Many aspiring traders feel lost when starting their journey. Viva Funders aims to be a guiding light, attracting both new and seasoned traders with its focus on the trader’s success. But is Viva Funders simply another proprietary trading firm, or does it truly live up to its promise of unlocking your trading potential? This review will delve into Viva Funders’ offerings and explore whether it’s the right fit for you.

About Viva Funders

Viva Funders positions itself as a prop firm designed with traders in mind. They emphasize understanding trader needs and challenges, fostering a welcoming environment for both experienced and new traders.

Innovative Funding Approach

Viva Funders aims to address shortcomings in traditional funding programs. They bypass lengthy demo phases or high initial investments, offering a quicker path to funded accounts. This attracts skilled traders while providing a supportive environment for development.

Focus on Accessibility and Transparency

Viva Funders prioritizes accessible funding. Their goal is to create an ecosystem that empowers people from all backgrounds to participate in financial markets. They emphasize transparency and a focus on mutual benefit to build trust.

Global Community and Support

Viva Funders boasts a global reach, engaging traders from over 120 countries. This diverse community fosters exchange of ideas and strategies, creating a vibrant trading environment. They claim to maintain a personal touch despite their size, ensuring each trader feels supported.

Education and Development

Viva Funders highlights the importance of continuous learning for successful trading. They invest in trader development by offering educational opportunities.

Funding Program Options

Viva Funders provides tiered programs and trading challenges to cater to a range of experience levels and risk tolerance. These options aim to be accessible and flexible, attracting both cautious and ambitious traders.

Central to Viva Funders’ approach are trading challenges. Designed to simulate real-world trading environments, these challenges assess a trader’s skills. They reportedly allow traders to progress at their own pace, potentially reducing stress and encouraging thoughtful decision-making.

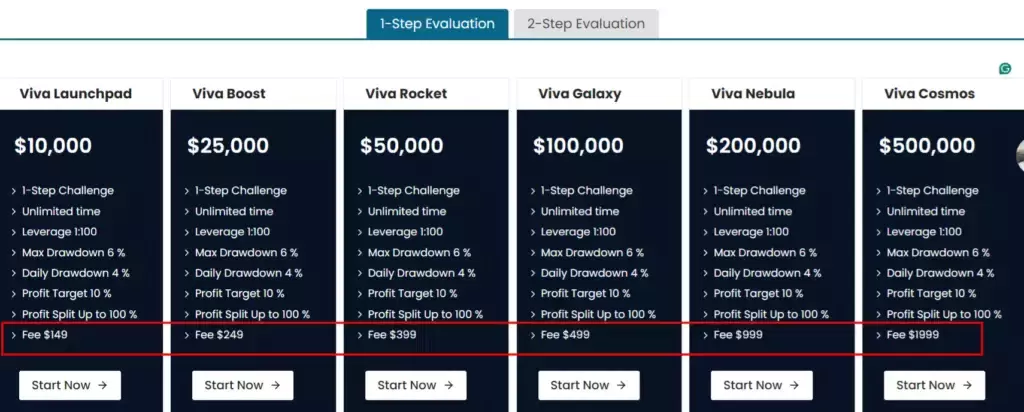

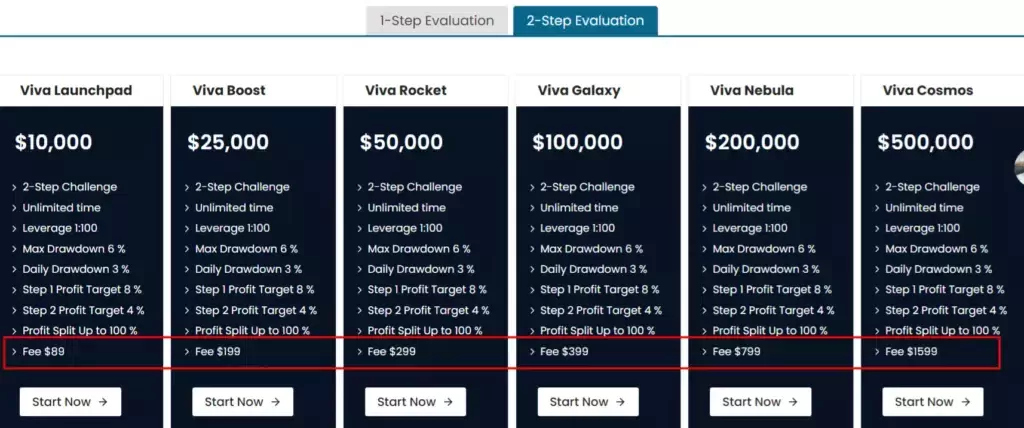

Viva Funders offers a variety of funding programs with different account sizes. This allows traders to choose a program that aligns with their budget and trading style. Here’s a breakdown of key program details:

- Minimum Trading Days: No minimum trading days are required.

- Maximum Loss:

- Program 1: Daily loss limit of 4%, total loss limit of 6%.

- Program 2: Daily loss limit of 3%, total loss limit of 6%.

- Profit Targets:

- Program 1: Profit target of 10%.

- Program 2: Profit target for step 1: 8%, profit target for step 2: 4%.

- Leverage: Viva Funders offers 1:100 leverage.

Fees

Viva Funders’ program fees vary depending on the chosen account size, ranging from $10,000 to $500,000. This caters to traders with differing funding capacities.

- Fee Structure:

- The fee starts at $89 for the 2-step program and $149 for the 1-step program.

- Larger accounts (e.g., $500,000) incur higher fees ($1599 for the 2-step program and $1999 for the 1-step program).

- Refundable Fees: Notably, Viva Funders offers a refund on these fees if you become a funded trader with their firm.

Viva Funders’ profit-sharing model stands out as a potential benefit. Traders have the opportunity to keep up to 100% of their profits, which is reportedly higher than what many other prop firms offer.

Tradable Assets

Viva Funders offers a variety of tradable instruments to suit different trading styles and preferences. They also have specific policies in place to manage risk and promote responsible trading.

- Forex: A wide selection of currency pairs is available for traders focused on the foreign exchange market.

- Metals and Commodities: These instruments can be used to diversify portfolios beyond currencies.

- Shares and Indices: Viva Funders allows trading in shares and indices, providing exposure to the stock market.

- Cryptocurrencies: Unlike other asset classes with limited trading hours, Viva Funders offers the ability to trade cryptocurrencies 24/7.

Restrictions

Maximum Daily Loss Limit

To protect traders, Viva Funders sets a maximum daily loss limit of 4% and 6% overall loss limit of equity for the 1-step account. For the 2-step account, the max daily loss limit is 3%, and the overall loss at 6%. This policy helps manage risk and encourages responsible trading.

Overnight/Weekend Trading

You may hold trades overnight; however, it is against our rules to hold trades over weekends.

Expert Advisors (EAs)

Viva Funders supports the use of Expert Advisors and Indicators, as long as traders comply with their Responsible Trading Policy. This flexibility allows traders to leverage automated tools to refine their strategies and make informed decisions.

Responsibility and Compliance

Traders must align their trading parameters with their individual style and account specifications. Viva Funders’ policy framework ensures that traders operate within a secure environment, promoting both individual success and overall market stability.

Challenge

Viva Funders offers a trading challenge designed to assess a trader’s skills in a simulated trading environment. Here’s a breakdown of key features:

- Flexible and Realistic: The challenge aims to replicate real-world trading conditions while providing flexibility for traders to showcase their skills.

- User-Friendly Interface: Viva Funders’ cTrader platform is designed to be easy to use, potentially making the challenge less intimidating for new traders.

- Self-Paced Trading: There’s no time limit for completing the challenge, allowing traders to progress at their own pace and implement their strategies thoughtfully.

- Profit Targets:

- 1-Step Program: Requires achieving a profit target of 10%.

- 2-Step Program: Involves a two-step process with profit targets of 8% in step 1 and 4% in step 2.

- Refundable Fees: The challenge fee is reportedly refundable upon reaching the first profit split with Viva Funders.

- Profit Sharing: Funded traders can potentially earn a significant share of the profits, with a split reaching up to 100%. This incentivizes successful trading and aligns interests between Viva Funders and its traders.

Overall, Viva Funders’ Trading Challenge offers a structured program for aspiring traders to demonstrate their skills and potentially gain access to funded accounts. The emphasis on flexibility, a user-friendly platform, and a generous profit-sharing model makes it an attractive option for some traders.

Trading Platform: cTrader

Viva Funders utilizes the cTrader platform for trade execution. cTrader is known for its:

- User-friendly Interface: A reportedly easy-to-use interface can be beneficial for new traders or those unfamiliar with complex platforms.

- Advanced Features: Despite its user-friendliness, cTrader also offers advanced features that may appeal to experienced traders, such as a variety of order types and extensive charting capabilities.

- Transparency: cTrader is known for its transparency in order execution and fee structures. This can be a positive for traders who value clear information.

In Conclusion

Viva Funders positions itself as a prop firm with a focus on trader development and offers a variety of programs to suit different experience levels. Key features include:

- Tiered Funding Programs: Cater to traders with varying capital through account sizes ranging from $10,000 to $500,000.

- Trading Challenges: Simulate real-world trading to assess skills and grant access to funded accounts.

- Profit Sharing: Offers a profit-sharing model of up to 100%, potentially rewarding successful traders.

- Diverse Tradable Instruments: Provides access to Forex, commodities, shares, and indices. (Mention of overnight holding and Expert Advisors allowed can be added here if relevant to your overall tone).

- Educational Resources: Emphasizes ongoing learning and development for traders.

Considerations for Aspiring Traders

Viva Funders may be a suitable option for traders seeking a prop firm with educational resources, a tiered funding structure, and a focus on skill development in Forex trading. However, potential downsides to consider include:

- Fees: Program fees vary depending on account size and may not be suitable for all budgets.

- Profitability: There’s no guarantee of profitability in prop trading, and even with a 100% profit split, traders can still lose their capital.

- Risk Management: While Viva Funders has risk management policies like maximum loss limits, prop trading inherently carries significant risk.

Aspiring traders need to conduct their research on Viva Funders and prop trading in general. This should include a thorough review of Viva Funders’ website, including details on fees, risk management policies, and the Responsible Trading Policy. Traders should also consider their own financial situation, risk tolerance, and trading goals before making a decision.

Viva Funders Discount Code

Use MOON20 for 20% OFF All Viva Funders Challenges