You may earn 80%-90% of earnings with no scaling strategy if you complete the Trading Challenge and oversee accounts up to $2 million.

- $1m straight capital no scaling

- 1:100 leverage

- Over 175 assets to trade

- News trading, overnight and Weekend holding allowed

- EAs allowed

- 5% max loss for normal account

- 12 months to double your capital

Fidelcrest Review

A career as a “prop trader” allows one to trade with bigger capital and lower risk. Fidelcrest Funded Trader Accounts are a great option for novices, seasoned traders, risk managers, and anybody else with varying levels of experience in the financial markets. Learn about Fidelcrest’s funding options, fees, restrictions, and tradeable assets, by reading this review.

About Fidelcrest

Established in 2018, Fidelcrest is a proprietary trading organization that has operations all over the world and maintains its headquarters in Nicosia, Cyprus. They have more than 6,000 traders from all around the world actively engaged in trading activities.

There are members of the Fieldcrest management team who have been involved in the foreign exchange market for more than 10 years and who have worked for multinational brokerage firms. The company’s ownership and management remain a mystery. There is a lack of openness in comparison to the norm in this industry when it comes to who owns and operates prop firms.

In order to get started, you’ll need to pay a one-time charge and accept their challenge. If you pass the company’s initial trading challenge, you’ll be given control of up to $2,000,000 and allowed to keep as much as 90% of any earnings you make.

Traders of all experience levels and with varying demands can find an account type and size that works for them at this firm.

Funding Program Options

Fidelcrest gives its clients a substantial amount of flexibility by providing a variety of account sizes to accommodate their varying degrees of experience and investing capital. There are over a thousand different trading products available, including forex and cryptocurrencies, that may be traded with their funds on a variety of top trading platforms.

Get some practice with smaller accounts through the Fidecrest Micro Trader Evaluation and Prop Trading Program. Through this program, you may learn the fundamentals of trading and risk management and, after completing just the first phase, you may be able to start making money right away.

Traders at Fidelcrest have their pick of 4 distinct account kinds. The Micro accounts are the starting point. Micro accounts, depending on the funding method used, provide traders control of $10,000 to $50,000. Naturally, they come with a one-time cost, but at €99, it’s one of the most affordable options out there. There are 2 types of Micro Accounts, the normal risk and the aggressive risk.

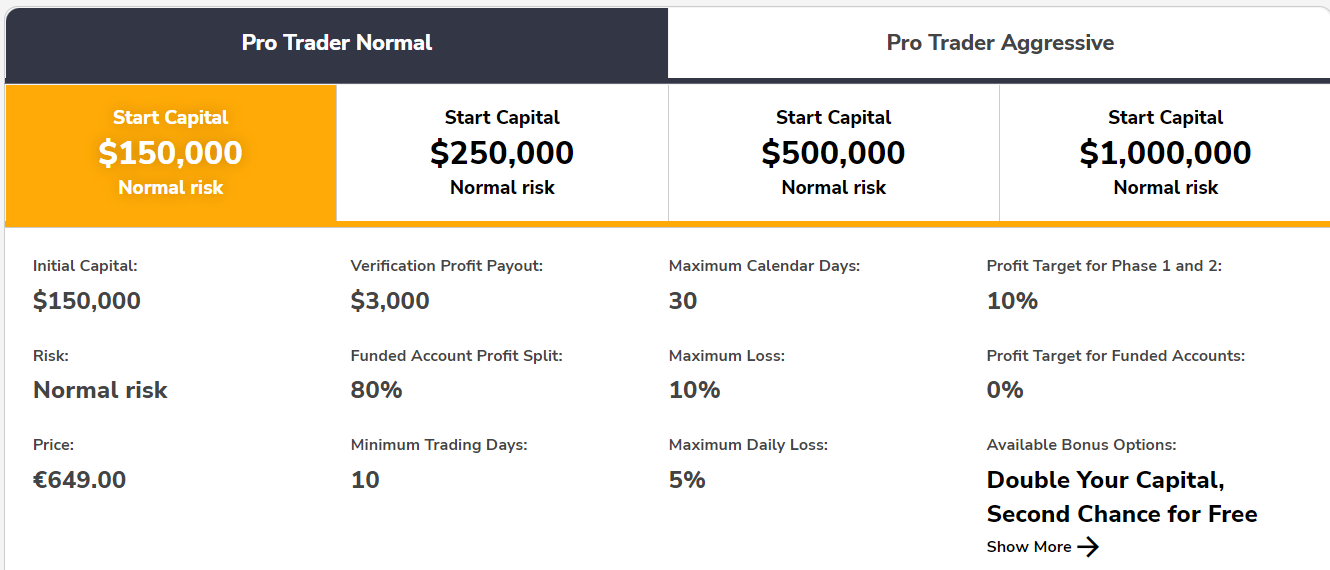

They also have a more advanced account tier called “Pro” which also comes with normal risk or aggressive risk. This account begins at $150,000 and goes up to $1,000,000 in capital. This is probably the largest account available for purchase from any prop firm at the present time. If you want to expand your capital into the millions, you can do so with other firms, but in terms of starting account balance, Fidelcrest has the biggest you’ll find anywhere at $1,000,000.

Fees

There are no hidden fees or monthly minimums with Fidelcrest; all you pay is an initial setup cost. The Micro Trader Program is the lowest option, with costs ranging from €99 to €499. The Pro Trader account is the one that will cost you the most money, with fees ranging from €649 to €2,899,00 for their million-dollar funding. However, the $1m capital is only on the normal risk account, and not available for the aggressive account.

Normal Account

Capital – Fee:

$10,000 – €99

$25,000 – €249

$50,000 – €449

$150,000 – €649

$250,000 – €999

$500,000 – €1,599

$1,000,000 – €2,699

Aggressive Account

Capital – Fee:

$10,000 – €149

$25,000 – €349

$50,000 – €549

$150,000 – €999

$250,000 – €1,599

$500,000 – €2,899

Tradable Assets

When compared to the traditional prop trading firm, which offers solely Forex trading, Fidelcrest stands out. Over 175 assets are available for trading on Fidelcrest. The foreign exchange, indices, metals, commodities, stocks, and cryptocurrency markets are included.

Restrictions

After you have passed the challenge’s requirements, you will be given access to trade the capital of the Fidelcrest prop trading firm without profit goals, provided you do not exceed the firm’s maximum drawdown limit. After every 5 trading day to 30 trading day period, you will get up to 90% of the earnings produced.

The rules here are the same for Micro Trader Program and Pro Trader Program.

Strategy:

Normal | Aggressive

Trading Period:

30 days

Minimum Trading Days:

10 | 10 days

Maximum Loss:

10% | 20%

Maximum Daily Loss:

5% | 10%

Profit Target:

–

Your Share:

80% | 90%

Challenge

Expectedly, there is a two-part evaluation process to get through before you may trade with real money in Fidelcrest’s funded accounts:

Phase 1: Trading Challenge

Pick an appropriate account size, risk level, and free bonus choice in accordance with your degree of expertise and desired amount of profit. You must demonstrate that you are a professional trader who is capable of reaching the profit objective by trading all of the available instruments. It’s up to you to determine how you want to trade.

Pro Trader Program Phases

Strategy:

Normal | Aggressive

Trading Period:

30 days

Minimum Trading Days:

10 | 10 days

Maximum Loss:

10% | 20%

Maximum Daily Loss:

5% | 10%

Profit Target:

10% | 20%

Micro Trader Program Phases

Strategy:

Normal | Aggressive

Trading Period:

30 days

Minimum Trading Days:

10 | 10 days

Maximum Loss:

10% | 20%

Maximum Daily Loss:

5% | 10%

Profit Target:

5% | 15%

Phase 2: Verification

Using the verification account, you can keep trading to show that your challenge success was more than a fluke. If you meet a minimal profit requirement, you get to retain $30,000.

Pro Trader Program Phases

Strategy:

Normal | Aggressive

Trading Period:

60 days

Minimum Trading Days:

10 | 10 days

Maximum Loss:

5% | 10%

Maximum Daily Loss:

5% | 10%

Profit Target:

10% | 20%

Your Share:

Up to $30.000

Micro Trader Program Phases

Strategy:

Normal | Aggressive

Trading Period:

60 days

Minimum Trading Days:

10 | 10 days

Maximum Loss:

5% | 10%

Maximum Daily Loss:

5% | 10%

Profit Target:

5% | 15%

Your Share:

40% | 50%

If you are able to successfully complete these two stages and reach the goals set for you, you will be given access to a real money trading account where you will be eligible to keep up to 90% of your profits.

In contrast to other proprietary trading organizations, their trading regulations are straightforward, with additional wiggle room for Aggressive accounts in key areas like maximum daily and total losses.

In Conclusion

It is safe to say that Fidelcrest is a respectable company that offers a safe environment for prop firm funding. When compared to competing firms, they provide a number of advantages, including a maximum funding amount of $2,000,000, account leverage of 1:100, several trading platforms, and a vast selection of tradable products where other prop firms might be lacking.

Fidelcrest provides a $1,000,000 starting capital without the need to scale. However, they estimate that it would take you at least a year to double your account from $1 million to $2 million. If you are a profitable trader and want to start with huge capital, Fidelcrest might just be the prop firm for you.

Share your Experience