FinProp is a prop firm with an innovative “Pay as You Pass” model, making funding challenges more affordable for traders. Focused on providing a secure and trader-centered environment, FinProp offers flexible challenges and industry-leading profit splits. With its unique profit scaling and high drawdown limits, FinProp aims to cater to both beginner and experienced traders.

This sounds good on paper, but is it actually worth your time? In this review, we’ll cut through the hype and look at what FinProp really brings to the table—the advantages, the limitations, and whether it’s a legit choice for serious traders.

About FinProp

FinProp positions itself as the first prop firm to ‘split risk’ with traders, letting you enter trading challenges at a lower upfront cost. They’ve partnered with regulated brokers like Purple Trading SC to provide solid data feeds and decent trading conditions. Their pitch? Accessible challenges, good profit splits, and features aimed at long-term growth.

Funding Program Options

FinProp offers three main funding programs: FinProp Prime, FinProp Standard, and FinProp Pro. Each program is tailored to different trading styles, account sizes, and goals, offering traders flexibility and support based on their experience and risk preferences.

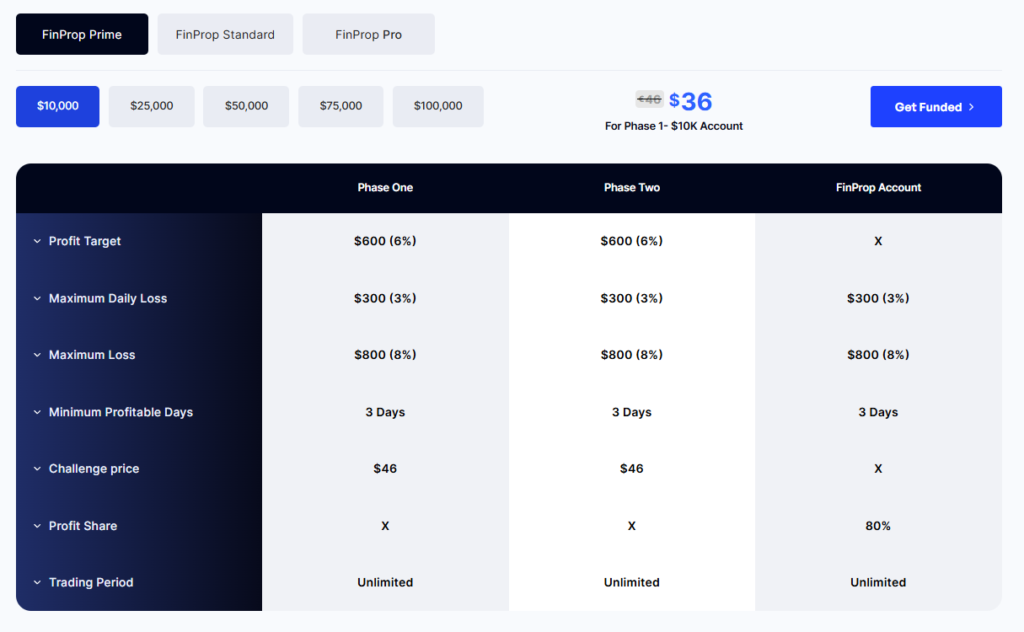

FinProp Prime

The FinProp Prime program uses a “Pay as You Pass” model, letting you pay half the challenge fee upfront and the rest after Phase One. Account sizes range from $10,000 to $100,000. With a 6% profit target and 8% max loss limit, it’s a balanced option that also lets you hold trades over the weekend and during news events.

FinProp Standard

The FinProp Standard program is for traders wanting more risk tolerance. You get up to a 12% drawdown, with an 8% profit target for Phase One and a 5% target for Phase Two. Account sizes also range from $10,000 to $100,000, and profit splits can go up to 90%. This program is better for traders looking to scale capital with some flexibility.

FinProp Pro

For a budget-friendly option, FinProp Pro has lower entry fees but still offers account sizes from $10,000 to $100,000. With a 10% profit target in Phase One, an 8% drawdown, and the ability to hold trades over weekends and during news, it’s designed for cost-conscious traders looking for decent profit-sharing without time limits.

All three programs offer unlimited time to hit profit targets and start with an 80% profit share upon passing. So, no matter your level, there’s an option to grow your account and potentially scale up your profits.

Fees

FinProp’s fees vary by program, so you can pick what fits your budget. Each program has a one-time fee based on account size, with no hidden charges. Here’s how it breaks down:

FinProp Prime

The FinProp Prime program’s fees range from $36 to $269, depending on the account size. This program’s unique “Pay as You Pass” model allows traders to split the cost, paying half upfront and the remaining balance after passing Phase One, reducing the initial financial commitment.

FinProp Standard

For the FinProp Standard program, fees range from $89 to $499. This program includes a 123% fee refund upon successful completion, which adds extra value by rewarding traders who complete both phases. The one-time fee covers the entire evaluation process, giving traders access to larger drawdowns and higher potential profit splits.

FinProp Pro

The FinProp Pro program has fees ranging from $69 to $499, offering an affordable entry point for traders. The Pro program remains cost-effective while providing all the benefits of a funded trading account, including profit sharing and drawdown protections, without additional or recurring fees.

Buy 5 Challenges, Get 1 Free: How It Works

For traders purchasing multiple challenges, FinProp offers a “Buy 5, Get 1 Free” deal. Here’s the breakdown:

- You must purchase 5 challenges of the same size to qualify for a free challenge of that same size.

- Example: Buy 5x 100k challenges, and you’ll receive a 100k challenge for free.

- Mixed-size purchases, such as 4x 100k and 1x 50k, don’t qualify. However, if you later purchase an additional 100k challenge, you’ll meet the criteria for a free 100k challenge.

This offer applies only to the Standard and Pro accounts.

Tradable Assets

FinProp gives traders access to a solid range of assets, which is key for building a flexible trading strategy across multiple markets:

- Forex: FinProp offers a comprehensive selection of major, minor, and exotic currency pairs, allowing traders to explore both stable and more volatile options. Popular pairs like EUR/USD, GBP/USD, and USD/JPY provide liquidity, while exotic pairs add unique trading opportunities.

- Indices: For those looking to trade broader market trends, FinProp includes major global indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 30. These indices allow traders to speculate on the performance of entire stock markets, offering an alternative to individual stock trading.

- Commodities: FinProp also supports trading in key commodities like gold, silver, crude oil, and natural gas. These assets add diversification and offer additional trading opportunities, especially during periods of economic uncertainty or inflationary trends.

With this lineup, FinProp lets you build a well-rounded portfolio, supporting both short-term plays and long-term market views.

Restrictions

FinProp enforces specific restrictions to maintain a fair and secure trading environment for all users.

Country Restrictions

Currently, FinProp does not accept traders from certain countries, including the United States, Afghanistan, North Korea, and Venezuela, among others. Any updates on eligibility for these countries will be announced in FinProp’s news section.

EA (Expert Advisor) Usage

FinProp allows the use of Expert Advisors (EAs) on the Standard and Pro challenges, while restricting them on the Prime Challenge. However, EAs connected to multiple traders simultaneously or using prohibited strategies, such as high-frequency trading, latency exploitation, or arbitrage, are not permitted.

Multiple IP Addresses

Traders can operate from multiple IP addresses, but unusual account activity may prompt FinProp to request verification, such as proof of travel or a video call. For those planning to trade from a new location, informing FinProp in advance is recommended.

Prohibited Trading Strategies

FinProp strictly prohibits certain trading strategies that exploit system mechanics or simulate unfair trading advantages. Banned methods include latency trading, order layering (where trades are split to manipulate slippage in simulated environments), high-frequency trading, and opposite trades across multiple accounts. Account sharing is also disallowed, meaning only the authorized account holder can manage and execute trades.

Violating these rules could lead to immediate account suspension and forfeiture of profits. FinProp actively monitors for violations to keep trading conditions fair for everyone.

Challenge

FinProp’s challenge programs offer traders a structured path to secure funded accounts, each with specific profit targets, drawdown limits, and phases designed to assess and support trading skill and consistency.

FinProp Prime

The FinProp Prime Challenge offers a two-phase evaluation with a 6% profit target in each phase and an 8% maximum drawdown. With the unique “Pay as You Pass” model, traders pay half of the challenge fee upfront and the remainder after completing Phase One. This challenge allows for weekend holding and trading during news events, making it flexible for various trading strategies.

Prime Challenge Salary Bonus Opportunity

FinProp Prime traders have the unique chance to earn a performance-based salary after getting funded. If you complete the challenge and achieve two consecutive payouts of at least 3% per payout, you’ll qualify for a monthly salary bonus.

The bonus is calculated based on your funded account size and paid on the last Friday of each month:

- $100k account: $500/month

- $75k account: $375/month

- $50k account: $250/month

- $25k account: $125/month

- $10k account: $50/month

The Catch: You must maintain the streak of 3% payouts to keep receiving the bonus. If you request a payout below 3%, the salary bonus stops immediately.

This feature adds an extra layer of reward for consistent, profitable trading, making the Prime Challenge even more appealing to disciplined traders.

FinProp Standard

The FinProp Standard Challenge caters to traders who prefer more leeway in risk management, with a high 12% maximum drawdown and profit targets of 8% in Phase One and 5% in Phase Two. Successful completion not only secures funding but also includes a 123% refund on the challenge fee, rewarding traders who meet all criteria. Traders in this challenge can hold positions over weekends and scale up profit splits up to 90% as they progress.

FinProp Pro

The FinProp Pro Challenge is the most affordable option, with a two-phase evaluation that includes a 10% profit target in Phase One and a 5% target in Phase Two. This challenge maintains an 8% overall drawdown and allows weekend holding and news trading, providing cost-conscious traders with a balanced opportunity to reach a funded account.

Each program allows traders unlimited time to meet their profit targets, focusing on consistent trading performance rather than time pressure. Upon passing, traders receive an 80% profit share and gain access to larger trading capital, with the potential to scale up profit splits over time.

VIP Trader Program

FinProp also offers a VIP Trader Program for top-performing traders who meet specific criteria. Designed to reward consistent, skilled trading, the program is invite-only and comes with some serious perks:

- Custom capital allocation up to $500,000

- Increased max drawdown up to 15%

- No daily drawdown hard breach

- Monthly salary of up to $5,000

- A personal account manager

Criteria to qualify include:

- 6 months of profitable trading without losing a funded account

- At least 30% in total payouts across a minimum of 8 payouts, with no single payout exceeding 30% of the total

- A non-aggressive, low-risk trading approach

This program is a major incentive for experienced traders to focus on consistency and discipline, offering opportunities to grow both trading capital and income while enjoying tailored support.

Conclusion

FinProp’s got a few standout features that make it worth a look: the “Pay as You Pass” model in their Prime Challenge lowers the initial cost, and the high drawdown limits give you some breathing room. With profit splits that can reach 90%, and the flexibility to hold trades over weekends and during news events, they’re aiming to attract both cautious beginners and more experienced traders looking to scale up.

The unlimited time to complete challenges is a major plus, as are the options for diversified trading across forex, indices, and commodities. But keep in mind the restrictions on EAs and certain trading strategies, as these could limit flexibility for some traders.

Key Features:

- Flexible Funding Programs: Options include FinProp Prime, Standard, and Pro, catering to different levels of experience and risk preferences.

- “Pay as You Pass” Model: Available in FinProp Prime, allowing traders to pay in two phases, reducing initial costs.

- Generous Drawdown and Profit Splits: Drawdown limits up to 12% and profit splits starting at 80%, scaling to 90%.

- Unlimited Time for Challenges: Traders can work at their own pace, without pressure from time limits.

- Diverse Asset Range: Access to forex, indices, and commodities for well-rounded trading strategies.

Considerations:

- Country Restrictions: FinProp does not accept traders from certain countries, including the U.S., Afghanistan, and Venezuela.

- Trading Restrictions: Specific strategies, such as high-frequency trading and order layering, are prohibited to maintain fairness.

- EA Limitations: Automated trading is only allowed in the Standard and Pro programs, with certain restrictions on usage.

Bottom line? FinProp offers a legit, flexible platform with options for different trading styles. If the features match what you’re looking for, it could be a solid choice.