Funded Trader Markets offers up to $700,000 in funding with profit splits up to 100%. Traders get on-demand payouts, flexible evaluations, and access to forex, indices, and commodities.

Funded Trader Markets provides traders with a straightforward path to accessing capital, offering multiple evaluation programs to suit different trading styles. With account scaling up to $700,000, instant and on-demand payouts, and a profit split of up to 100%, traders have the opportunity to maximize their earnings.

The prop firm offers 1-Step and 2-Step evaluation challenges along with instant funding options for traders who want to skip the evaluation process. With leverage up to 1:100, traders can participate in forex, indices, and commodities markets while benefiting from fast payout processing and no minimum trading days in evaluations.

Funded Trader Markets is designed for traders looking for fast withdrawals, flexible account options, and a supportive trading environment.

About Funded Trader Markets

Funded Trader Markets provides traders with direct access to capital through a clear and structured system. The firm operates in over 120 countries, offering up to $700,000 in funding, fast payouts, and profit splits reaching 100 percent. With on-demand withdrawals and a transparent trading environment, traders can focus entirely on their strategies without worrying about delays or hidden conditions.

Founded by Revin Zabala, the company is built on years of experience in trading, risk management, and business leadership. The team ensures that every trader has the tools, capital, and support needed to perform at their best. With instant funding options and evaluation programs, Funded Trader Markets gives traders multiple ways to secure capital and grow their accounts.

Funding Program Options

Funded Trader Markets offers three funding options, giving traders flexibility in how they access capital. Traders can choose between 1-Step and 2-Step evaluations or instant funding for those who want to start trading immediately.

1-Step Evaluation

This program provides a fast-track way to funding with a single-phase challenge. Traders must meet a profit target while staying within the drawdown limits. There are no time restrictions, allowing traders to complete the evaluation at their own pace.

2-Step Evaluation

A structured approach that requires traders to pass two phases before receiving funding. The first phase has a higher profit target, while the second phase has a lower requirement to confirm consistency. This program is designed for traders who prefer a more gradual evaluation process.

Instant Funding

Traders who want immediate access to capital can opt for instant funding. There is no challenge or evaluation phase, and traders start with a live account from day one. The profit split is lower than evaluation programs, but traders can withdraw earnings without proving profitability first.

Each funding option includes competitive payouts, on-demand withdrawals, and leverage up to 1:100. Traders can choose the program that best fits their strategy and experience level.

Fees

Funded Trader Markets offers competitive pricing across all funding options, with fees based on the chosen program and account size. The evaluation programs have lower entry costs, while instant funding has higher fees due to immediate access to capital. All evaluation fees are refundable after the first payout, making the challenges risk-free for profitable traders.

1-Step Evaluation

This program has a one-time fee based on the selected account size. Prices start at $23 for a $5,000 account and go up to $439 for a $200,000 account. Since this is a single-phase evaluation, the fees are generally lower than the two-step option.

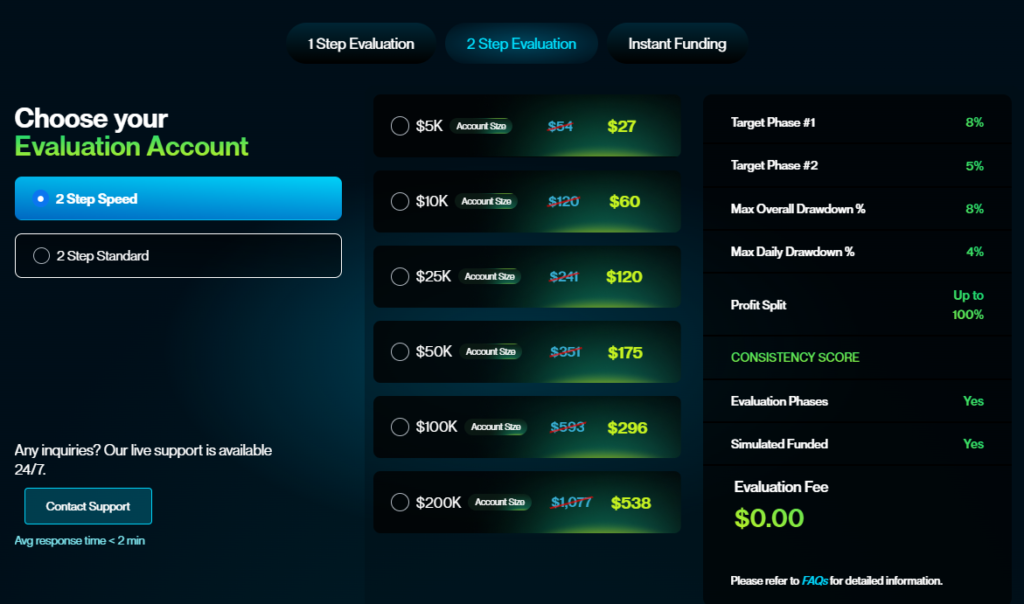

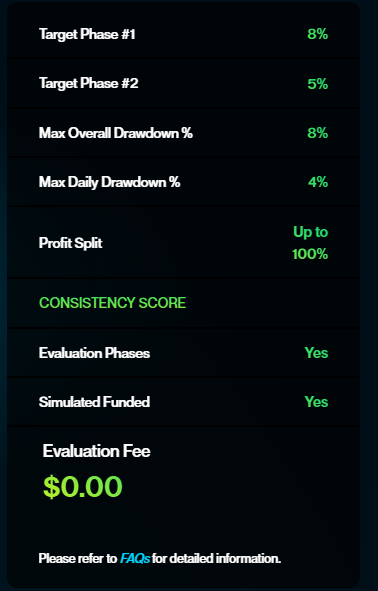

2-Step Evaluation

The 2-Step Evaluation requires traders to complete two phases before receiving funding. Fees begin at $27 for a $5,000 account and go up to $538 for a $200,000 account. The cost reflects the added evaluation stage, but successful traders still receive a full refund after their first withdrawal.

Instant Funding

Instant Funding allows traders to skip the evaluation process and start with a live account immediately. The fees are higher than evaluation-based programs, ranging from $69 for a $5,000 account to $1,099 for a $100,000 account. While there is no challenge to pass, profit splits are lower compared to the evaluation-based options.

Funded Trader Markets ensures transparency in pricing, with no hidden costs or extra fees. Traders can select the funding option that fits their trading style and capital needs.

Tradable Assets

Funded Trader Markets gives traders access to a diverse range of financial instruments, allowing for multiple trading strategies across different markets. With leverage up to 1:100, traders can take advantage of market movements with competitive spreads and reliable execution.

Forex

Traders can access major, minor, and exotic currency pairs. The forex market offers high liquidity and 24/5 trading opportunities, making it ideal for day traders and swing traders alike.

Indices

Popular global indices such as US30, NAS100, and S&P500 are available for trading. These instruments allow traders to speculate on broader market trends without focusing on individual stocks.

Commodities

Gold, silver, crude oil, and other key commodities are available for those looking to hedge or trade based on macroeconomic factors. Commodities can be volatile, providing strong trading opportunities.

All assets can be traded with news trading, weekend holding, and swap-free accounts, ensuring flexibility for different trading strategies.

Restrictions

Funded Trader Markets enforces clear trading rules to maintain fair conditions and prevent platform abuse. Traders must follow these guidelines to keep their accounts in good standing and qualify for payouts.

Copy Trading

Traders can only copy trades between their own accounts. Copying trades from other users, signal providers, or external accounts is strictly prohibited. Any detected copy trading from unauthorized sources will result in account termination.

Expert Advisors (EAs)

EAs are allowed but must have unique settings. Using the same EA as other traders without customization can lead to disqualification. If an EA causes excessive trading activity or disrupts the platform, traders may be asked to adjust its parameters.

Hedging

Hedging is permitted within a single account but is not allowed across multiple accounts. Opening opposite trades in different accounts to manipulate risk exposure is considered a violation and may lead to account suspension.

Tick Scalping and High-Frequency Trading (HFT)

Strategies that exploit price fluctuations within milliseconds using rapid-fire trades are not allowed. These activities can create unfair market conditions and will result in account closure.

Arbitrage Trading

Taking advantage of price discrepancies or latency across different platforms is strictly prohibited. Traders found engaging in arbitrage strategies will have their accounts revoked.

News Trading

News trading is allowed in all evaluation and funded accounts. However, traders must ensure they are not using exploitative strategies that take advantage of delayed price feeds or system inefficiencies.

Weekend Holding

All accounts allow traders to hold positions over the weekend. However, traders must monitor their risk exposure to avoid potential market gaps that could lead to violations of the drawdown limits.

Hyperactivity

Excessive trade modifications, frequent order changes, or overloading the system with unnecessary activity can trigger a review. Traders who repeatedly engage in hyperactive trading behavior may face account restrictions.

Funded Trader Markets maintains strict compliance with these rules to ensure a fair and competitive trading environment. Traders who violate any of these restrictions risk losing their accounts and forfeiting any pending payouts.

Challenge

Funded Trader Markets offers multiple challenge options designed to test traders’ skills and discipline. Traders can choose between 1-Step and 2-Step evaluations or opt for instant funding to bypass the challenge process entirely.

1-Step Evaluation

This challenge provides a fast-track route to funding with a single-phase test. Traders must reach a 10% profit target while staying within a 4% daily drawdown and 6% overall drawdown limit. Once the target is met, the trader moves to a simulated funded account before full funding approval.

2-Step Evaluation

A more structured process that requires traders to complete two phases. The first phase has an 8% profit target, followed by a 5% target in the second phase. The daily drawdown is capped at 4%, while the overall drawdown is set at 8%. This challenge is designed to assess consistency over an extended period.

Instant Funding

Traders who want immediate access to capital can skip the challenge process with instant funding. There is no evaluation phase, and traders start trading live immediately. The profit split goes up to 80%, with a 5% overall drawdown limit.

All challenges include leverage up to 1:100, no time limits for evaluations, and the ability to hold trades over the weekend. Successful traders receive on-demand payouts and can scale their accounts over time.

Conclusion

Funded Trader Markets provides traders with a reliable way to access capital through evaluation programs and instant funding options. With profit splits up to 100%, on-demand payouts, and funding up to $700,000, the firm offers a strong platform for traders looking to grow. The 1-Step and 2-Step challenges cater to different risk preferences, while instant funding allows experienced traders to start trading immediately without an evaluation phase.

With access to forex, indices, and commodities, traders have a diverse range of assets to trade. The 1:100 leverage, no time limits on evaluations, and weekend holding create a flexible trading environment. Strict but fair trading rules ensure that traders who manage risk properly can scale their accounts and maximize earnings.

For traders looking for fast payouts, clear rules, and a structured path to funding, Funded Trader Markets is a strong choice. Success depends on discipline and risk management, but those who meet the requirements can benefit from high payouts and long-term growth opportunities.

Key Features

- Profit splits up to 100%

- Funding up to $700,000

- On-demand payouts with 24-hour processing

- No time limits on evaluations

- 1:100 leverage on all accounts

- Weekend holding and news trading allowed

Considerations

- Instant funding has a lower profit split compared to evaluation programs

- Exceeding drawdown limits results in account termination

- Copy trading from external sources is prohibited

Funded Trader Markets provides a well-balanced approach to funding, combining fast access to capital with fair trading conditions. Traders who follow the guidelines and manage risk effectively can use the firm’s resources to scale their strategies and achieve long-term profitability.