MyForexFunds Review

MyForexFunds is a new player on the scene, but in a couple of years, they claimed to have funded over 180,000 traders with forex trading accounts in a short amount of time. It’s not surprising because they have become one of the most popular prop firms in the industry. It has established itself as a market leader with more than 300 employees across the globe and more than 2,000 customers every day. In this article, we will look at what MyForexFunds has to offer.

About MyForexFunds

They offer similar trading conditions to the other prop firms we’ve reviewed. What differentiates them from other prop firms is that they provide three different levels or structures for funding traders based on your trading experience. This includes both novice and experienced traders.

Funding Program Options

The 3 different types of accounts they offer, depending on your experience level, are:

- The My Forex Funds Rapid account program aims to give traders something for their time while evaluating them as they learn to trade with a demo account. The sizes of the accounts range from $10,000 to $100,000. Bonuses are paid every two weeks or every month.

The ultimate goal of My Forex Funds’ Rapid program is to get a three-month snapshot of a trader’s skills before giving them access to their real trading funds. The benefit of the Rapid program is that you get bonuses while being evaluated. This means your time is worth something even though you are trading in a demo environment for the first three months. In the Rapid model, there is no set amount of time.

- The evaluation program has two steps traders must go through to show how well they can trade forex, CFDs, or commodities. Like rapid trading accounts, evaluation trading accounts range from $10,000 to $200,000. Profit-split payouts happen once a month for the first month and then every two weeks after that. From evaluation accounts, a trader can have up to $600,000 in capital, but only $300,000 per trading account.

Through this evaluation, MFF wants to find serious forex traders with the skills needed to succeed in forex. You will be rewarded if you demonstrate consistency, accuracy, and sound risk management in trading. Get your account funded in as little as 10 days if you can prove your ability. Or take your time and pass in 90 days.

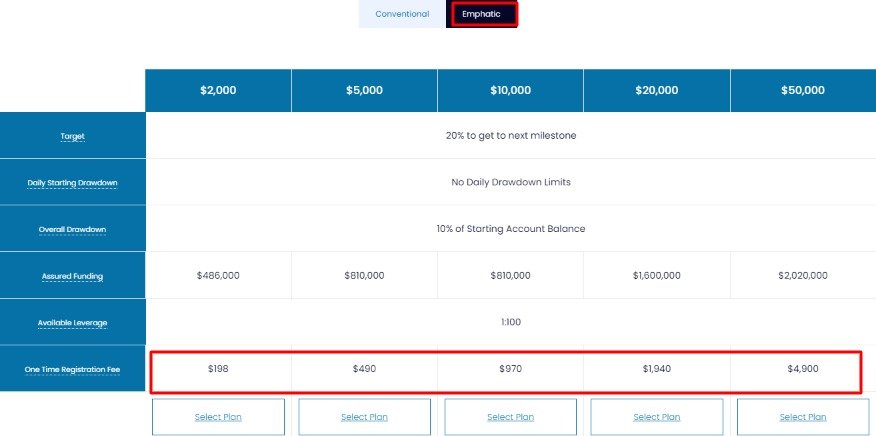

- Their instant funding model is the Accelerated program. You can skip the evaluation and get funding right away. You can start with as little as $2,000 and as much as $50,000, and your money can grow to a maximum of $2 million.

You can bypass the learning curve and start trading with real money immediately with the Accelerated program from My Forex Funds.

Fees

Let’s start with their Rapid account. Like all their accounts, you will have to pay a one-time refundable fee. If you pass the evaluation, you will get your one-time fee refunded. This fee is to allow you to trade a demo account for them. The fee range from $99 for a $10,000 funded account to $749 for a $100,000 funded account.

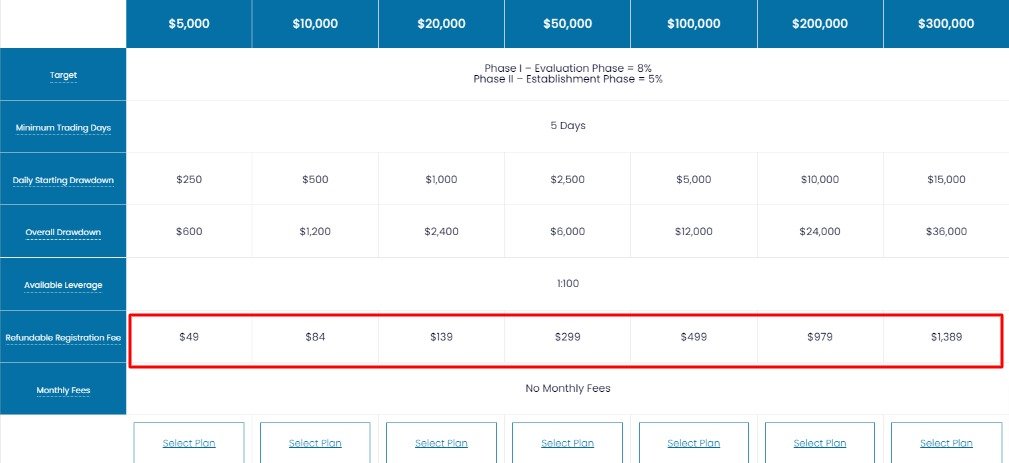

The second one is the Evaluation account. The funding range from $10,000 to $200,000, and the fee range from $84 to $979. The fee here is for you to take their 2-step challenge, similar to that of FTMO. But just a little bit cheaper.

The last is the Accelerated account. This is for instant funding, so there is no challenge. You will instantly have trading capital ranging from $2,000 to $50,000. The no challenge is similar to FundYourFX, but the funding capital and the fees are higher. In MyForexFunds, to get the $2,000 funding, you will have to pay a one-time registration fee of $99. To get the maximum of $50,000, the fee is $2,450. This costs a lot more than doing an evaluation program. This is understandable since giving instant funding to traders involves more risk.

Tradable Assets

In MyForexFunds, you can trade forex, metals, and indices.

SPOT Forex

| Symbol Name | Symbol Description | Contract Size | Digit | Leverage | 1 Pip PL | Quote CCY |

|---|---|---|---|---|---|---|

| AUDCAD | Australian Dollar/Canadian Dollar | 100000 | 5 | 1:100 | 10 | CAD |

| AUDCHF | Australian Dollar/Swiss Franc | 100000 | 5 | 1:100 | 10 | CHF |

| AUDJPY | Australian Dollar/Japanese Yen | 100000 | 3 | 1:100 | 10 | JPY |

| AUDNZD | Australian Dollar/New Zealand Dollar | 100000 | 5 | 1:100 | 10 | NZD |

| AUDUSD | Australian Dollar/US Dollar | 100000 | 5 | 1:100 | 10 | USD |

| CADCHF | Australian Dollar/US Dollar | 100000 | 5 | 1:100 | 10 | CHF |

| CADJPY | Canadian Dollar/Japanese Yen | 100000 | 3 | 1:100 | 10 | JPY |

| CHFJPY | Swiss Franc/Japanese Yen | 100000 | 3 | 1:100 | 10 | JPY |

| EURAUD | Euro/Australian Dollar | 100000 | 5 | 1:100 | 10 | AUD |

| EURCAD | Euro/Canadian Dollar | 100000 | 5 | 1:100 | 10 | CAD |

| EURCHF | Euro/Swiss Franc | 100000 | 5 | 1:100 | 10 | CHF |

| EURCZK | Euro/Czech Koruna | 100000 | 5 | 1:100 | 10 | CZK |

| EURGBP | Euro/Great Britain Pound | 100000 | 5 | 1:100 | 10 | GBP |

| EURJPY | Euro/Japanese Yen | 100000 | 3 | 1:100 | 10 | JPY |

| EURNOK | Euro/Norwegian Krone | 100000 | 5 | 1:100 | 10 | NOK |

| EURNZD | Euro/New Zealand Dollar | 100000 | 5 | 1:100 | 10 | NZD |

| EURSEK | Euro/Swedish Krona | 100000 | 5 | 1:100 | 10 | SEK |

| EURTRY | Euro/Turkish Lira | 100000 | 5 | 1:100 | 10 | TRY |

| EURUSD | Euro/US Dollar | 100000 | 5 | 1:100 | 10 | USD |

| GBPAUD | Great Britan Pound/Australian Dollar | 100000 | 5 | 1:100 | 10 | AUD |

| GBPCAD | Great Britain Pound/Canadian Dollar | 100000 | 5 | 1:100 | 10 | CAD |

| GBPCHF | Great Britain Pound/Swiss Franc | 100000 | 5 | 1:100 | 10 | CHF |

| GBPJPY | Great Britain Pound/Japanese Yen | 100000 | 3 | 1:100 | 10 | JPY |

| GBPNOK | Great Britain Pound/Norwegian Krone | 100000 | 5 | 1:100 | 10 | NOK |

| GBPNZD | Great Britain Pound/New Zealand Dollar | 100000 | 5 | 1:100 | 10 | NZD |

| GBPTRY | Great Britain Pound/Turkish Lira | 100000 | 5 | 1:100 | 10 | TRY |

| GBPUSD | Great Britain Pound/US Dollar | 100000 | 5 | 1:100 | 10 | USD |

| NZDCAD | New Zealand Dollar/Canadian Dollar | 100000 | 5 | 1:100 | 10 | CAD |

| NZDCHF | New Zealand Dollar/Swiss Franc | 100000 | 5 | 1:100 | 10 | CHF |

| NZDJPY | New Zealand Dollar/Japanese Yen | 100000 | 3 | 1:100 | 10 | JPY |

| NZDUSD | New Zealand Dollar/US Dollar | 100000 | 5 | 1:100 | 10 | USD |

| USDCAD | US Dollar/Canadian Dollar | 100000 | 5 | 1:100 | 10 | CAD |

| USDCHF | US Dollar/Swiss Franc | 100000 | 5 | 1:100 | 10 | CHF |

| USDCZK | US Dollar/Czech Koruna | 100000 | 5 | 1:100 | 10 | CZK |

| USDDKK | US Dollar/Danish Krone | 100000 | 5 | 1:100 | 10 | DKK |

| USDJPY | US Dollar/Japanese Yen | 100000 | 3 | 1:100 | 10 | JPY |

| USDMXN | US Dollar/Mexican Peso | 100000 | 5 | 1:100 | 10 | MXN |

| USDNOK | US Dollar/Norwegian Krone | 100000 | 5 | 1:100 | 10 | NOK |

| USDSEK | US Dollar/Swedish Krona | 100000 | 5 | 1:100 | 10 | SEK |

| USDTRY | US Dollar/Turkish Lira | 100000 | 5 | 1:100 | 10 | TRY |

| USDZAR | US Dollar/South Africa Rand | 100000 | 5 | 1:100 | 10 | ZAR |

SPOT Metals

| Symbol Name | Symbol Description | Contract Size | Digit | Leverage | 1 Pip PL | Quote CCY |

|---|---|---|---|---|---|---|

| XAUUSD | Gold/US Dollar | 100 | 2 | 1:100 | 10 | USD |

| XAGUSD | Silver/US Dollar | 5000 | 4 | 1:100 | 5 | USD |

| GAUUSD | Gold Gram vs US Dollar | 1000 | 3 | 1:100 | 10 | USD |

| GAUTRY | Gold Gram vs Turkish Lira | 1000 | 10 | 1:100 | 10 | TRY |

SPOT CFD

| Symbol Name | Symbol Description | Contract Size | Digit | Leverage | 1 Pip PL | Quote CCY |

|---|---|---|---|---|---|---|

| AUS200 | Australia 200 Index | 1 | 2 | 1:100 | 1 | AUD |

| ESP35 | Spain 35 Index | 1 | 2 | 1:100 | 1 | EUR |

| FRA40 | France 40 Index | 1 | 2 | 1:100 | 1 | EUR |

| GER30 | Germany 30 Index | 1 | 2 | 1:100 | 1 | EUR |

| JPN225 | Japan 225 Index | 1 | 2 | 1:100 | 1 | USD |

| NAS100 | NASDAQ 100 Index | 1 | 2 | 1:100 | 1 | USD |

| SPX500 | SP 500 Index | 1 | 2 | 1:100 | 1 | USD |

| UK100 | UK 100 Index | 1 | 2 | 1:100 | 1 | GBP |

| UKOIL | Crude Oil (Brent) | 100 | 2 | 1:100 | 1 | USD |

| US30 | Wall Street 30 Index | 1 | 2 | 1:100 | 1 | USD |

| USOIL | Crude Oil (WTI) | 100 | 2 | 1:100 | 1 | USD |

Restrictions

The rules for Rapid account and Evaluation are different. They both have a maximum daily drawdown is 5% with a total maximum drawdown of 12%. The leverages range between 1:50 to 1:500, and there is a rule of 3 trading days a week in the Rapid account and minimum 5 trading days in the Evaluation.

Although there are no profit targets for the Rapid account, the difference here is that 12% of what you make on the demo account will be paid into a live account for you.

For the Accelerated account, the maximum overall drawdown is 5% of starting account balance.

Challenge

The challenge that is offered in MyForexFunds is for the Evaluation account. The challenge is similar to FTMO with 2 step challenge. You will have to trade for a minimum of 5 days during the 30-day process. And then 60 days in the stage 2 challenge. In stage 1, you have a profit target of 8%, and a profit target of 5% in stage 2.

In Conclusion

Overall they are similar to other prop firms we have reviewed. Their challenge fee is lower than FTMO. In a way, if you are looking to trade with an established prop firm with a challenge, they offer a better deal than FTMO. But their fee for instant funding is higher compared to FundYourFX. If FundYourFX offers starting capital of $15,000 and a fee of £297 ($372), a similar price in MyForexFund is $245 for $5,000 capital or $485 for $10,000 capital.

But are they worth joining? MyForexFunds has become of the top prop firms even though they were only created in July 2020. In all, they’ve provided funding for over 180,000 traders throughout the globe, and there’s plenty of evidence of their prompt payouts on the internet. There is no doubt you can put your trust in them.