Windlu Review

Navigating the challenging Forex trading industry is made easier with our Windlu review. Discover a refreshing and effective approach as Windlu stands out, dedicated to nurturing successful traders through a unique combination of education, practical experience, and lifestyle enhancement.

About Windlu

Windlu combines entrepreneurial skills, IT knowledge, and in-depth Forex trading education. More than just a training course, Windlu is designed to transform participants into successful Forex traders. Located in Rosebank, South Africa, at 114 Oxford Road, Oxford and Glenhove Building 2, 1st Floor, Windlu represents the flexibility and opportunities available in modern Forex trading.

The program focuses on empowering traders, giving them access to substantial virtual funds in demo accounts. This approach offers a realistic and secure environment for developing skills, building confidence, and preparing for real-world trading.

A key element of Windlu is its commitment to education. Participants receive training in the latest market trends and trading techniques, ensuring they are well-prepared for the Forex market. This emphasis on continuous learning and skill development differentiates Windlu in the Forex education sector.

Windlu appeals to those looking for a balance between work and personal life. It provides the advantage of trading flexibility, enabling people to trade from anywhere in the world. This feature is particularly attractive to modern traders prioritising financial success and personal freedom.

Funding Program Options

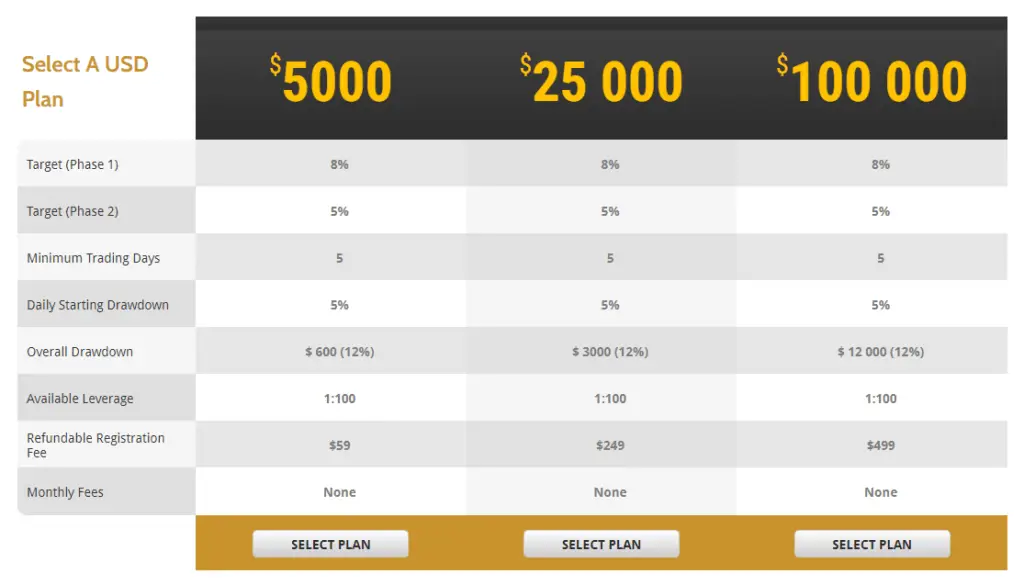

Windlu provides flexible funding options in its 2 Phase Challenge, designed for traders of all experience levels and risk preferences. Whether you prefer a cautious approach or are comfortable taking larger risks, Windlu has a plan that suits your trading style.

2 Phase Challenge

This program is the cornerstone of Windlu’s funding options. It consists of two phases, each designed to assess and hone different aspects of your trading expertise.

- Phase 1: The initial phase acts as a proving ground for traders, where they are required to meet an 8% profit target within a 30-day period.

- Phase 2: Upon successfully completing Phase 1, traders move to Phase 2, which has 60 days with a 5% profit target.

Both phases have a minimum trading requirement of 5 days and allow for weekend position holding. They also share the same parameters for daily and overall drawdown, capped at 5% and 12%, respectively, and offer a leverage of 1:100.

Fees

Traders can choose from a range of capital options, including ZAR 100,000, ZAR 250,000, ZAR 500,000, $5,000, $25,000, and $100,000. The corresponding prices for these capital options are ZAR 999, ZAR 2,499, ZAR 4,999, $59, $249, and $499 respectively. This variety ensures that traders of all financial backgrounds have an opportunity to participate.

One of Windlu’s features is its refundable fee policy. Upon successful completion of the 2 Phase Challenge and meeting the set profit targets, traders can have their initial fee refunded. This policy underscores Windlu’s commitment to rewarding skill and dedication.

However, it’s important to note that if a trader doesn’t pass the evaluation on their first try, the fees are not refundable. Nonetheless, Windlu provides an opportunity to reapply and retake the challenge, offering traders a second chance to prove their skills.

Windlu’s funding options are structured to accommodate a wide array of traders, from novices to those more seasoned. The clear and straightforward fee structure, combined with the refundable policy, makes Windlu an appealing choice for those looking to embark on or advance their Forex trading journey. The 2 Phase Challenge not only tests a trader’s skill but also provides an educational curve, enhancing their trading acumen in a realistic and supportive environment.

Tradable Assets

Windlu offers a focused selection of assets that caters to traders who are looking to specialize in specific markets:

Forex

Access to a wide range of currency pairs, providing ample opportunities for traders who are keen on the foreign exchange market.

CFDs (Contracts for Difference)

These instruments allow for speculation on price movements without owning the underlying asset. Windlu provides CFD options for traders interested in this derivative.

Index CFDs

Ideal for those who wish to trade on the performance of global markets, Windlu’s index CFDs offer a gateway to a diversified investment approach.

Commodities

Windlu includes commodities such as oil and metals in its asset list, appealing to traders who are looking to trade in the commodities market.

Restrictions

Windlu has established certain trading restrictions, aimed at maintaining a stable and secure trading environment:

Max Trading Volume

The maximum trading volume is not restricted, granting traders the freedom to choose their own scale of trade.

Trade Copiers

The usage of trade copiers is not permitted on Windlu’s platform.

News Trading

Windlu does not recommend or allow trading during significant economic news events. To safeguard against the volatility that such events can induce, they have implemented a restriction that prevents trading from occurring 5 minutes before and 10 minutes after major news announcements.

Expert Advisor (EA)

The use of Expert Advisors for automated trading is not supported by Windlu. Traders are encouraged to apply their own analysis and judgment in their trading activities.

Weekend Holding

Windlu does allow for positions to be held over the weekend, which is beneficial for traders who employ longer-term strategies or those who want to keep their trades open beyond the standard trading week.

Challenge

The Windlu Challenge, as part of their Funding Program Options, is structured into two distinct phases, each with specific targets and conditions for traders to meet:

Phase 1: This initial phase requires traders to hit an 8% profit target. It tests traders’ ability to generate profits while managing risks effectively.

Phase 2: Upon successfully completing Phase 1, traders enter Phase 2, which has a slightly lower profit target of 5%. This phase continues to assess the traders’ skill in sustaining profitable trades over a longer period.

Both phases demand adherence to risk management protocols, with set limits on daily and overall drawdowns to ensure that traders do not exceed acceptable loss thresholds. Additionally, traders are given the flexibility to trade with substantial leverage, reflecting the firm’s confidence in their selection process and the skills of their traders.

The leverage offered can be up to a specified limit, which allows traders to control a large position with a comparatively small amount of capital. This can potentially increase the returns on successful trades. However, it is essential to remember that leverage also increases the risks, as it can amplify losses just as it can increase profits.

Completing the Windlu Challenge successfully and meeting all specified targets and conditions allows traders to manage a funded account. This milestone signifies a trader’s ability to trade responsibly and profitably, aligning with Windlu’s commitment to fostering trading expertise and risk management proficiency.

Broker

Regarding the broker information, Windlu uses RaiseFX as its brokerage partner. RaiseFX is noted for offering a wide range of trading instruments, including over 500 different assets across Forex, Indices, Crypto, Commodities, and Stocks CFDs. It also provides flexible leverage options and availability of the MetaTrader 4 platform, with no deposit or withdrawal fees and competitive spreads starting from 0.0 pips. Customer support is available during weekdays.

RaiseFX is operated by Raise Global SA (Pty) LTD, with Company Number: 2018/616118/07. They are an authorized Financial Service Provider (FSP), registered and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 50506. Their main and physical office is at 114 Oxford Road, Rosebank, Gauteng, 2196, South Africa. Additionally, their physical office is situated at Portside Building, 4 Bree Street, Cape Town, 8001, South Africa.

In Conclusion

As we conclude our look into Windlu, it’s important to highlight what makes it stand out in the world of funded trading programs.

Windlu collaborates with RaiseFX as its brokerage partner, emphasizing their dedication to offering a wide range of trading instruments and flexible conditions.

A key feature of Windlu is its two-phased challenge, designed to assess and improve a trader’s skills rigorously. This process evaluates both a trader’s ability to reach profit targets and adhere to strict risk management rules.

Windlu is notable for its commitment to education and skill development. By providing traders with the knowledge and practice needed to succeed, Windlu goes beyond just funding; it aims to create proficient, well-rounded traders.

Additionally, the flexibility to hold positions over the weekend caters to various trading strategies and schedules.

Deciding if Windlu is the right fit depends on individual goals, risk tolerance, and trading style. For those aspiring to grow in Forex trading, especially with a focus on education and a structured approach to managing larger capital, Windlu offers an opportunity worth considering.

Windlu’s balanced approach, offering both freedom and structure, could be the catalyst for traders seeking greater proficiency and financial success on their journey.