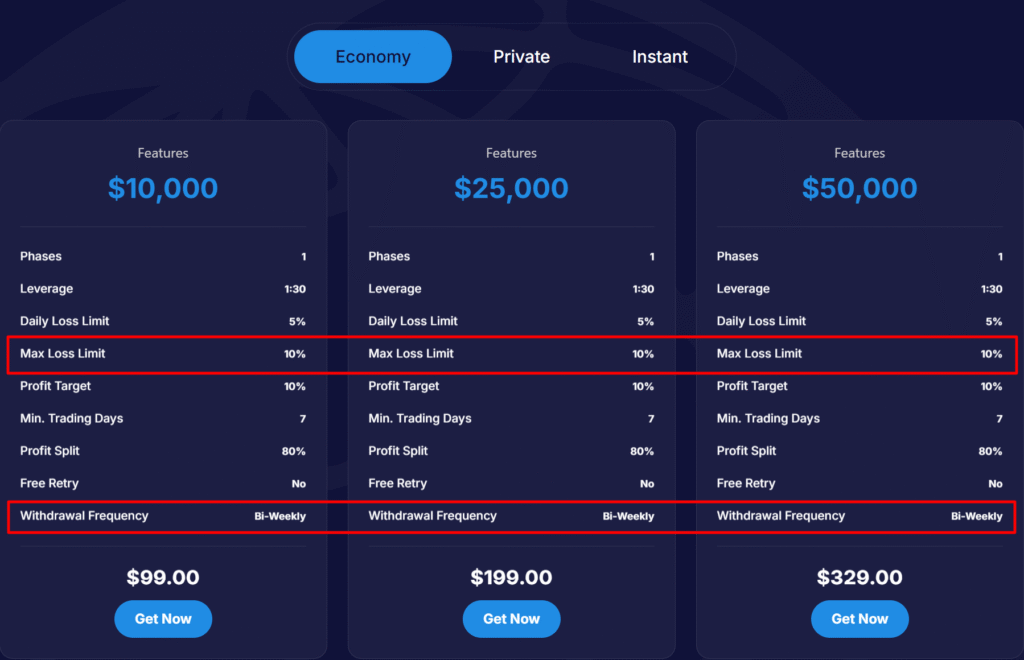

Economy Challenge — Simple, Affordable

- 1 Phase

- 10% Drawdown

- 10% Profit Target

- 1:30 Leverage

- 7 Min Trading Days

- Budget-friendly pricing

✔️ A clean entry point with trader-friendly rules

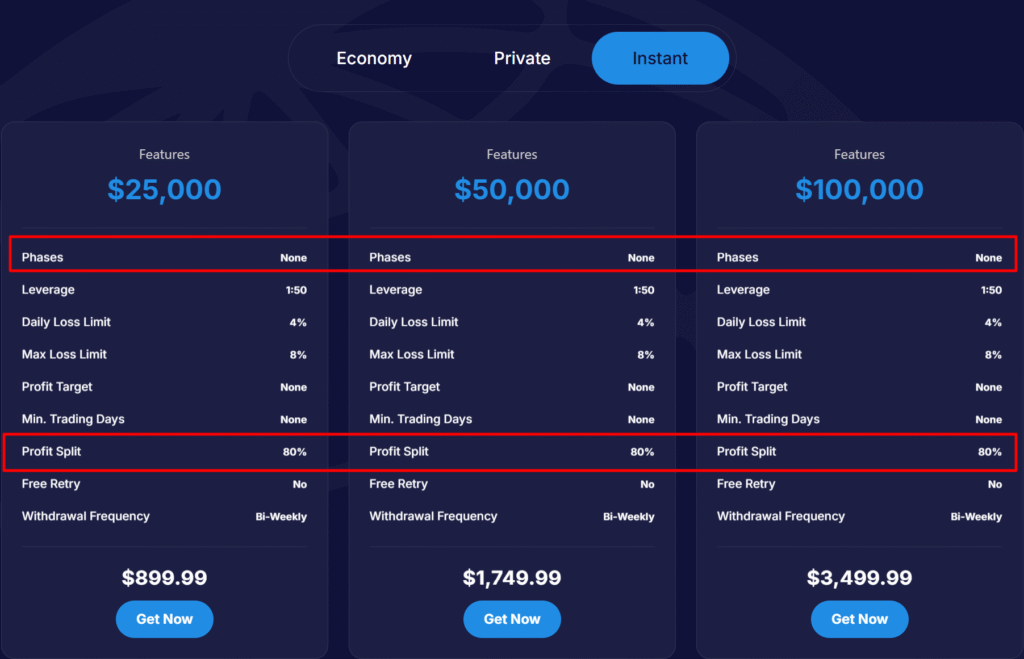

Instant Funding — Skip the Challenge. Trade Now.

- No Evaluation

- 8% Max Drawdown / 4% Daily

- Trade same day

- Withdrawable profits from day one

- Competitive pricing

✔️ For traders who want instant funding. Skip the evaluation process and start earning

Who This Is For

The Private Challenge is ideal for:

- Traders tired of failing strict 2-step challenges

- Anyone who wants fair conditions

- Scalpers, swing traders, or intraday setups that need space to breathe

A UK Prop Firm Offering a Simpler Path to Funding

The launch of the Private Account Challenge by Global Forex Funds reflects a growing demand for more trader-friendly evaluation models in the proprietary trading space. With a higher drawdown limit, simplified rules, and realistic profit targets, this challenge provides a clear alternative to traditional multi-phase setups.

For traders who are looking for a structured yet accessible path to funding, the Private Account offers a balance of flexibility and performance-focused conditions. As with any prop firm, it’s important to review the full terms, understand the risk parameters, and choose a model that aligns with your trading style and goals.

To explore the Private Challenge and other funding options, visit Global Forex Funds.