Funding Traders offers traders up to $2 million in capital with a 100% profit split and fast payouts within 7 days. With no commission or swap fees, access to top platforms, and a solid scaling plan, it provides a trader-friendly environment for consistent growth.

Funding Traders, founded in 2023, offers a transparent and flexible funding program aimed at supporting consistently profitable traders. With global offices in financial hubs like Miami, Dubai, and the UK, the firm allows traders to manage up to $2 million in capital while enjoying 100% profit splits and fast, 7-day payouts. One of the standout features is the commission-free and swap-free trading environment, along with access to popular platforms like MT5, TradeLocker, and DXTrade.

The firm provides an attractive scaling plan, increasing traders’ funding by 25% every two months for consistent performance. With over $4.7 million paid out in 2023 and an average payout time of just 24 hours, Funding Traders ensures a seamless experience. Traders can work across various markets, including forex, metals, indices, and cryptocurrencies, with competitive spreads from 0.0 pips and high leverage options.

With its commission-free setup, scaling opportunities, and mentorship from seasoned professionals, including guidance from the CEO, Funding Traders focuses on fostering the growth of skilled traders. It offers a dynamic platform for those looking to scale up and succeed in the trading world.

About Funding Traders

Funding Traders, founded in 2023, is a global prop trading firm that gives traders the chance to grow their accounts up to $2 million through a flexible and transparent funding model. With offices in financial centers like Miami, Dubai, and the UK, the firm stands out by offering traders the freedom to trade without time limits, commission fees, or swap charges.

Focused on trader development, Funding Traders provides access to mentorship from experienced professionals and offers a generous scaling plan for consistent performers, allowing account growth by 25% every two months. This makes it a strong option for traders looking to maximize their potential in a supportive, fee-free environment.

Funding Program Options

Funding Traders offers two main evaluation programs designed for traders aiming to secure funding:

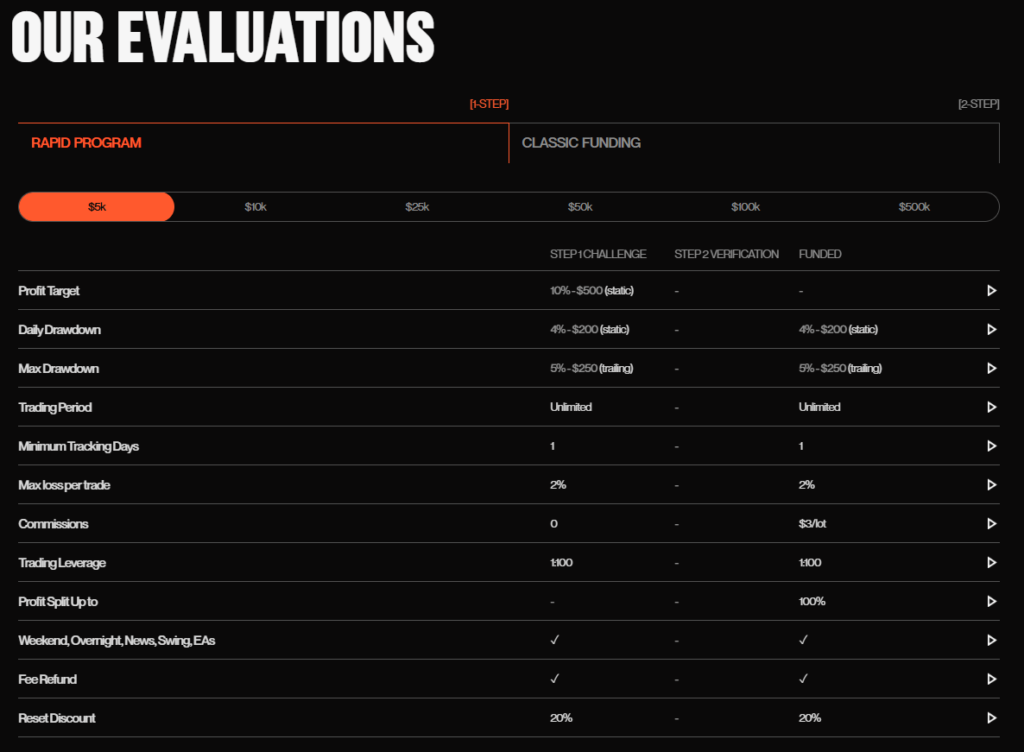

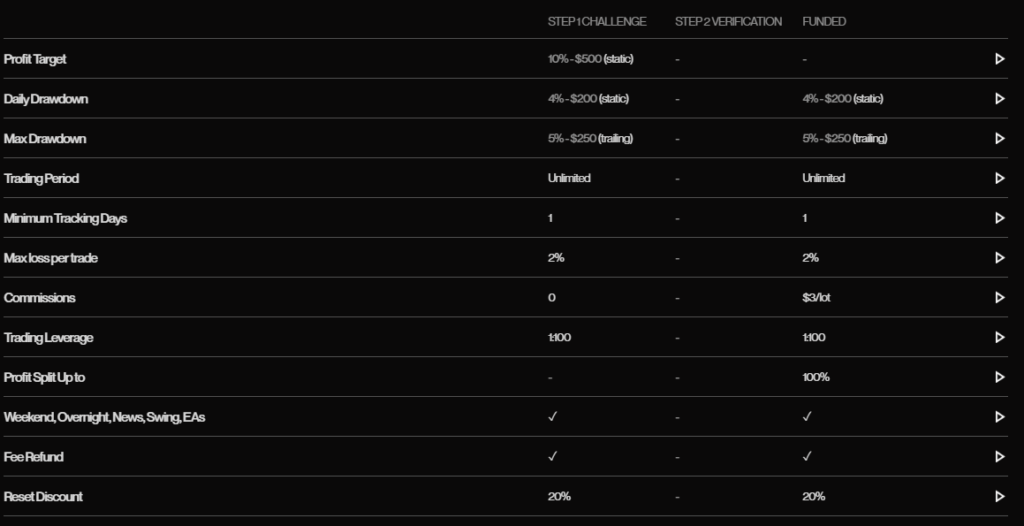

1-Step Rapid Program

This program offers a simple and fast route to funding, where traders must meet a set profit target while adhering to clear drawdown limits. It’s perfect for those seeking a quicker path to a live funded account, with the flexibility to trade on weekends, during news events, and overnight. Upon completing the challenge, traders gain access to a live funded account with a 100% profit split.

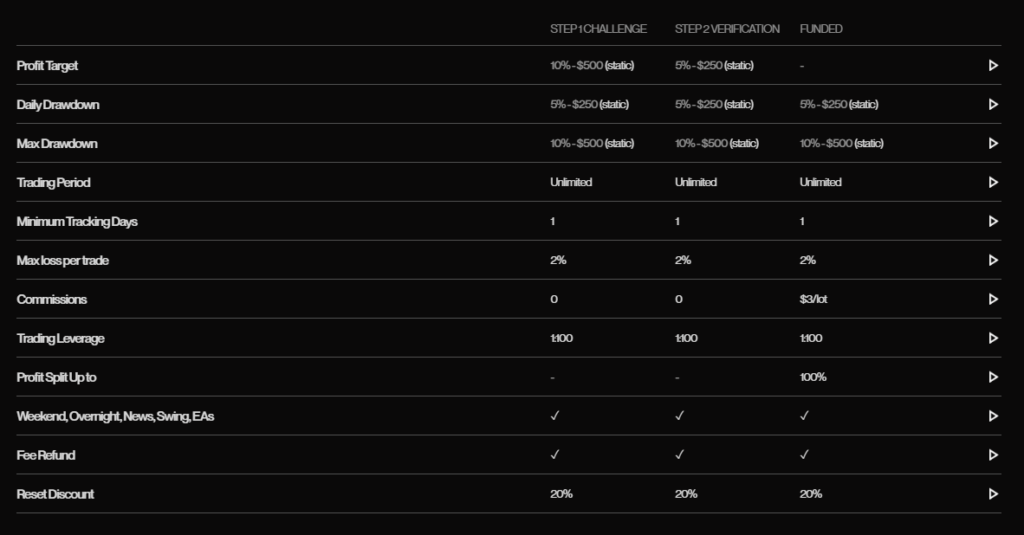

2-Step Classic Funding

The Classic Funding program features a two-phase evaluation, requiring traders to meet profit targets at each stage. This option provides a more gradual approach, with no time limits on completing either phase. Once both steps are successfully passed, traders manage a live funded account and benefit from the firm’s profit split system.

Both programs offer flexibility and transparency, with different account sizes available to match each trader’s preferences.

Fees

Funding Traders offers competitive pricing for their evaluation programs, with fees determined by account size and program type. Below is a breakdown of the costs for both the 1-Step Rapid Program and the 2-Step Classic Funding:

1-Step Rapid Program

- $5K Account: $50

- $10K Account: $100

- $25K Account: $200

- $50K Account: $300

- $100K Account: $550

- $200K Account: $1,100

- $350K Account: $2,000

- $500K Account: $3,000

2-Step Classic Funding

- $5K Account: $50

- $10K Account: $100

- $25K Account: $200

- $50K Account: $300

- $100K Account: $550

- $200K Account: $1,100

- $350K Account: $2,000

- $500K Account: $3,000

All fees are 100% refundable once traders hit their profit targets and qualify for a funded account. With no commissions, no swap fees, and high leverage, Funding Traders provides a cost-effective path for those looking to become funded traders.

Tradable Assets

Funding Traders offers a diverse selection of tradable assets, giving traders the flexibility to implement strategies across various markets. Major asset classes include:

- Forex: Trade major, minor, and exotic currency pairs with tight spreads and fast execution.

- Commodities: Access key commodities like gold, silver, crude oil, and natural gas.

- Indices: Speculate on global indices such as the S&P 500, NASDAQ, and FTSE 100.

- Cryptocurrencies: Capitalize on price movements in top digital assets like Bitcoin and Ethereum.

These assets are available on leading platforms, including MT5, TradeLocker, and DXTrade, offering advanced tools, low spreads, and minimal slippage to enhance the trading experience.

Challenge

Funding Traders offers two main evaluation programs that traders can choose from, each designed to test their trading skills and risk management capabilities:

1-Step Rapid Program

In the 1-Step Challenge, traders must achieve a 10% profit target while staying within a 4% daily drawdown and a 5% overall drawdown. There are no time limits, and traders can hold positions overnight, on weekends, and during news events. Once the target is met, traders receive a live funded account with a 100% profit split. This option suits those seeking a faster route to funding without multiple evaluation stages.

2-Step Classic Funding

The 2-Step Program provides a more gradual evaluation. In Step 1, traders aim for a 10% profit target, with a 5% daily drawdown and a 10% overall drawdown. In Step 2, the profit target drops to 5%, but the same risk management rules apply. Like the 1-Step option, there are no time restrictions, and traders can hold trades overnight and during key events. Upon completing both steps, traders are granted a funded account with a 100% profit split.

Both programs offer a range of account sizes, from $5K to $500K, giving traders the flexibility to choose the best path for their style and risk appetite.

Restrictions

Funding Traders enforces several key restrictions to promote responsible trading and safeguard both the trader and the firm. These rules help ensure that traders adopt consistent, risk-managed strategies.

Consistency Rule

Traders are required to maintain consistent risk per trade, with position sizing staying steady. Over-risking on a single trade is discouraged to prevent large equity swings. Risking more than 2% on any trade is considered excessive and may lead to avoidable losses.

Copy Trading

Traders are allowed to use copy trading tools, but only across their own accounts. Copying trades to other traders’ accounts or sharing trading signals is strictly prohibited. Copy trading software can be used within a trader’s own accounts but cannot be applied between different Funding Traders accounts.

EAs/Bots/HFT

Expert Advisors (EAs) and bots are permitted to automate strategies, but High-Frequency Trading (HFT) is not allowed. HFT strategies often suffer from latency issues that are difficult to replicate in live markets. Additionally, grid EAs, off-the-shelf EAs, and purchased EAs are not permitted.

Martingale Systems and Arbitrage Trading

Martingale and arbitrage strategies are banned due to their high-risk profiles. Martingale systems, which increase position sizes after losses, can lead to rapid drawdowns, while arbitrage relies on short-term price differences, which are unsustainable over time.

News Trading

News trading is allowed, but traders should be mindful of potential risks such as widened spreads and slippage during high-impact events. While this strategy is permitted, relying heavily on it is not recommended due to the execution challenges that can arise during major news releases.

These rules ensure that traders manage risk responsibly while maintaining sustainable trading conditions for the platform.

Conclusion

Funding Traders offers a flexible and well-structured trading environment for those seeking substantial funding, with account sizes reaching up to $2 million. The firm’s transparent evaluation programs, including the 1-Step Rapid Program and 2-Step Classic Funding, allow traders to demonstrate their abilities while benefiting from a 100% profit split on funded accounts.

With access to a wide variety of tradable assets, competitive fees, and the option to use Expert Advisors and Bots, Funding Traders accommodates different trading styles. The firm’s clear risk management rules, no time limits on evaluations, and features like copy trading and news trading make it suitable for both experienced and beginner traders.

Key Features:

- Multiple evaluation programs with flexible funding options.

- 100% profit split on live funded accounts.

- Access to forex, indices, commodities, and cryptocurrencies.

- Competitive fees with accessible scaling plans.

- Support for Expert Advisors and copy trading.

Considerations:

- Strict risk management rules, prohibiting strategies like Martingale and HFT.

- Caution advised for heavy reliance on news trading due to execution risks.

Funding Traders provides a transparent, supportive framework for traders to grow. With experienced backing and a straightforward funding process, it’s a solid choice for traders looking to advance their trading careers.