Islamic Finance

Swap-free accounts are also known as Islamic accounts because they follow the principles of Islamic finance. In Islamic finance, earning or paying interest is not allowed, and swap-free accounts allow traders to avoid paying or receiving interest on positions held overnight. Therefore, swap-free accounts are typically designed for traders who follow Islamic law. Still, they can also be helpful for non-Islamic traders who want to avoid the interest charges that are associated with traditional accounts.

What is Swap in Trading?

A swap is a derivative mechanism that enables two parties to trade cash flows, liabilities, or price changes of two assets. An illustration would be when two parties exchanged the cash flows of two bonds or other interest-rate products. Although the other may pay a variable rate, one may pay a fixed rate.

Swaps are a relatively new class of derivatives that first appeared in the late 1980s. Despite being very young, they are among the most widely traded financial contracts due to their simplicity and wide range of applications.

What is a Swap-free Trading Account?

Brokers charge traders a “swap”—a rollover interest or commission—when they hold a position for longer than a day. You can trade as a result without paying any overnight costs.

A swap-free account is an account type with a fixed charge instead of a swap intended for Islamic traders. The fee is not an interest but based on the order’s placement. They are the only varieties of interest-free trading accounts, and Muslim traders increasingly prefer them. Examples of Swap Free Accounts brokers are JustForex, IC Markets, Exness, FXOptimax, HotForex, and XM brokers.

How Swap-Free Accounts Work

Islamic or swap-free accounts only generate income from foreign exchange. It also does away with the prohibition on gambling, which is categorically prohibited by Sharia Law, and the limit on interest.

This account does not consider the impact of the swap. It allows the owner to retain open positions indefinitely without the commission for a trade transfer developing in either a positive or negative direction. In this situation, a change in currency rates over the specified time may influence the trade outcome.

Advantages and Disadvantages of Swap-Free Accounts

Advantages

- It is accessible on various currencies, indexes, equities, and precious metals.

- Use trades with a broader scope and maintain open positions for longer than 24 hours.

- Brokers don’t charge or give out interest.

- Allow you to hold positions open throughout the night without paying rollover fees.

- Ultra-tight spreads.

Disadvantages

- All Muslim customers that use Islamic trading accounts with the forex broker pay non-Riba or haram, such as margin, commission, and administrative costs. Moreover, these costs occasionally exceed position swaps and might be pretty high.

- A more significant minimum investment requirement and lessening the leverage.

- Not all of the account types and instruments that the broker offers can be used for swap-free trading.

- A positive swap cannot be substituted, so moving an open position for the following day is not profitable.

How to Open a Swap-Free Account

Most traders must open a MetaTrader 4-based account to enable the “Swap-Free” feature. Then, write to the 24/7 online support chat or contact the prop firm customer support.

Many prop firms now provide swap-free or Islamic accounts that follow Islamic Law by removing roll-over interest and interest-related fees to provide everyone with trading opportunities.

Here are a few prop firms that offer swap-free accounts:

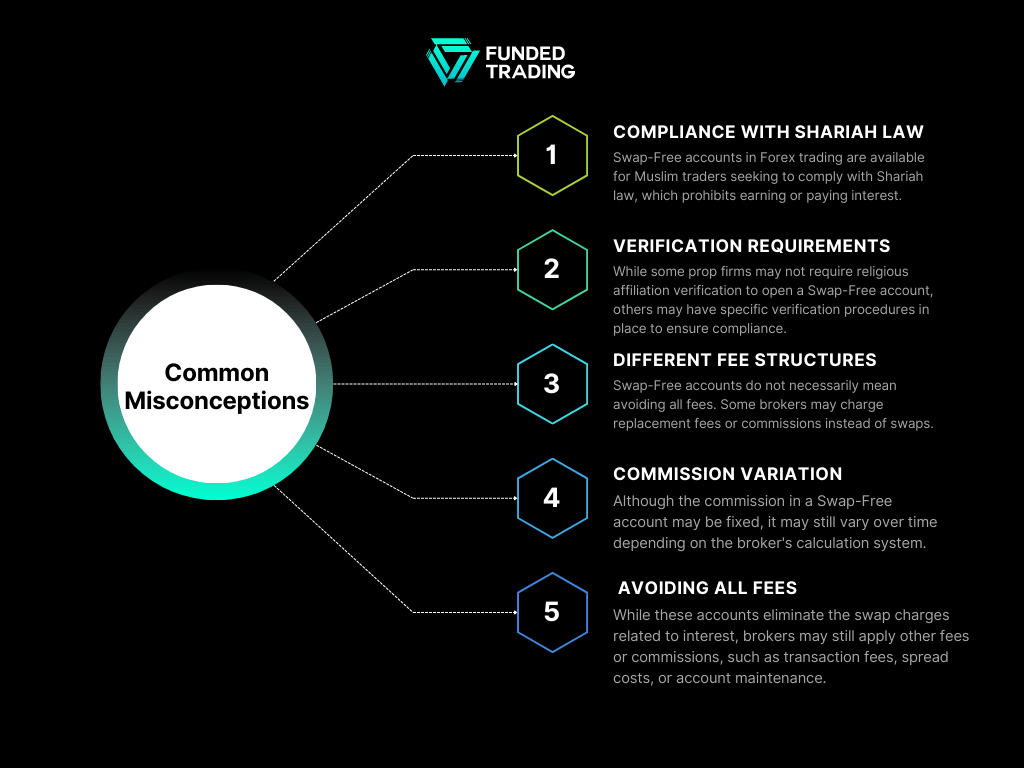

Common Misconceptions About Swap-Free Accounts

Swap-Free accounts are available for Muslim traders who wish to comply with Shariah law, which prohibits earning or paying interest. However, not all prop firms require verification to open such an account. Some firms may allow traders to use a Swap-Free account without verifying their religious affiliation, while others may require special verification procedures to ensure compliance. It’s important to check the specific requirements of each prop firm before opening a Swap-Free account.”

However, it is important to note that having these accounts does not guarantee the avoidance of all fees, as certain brokers may impose replacement fees or commissions instead. Take Alpari, for instance, which applies a fixed commission based on the pair type and trading lot quantity, rather than the interest rate differential. It is crucial to comprehend that although the commission might be fixed, it can still fluctuate over time and may differ based on the broker’s calculation system. Overall, Forex Islamic accounts offer a way for Muslim traders to participate in the Forex market while adhering to their religious beliefs.

Conclusion

In summary, a swap-free account is designed explicitly for Islamic traders and replaces the swap fee with a fixed charge. This account type, also known as an Islamic account, eliminates rollover fees entirely, making it compatible with Islamic principles.

In conventional forex trading, interest fees, including rollover fees, are part of the process. However, Islamic Forex accounts are exempt from these costs, providing a solution for traders who wish to adhere to Islamic financial principles.

When switching to a Swap-Free account, traders retain all other forex trading terms, ensuring a seamless transition. The overnight commission is determined solely by the instrument and the number of open positions, allowing traders to manage their accounts while respecting their religious beliefs.