Trade The Pool empowers stock traders with real market access, no PDT restrictions, and funding options ranging from $20K to $160K for day trading or $3K to $24K for swing trading, offering profit splits up to 70% and a clear path to scaling capital.

Trade The Pool is a stock trading prop firm designed for traders seeking access to live market conditions without risking personal capital. It offers a range of funding programs with buying power options from $20,000 to $260,000 for day trading and $3,000 to $39,000 for swing trading. Traders can bypass the PDT rule, trade over 12,000 stocks and ETFs, and utilize real-time data feeds.

With features like free access to top tools during evaluations, scaling opportunities for consistent performance, and profit splits of up to 80%, Trade The Pool creates a supportive environment for traders at all levels. Fast payouts, no time limits, and transparent rules make it a compelling choice for traders aiming to grow their skills and capital.

About Trade The Pool

Trade The Pool, created by Five Percent Online Ltd (the team behind The5ers.com), focuses on stock trading funding for traders of all levels. With extensive experience in stock and forex trading, the firm removes barriers like the PDT rule and limited capital, allowing traders to access real stocks, ETFs, and penny stocks.

Traders can access real accounts, scalable capital, and tailored stock trading programs. With live market conditions, advanced tools, and a transparent approach, Trade The Pool is dedicated to supporting traders in growing their skills and achieving success.

Funding Program Options

Trade The Pool provides funding programs designed to give traders access to significant capital without risking their own funds. Whether you focus on day trading or swing trading, the firm offers options suited to different trading strategies and styles. Traders can access U.S. stocks, ETFs, and penny stocks, with the ability to trade under real market conditions, including pre-market and after-hours sessions.

Day Traders

Trade The Pool offers funding programs for day traders with buying power ranging from $20,000 to $260,000. These programs allow traders to trade U.S. stocks and ETFs while meeting profit targets and adhering to drawdown limits. With pre-market and after-hours trading available, day traders can take advantage of more opportunities and demonstrate their skills effectively.

Swing Traders

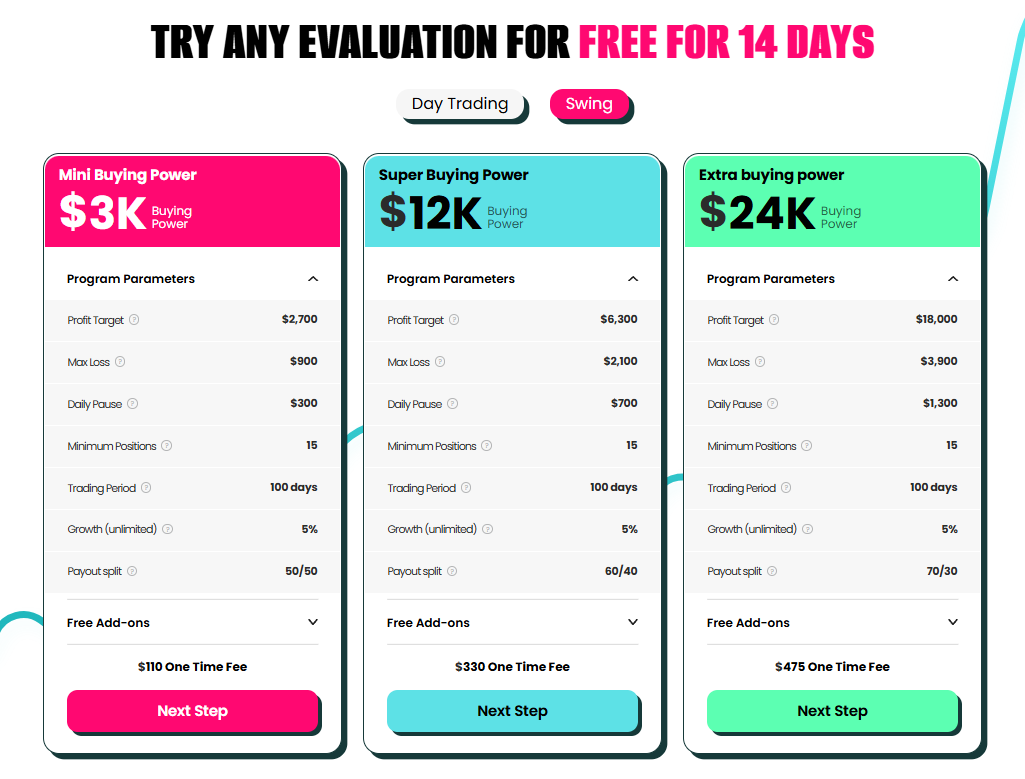

For swing traders, Trade The Pool provides funding options starting from $3,000 in buying power, scaling up to $39,000. These programs are suitable for those holding positions overnight or over weekends. With defined profit targets, trading periods, and risk rules, swing traders can focus on achieving consistent results over longer timeframes.

Fees

Trade The Pool offers a one-time payment structure for its funding programs, with costs varying depending on the funding tier. Below is the breakdown of fees for day traders and swing traders, ranging from the most affordable to the highest tiers.

Day Trading Fees

- Mini Buying Power: $97

- Super Buying Power: $300

- Extra Buying Power: $475

Swing Trading Fees

- Mini Buying Power: $110

- Super Buying Power: $330

- Extra Buying Power: $475

These one-time fees grant traders access to live market conditions without additional recurring costs, making it a clear and straightforward option for those seeking funded trading opportunities.

Tradable Assets

Trade The Pool provides access to a wide selection of U.S. stocks and ETFs, catering to traders focused on the stock market. From major stocks to penny stocks and ETFs, traders can take advantage of diverse opportunities across different sectors and market conditions.

Day traders and swing traders alike can execute their strategies effectively, with options to trade during pre-market and after-hours sessions. This setup allows traders to stay active beyond regular trading hours, ensuring they can respond to market trends as they develop.

Challenge

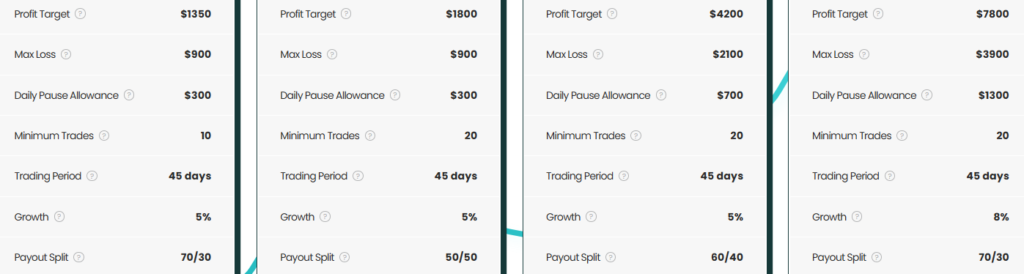

Trade The Pool provides a structured challenge for traders to prove their skills and secure funded accounts. With options designed for both day traders and swing traders, participants can select the buying power level that suits their trading style while adhering to clear rules and targets.

Day Traders

Day traders can choose from buying power levels ranging from $20,000 to $260,000. Each level comes with specific profit targets, rules, and a one-time fee between $97 and $475. Traders must meet their profit targets while following guidelines such as a minimum trade duration of 30–60 seconds and a price movement of at least 10 cents per trade. A consistency rule applies, requiring no single trade to account for more than 30–50% of total profits, depending on the chosen level. Successfully completing the challenge allows traders to access funded accounts and start withdrawing profits.

Swing Traders

Swing traders can participate in the challenge with buying power options ranging from $3,000 to $39,000 and a 100-day trading period. Trades must meet a minimum duration of 60 seconds and a minimum price movement of 10 cents. Additionally, the consistency rule ensures that no single trade exceeds 30% of total profits. This program is tailored for traders who prefer holding positions overnight or over weekends. Meeting the profit targets within the defined rules grants swing traders access to funded accounts.

Restrictions

Trade The Pool ensures disciplined and responsible trading through specific risk management rules applied during both the evaluation and funded phases.

Profitable Position Rule

No single trade can contribute more than 30% of the profit target in both the evaluation and funded phases. For example, if the profit target is $1,800, the maximum profit from one trade cannot exceed $540.

10 Cents Rule

All profitable trades must achieve a minimum price movement of 10 cents per share. For instance, if you buy a stock at $50.10, it must be sold at $50.20 or higher to count as a profitable trade. Trades with less than a 10-cent movement won’t qualify as profitable.

Halt Trading Rule

Trading is restricted on stocks experiencing significant volatility. If a stock moves 8% within 4 minutes or 10% within 5 minutes, trading on it is paused. After the pause, traders must wait at least one minute before placing a new trade on the stock.

60 Seconds Rule

Each trade must remain open for a minimum of 60 seconds between opening and closing actions. For example, if you buy Apple (AAPL) at 11:00 AM, it cannot be sold until at least 11:01 AM. Trades completed in less than 60 seconds will not count as profitable.

Minimum Volume Rule

For trades placed during pre-market or after-market hours, the stock must have traded at least 20,000 shares on that day. During regular trading hours, the minimum volume requirement increases to 200,000 shares. These rules ensure liquidity and reduce risks in low-volume trading periods.

Overnight and Swing Trading Rules

Traders holding positions overnight or over weekends must ensure that the stock does not belong to a company reporting earnings during these periods. Any overnight position on reporting stocks will be liquidated before market close.

Scaling and Consistency Requirements

Traders must meet consistency rules, such as ensuring no single trade contributes more than 30–50% of the total profits, depending on the program tier. Additionally, consistent performance is required to scale account buying power and daily loss limits.

These updated rules reflect Trade The Pool’s commitment to maintaining a fair and supportive environment for all traders, ensuring both safety and transparency in their funded programs.

Conclusion

Trade The Pool offers stock traders a practical path to trading in real market conditions without risking their own capital. With no PDT rule and funding programs designed for both day and swing traders, the firm provides opportunities for traders at all levels to grow their skills and capital. Buying power options range from $20K to $160K for day traders and $3K to $24K for swing traders, catering to different trading styles and risk preferences. Profit-sharing reaches up to 70%, allowing traders to reap significant rewards while adhering to clear guidelines on profit targets, trade duration, and risk management.

The platform provides access to over 12,000 stocks and ETFs, ensuring a wide variety of trading opportunities. Features like a transparent evaluation process and risk management rules, such as the 60-second holding requirement and halt trading limits, encourage disciplined and fair trading practices.

With competitive fees, clear challenges, and a structured profit-sharing model, Trade The Pool is an appealing choice for traders looking to advance in the stock market.

Key Features:

- Trade real stocks and ETFs with no PDT rule.

- Funding programs ranging from $20K to $160K for day traders and $3K to $24K for swing traders.

- Up to 70% profit share.

- Access to over 12,000 U.S. stocks and ETFs.

- Evaluation and funded phases designed for both day and swing trading styles.

Considerations:

- Clear risk management rules, including the 60-second holding rule and drawdown limits.

- Minimum price movement of 10 cents per trade to qualify as profitable.

- Consistency and evaluation requirements must be met during the funded stages.

Trade The Pool blends opportunity with accountability, offering traders a professional platform to scale their strategies while promoting responsible trading practices.