Looking For The Best Prop Trading Firm In 2025?

If you’re searching for a prop firm that offers more than just capital, Upside Funding might be what you’ve been waiting for. While big names like FTMO, The 5%ers, and TopStep dominate the space, Upside Funding takes it to the next level.

What if you could get funded, mentored directly by industry experts, and even land a full-time trading role with a $350K salary?

That’s exactly what Upside Funding offers.

Founded by two former Citigroup Managing Directors with over 60 years of trading experience, Upside Funding provides a path for traders to scale up to $1.5M in capital while keeping 90% of profits. What really sets it apart is the opportunity to earn a full-time salary of up to $350K per year and access to direct 1:1 mentorship from the firm’s leadership.

Fast 24-hour payouts, trader friendly conditions, and institutional-level support make Upside Funding a serious contender for the best prop firm of 2025.

In this comprehensive review, we’ll break down how Upside Funding works, who it’s best for, and how it compares to other top prop firms.

About The Upside Funding

Most prop firms follow a simple, limited model: you pay for an evaluation, get funded, and keep a portion of the profits. But what happens when you want to scale beyond that?

Instead of just handing you capital, Upside Funding is structured like an institutional trading desk—offering direct 1:1 mentorship, performance tracking, and even the opportunity to land a $350K salaried trading position.

Other firms give you capital. Upside Funding builds your career, with professional coaching, growth, and a real shot at long-term success.

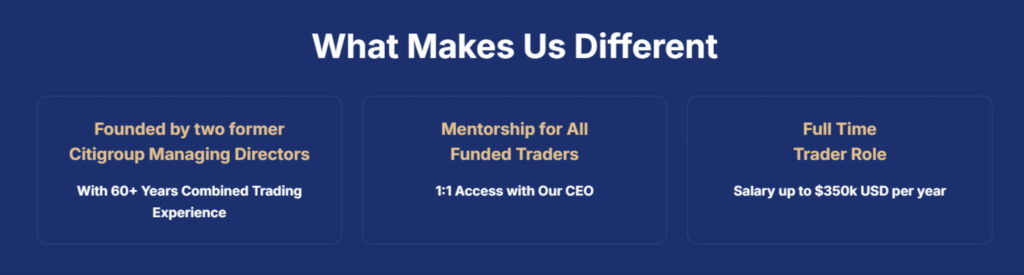

Here’s why Upside Funding is different from traditional prop firms:

1. Founded by Institutional Trading Experts

Most prop firms are started by retail traders or fintech entrepreneurs. Upside Funding is different. It was founded by two former Citigroup Managing Directors with over 60 years of combined experience at the highest levels of global finance.

- 60+ Years of Combined Trading Experience

- Institutional Trading Strategies Adapted for Retail Traders

- Proprietary Risk Management Techniques Used by Banks & Hedge Funds

Why does this matter? Because learning from traders who managed billions in capital gives you a serious edge over competitors who are simply learning on their own.

2. Direct 1:1 Mentorship from the CEO & Senior Traders

While most prop firms just hand you capital, Upside Funding gives you direct mentorship from senior traders and the CEO to help you. They provide direct guidance to help traders develop their skills and scale capital effectively.

What Funded Traders Get:

- 1:1 Coaching with the CEO – Personalized strategy reviews & feedback

- Performance Reviews & Psychological Support – Fine-tune your trading mindset

- Trading Strategy Optimization – Learn risk management methods used by hedge funds

3. Full-Time Trader Role with Salaries Up to $350K

Most prop firms only offer profit splits. Upside Funding takes it a step further by offering a real career path for top-performing traders.

The Remote Trader Program:

- Earn a fixed salary of up to $350K per year while trading firm capital.

- No personal financial risk—your salary is not dependent on your PnL.

- Scale beyond retail trading into a professional role.

This is rare in the retail prop trading industry. While some firms, like FTMO’s QuantLane program, offer career advancement, Upside Funding provides a direct route to full-time employment with a salary and scaling capital.

Quick Comparison: Upside Funding vs. Traditional Prop Firms

| Feature | Upside Funding | Typical Prop Firm |

| Mentorship | ✅ Direct 1:1 coaching with CEO & senior traders | ❌ No direct mentorship |

| Career Path | ✅ Salaried trader positions (up to $350K per year) | ❌ No career path – profit splits only |

| Scaling Capital | ✅ Scale up to $1.5M in funding | ⚠️ Capped at ~$200K in most firms |

| News & Weekend Trading | ✅ Allowed – no major restrictions | ❌ Often restricted |

| Profit Split | ✅ Keep up to 90% of your profits | ✅ Typically 75%–90% |

| Stop-Loss Required? | ❌ No – more flexibility in trading strategy | ✅ Usually required |

If you’re looking for more than just funding, like mentorship, real capital growth, and the chance to trade professionally, Upside Funding could be a great fit.

They stand out by investing in its traders’ development, offering professional-level guidance and growth opportunities. That is something not all prop firms provide.

Funding Program Options

Now that we’ve established what makes Upside Funding different, it’s time to explain how traders can get funded. This section will break down:

- The 2-Step Evaluation Process – Profit targets, drawdown rules, and flexibility.

- Scaling Program – How traders can grow their accounts up to $1.5M.

- Payouts & Profit Splits – Fast withdrawals, up to 90% profit share.

How to Get Funded by Upside Funding

The goal of most prop firms isn’t just to test traders. It’s to develop profitable, consistent professionals. Upside Funding uses a 2-Step Evaluation Process to identify skilled traders while allowing for maximum flexibility.

Unlike some firms that impose strict time limits, Upside Funding lets traders complete the challenge at their own pace—giving them the freedom to wait for high-probability setups instead of rushing trades.

1. The 2-Step Evaluation Process

Step 1 – Prove Your Skill

- Profit Target: +9%

- Daily Drawdown Limit: 3%

- Max Total Drawdown: 9%

- Minimum Profitable Trading Days: 3

- No Time Limits

Pass Step 1? You move to the next phase.

Step 2 – Show Consistency

- Profit Target: +5%

- Daily Drawdown Limit: 3%

- Max Total Drawdown: 9%

- Minimum Profitable Trading Days: 3

- No Time Limits

Pass Step 2? You receive a real funded account and keep up to 90% of your profits.

| Feature | Upside Funding | Other Prop Firms |

| Profit Target | ✅ 9% Step 1, 5% Step 2 | ⚠️ Often 10%+ in both phases |

| Time Limits | ❌ None | ✅ Most firms enforce 30-60 day limits |

| Stop-Loss Required? | ❌ No | ✅ Yes, usually mandatory |

| News & Weekend Trading | ✅ Allowed | ❌ Often restricted |

| Challenge Fee Refund | ✅ 100% refund after 2nd payout | ⚠️ Some offer refunds, some don’t |

Many prop firms force traders into tight deadlines, leading to overtrading and forced setups. The no time limit rule here allows traders to execute high-quality trades without pressure—which is how real institutional traders operate.

2. Scaling Program – Grow Your Capital Up to $1.5M

At Upside Funding, traders have the opportunity to increase their account size over time as they demonstrate consistent performance.

How Scaling Works:

- Generate 10% profit over three consecutive months.

- Maintain proper risk management (3% daily drawdown, 9% total).

- No extra challenges or fees—just automatic capital increases.

✔️ Start with up to $300K → Scale up to $1.5M.

✔️ Profit Split Stays the Same (Up to 90%).

The more you grow, the more Upside Funding invests in you.

3. Payouts & Profit Splits – Get Paid Every 14 Days

Upside Funding prioritizes fast, reliable payouts.

- First Payout After 5 Profitable Trading Days.

- Ongoing Payouts Every 14 Days.

- No Hidden Fees or Withdrawal Restrictions.

- Payment Methods: Bank Transfer, Wise, Crypto.

Profit Split Structure:

- Standard Profit Split: 70% to trader

- With Add-Ons: Up to 90% profit split

The Upside Funding Pricing

The Upside Funding’s challenge fees are competitive compared to other prop firms, and they follow a straightforward, one-time payment .

Here’s a breakdown of the current pricing:

| Account Size | Challenge Fee | Refund Policy |

|---|---|---|

| $5K Account | $49 | 100% refund after second payout |

| $10K Account | $89 | 100% refund after second payout |

| $25K Account | $169 | 100% refund after second payout |

| $50K Account | $288 | 100% refund after second payout |

| $100K Account | $490 | 100% refund after second payout |

- Affordable Entry Point: Starting at just $49 for a $5K account, Upside Funding’s fees are accessible even for newer traders.

- Refund After Second Payout: Upside Funding refunds the fee after two successful payouts, which reduces overall risk.

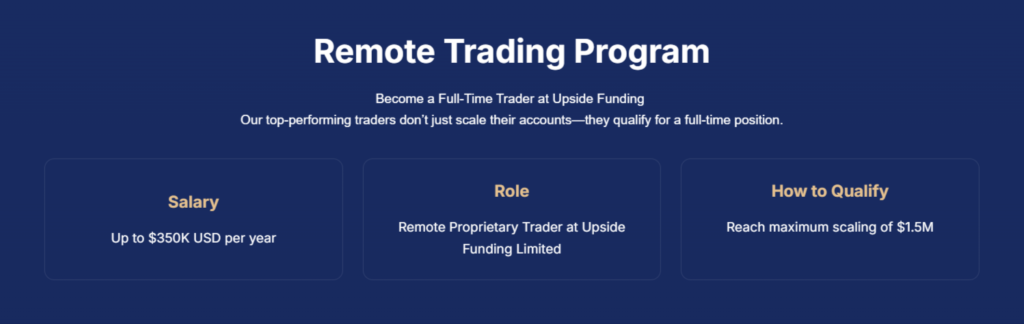

The Remote Trader Program – Earn a $350K Salary

Most prop firms stop at funding. Upside Funding goes further.

What happens after you prove your skills and scale your account?

- You keep 90% of your profits.

- You can scale up to $1.5M in capital.

- But there’s an even bigger opportunity—a full-time proprietary trading role.

Top traders at Upside Funding may qualify for a salaried position earning up to $350,000 per year.

What Is the Remote Trader Program?

Most traders at prop firms are independent contractors—they pass an evaluation, get funded, and trade on their own. While this is great, it lacks stability.

Upside Funding offers a different path. The Remote Trader Program gives top-performing traders:

- A guaranteed salary of up to $350K per year.

- Firm-backed capital with no personal risk.

- Full-time proprietary trader status.

- Direct access to the firm’s leadership and mentors.

This program offers more structure and stability compared to typical prop firm arrangements.

How to Qualify for a Salaried Trading Role

To be considered for Upside Funding’s Remote Trader Program, traders must:

- Pass the 2-Step Challenge & Get Funded.

- Demonstrate consistent profitability over time.

- Follow strong risk management principles.

- Showcase discipline, execution, and decision-making skills.

Traders who meet these standards may be invited to apply for a salaried position. This sets Upside Funding apart from many prop firms, which typically stop at offering profit splits and scaling.

What’s Included in the $350K Trader Role?

Base Salary + Performance Bonuses

- Earn a guaranteed salary, not just profit splits.

- Get additional bonuses based on performance.

Full-Time Trading With Firm Capital

- No personal risk—trade with the firm’s funds.

- No evaluation fees—your track record speaks for itself.

Mentorship & Institutional-Level Development

- 1:1 coaching from the CEO and senior traders.

- Weekly performance reviews and strategy optimization.

- Access to proprietary market insights and analysis tools.

Career Growth & Stability

- A path to higher capital allocations over time.

- More security than independent trading.

- The opportunity to trade in a professional firm environment.

This model aims to give retail traders access to opportunities typically found in institutional trading. Few prop firms provide this kind of career-building structure.

The Best Opportunity for Professional Traders

If you’re serious about trading and want to go beyond just funded accounts, this is your best path forward.

- Prove yourself through the 2-step evaluation.

- Scale your capital up to $1.5M.

- Become a full-time salaried trader with Upside Funding.

Upside Funding offers more than just funding. They provide traders with a path toward professional development and long-term career growth.

How Upside Funding Compares to Other Prop Firms

Most prop firms focus solely on providing capital.

Upside Funding takes a broader approach by offering not just funding, but also support and professional development opportunities.

Here’s what sets Upside Funding apart from other prop firms:

1. Direct Access to Institutional Expertise

Most prop firms are run by traders, but not institutional traders.

Upside Funding is founded by two former Managing Directors from Citigroup, bringing 60+ years of institutional trading experience to retail traders.

Why does this matter?

- Institutional traders operate differently than retail traders. They use advanced risk management, deep liquidity access, and professional trading strategies.

- Upside Funding integrates institutional trading principles into its mentorship, ensuring traders learn and apply real, career-level trading strategies.

- Other prop firms fund traders but don’t develop them. Upside Funding teaches institutional risk management, order flow analysis, and high-level execution.

This is the closest retail traders can get to an institutional-level prop firm.

2. The Only Prop Firm That Builds Trading Careers

Most prop firms fund traders. Upside Funding funds AND hires traders.

Upside Funding provides full-time salaried roles for top traders, giving them stability, career growth, and real institutional backing.

Instead of just offering profit splits, Upside Funding gives traders:

- Up to $1.5M in scaling capital.

- 90% profit split and fast payout.

- A full-time trader role with a $350K salary.

3. A True Trader Development Model

Most traders don’t struggle because of their strategy—they struggle because they don’t have proper guidance.

Key Features That Separate It From Other Firms:

- 1:1 CEO Mentorship – Direct access to industry experts.

- Performance Coaching & Risk Analysis – Weekly performance reviews, deep trade analysis, and direct feedback.

- Trader Scaling Program – Get access to higher capital as you prove your consistency.

- Institutional-Level Strategy Development – Learn how to trade like a professional, not just a retail trader.

4. Maximum Flexibility for Traders

Upside Funding offers more flexibility than many other prop firms.

Some firms restrict strategies, enforce hidden rules, and limit trader freedom—but Upside Funding takes a more open approach:

Upside Funding allows:

- EA/Bot Trading

- News Trading & Weekend Holding

- No Stop-Loss Requirement

- Scaling Up to $1.5M Without Extra Challenges

This gives traders more control over how they trade and how they scale.

5. Fastest Payouts & 90% Profit Share

Traders can keep up to 90% of their profits, which is higher than the standard payout rate at most firms.

🔹 Fast Payouts Within 24-48 Hours – No long waiting times.

🔹 Flexible Withdrawal Methods – Crypto, Wise, and Bank Transfers.

🔹 Evaluation Fee Refund – Get your challenge fee back after your second payout.

Some firms take longer to process withdrawals, but Upside Funding aims to keep the process quick and straightforward.

Conclusion: Is Upside Funding the Best New Prop Firm for Traders?

The proprietary trading industry has no shortage of firms offering capital, but few provide career development and professional support.

Upside Funding takes a different approach by combining funding with direct mentorship and career opportunities. The firm’s structure reflects an institutional trading model, offering traders more than just capital.

Why Upside Funding Stands Out:

- Founded by Experienced Traders – Created by two former Citigroup Managing Directors with over 60 years of combined experience.

- 1:1 CEO Mentorship & Trader Development – Direct coaching from experienced professionals.

- Full-Time Trader Program – Top performers can qualify for a full-time trading position with a salary of up to $350K.

- Scaling Up to $1.5M – Traders can increase their capital without additional challenges.

- 90% Profit Split – Competitive payout structure.

- Flexible Trading Rules – EAs, bots, news trading, and weekend holding allowed.

- Fast Payouts – Withdrawals processed within 24–48 hours.

The Upside Funding offers traders a path toward long-term growth and professional development, combining capital, guidance, and a clear career trajectory. While it’s still a newer firm, the combination of high payouts, direct mentorship, and the opportunity for a full-time trading career sets it apart from more established names. For traders looking for both funding and professional growth, Upside Funding is worth considering.