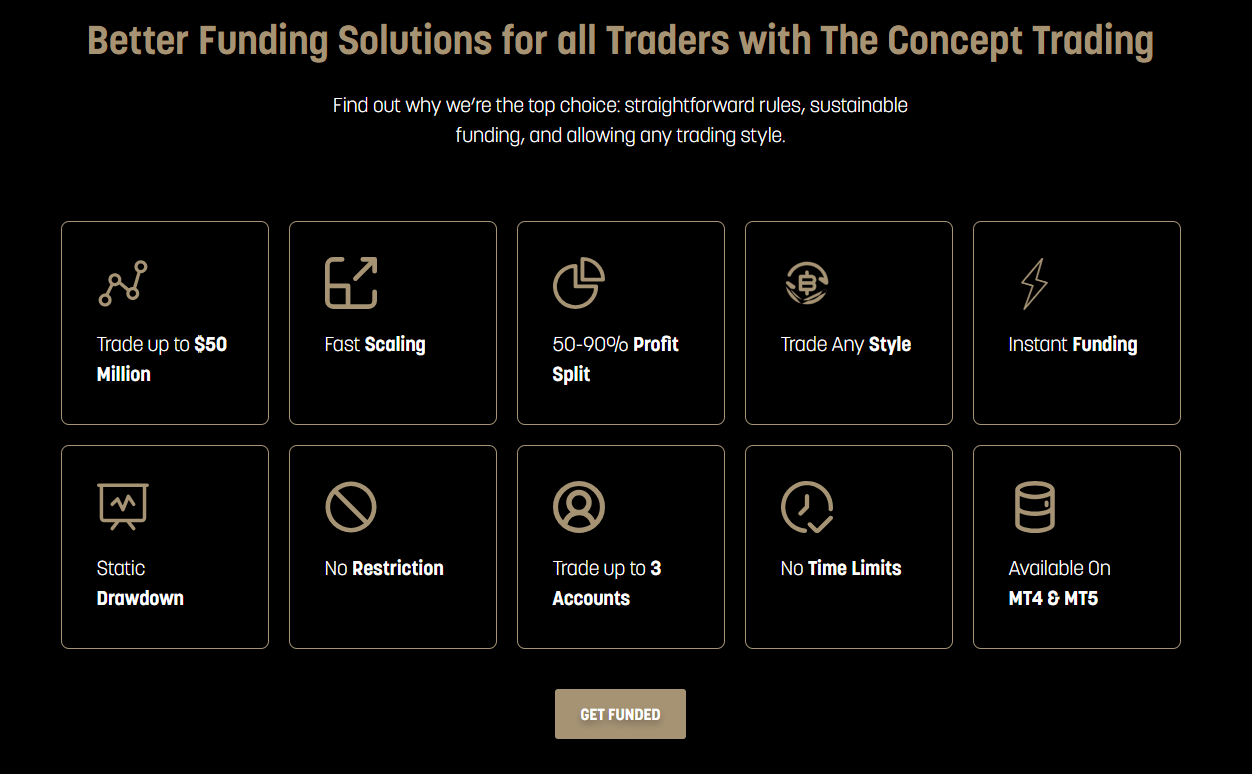

The Concept Trading is a proprietary trading firm providing access to capital up to $50 million through a single-step assessment model. With no daily drawdown limits, unrestricted trading styles, and support for both TradeLocker and MT5, it appeals to traders seeking straightforward conditions and high growth potential.

In this Concept Trading review, we’ll explore how the firm operates in 2025, including profit splits ranging from 50% to 90%, static drawdowns across all accounts, and withdrawal processing within 48 hours.

Multiple program tiers are available, each with defined scaling targets and transparent fee structures. Whether you trade manually or use automation, The Concept Trading allows up to three active accounts and provides global traders with the tools to scale efficiently.

If you’re evaluating proprietary firms this year, this review covers everything you need to know about The Concept Trading’s current offerings and trading environment.

About The Concept Trading

The firm offers four defined funding programs with scaling potential up to $50 million, depending on performance. All programs use static drawdown limits and provide leverage up to 1:200, except in specific cases where it’s capped at 1:30. Traders are allowed to manage up to three accounts at once.

There are no restrictions on trading style, and the platform supports both manual and automated strategies, including EAs, HFT, and signal copying. Available instruments include forex (majors, minors, exotics), cryptocurrencies, indices, metals, energy markets, and commodities, depending on the broker setup.

Accounts above Intern level operate on live servers. Profit withdrawals are allowed monthly at minimum, with 48-hour payout processing once a withdrawal is approved. For top-tier accounts or those using the 90% Lock Rule, weekly payouts are permitted.

Support is available 24/7, and all funding models are structured to scale capital incrementally based on reaching defined profit targets.

Funding Program Options

Each funding model at The Concept Trading is built around different risk thresholds and growth trajectories. Traders can use any strategy they prefer, including automation, and are allowed to run up to three accounts simultaneously. There are no strategy restrictions baked into the rules, which keeps the programs accessible to a wide range of trading approaches.

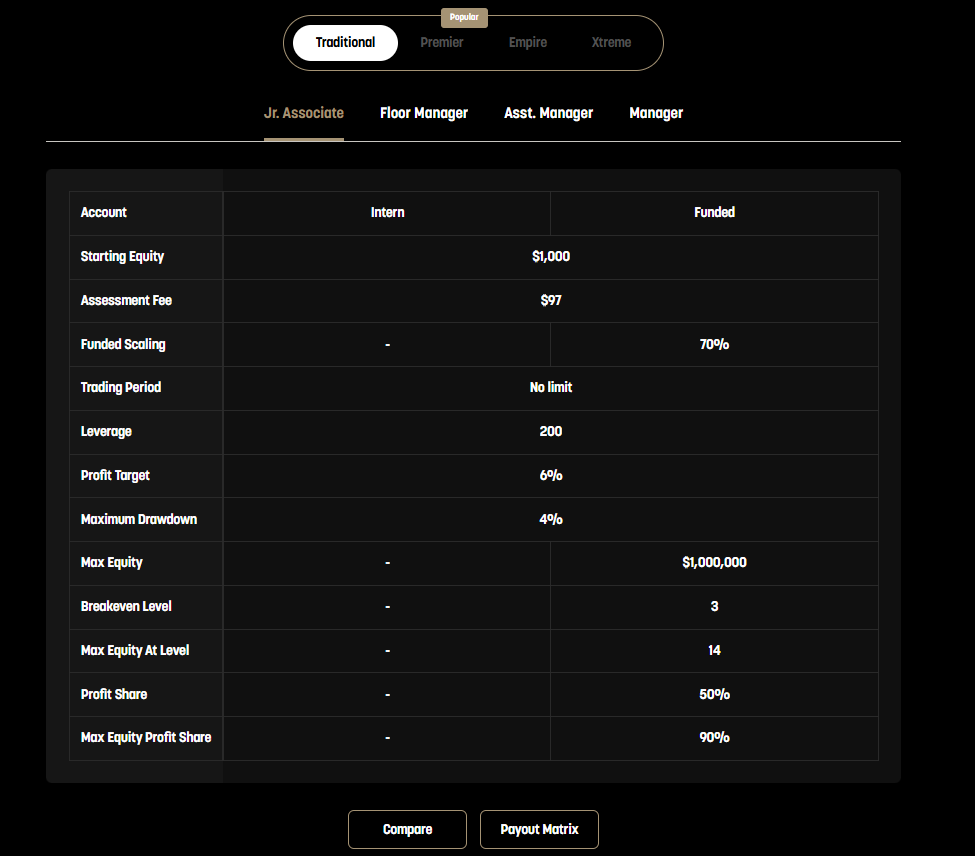

Traditional Program

The Traditional Program is ideal for traders looking to achieve six-figure success through an incremental scaling process.

- Profit Target: 6% per level

- Capital Increase: 70% upon hitting the profit target

- Maximum Capital: $1.5 million

- Static Drawdown: 4%

- Leverage: 1:200

- Restrictions: None

- Starting Fee: $110

Premier Program

The Premier Program offers rapid capital growth, doubling the trader’s capital at each profit milestone.

- Profit Target: 10% per level

- Capital Increase: 100% upon hitting the profit target

- Maximum Capital: $10 million

- Static Drawdown: 5%

- Leverage: 1:200

- Restrictions: None

- Starting Fee: $330

Empire Program

The Empire Program is designed for managing substantial balances with significant scaling potential.

- Profit Target: 10% per level

- Capital Increase: Approximately 50% upon hitting the profit target

- Maximum Capital: $20 million

- Static Drawdown: 10%

- Leverage: 1:200

- Restrictions: None

- Starting Fee: $997

Xtreme Program

The Xtreme Program offers the highest potential for capital growth, with extreme scaling options.

- Profit Target: 6% per level

- Capital Increase: 80% upon hitting the profit target

- Maximum Capital: $50 million

- Static Drawdown: 3%

- Leverage: 1:30

- Restrictions: None

- Starting Fee: $300

The funding programs at The Concept Trading vary in terms of scaling speed, drawdown limits, and capital ceilings, providing traders with options based on their desired growth strategy. Since there are no limits on trading style and up to three accounts can be traded at once, the structure works for both discretionary and system-driven traders.

Fees

Fees at The Concept Trading are tied directly to the starting capital of each program. The pricing model is simple and listed upfront, so traders know exactly what they’re paying for before committing.

Traditional Program:

- Starting Fee: $110

- Fee Structure: The fee is calculated as nine times the starting capital, reflecting the significant scaling potential and support provided.

Premier Program:

- Starting Fee: $330

- Fee Structure: Similar to the Traditional Program, the fee is nine times the starting capital, emphasizing the rapid capital growth and high leverage offered.

Empire Program:

- Starting Fee: $997

- Fee Structure: The fee is ten times the starting capital, in line with the substantial balances managed and the significant scaling potential of this program.

Xtreme Program:

- Starting Fee: $300

- Fee Structure: The fee is thirty-three times the starting capital, reflecting the extreme scaling options and high maximum capital of up to $50 million.

Each program’s fee reflects its scaling potential and risk profile. Higher-cap programs cost more to access, but also offer larger growth ceilings, making the cost proportional to what traders stand to gain.

Tradable Assets

Traders at The Concept Trading can access a broad selection of markets, including forex, crypto, indices, metals, and commodities. The variety supports different trading strategies and makes it easier to diversify positions across asset classes.

- FX Majors: Trade the most widely followed currency pairs, including EUR/USD, GBP/USD, and USD/JPY, offering high liquidity and tighter spreads.

- FX Minors: Access less commonly traded currency pairs like EUR/GBP and AUD/CAD, which provide unique opportunities and diversification benefits.

- FX Crosses: Trade currency pairs that do not include the USD, such as EUR/JPY and GBP/JPY, allowing for diverse strategies across different forex markets.

- FX Exotics: Explore currency pairs involving emerging market currencies, such as USD/TRY and USD/ZAR, offering high volatility and potential for significant returns.

- Metals: Invest in precious metals like gold and silver, which are popular for hedging and long-term investment strategies.

- Energy: Trade energy commodities like crude oil and natural gas, crucial for understanding and leveraging global energy market trends.

- Crypto: Access the rapidly growing cryptocurrency market with major digital currencies like Bitcoin, Ethereum, and others, offering high volatility and growth potential.

- Indices: Speculate on the performance of major global stock indices, including the S&P 500, FTSE 100, and DAX 30, to gain exposure to broad market movements.

- FX Index: Trade indices that track the performance of multiple currencies, providing a broader perspective on forex market trends.

- Commodities: Diversify with a range of commodities, including agricultural products and industrial metals, allowing for comprehensive market strategies.

The range of available instruments gives traders room to tailor their approach, whether they’re focused on short-term setups or longer-term positions. It also allows for better risk management by spreading exposure across different market types.

Restrictions

The Concept Trading sets a few baseline rules for account use and risk control. There’s no cap on trade size, but large positions should be split when possible to avoid slippage, especially in FX. Brokers may also enforce a hard limit, typically around 100 standard lots per order.

Traders can run up to three accounts at once and must be at least 18 years old to join.

As for risk, the firm advises keeping exposure under 1% of total equity per trade and recommends always using a stop loss. Repeated high-risk trading without stops — especially if it results in max drawdown — may affect future eligibility with the program.

Challenge

The Concept Trading uses a single-phase assessment to evaluate traders before granting access to funded accounts. Once the profit target is reached, the trader qualifies for capital allocation and can operate up to three accounts simultaneously.

Each funding program sets its own profit target — typically between 6% and 10% — and meeting these targets unlocks higher funding tiers. Scaling is incremental, based on consistent performance, not time pressure.

Leverage is program-dependent: most offer up to 1:200, while some, like the Xtreme program, cap it at 1:30. Drawdown limits are static and range from 3% to 10%, depending on the account type.

There are no time limits imposed to reach targets, which removes pressure and lets traders move at their own pace. All trading styles are accepted — including EAs, scalping, and discretionary methods.

The evaluation process is straightforward, with clear criteria tied to funding increases. It’s designed to gauge risk handling and trading discipline rather than force traders into a specific strategy.

Conclusion

The Concept Trading offers multiple funding tracks aimed at traders looking to scale their capital through defined performance milestones. With account growth tied to meeting profit targets, traders can access up to $50 million in funding depending on the program. The one-phase challenge model and static drawdown rules make the structure easy to understand and execute.

Key Features:

- Flexible Funding Programs: The Concept Trading offers multiple funding models, each designed to meet different trading styles and goals. From the Traditional Program to the Xtreme Program, traders can choose the path that best suits their needs.

- High Profit Potential: Traders can achieve profit splits ranging from 50% to 90%, maximizing their earnings while leveraging the firm’s capital.

- Diverse Tradable Assets: Access to a wide range of assets, including FX Majors, FX Minors, FX Crosses, FX Exotics, Metals, Energy, Crypto, Indices, FX Index, and Commodities, allows traders to diversify and capitalize on various market opportunities.

- Transparent Fee Structure: The clear and straightforward fee structure ensures that traders know exactly what to expect, with fees aligned to the potential benefits of each program.

- Supportive Environment: With no restrictions on trading styles, high leverage, and no time limits, The Concept Trading provides a stress-free and accommodating trading environment.

Considerations:

- Market Impact: While there is no size limit on trades, traders must consider the impact of large orders on the market, particularly in the FX market.

- Risk Management: Proper risk management practices are essential, with a recommendation to risk no more than 1% of total equity per trade and always use stop losses.

Overall, The Concept Trading offers high funding limits and minimal trading restrictions, which may appeal to traders looking for more autonomy. The absence of daily drawdowns, support for all trading styles, and the ability to scale up to $50 million make it a competitive option. That said, traders should still consider the cost of entry, risk rules, and how each program aligns with their trading approach.