In this TraderFundZone review, we look into how the prop firm is revolutionizing the trading world by offering flexibility and support. With relaxed trading rules, instant funding access, and up to $300,000 in trading capital, TraderFundZone is dedicated to empowering traders and breaking industry norms. This review will guide you through the essential features and benefits that make TraderFundZone an exciting option for traders looking to enhance their trading careers with substantial capital and supportive conditions.

About TraderFundZone

TraderFundZone is a proprietary trading firm focused on empowering traders. They offer a different approach to trading by providing relaxed rules that are not common in the industry. While traditional trading often involves strict regulations that limit flexibility and creativity, TraderFundZone creates an environment where traders can operate without unnecessary constraints.

Their mission includes offering substantial capital, high profit splits, and a supportive environment. By partnering with reputable, regulated brokers like Purple Trading SC, they ensure a secure and transparent trading experience. TraderFundZone also invests in advanced technology and educational resources to support trader success.

At TraderFundZone, traders can access high-capital accounts, enjoy an 80% profit split, and benefit from relaxed trading rules. This platform is designed to help traders advance in their trading careers.

Funding Program Options

TraderFundZone empowers traders of all stripes by offering a range of funding programs suited to individual trading styles and experience levels.

Instant Funding

TraderFundZone’s Instant Funding option allows traders to start trading immediately without having to complete a trading challenge. Traders can access capital ranging from $5,000 to $100,000. Key details include:

- Challenge Period: Unlimited

- Profit Target: None

- Minimum Trading Days: 3 days

- Maximum Daily Loss: 5%

- Maximum Overall Loss: 10%

- Leverage: Up to 1:30

- Weekend Holding: Yes

- Refundable Fee: No

1 Phase Challenge

The 1 Phase Challenge offers a single-phase evaluation process for traders seeking a straightforward path to funding. Account sizes range from $5,000 to $300,000. Key details include:

- Challenge Period: Unlimited

- Profit Target: 10% for the challenge phase, none for the funded account

- Minimum Trading Days: 2 days for the challenge phase, none for the funded account

- Maximum Daily Loss: 3%

- Maximum Overall Loss: 8% for the challenge phase, 6% for the funded account

- Leverage: Up to 1:30

- Weekend Holding: Yes

- Refundable Fee: 100% upon successful completion

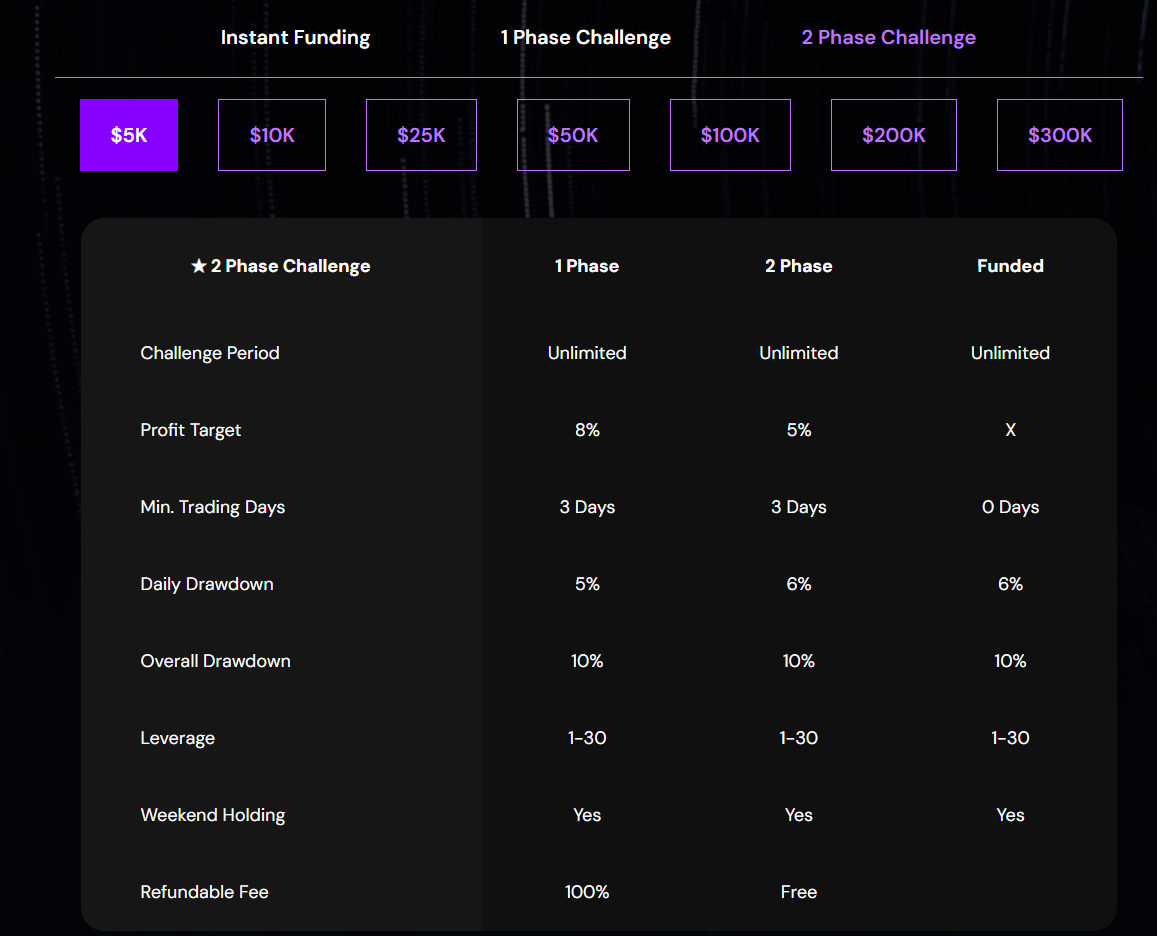

2 Phase Challenge

The 2 Phase Challenge involves a thorough evaluation process over two distinct phases. Account sizes range from $5,000 to $300,000. Key details include:

- Challenge Period: Unlimited for both phases

- Profit Targets: 8% for Phase 1, 5% for Phase 2

- Minimum Trading Days: 3 days for each phase

- Maximum Daily Loss: 5% for Phase 1, 6% for Phase 2 and funded account

- Maximum Overall Loss: 10% for both phases and the funded account

- Leverage: Up to 1:30

- Weekend Holding: Yes

- Refundable Fee: 100% for Phase 1, free for Phase 2

TraderFundZone’s flexible funding options allow traders to choose the path that best fits their strategy and goals. Whether opting for instant funding or taking on one of the challenges, traders can benefit from significant capital, high profit splits, and a supportive trading environment.

Fees

TraderFundZone’s transparent fee structure aligns with their various funding programs, offering traders flexibility and clarity on costs.

Instant Funding

The Instant Funding option provides immediate access to trading capital without the need for an evaluation. The fees for this option range from $239 to $4,449, depending on the account size selected, which can be between $5,000 and $100,000. This fee is non-refundable, reflecting the immediate access to capital and trading opportunities.

1 Phase Challenge

The 1 Phase Challenge requires a single-phase evaluation with fees that vary based on the chosen account size, ranging from $49 to $1,499. Account sizes available are from $5,000 to $300,000. Importantly, the fee for this challenge is 100% refundable upon successful completion, making it an attractive option for traders confident in their abilities.

2 Phase Challenge

The 2 Phase Challenge involves a two-step evaluation process, with fees ranging from $48 to $1,478, depending on the account size, which ranges from $5,000 to $300,000. The fee for Phase 1 is fully refundable upon successful completion. Additionally, the fee for Phase 2 is free, emphasizing the firm’s commitment to supporting traders through the evaluation process.

TraderFundZone keeps fees clear and competitive, offering various options that align with your trading approach and budget. Their refundable fees for the 1 Phase and 2 Phase Challenges provide financial security, minimizing upfront costs as you strive for a funded account.

Tradable Assets

TraderFundZone equips you to navigate market shifts with a vast selection of tradable assets. Diversify your portfolio and seize opportunities across multiple categories, including Forex, Commodities, Cryptocurrencies, and Indices.

- Forex: Trade major, minor, and exotic currency pairs in the world’s largest financial market, capitalizing on global events and currency movements.

- Commodities: Invest in the stability of precious metals like gold and silver, or seek returns in energy products like oil.

- Cryptocurrencies: Trade popular options like Bitcoin and Ethereum, or explore other offerings to tap into the dynamic crypto market.

- Indices: Speculate on the performance of entire stock markets with access to leading global indices from various regions.

TraderFundZone’s extensive asset selection empowers you to craft well-diversified strategies and navigate various markets. This breadth not only unlocks the potential for maximized returns but also equips you to manage risk effectively.

Restrictions

TraderFundZone prioritizes a fair and effective trading experience with clear-cut restrictions. Unlike some prop firms, they allow:

- Expert Advisors (EAs) and trade copiers: Automate your strategies or leverage successful traders.

- News trading and weekend holding: React to market events and manage positions strategically.

One key safeguard:

- Maximum trading volume limit: This ensures responsible risk management and a stable trading environment for everyone.

By following these guidelines, you’ll benefit from a secure framework aligned with TraderFundZone’s risk policies, allowing you to focus on maximizing your trading potential.

Challenge

TraderFundZone offers three distinct challenge options designed to evaluate and reward traders based on their performance and trading style. These challenges provide a clear pathway to accessing substantial trading capital and earning a high profit split.

Instant Funding

The Instant Funding option provides immediate access to trading capital without the need for a preliminary challenge. This option is ideal for traders looking to start trading right away.

- Account Sizes: $5,000 to $100,000

- Challenge Period: Unlimited

- Profit Target: None

- Minimum Trading Days: 3

- Maximum Daily Loss: 5%

- Maximum Overall Loss: 10%

- Leverage: Up to 1:30

- Weekend Holding: Yes

- Fee: Ranges from $239 to $4,449 (non-refundable)

1 Phase Challenge

The 1 Phase Challenge offers a straightforward path to funding through a single-step evaluation process.

- Step 1: Traders have an unlimited period to achieve a profit target of 10%, with a minimum of 2 trading days required. The daily drawdown limit is set at 3%, and the overall drawdown limit is 8%. Leverage is up to 1:30, and weekend holding is permitted. The fee for this challenge is 100% refundable upon successful completion.

- Funded Account: Once the challenge is successfully completed, traders move to a funded account with the following conditions:

- Profit Target: None

- Minimum Trading Days: None

- Maximum Daily Loss: 3%

- Maximum Overall Loss: 6%

- Leverage: Up to 1:30

- Weekend Holding: Yes

2 Phase Challenge

The 2 Phase Challenge is designed to rigorously assess traders’ skills over two phases.

- Phase 1: Traders have an unlimited period to reach a profit target of 8%, with a minimum of 3 trading days required. The daily drawdown limit is set at 5%, and the overall drawdown limit is 10%. Leverage is up to 1:30, and weekend holding is permitted. The fee for Phase 1 is 100% refundable upon successful completion.

- Phase 2: Upon passing Phase 1, traders proceed to Phase 2, which also has an unlimited period to achieve a profit target of 5%, with a minimum of 3 trading days required. The daily drawdown limit is set at 6%, and the overall drawdown limit is 10%. Leverage remains up to 1:30, and weekend holding is allowed. There is no additional fee for Phase 2.

- Funded Account: After successfully completing both phases, traders receive a funded account with the following conditions:

- Profit Target: None

- Minimum Trading Days: None

- Maximum Daily Loss: 6%

- Maximum Overall Loss: 10%

- Leverage: Up to 1:30

- Weekend Holding: Yes

These challenges are structured to provide fair and comprehensive assessments, ensuring that traders who successfully complete them are well-prepared to manage significant trading capital. TraderFundZone’s approach accommodates various trading styles and experience levels, offering flexible and supportive pathways to becoming a funded trader.

Conclusion

TraderFundZone stands out as an innovative and supportive platform for traders looking to excel in their trading careers. By breaking conventional norms, TraderFundZone offers relaxed trading rules, instant funding access, and comprehensive evaluation challenges that cater to various trading styles and experience levels.

Key Features:

- Flexible Funding Programs: TraderFundZone offers multiple funding options, including Instant Funding, 1 Phase Challenge, and 2 Phase Challenge, each designed to meet the needs of different traders.

- High Profit Potential: Traders benefit from an 80% profit split, allowing them to keep the majority of their earnings.

- Diverse Tradable Assets: Access to a wide range of assets, including Forex, Commodities, Cryptocurrencies, and Indices, ensures that traders can diversify their portfolios and capitalize on various market opportunities.

- Transparent Fee Structure: The fee structure is clear and straightforward, with refundable fees upon successful completion of challenges, making the platform financially accessible.

- Supportive Trading Environment: The use of expert advisors, trade copiers, and the ability to trade during news events and hold trades over the weekend provide traders with the flexibility to implement their strategies effectively.

Considerations:

- Trading Volume Limits: To manage risk effectively, there are maximum trading volume limits in place.

- Non-Refundable Fees for Instant Funding: While the Instant Funding option provides immediate access to capital, the fees are non-refundable.

Overall, TraderFundZone offers a well-structured and empowering environment for traders. With its commitment to flexibility, substantial capital access, and trader support, TraderFundZone is an excellent choice for those seeking to advance their trading careers and achieve significant success in the trading world.