Instant Funding provides traders with immediate access to capital, no minimum trading days, and account sizes up to $1.28M. With profit splits up to 90% and fast payouts, it offers a seamless path to scaling and success.

Instant Funding, founded in 2022 and headquartered in the UK, has quickly gained recognition as a trusted prop trading firm. With a focus on offering traders real opportunities, the firm provides a wide range of account options, competitive profit splits, and scalable funding up to $1.28 million. Its trader-friendly approach includes no minimum trading days, a proven payout system exceeding $7.2 million, and access to top platforms like cTrader, MT5, and DXTrade. Instant Funding combines transparency, advanced tools, and a robust support system to create an ideal environment for traders aiming to advance their careers.

About Instant Funding

Instant Funding, established in 2022 and based in the UK, was created with a vision to redefine prop trading and trader education. The firm focuses on providing a transparent, trader-centric environment that balances opportunity with robust risk management. Operating with the highest standards of integrity and compliance, Instant Funding aims to be the gold standard for modern proprietary trading firms.

Since its inception, the firm has grown rapidly, reaching over 25,000 traders in 2023 and paying out more than $7.2 million to successful traders. With clear rules, competitive pricing, and cutting-edge tools, Instant Funding provides an ideal platform for traders to grow their skills and achieve their goals. The company prides itself on its commitment to transparency and customer satisfaction, ensuring a supportive environment for traders at every level.

Funding Program Options

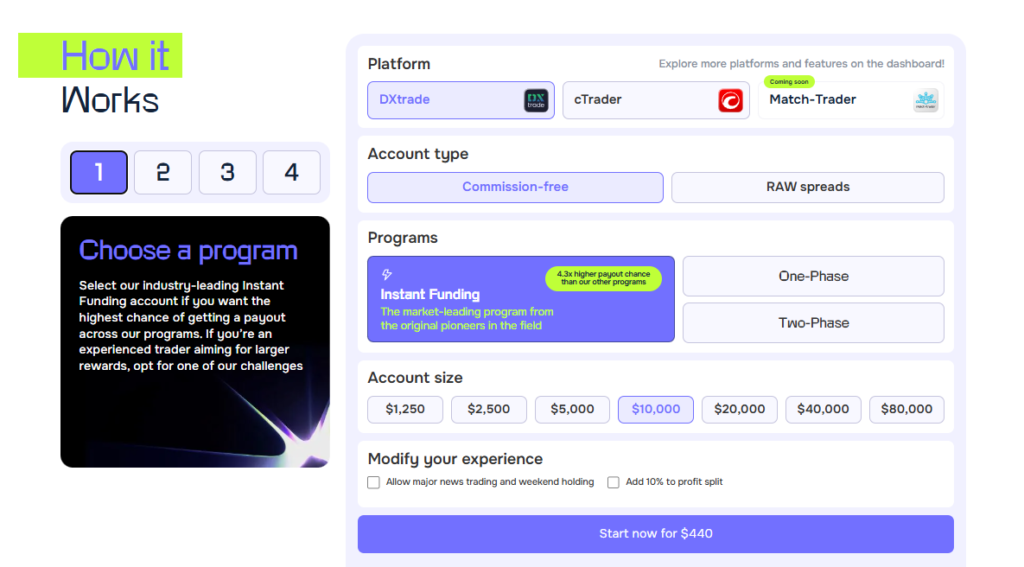

Instant Funding offers multiple programs tailored to meet the needs of traders with different experience levels and goals. These programs are divided into three main categories: Instant Funding, One-Phase, and Two-Phase accounts, each designed to provide flexibility and growth opportunities.

Instant Funding

The Instant Funding program provides traders with immediate access to capital, eliminating the need for an evaluation phase. With account sizes ranging from $1,250 to $80,000, this program is ideal for those looking to trade live markets without delays. Traders enjoy an 80% profit split, a 10% maximum drawdown, and a trailing drawdown system that adapts as profits grow. Scaling is available, allowing accounts to expand up to $1.28 million.

One-Phase Evaluation

The One-Phase program offers a simplified evaluation process, requiring traders to meet a 10% profit target with no time limit. Account sizes start at $10,000 and go up to $200,000. Traders must adhere to a maximum daily loss of 3% and a total drawdown of 8%. Upon completion, traders gain access to live trading with the same 80% profit split and can benefit from the program’s scaling options.

Two-Phase Evaluation

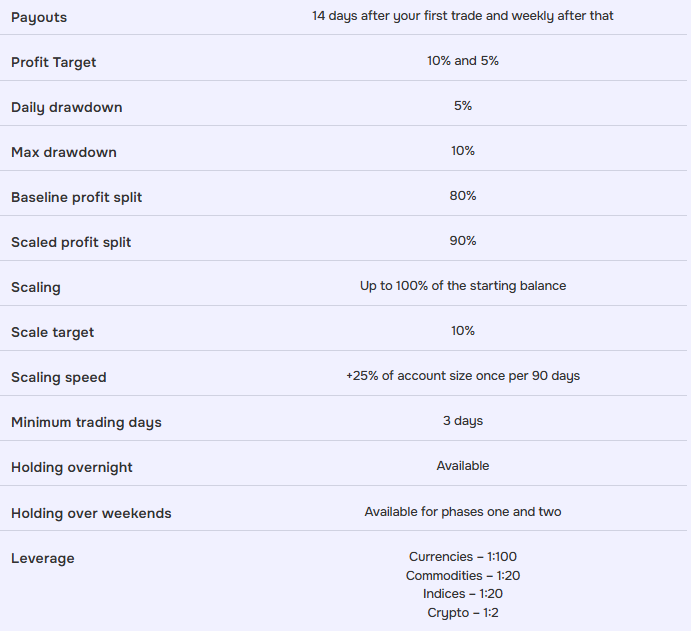

The Two-Phase program provides a more gradual evaluation process, split into two stages. In Phase 1, traders must achieve a 10% profit target, while Phase 2 requires a 5% profit target, with both phases allowing unlimited time to complete. Account sizes range from $25,000 to $200,000, with a 5% daily loss and 10% total drawdown. Like the other programs, successful traders are rewarded with an 80% profit split and scaling opportunities.

These funding options cater to traders seeking either immediate access to capital or a structured evaluation path to prove their skills. With no minimum trading days in some programs and clear risk management rules, Instant Funding provides a platform that empowers traders to grow their capital effectively.

Fees

Instant Funding offers competitive pricing for its funding programs, ensuring accessibility for traders while maintaining flexibility across different account sizes.

Instant Funding Fees

Traders opting for the Instant Funding program pay a one-time fee based on their chosen account size. Fees start at $39.50 for the $1,250 account and go up to $2,759.35 for the $80,000 account. These fees grant immediate access to live trading without any evaluation phase, making it an attractive option for experienced traders.

One-Phase Evaluation Fees

The One-Phase program, designed for a quicker evaluation, has fees starting at $70.98 for the $10,000 account and go up to $795.11 for the $200,000 account. This one-time payment covers the entire evaluation process, with no recurring charges.

Two-Phase Evaluation Fees

The Two-Phase program offers a gradual evaluation process and starts at $158.70 for the $25,000 account. Fees for larger accounts, like the $200,000 account, are priced at $836.58. These fees include both phases of the evaluation, with unlimited time to complete each phase.

All fees are a one-time payment, giving traders access to their chosen program without the burden of ongoing costs. This pricing model ensures traders can focus on their trading goals while enjoying a transparent and cost-effective path to funded trading.

Tradable Assets

Instant Funding provides access to a wide range of trading instruments, catering to diverse strategies and market preferences. Traders can explore opportunities in the following asset classes:

- Forex: Trade major, minor, and exotic currency pairs with leverage of up to 1:100.

- Commodities: Access popular commodities like gold, silver, oil, and natural gas with leverage of 1:20.

- Indices: Speculate on global indices, including major markets such as the S&P 500 and NASDAQ, with leverage of 1:20.

- Cryptocurrencies: Trade leading digital assets like Bitcoin and Ethereum with a leverage ratio of 1:2.

All assets are available across supported platforms like cTrader, MT5, and DXTrade, providing seamless execution and real-time market data. Instant Funding’s offerings enable traders to implement their strategies effectively, whether focusing on intraday opportunities or long-term market trends.

Restrictions

Instant Funding enforces key restrictions to maintain fair trading conditions and ensure responsible risk management. These rules apply across both evaluation and funded accounts:

Profit Consistency Rule

Traders must maintain a balanced approach, as no single trade can account for more than a set percentage of the total profit target. This ensures consistent risk management and prevents over-reliance on one trade.

Trade Duration Rule

All positions must remain open for at least 60 seconds before being closed. Any trade executed faster than this will not count toward the challenge or funded profits.

Minimum Price Movement

Each trade must achieve a minimum price movement of 10 cents per share. If a trade is closed below this threshold, it will not be considered profitable.

Halt Trading Rule

Trading is restricted on assets that experience sharp price movements—8% within 4 minutes or 10% within 5 minutes. If a halt occurs, traders must wait at least one minute before executing a new position.

News Trading Limitations

While news trading is allowed in evaluation and swing accounts, it is restricted in funded accounts. Traders cannot open or close positions within five minutes before or after high-impact news events.

Copy Trading Rules

Copy trading is permitted but only for personal accounts. Trades cannot be copied between different traders’ accounts, ensuring fair trading conditions.

Overnight & Weekend Holding

Overnight holding is available for select accounts, but weekend holding is generally restricted unless an add-on is purchased.

Trading Volume Requirements

During pre-market and after-market hours, a minimum daily volume of 20,000 shares is required to open or add to positions. This rule ensures adequate liquidity and prevents market manipulation.

Challenge

Instant Funding provides traders with challenge-based funding programs designed to test and refine their trading skills. The one-phase challenge requires a 10% profit target with a maximum drawdown of 8-10%, allowing traders to secure funding in a single step.

The two-phase challenge has a structured approach, with phase one requiring a 10% profit target and phase two lowering the target to 5%, while maintaining a 10% drawdown limit and a 5% daily loss cap. Traders can choose from account sizes ranging from $1,250 to $200,000, with an 80% profit split upon funding.

The program offers no minimum trading days for one-phase accounts and a three-day minimum per phase for the two-phase option. Successful traders can scale their accounts up to $1.28 million by reaching a 10% profit milestone, making it a strong option for those looking for long-term growth.

Conclusion

Instant Funding gives traders access to capital without risking their own money. With both instant funding and challenge-based evaluations, traders can secure accounts up to $200,000 and earn an 80% profit split. The scaling plan allows traders to grow their accounts up to $1.28 million by consistently meeting performance targets.

The firm supports forex, commodities, indices, and crypto, with trading available on cTrader, MT5, and DXTrade. Payouts can be requested as early as five days after the first trade and then every seven days.

Risk management includes a 10% total drawdown limit and restrictions on high-impact news trading for funded accounts. With competitive fees, instant payouts, and a clear path for account growth, Instant Funding stands out as a solid choice for traders looking for reliable funding.

Key Features:

- Instant funding and challenge-based evaluations.

- 80% profit split with scaling up to $1.28 million.

- Payouts available within five days of the first trade, then weekly.

- Access to forex, indices, commodities, and crypto.

- Platforms include cTrader, MT5, and DXTrade.

Considerations:

- Funded accounts have restrictions on trading during major news events.

- A 10% total drawdown limit applies.

- Instant funding accounts do not allow weekend holding.

Instant Funding provides a clear and efficient way for traders to grow their capital and access funding on favorable terms.