Alpha Futures is a prop firm designed for futures traders, offering a straightforward one-step evaluation. Traders can qualify for up to $450,000 in simulated funding while keeping up to 90% of their profits. With no daily drawdown on evaluations and clear risk management rules, the firm aims to provide a fair trading environment.

The company offers a balance-based drawdown, allowing traders to manage risk effectively without unexpected failures. They also provide unlimited resets, giving traders the opportunity to retry their evaluations when needed. Bi-weekly payouts ensure consistent access to earnings, making it a competitive choice for traders looking for fast withdrawals.

Alpha Futures supports trading on CME futures across equities, foreign exchange, agricultural commodities, energy, and financial instruments. Their in-house trading platform, AlphaTicks, offers commission-free trading with lower fees than most competitors. With strong industry backing and transparent funding rules, the firm seeks to attract experienced futures traders.

About Alpha Futures

Alpha Futures was founded in July 2024 by Andrew Blaylock and George Kohler, with the goal of providing a fair and efficient funding model for futures traders. The firm is based in the United Kingdom and is backed by Alpha Capital Group, a well-known name in the prop trading industry. Their mission is to offer traders a straightforward path to funding without restrictive rules that hinder performance.

Since its launch, Alpha Futures has quickly gained traction due to its simple one-step evaluation, balance-based drawdown model, and bi-weekly payouts. The firm provides a trader-friendly experience, allowing participants to trade without daily drawdowns while benefiting from flexible account scaling.

With an in-house trading platform, AlphaTicks, and a direct partnership with ProjectX as their broker, Alpha Futures ensures that traders have access to a seamless trading experience. They also offer a professional portfolio tracker, helping traders build resumes and connect with industry leaders. Their transparent funding approach and commitment to trader success make them a competitive option in the futures prop trading space.

Funding Program Options

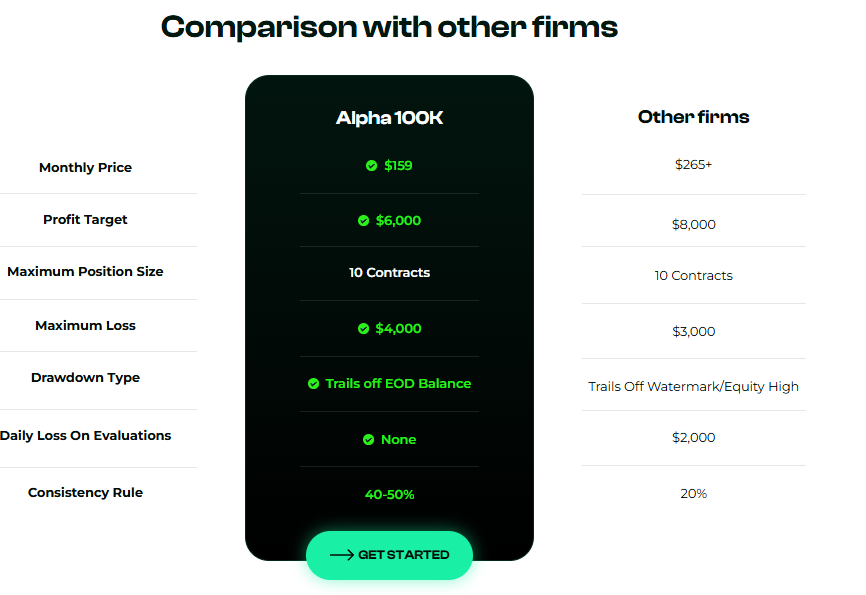

Alpha Futures offers a one-step evaluation that allows traders to qualify for funded accounts efficiently. With no daily drawdown restrictions and clear funding rules, traders can focus on profitability while managing risk. The firm provides two main funding plans: Standard and Advance, each with distinct features to match different trading preferences.

Standard Plan

The Standard Plan offers a profit split ranging from 70% to 90%, depending on account performance. There are no minimum trading days, and traders can trade up to 15 contracts on the largest account size. Drawdown is balance-based, and payouts are processed bi-weekly. Traders must maintain a 50% consistency rule during the evaluation phase and a 40% rule in funded accounts.

Advance Plan

The Advance Plan provides a 90% profit split from the start, giving traders higher earnings potential. Unlike the Standard Plan, payouts are available after five winning days with at least $200 profit per day. Traders can trade up to 15 contracts, and the drawdown is trailing at the end of the day. Similar consistency rules apply, ensuring traders follow a structured risk approach.

Both plans allow traders to manage up to $450,000 across three qualified accounts. Alpha Futures provides built-in copy trading for traders managing multiple accounts under the same name. With competitive payout structures and no daily drawdown, the firm offers a clear path to securing funded capital.

Fees

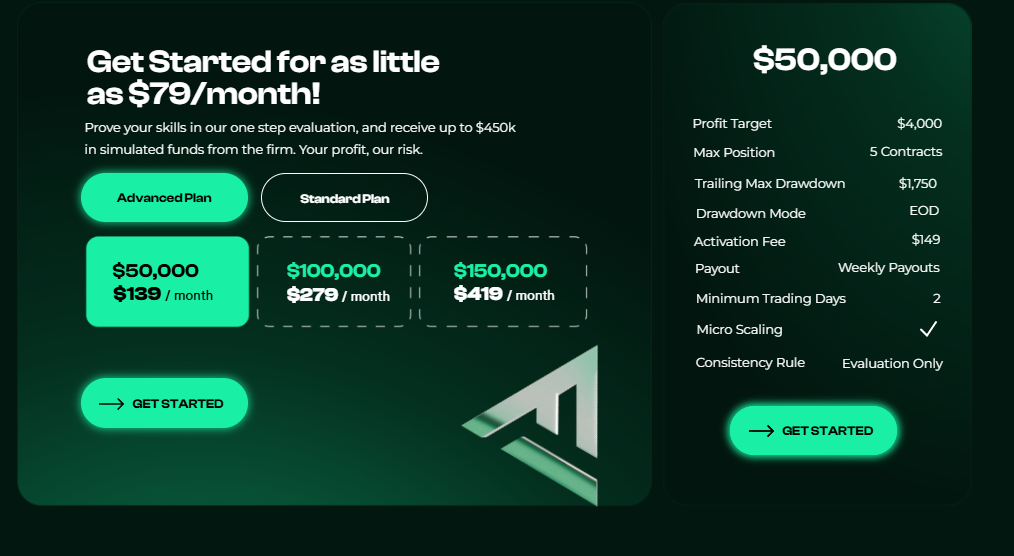

Alpha Futures offers competitive pricing for its funding programs, with different cost structures based on the selected plan and account size.

Standard Plan Pricing

The Standard Plan features monthly pricing, making it an affordable option for traders looking for consistent funding access. The pricing structure ranges from $79 to $419 per month, depending on the account size. Activation fees start at $149, and traders can reset their accounts for a fee ranging from $129 to $419.

Advance Plan Pricing

The Advance Plan comes with a higher initial cost but offers a 90% profit split from the beginning. Monthly fees range from $139 to $419, with activation fees set at $149. Reset fees vary from $139 to $419, depending on the account size.

All fees include access to AlphaTicks, their in-house trading platform, with no commission charges beyond regulatory fees. Additionally, there are no hidden costs, ensuring transparency throughout the funding process.

Tradable Assets

Alpha Futures provides access to a wide range of CME futures markets, allowing traders to take positions in multiple asset classes. The firm ensures deep liquidity and reliable execution, supporting professional-grade trading conditions.

Equity Futures

Traders can access major stock indices, including:

- S&P 500 (ES)

- Nasdaq 100 (NQ)

- Dow Jones (YM)

- Russell 2000 (RTY)

Foreign Exchange Futures

The firm offers futures contracts on major currency pairs, such as:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

Commodity Futures

Alpha Futures includes a range of commodity markets, covering:

- Gold (GC), Silver (SI), Copper (HG)

- Crude Oil (CL), Natural Gas (NG), Heating Oil (HO)

- Agricultural products like Corn (ZC), Soybeans (ZS), and Wheat (ZW)

Financial and Interest Rate Futures

Traders have access to U.S. Treasury futures, such as:

- 10-Year T-Note (ZN)

- 30-Year T-Bond (ZB)

Alpha Futures does not support trading in stocks, options, spot forex, CFDs, or cryptocurrencies. The firm focuses exclusively on futures trading to maintain a structured and regulated trading environment.

Restrictions

Alpha Futures enforces strict rules to maintain a fair and ethical trading environment. Violating these rules can result in account termination, forfeited profits, or disqualification from funding.

Automated and High-Frequency Trading

- AI, bots, and fully automated trading systems are prohibited.

- High-frequency trading (HFT) or strategies that place over 100 trades per day are not allowed.

- Semi-automated trading is permitted, but traders must manually manage and monitor positions.

Order Manipulation

- Order book spamming, such as placing excessive small orders to create fake market activity, is strictly prohibited.

- Latency arbitrage and any form of tick scalping strategies are not allowed.

- Traders cannot use multiple accounts to hedge or mirror trades.

News Trading Rules

- Allowed during evaluation phases, but restricted in funded accounts.

- Funded traders cannot execute or close trades within two minutes before or after high-impact news events.

- Stop-loss and take-profit activations within restricted news windows are considered violations.

Account and Trading Conduct

- Traders must execute their own trades—third-party account management is not permitted.

- Copy trading is allowed only if the trader owns both accounts.

- Trade durations must average over two minutes to prevent ultra-fast scalping attempts.

These rules ensure that traders compete on skill and strategy rather than system exploits or unfair practices.

Challenge

Alpha Futures offers a one-step evaluation process to help traders secure funding. Traders must reach a profit target while managing risk within the defined drawdown limits. There are no daily drawdown restrictions, allowing for greater flexibility.

Standard Plan

- Profit Target: $6,000 for a 100K account, $9,000 for a 150K account

- Max Drawdown: $4,000 for 100K, $6,000 for 150K

- Profit Split: 70% to 90%

- Consistency Rule: 50% in evaluation, 40% in funded accounts

- Payouts: Bi-weekly

Advance Plan

- Profit Target: $8,000 for 100K, $12,000 for 150K

- Max Drawdown: $3,500 for 100K, $5,250 for 150K

- Profit Split: 90%

- Payout Requirements: 5 winning days of $200 or more

- Payouts: Bi-weekly

Traders can use AlphaTicks, the firm’s proprietary platform, or connect to TradingView for charting and order execution. No commissions are charged on AlphaTicks, and traders can trade micro and full-size contracts.

Successful traders can scale their accounts up to $450,000, making this an attractive option for those seeking long-term growth in futures trading.

Conclusion

Alpha Futures offers a straightforward one-step evaluation process, giving traders access to simulated capital up to $450,000. With no daily drawdowns on evaluations, traders can manage their strategies without unnecessary restrictions. The firm ensures a bi-weekly payout structure, with traders earning up to 90% profit split on their earnings.

The platform supports CME futures markets, covering equity indices, foreign exchange, commodities, and interest rate futures. With no commissions on AlphaTicks, traders can execute trades with lower costs compared to other platforms. Risk management is key, as the firm enforces an end-of-day trailing drawdown and a consistency rule to maintain stable trading performance.

For traders seeking a simple funding model, frequent payouts, and fair trading conditions, Alpha Futures provides an appealing option. Success depends on discipline and consistency, but those who meet the requirements can scale their accounts effectively.

Key Features

- One-step evaluation with no daily drawdown

- Up to 90% profit split with bi-weekly payouts

- Access to CME futures markets, including equities, forex, and commodities

- No commissions on AlphaTicks platform

- Scaling available up to $450K in funded capital

Considerations

- End-of-day trailing drawdown applies to all accounts

- 50% consistency rule for evaluations, 40% for funded accounts

- No automated trading, AI bots, or high-frequency trading allowed

- News trading restrictions apply to funded accounts

Alpha Futures provides a balanced funding approach, catering to traders who prefer clear rules and efficient risk management. With a strong payout model and an industry-backed platform, it stands as a competitive choice in the futures prop trading space.